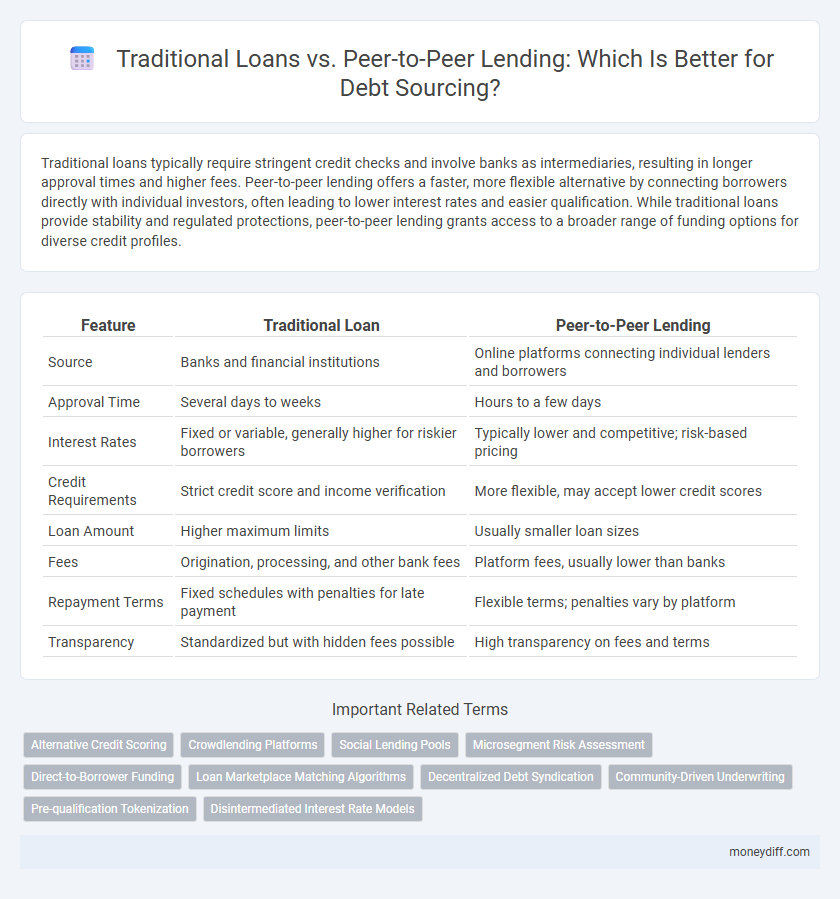

Traditional loans typically require stringent credit checks and involve banks as intermediaries, resulting in longer approval times and higher fees. Peer-to-peer lending offers a faster, more flexible alternative by connecting borrowers directly with individual investors, often leading to lower interest rates and easier qualification. While traditional loans provide stability and regulated protections, peer-to-peer lending grants access to a broader range of funding options for diverse credit profiles.

Table of Comparison

| Feature | Traditional Loan | Peer-to-Peer Lending |

|---|---|---|

| Source | Banks and financial institutions | Online platforms connecting individual lenders and borrowers |

| Approval Time | Several days to weeks | Hours to a few days |

| Interest Rates | Fixed or variable, generally higher for riskier borrowers | Typically lower and competitive; risk-based pricing |

| Credit Requirements | Strict credit score and income verification | More flexible, may accept lower credit scores |

| Loan Amount | Higher maximum limits | Usually smaller loan sizes |

| Fees | Origination, processing, and other bank fees | Platform fees, usually lower than banks |

| Repayment Terms | Fixed schedules with penalties for late payment | Flexible terms; penalties vary by platform |

| Transparency | Standardized but with hidden fees possible | High transparency on fees and terms |

Understanding Traditional Loans: Key Features

Traditional loans typically involve borrowing from banks or credit unions with fixed interest rates and structured repayment schedules tailored to creditworthiness and income stability. These loans require extensive documentation, including credit checks, income verification, and collateral in many cases, ensuring a regulated and secure lending process. Borrowers experience predictable monthly payments but may face longer approval times compared to alternative lending options like peer-to-peer platforms.

What Is Peer-to-Peer Lending?

Peer-to-peer lending is a method of debt sourcing that connects borrowers directly with individual investors through online platforms, bypassing traditional financial institutions. This approach often offers lower interest rates and faster approval compared to traditional loans from banks. By leveraging technology, peer-to-peer lending provides increased transparency and accessibility for both borrowers and lenders in the financial ecosystem.

Eligibility Criteria: Traditional Loans vs P2P Lending

Traditional loans typically require stringent eligibility criteria, including a strong credit score, steady income, and collateral, making them less accessible for borrowers with limited credit history. Peer-to-peer (P2P) lending platforms often have more flexible eligibility requirements, focusing on broader risk assessments and allowing individuals or small businesses with lower credit scores to access funds. These differences enable P2P lending to serve a wider range of borrowers who may not qualify for conventional bank loans.

Interest Rates Comparison: Bank Loans vs P2P Platforms

Interest rates for traditional bank loans typically range from 4% to 10%, influenced by credit scores and loan terms, while peer-to-peer (P2P) lending platforms often offer rates between 5% and 12%, reflecting borrower risk and platform fees. Banks may provide lower rates to high-credit borrowers due to established risk assessment models, whereas P2P lenders price interest rates based on investor demand and credit risk diversification. Comparing these options, P2P lending can offer competitive or sometimes lower rates for borrowers with moderate credit, but traditional loans remain more favorable for those with excellent credit histories.

Application and Approval Process: Speed and Simplicity

Traditional loan applications often involve extensive paperwork, credit checks, and a longer approval timeline, typically ranging from several days to weeks. Peer-to-peer lending platforms streamline the process with digital applications and automated credit assessments, providing faster decisions often within 24 to 48 hours. This speed and simplicity make peer-to-peer lending a more accessible and efficient option for borrowers seeking quick financing solutions.

Loan Amounts and Repayment Terms: Key Differences

Traditional loans typically offer higher loan amounts, often ranging from $5,000 to $500,000, with fixed repayment terms spanning 1 to 30 years depending on the loan type. Peer-to-peer lending platforms usually provide smaller loan amounts, generally between $1,000 and $40,000, with more flexible repayment schedules that can vary from 6 months to 5 years. The key difference lies in the structured, longer-term repayment plans of traditional loans versus the customizable, short-to-medium term options available through peer-to-peer lending.

Credit Score Impact: Traditional vs Peer-to-Peer Lending

Traditional loans often require a higher credit score and can lead to significant credit inquiries, impacting your credit score negatively during the application process. Peer-to-peer lending platforms typically have more flexible credit score requirements and use alternative data, potentially minimizing the immediate impact on credit scores. Borrowers with lower credit scores might find peer-to-peer lending less damaging to their credit health compared to traditional financial institutions.

Fees and Hidden Costs to Watch Out For

Traditional loans often come with upfront origination fees, hidden prepayment penalties, and variable interest rates that can increase overall borrowing costs. Peer-to-peer lending platforms may charge service fees and investors' risk premiums, which can lead to higher effective interest rates than initially advertised. Carefully reviewing the fee structures and fine print of both options is essential to avoid unexpected expenses when sourcing debt.

Risk Factors in Traditional Loans and P2P Lending

Traditional loans often carry rigid risk factors including stringent credit checks, collateral requirements, and higher default penalties, which can limit access for borrowers with low credit scores. Peer-to-peer lending exposes investors to increased credit risk and liquidity risk due to the absence of institutional backing and secondary markets for loan trading. Both financing methods face regulatory uncertainties, but P2P platforms typically implement diversified loan portfolios and credit scoring algorithms to mitigate default risks more flexibly than traditional banks.

Which Option Suits Your Debt Management Needs?

Traditional loans offer structured repayment schedules and established credit requirements, making them suitable for borrowers seeking predictable terms and reliable lenders. Peer-to-peer lending provides flexible borrowing options with competitive interest rates through online platforms connecting individual investors and borrowers. Assess your credit profile, loan purpose, and preference for lender type to determine which debt sourcing option best aligns with your financial goals.

Related Important Terms

Alternative Credit Scoring

Peer-to-peer lending leverages alternative credit scoring models that analyze non-traditional data such as social behaviors, mobile phone usage, and utility payments, providing more inclusive access to credit compared to traditional loans reliant on conventional credit scores and fixed financial documentation. This innovative approach reduces barriers for underbanked borrowers, enabling personalized risk assessments and often resulting in faster loan approvals and competitive interest rates.

Crowdlending Platforms

Crowdlending platforms offer an alternative to traditional loans by connecting borrowers directly with individual investors, often resulting in faster approval and competitive interest rates. These platforms provide increased transparency and flexibility compared to conventional bank loans, enabling borrowers to secure debt with potentially lower fees and customized repayment terms.

Social Lending Pools

Traditional loans typically involve financial institutions providing debt with fixed interest rates and strict criteria, while peer-to-peer lending leverages social lending pools where individual investors collectively fund borrower's needs, often resulting in competitive rates and increased access. Social lending pools enhance debt sourcing by diversifying risk among multiple lenders and fostering community-driven financial support, driving innovation in online debt marketplaces.

Microsegment Risk Assessment

Traditional loans rely on standardized credit scoring models that may overlook nuanced borrower behavior in microsegments, leading to potential risk misclassification. Peer-to-peer lending platforms utilize advanced data analytics and social signals to perform granular microsegment risk assessments, offering more precise risk profiling and tailored interest rates.

Direct-to-Borrower Funding

Direct-to-borrower funding through peer-to-peer lending platforms offers access to lower interest rates and faster approval compared to traditional loans, which often involve banks with stringent credit requirements and slower processing times. This debt sourcing alternative increases borrowing flexibility by connecting individual lenders directly to borrowers, reducing intermediary costs and enhancing transparency.

Loan Marketplace Matching Algorithms

Traditional loan platforms rely on centralized underwriting processes, often leading to longer approval times and less personalized rates, while peer-to-peer lending uses advanced loan marketplace matching algorithms to connect borrowers directly with investors, optimizing interest rates based on credit profiles and risk assessments. These algorithms enhance efficiency by automating loan matching, increasing funding speed, and offering borrowers competitive terms compared to conventional banking systems.

Decentralized Debt Syndication

Traditional loans rely on centralized financial institutions that control credit approval and fund distribution, often resulting in longer processing times and higher costs. Peer-to-peer lending harnesses decentralized debt syndication by connecting borrowers directly with multiple individual lenders via digital platforms, enhancing transparency, reducing intermediaries, and enabling more competitive interest rates.

Community-Driven Underwriting

Traditional loans rely on institutional underwriting criteria primarily based on credit scores and financial history, limiting access for some borrowers. Peer-to-peer lending leverages community-driven underwriting by incorporating social data and borrower reputation, enabling more flexible credit evaluations and personalized debt sourcing.

Pre-qualification Tokenization

Traditional loans typically require extensive pre-qualification processes involving credit checks and documentation, which can delay access to funds, whereas peer-to-peer lending platforms use tokenization to streamline borrower identification and risk assessment, accelerating approval times. Tokenization enhances security by converting sensitive borrower data into encrypted tokens, reducing fraud risk and simplifying compliance in peer-to-peer lending compared to conventional loan systems.

Disintermediated Interest Rate Models

Traditional loans typically involve financial intermediaries such as banks, which set interest rates based on credit risk assessments and operational costs, often resulting in higher borrowing costs. Peer-to-peer lending employs disintermediated interest rate models where rates are directly negotiated between borrowers and individual lenders, frequently leading to more competitive pricing by bypassing conventional banking overhead.

Traditional loan vs peer-to-peer lending for debt sourcing. Infographic

moneydiff.com

moneydiff.com