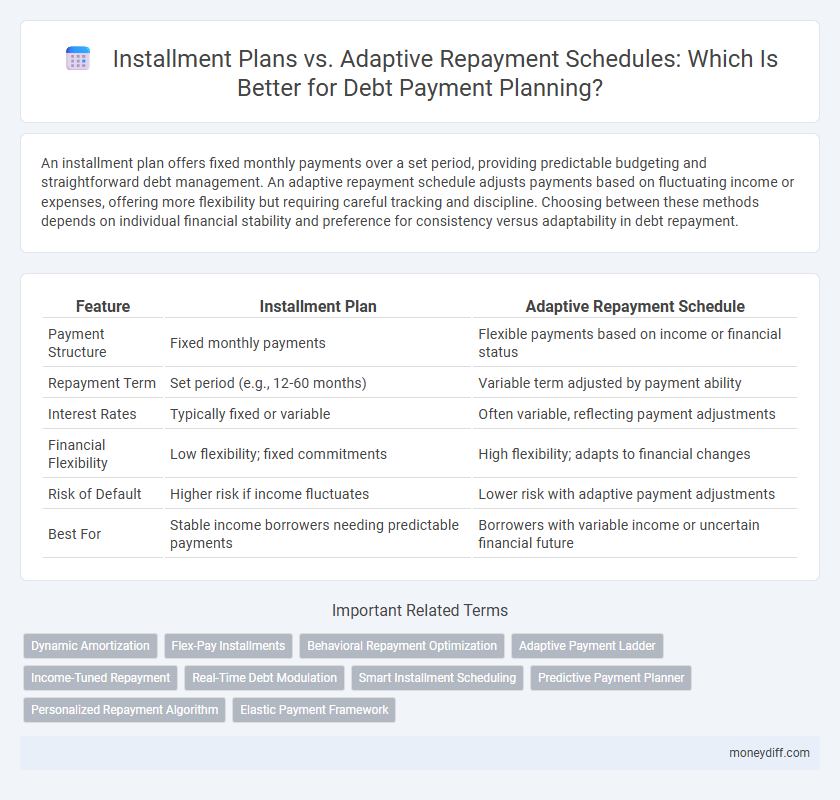

An installment plan offers fixed monthly payments over a set period, providing predictable budgeting and straightforward debt management. An adaptive repayment schedule adjusts payments based on fluctuating income or expenses, offering more flexibility but requiring careful tracking and discipline. Choosing between these methods depends on individual financial stability and preference for consistency versus adaptability in debt repayment.

Table of Comparison

| Feature | Installment Plan | Adaptive Repayment Schedule |

|---|---|---|

| Payment Structure | Fixed monthly payments | Flexible payments based on income or financial status |

| Repayment Term | Set period (e.g., 12-60 months) | Variable term adjusted by payment ability |

| Interest Rates | Typically fixed or variable | Often variable, reflecting payment adjustments |

| Financial Flexibility | Low flexibility; fixed commitments | High flexibility; adapts to financial changes |

| Risk of Default | Higher risk if income fluctuates | Lower risk with adaptive payment adjustments |

| Best For | Stable income borrowers needing predictable payments | Borrowers with variable income or uncertain financial future |

Understanding Installment Plans: A Traditional Approach

Installment plans provide a structured, fixed-payment schedule that helps borrowers manage debt through predictable monthly amounts, typically set over a defined term. These plans simplify budgeting by allocating equal payments that cover both principal and interest, reducing the risk of missed payments and penalties. Financial institutions often prefer installment plans for their clarity and stability, making them a reliable option for debt repayment.

What Is an Adaptive Repayment Schedule?

An adaptive repayment schedule dynamically adjusts payment amounts based on changes in a debtor's financial situation, offering greater flexibility than a fixed installment plan. Unlike traditional installment plans with set monthly payments, adaptive schedules can increase or decrease payments in response to income fluctuations, expenses, or unexpected financial hardship. This approach helps borrowers manage debt more effectively by aligning repayment obligations with their current ability to pay, reducing the risk of default.

Key Differences Between Installment Plans and Adaptive Repayment

Installment plans require fixed monthly payments over a set period, ensuring predictable budgeting but limited flexibility, whereas adaptive repayment schedules adjust payment amounts based on fluctuating income or financial circumstances. Installment plans typically involve a structured timeline with predetermined interest rates, while adaptive repayment allows for personalized modifications to better manage cash flow and avoid defaults. Choosing between the two depends on the borrower's stability of income and preference for fixed versus flexible debt management strategies.

Advantages of Fixed Installment Plans

Fixed installment plans offer predictable monthly payments, simplifying budgeting and financial planning for borrowers. These plans reduce the risk of missed payments by maintaining consistent amounts, which can improve credit scores over time. Lenders also favor fixed installments due to streamlined administration and lower default rates.

Benefits of Adaptive Repayment Schedules

Adaptive repayment schedules offer a flexible approach to debt management by adjusting payments based on changes in income and financial circumstances, reducing the risk of default. This method improves borrower cash flow, ensuring repayments remain affordable over time while optimizing debt reduction efficiency. Unlike fixed installment plans, adaptive schedules can accommodate fluctuating expenses, providing a personalized path to financial stability and faster debt payoff.

Flexibility vs. Predictability: Choosing the Right Payment Method

An installment plan offers predictable monthly payments, making budgeting simpler but lacks flexibility if your financial situation changes. An adaptive repayment schedule adjusts payments based on income fluctuations, providing flexibility but introducing uncertainty in monthly amounts. Choosing the right method depends on whether you prioritize consistent payment amounts or the ability to adapt to variable income streams.

Impact on Credit Score: Installment vs. Adaptive Repayment

Installment plans provide fixed monthly payments that can improve credit scores by ensuring consistent, timely repayments and reducing overall debt. Adaptive repayment schedules adjust payments based on income fluctuations, which may prevent defaults but offer less predictability for credit scoring models. Lenders often favor installment plans due to their stability, potentially resulting in a more positive impact on credit scores over time.

Suitability for Different Financial Situations

Installment plans provide fixed, predictable payments ideal for borrowers with steady income seeking simplicity and structure in debt repayment. Adaptive repayment schedules adjust payment amounts based on fluctuating income, making them suitable for individuals with irregular earnings or variable expenses. Choosing between these options depends on financial stability and the need for flexibility, ensuring effective debt management tailored to personal circumstances.

Cost Comparison: Interest and Fees Analysis

Installment plans typically involve fixed monthly payments with a predetermined interest rate, leading to predictable total interest costs over the loan term. Adaptive repayment schedules adjust payment amounts based on income or financial circumstances, potentially minimizing interest accrual during low-income periods but may extend the repayment duration and increase fees. A thorough cost comparison reveals installment plans often incur higher overall interest but fewer administrative fees, while adaptive schedules offer flexibility at the risk of cumulative cost variability.

How to Choose the Best Payment Plan for Your Debt

Selecting the best payment plan for your debt depends on your cash flow stability and long-term financial goals. An installment plan offers fixed monthly payments that provide predictability and help build credit, while an adaptive repayment schedule adjusts payments based on income fluctuations, offering flexibility during uncertain financial periods. Evaluating your income consistency, debt interest rates, and ability to commit to fixed payments will guide you in choosing the most effective strategy to reduce debt efficiently.

Related Important Terms

Dynamic Amortization

Dynamic amortization improves payment planning by adjusting installment plans or adaptive repayment schedules based on real-time financial data, optimizing debt reduction efficiency. This method enhances flexibility, allowing borrowers to modify payments to better align with income fluctuations and minimize interest over the loan term.

Flex-Pay Installments

Flex-Pay Installments offer a more flexible alternative to traditional installment plans by allowing payment amounts and dates to adjust based on the borrower's current financial situation, promoting timely repayments and reducing default risk. Adaptive repayment schedules dynamically modify payment terms in response to income changes, making Flex-Pay an ideal solution for debtors seeking customizable, manageable payment options tailored to fluctuating cash flows.

Behavioral Repayment Optimization

Installment plans provide fixed monthly payments, promoting consistent budgeting but often lack flexibility to match fluctuating income patterns. Adaptive repayment schedules leverage behavioral data to tailor payment amounts dynamically, optimizing debt reduction by aligning payments with borrowers' financial capabilities and improving overall repayment adherence.

Adaptive Payment Ladder

Adaptive Payment Ladder offers a flexible repayment structure that automatically adjusts payments based on the borrower's changing financial situation, reducing the risk of default and improving overall debt management. Unlike fixed installment plans, this approach optimizes cash flow by increasing or decreasing payment amounts in response to income fluctuations, enhancing affordability and long-term financial stability.

Income-Tuned Repayment

Income-tuned repayment plans adjust installment amounts based on a borrower's current earnings, offering flexibility that traditional fixed installment plans lack. This adaptive approach helps minimize default risk by aligning payments with income fluctuations, ensuring more manageable debt servicing over time.

Real-Time Debt Modulation

Installment plans provide fixed, predictable payments, while adaptive repayment schedules leverage real-time debt modulation to adjust payments dynamically based on current financial capacity and outstanding balance. Real-time debt modulation enhances flexibility and responsiveness, reducing default risk by aligning payments with borrowers' evolving monetary conditions.

Smart Installment Scheduling

Smart Installment Scheduling leverages data-driven algorithms to tailor payment plans that optimize cash flow and reduce default risk, contrasting with adaptive repayment schedules that adjust only after missed payments or financial shifts. By predicting income patterns and expenses, smart installment plans enable proactive, flexible repayment strategies that enhance debt management and borrower affordability.

Predictive Payment Planner

The Predictive Payment Planner leverages data analytics to tailor installment plans with adaptive repayment schedules, optimizing debt management by forecasting cash flow and adjusting payment amounts accordingly. This approach enhances financial flexibility and reduces default risk by aligning payments with borrowers' real-time financial capacity.

Personalized Repayment Algorithm

A personalized repayment algorithm leverages financial data and spending behavior to optimize installment plans, ensuring payment amounts and schedules dynamically adjust to the borrower's evolving income and expenses. This adaptive repayment schedule enhances debt management by reducing default risk and improving cash flow stability compared to fixed installment plans.

Elastic Payment Framework

The Elastic Payment Framework offers a flexible alternative to traditional installment plans by adjusting repayment schedules based on the borrower's financial situation and cash flow fluctuations, enhancing affordability and reducing default risk. This adaptive repayment schedule optimizes debt management by dynamically aligning payment amounts and timing with real-time income variations, promoting sustainable debt resolution.

Installment plan vs adaptive repayment schedule for payment planning. Infographic

moneydiff.com

moneydiff.com