Fixed-rate loans provide predictable monthly payments and consistent interest rates, making them ideal for stable budgeting and long-term debt planning. Adjustable-rate loans often start with lower interest rates but can fluctuate over time, potentially increasing monthly payments and financial uncertainty. Choosing between these loan types depends on your risk tolerance, financial stability, and future income expectations.

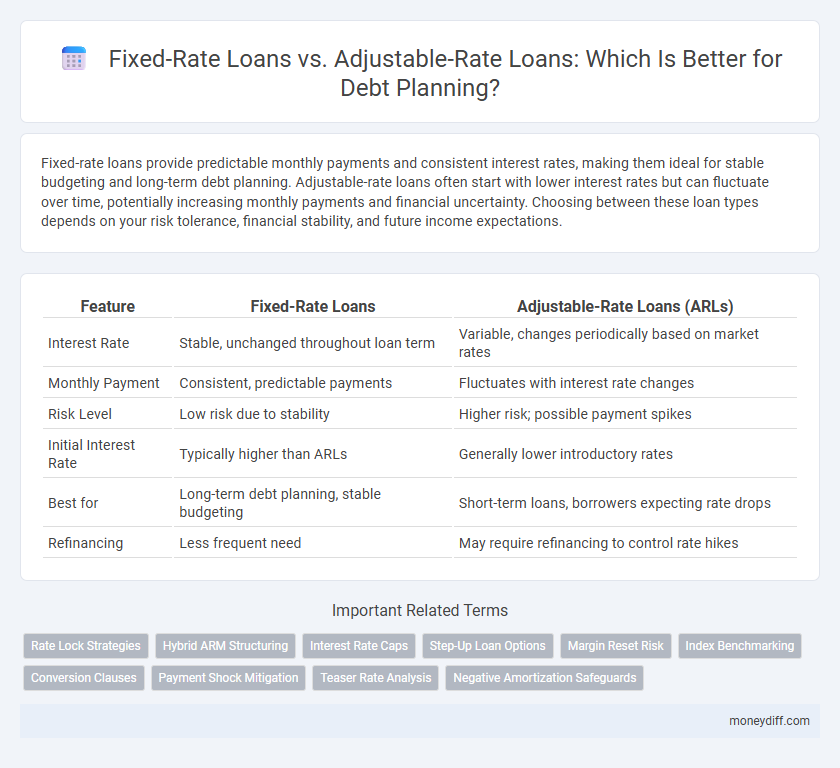

Table of Comparison

| Feature | Fixed-Rate Loans | Adjustable-Rate Loans (ARLs) |

|---|---|---|

| Interest Rate | Stable, unchanged throughout loan term | Variable, changes periodically based on market rates |

| Monthly Payment | Consistent, predictable payments | Fluctuates with interest rate changes |

| Risk Level | Low risk due to stability | Higher risk; possible payment spikes |

| Initial Interest Rate | Typically higher than ARLs | Generally lower introductory rates |

| Best for | Long-term debt planning, stable budgeting | Short-term loans, borrowers expecting rate drops |

| Refinancing | Less frequent need | May require refinancing to control rate hikes |

Understanding Fixed-Rate and Adjustable-Rate Loans

Fixed-rate loans provide borrowers with consistent monthly payments and a stable interest rate throughout the loan term, facilitating predictable long-term debt planning. Adjustable-rate loans feature interest rates that fluctuate periodically based on benchmark indices like the LIBOR or SOFR, potentially lowering initial payments but introducing uncertainty over time. Understanding the differences between fixed-rate and adjustable-rate loans is crucial for managing interest rate risk and optimizing debt repayment strategies.

Key Differences Between Fixed and Adjustable Interest Rates

Fixed-rate loans maintain a constant interest rate throughout the loan term, providing predictable monthly payments and shielding borrowers from market fluctuations. Adjustable-rate loans feature interest rates that vary periodically based on an index or benchmark, potentially lowering initial payments but increasing future payment uncertainty. Understanding these interest rate structures is crucial for effective debt planning and managing long-term financial risk.

Pros and Cons of Fixed-Rate Loans for Debt Management

Fixed-rate loans offer predictable monthly payments, allowing borrowers to budget effectively and avoid surprises from interest fluctuations. The stability of fixed interest rates protects against rising market rates, enhancing long-term financial planning and risk management. However, fixed-rate loans often come with higher initial interest rates compared to adjustable-rate loans, potentially leading to higher overall costs if market rates decline.

Advantages and Disadvantages of Adjustable-Rate Loans

Adjustable-rate loans offer the advantage of lower initial interest rates compared to fixed-rate loans, which can reduce early repayment costs and improve cash flow management. However, their interest rates fluctuate based on market conditions, introducing the risk of higher payments over time and complicating long-term debt planning. Borrowers must carefully evaluate potential rate increases and assess their ability to absorb payment variability when considering adjustable-rate loan options.

Impact of Interest Rate Changes on Your Loan Payments

Fixed-rate loans maintain a consistent interest rate throughout the loan term, providing predictable monthly payments regardless of market fluctuations. Adjustable-rate loans, however, have interest rates that fluctuate based on benchmark indexes, leading to variable monthly payments that can increase or decrease over time. Understanding the impact of interest rate changes on your loan payments is crucial for effective debt planning and managing financial risk.

Suitability: Who Should Choose Fixed-Rate Loans?

Fixed-rate loans are ideal for borrowers seeking predictable monthly payments and protection from interest rate fluctuations, making them suitable for individuals with stable income who prioritize budgeting certainty. Homeowners planning long-term stability or those in a low interest rate environment benefit most from fixed-rate loans. This loan type helps avoid payment shocks common in adjustable-rate loans, providing financial security during periods of economic uncertainty.

Suitability: Who Should Opt for Adjustable-Rate Loans?

Adjustable-rate loans are best suited for borrowers with short-term financial goals or those expecting income increases, as initial interest rates are typically lower than fixed-rate loans. Homebuyers planning to refinance or sell before the adjustable period begins can benefit from potential cost savings without long-term commitment. These loans are less ideal for risk-averse individuals due to possible rate fluctuations and higher future payments.

Long-Term Cost Comparison: Fixed vs Adjustable Rates

Fixed-rate loans provide predictability with a constant interest rate over the loan term, making long-term cost planning straightforward. Adjustable-rate loans often start with lower initial rates but can increase over time, potentially raising overall borrowing costs significantly. Evaluating the risk tolerance and interest rate trends is crucial for determining which loan type minimizes total debt repayment expenses.

Risk Assessment in Debt Planning with Loan Options

Fixed-rate loans provide predictable monthly payments and protect borrowers from interest rate fluctuations, reducing the risk of payment shock and facilitating long-term financial planning. Adjustable-rate loans often start with lower initial rates but carry the risk of increased payments if interest rates rise, requiring careful assessment of future rate trends and income stability. Evaluating the borrower's risk tolerance and market interest rate outlook is essential for optimizing debt planning between fixed and adjustable loan options.

Making the Right Choice for Your Debt Management Strategy

Choosing between fixed-rate loans and adjustable-rate loans significantly impacts your debt management strategy by affecting predictability and risk levels. Fixed-rate loans offer stable, predictable payments, making budgeting easier and protecting against interest rate fluctuations, while adjustable-rate loans may start with lower rates but carry the risk of increased payments over time. Evaluating your financial stability, risk tolerance, and market interest trends is essential to determine the ideal loan type for your long-term debt planning goals.

Related Important Terms

Rate Lock Strategies

Fixed-rate loans provide a predictable monthly payment by locking in a fixed interest rate for the entire loan term, offering stability in debt planning and shielding borrowers from market rate fluctuations. Adjustable-rate loans start with a lower initial rate that adjusts periodically based on market indexes, requiring strategic rate lock considerations to manage potential payment increases and optimize long-term debt costs.

Hybrid ARM Structuring

Hybrid Adjustable-Rate Mortgages (ARM) combine the stability of fixed-rate loans with the flexibility of adjustable-rate loans by offering a fixed interest rate for an initial period before shifting to a variable rate, optimizing debt planning through predictable payments early on and potential savings if rates decline later. This structure suits borrowers aiming to balance risk and cost by leveraging low initial rates while preparing for possible rate adjustments, making it a strategic option in managing long-term debt obligations.

Interest Rate Caps

Fixed-rate loans maintain a consistent interest rate throughout the loan term, providing predictable monthly payments and eliminating the risk of rate increases. Adjustable-rate loans feature interest rate caps that limit how much the rate can rise during each adjustment period and over the life of the loan, offering some protection against steep payment hikes while initially often providing lower rates.

Step-Up Loan Options

Step-up loan options in fixed-rate loans provide predictable payment increases at scheduled intervals, allowing borrowers to plan long-term debt management with stability and gradual payment growth. Adjustable-rate loans with step-up features offer initial lower interest rates that adjust upward over time, enabling short-term affordability but requiring careful monitoring to avoid sudden payment surges in debt planning.

Margin Reset Risk

Fixed-rate loans provide predictable monthly payments by locking in a constant interest rate, eliminating margin reset risk, whereas adjustable-rate loans expose borrowers to potential payment increases as the margin resets periodically based on market indexes. Understanding margin reset risk is crucial for debt planning, as sudden rate adjustments in adjustable-rate loans can significantly impact affordability and long-term financial stability.

Index Benchmarking

Fixed-rate loans offer predictable monthly payments by maintaining a constant interest rate, providing stability for long-term debt planning. Adjustable-rate loans rely on index benchmarking, such as the LIBOR or SOFR, causing interest rates to fluctuate periodically based on market conditions, which impacts repayment amounts.

Conversion Clauses

Conversion clauses in fixed-rate loans allow borrowers to switch to adjustable-rate terms, providing flexibility to capitalize on lower interest rates. These clauses enable strategic debt planning by balancing the stability of fixed rates with potential savings from rate adjustments.

Payment Shock Mitigation

Fixed-rate loans provide consistent monthly payments, offering predictable budgeting and reducing the risk of payment shock during debt planning. Adjustable-rate loans may start with lower payments but carry the risk of significant payment increases over time, potentially causing financial strain without proper mitigation strategies.

Teaser Rate Analysis

Fixed-rate loans provide stability with consistent interest payments, while adjustable-rate loans often feature teaser rates that initially offer lower payments before adjusting to higher rates, impacting long-term debt costs. Analyzing teaser rates helps borrowers anticipate potential payment increases and strategize debt management effectively.

Negative Amortization Safeguards

Fixed-rate loans provide predictable monthly payments that prevent negative amortization by ensuring consistent principal and interest repayment over the loan term. Adjustable-rate loans often include caps and margin limits to safeguard against negative amortization, but unexpected interest rate increases can cause monthly payments to rise, potentially leading to higher debt balances if payments do not cover accrued interest.

Fixed-rate loans vs Adjustable-rate loans for debt planning Infographic

moneydiff.com

moneydiff.com