Mortgage debt traditionally finances home purchases with fixed or variable interest rates, but often lacks incentives for sustainability. Climate-resilient debt integrates environmental risk assessments, promoting financing for energy-efficient and disaster-resistant housing. This approach helps mitigate future climate impacts while supporting long-term financial stability in the housing market.

Table of Comparison

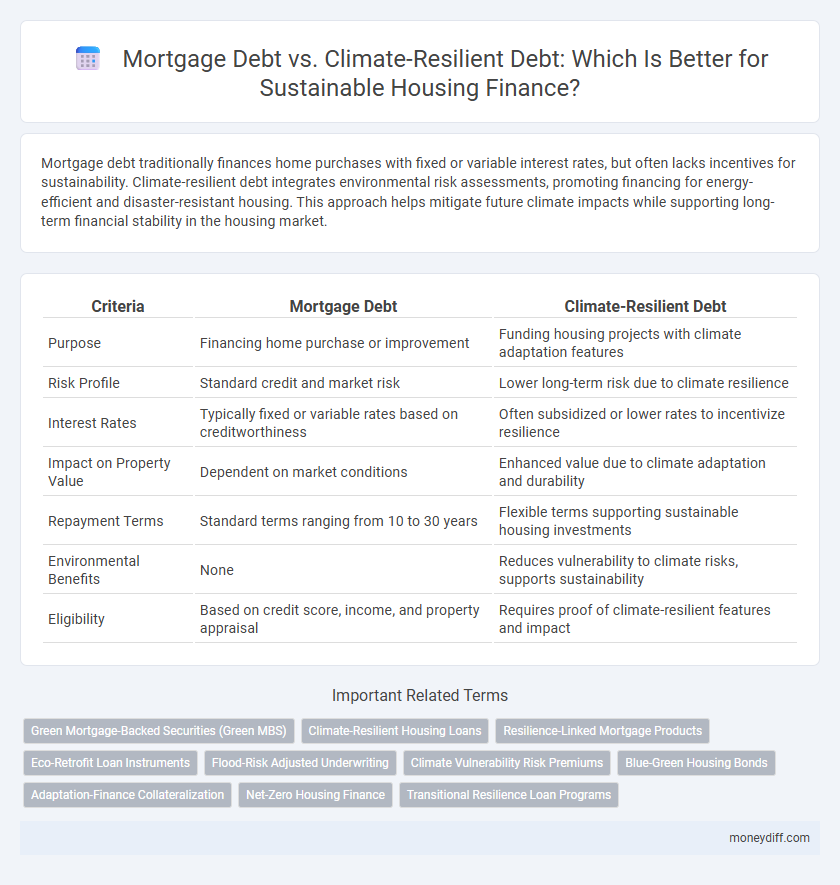

| Criteria | Mortgage Debt | Climate-Resilient Debt |

|---|---|---|

| Purpose | Financing home purchase or improvement | Funding housing projects with climate adaptation features |

| Risk Profile | Standard credit and market risk | Lower long-term risk due to climate resilience |

| Interest Rates | Typically fixed or variable rates based on creditworthiness | Often subsidized or lower rates to incentivize resilience |

| Impact on Property Value | Dependent on market conditions | Enhanced value due to climate adaptation and durability |

| Repayment Terms | Standard terms ranging from 10 to 30 years | Flexible terms supporting sustainable housing investments |

| Environmental Benefits | None | Reduces vulnerability to climate risks, supports sustainability |

| Eligibility | Based on credit score, income, and property appraisal | Requires proof of climate-resilient features and impact |

Comparing Mortgage Debt and Climate-Resilient Debt: An Overview

Mortgage debt traditionally finances home purchases with fixed or variable interest rates based on borrower creditworthiness and property value. Climate-resilient debt integrates environmental risk assessments and funds homes built or retrofitted to withstand climate impacts, potentially offering lower interest rates or incentives. This emerging debt type enhances housing finance by prioritizing sustainability and reducing long-term climate-related financial risks.

The Evolution of Housing Finance in a Climate-Conscious Era

Mortgage debt traditionally funds home purchases with fixed or variable interest rates tied to borrower credit and property value, but climate-resilient debt integrates environmental risk assessments and sustainability criteria into lending decisions. Financial institutions increasingly offer green mortgages and sustainability-linked loans that incentivize energy-efficient home improvements and climate-adaptive construction, reflecting the rising importance of climate resilience in creditworthiness. This evolution in housing finance aligns capital flows with long-term environmental sustainability, reducing exposure to climate-related financial risks and promoting resilient community development.

Traditional Mortgage Debt: Structure, Benefits, and Limitations

Traditional mortgage debt typically involves fixed or variable interest rates secured by residential real estate, providing predictable repayment schedules and access to substantial capital for homebuyers. Its benefits include established legal frameworks, widespread lender acceptance, and relatively low borrowing costs compared to unsecured credit. However, limitations arise from sensitivity to economic fluctuations, inflexible loan terms that may not accommodate climate risks, and the potential exacerbation of financial instability in vulnerable regions facing increasing environmental hazards.

Climate-Resilient Debt: Definition and Emerging Trends

Climate-resilient debt refers to financing mechanisms designed to support housing projects that can withstand environmental stresses such as floods, hurricanes, and rising temperatures. This form of debt prioritizes sustainable construction materials, energy-efficient designs, and infrastructure improvements that mitigate climate risks. Emerging trends include green bonds and sustainability-linked loans that incentivize developers to integrate climate adaptation measures into residential developments.

Financial Implications: Cost, Risk, and Returns

Mortgage debt typically offers lower interest rates due to established credit risk assessments but may expose lenders and borrowers to heightened climate-related risks, such as property damage from extreme weather events. Climate-resilient debt, while often carrying higher upfront costs to fund sustainable construction or retrofitting, aims to reduce long-term financial risks and increase asset value through enhanced durability and energy efficiency. The potential for improved risk-adjusted returns and access to green financing incentives makes climate-resilient debt an increasingly attractive option in sustainable housing finance portfolios.

Eligibility Criteria: Who Qualifies for Each Debt Type?

Mortgage debt eligibility primarily requires borrowers to demonstrate creditworthiness, stable income, and sufficient collateral, with loan-to-value ratios typically capped at 80%. Climate-resilient debt for housing finance prioritizes applicants residing in climate-vulnerable areas or those investing in energy-efficient, disaster-resistant property improvements, often requiring verification of environmental impact measures. Lenders offering climate-resilient debt may also mandate compliance with local climate adaptation policies or sustainability certifications to qualify.

Impact on Property Value and Long-Term Equity

Mortgage debt tied to traditional housing often risks property value depreciation due to climate vulnerabilities, such as flood damage or wildfire exposure, which can erode long-term equity for homeowners. Climate-resilient debt financing encourages investments in sustainable, fortified building materials and infrastructure, enhancing property durability and preserving or increasing equity over time. This type of debt shifts risk management from lenders and borrowers to proactive resilience strategies, stabilizing asset values in the face of environmental threats.

Resilience to Climate Risk: Financing for the Future

Mortgage debt typically focuses on property value and borrower creditworthiness without accounting for environmental vulnerabilities. Climate-resilient debt integrates risk assessments related to climate hazards, promoting investments in sustainable, disaster-resistant housing infrastructure. Financing through climate-resilient instruments enhances long-term affordability and asset protection by mitigating exposure to extreme weather events and rising climate risks.

Policy, Regulation, and Market Adoption

Mortgage debt traditionally dominates housing finance but often lacks incentives for climate resilience, prompting policymakers to explore regulations that integrate sustainability criteria. Climate-resilient debt instruments, supported by green bond frameworks and tax incentives, are gaining traction to promote energy-efficient and flood-resistant housing developments. Market adoption increases as regulatory bodies standardize disclosure requirements and risk assessments, encouraging lenders and investors to prioritize loans aligned with climate adaptation goals.

Choosing the Right Debt Instrument for Sustainable Homeownership

Mortgage debt remains the primary financing tool for homeownership, but climate-resilient debt instruments are increasingly essential for sustainable housing finance. Climate-resilient debt integrates risk assessments related to environmental factors, promoting investments in energy-efficient and disaster-resistant properties. Prioritizing these innovative debt options supports long-term financial stability and mitigates climate-related losses in the housing sector.

Related Important Terms

Green Mortgage-Backed Securities (Green MBS)

Green Mortgage-Backed Securities (Green MBS) represent a growing segment in housing finance, channeling investments into climate-resilient housing projects that reduce carbon footprints and enhance energy efficiency. Compared to traditional mortgage debt, Green MBS offer investors opportunities to support sustainable development while potentially benefiting from favorable risk-adjusted returns linked to environmentally resilient properties.

Climate-Resilient Housing Loans

Climate-resilient housing loans prioritize financing for properties built with sustainable materials and technologies that withstand extreme weather events, reducing long-term risks compared to conventional mortgage debt. These loans integrate climate risk assessments into credit evaluations, promoting adaptive infrastructure while supporting market stability and environmental goals.

Resilience-Linked Mortgage Products

Resilience-linked mortgage products integrate climate risk assessments into housing finance, incentivizing borrowers to invest in climate-resilient home improvements that enhance property durability and reduce long-term costs. These innovative debt instruments shift traditional mortgage debt by promoting sustainability and mitigating climate-related financial risks in housing markets.

Eco-Retrofit Loan Instruments

Eco-retrofit loan instruments enable homeowners to finance energy-efficient upgrades, reducing mortgage debt risks by enhancing property resilience to climate impacts such as floods and heatwaves. Incorporating climate-resilient debt into housing finance supports sustainable urban development by lowering utility costs, improving property values, and mitigating environmental damage.

Flood-Risk Adjusted Underwriting

Mortgage debt traditionally relies on fixed-interest rates without accounting for environmental risks, whereas climate-resilient debt integrates flood-risk adjusted underwriting to evaluate property vulnerability and ensure sustainable housing finance. This approach leverages geospatial flood data and predictive modeling to set risk-based loan terms, reducing financial exposure and promoting resilient infrastructure investment.

Climate Vulnerability Risk Premiums

Mortgage debt traditionally offers fixed or variable interest rates based on credit risk, whereas climate-resilient debt incorporates climate vulnerability risk premiums that adjust financing costs to reflect potential environmental hazards such as flooding, wildfires, or hurricanes. Incorporating climate vulnerability risk premiums incentivizes investments in resilient housing infrastructure by pricing in long-term climate risks, ultimately driving more sustainable and adaptive housing finance solutions.

Blue-Green Housing Bonds

Mortgage debt traditionally funds housing construction without specific environmental considerations, whereas climate-resilient debt, such as Blue-Green Housing Bonds, directly supports sustainable infrastructure by integrating water and climate resilience features into housing finance. Blue-Green Housing Bonds attract investors focused on environmental impact, driving capital toward projects that reduce flood risks, improve energy efficiency, and enhance long-term climate adaptability in residential developments.

Adaptation-Finance Collateralization

Mortgage debt traditionally prioritizes borrower creditworthiness and property value, whereas climate-resilient debt integrates adaptation-finance collateralization by leveraging climate risk reduction assets to secure housing finance. This emerging model enhances resilience by tying loan security to infrastructure or improvements that mitigate climate impacts, promoting sustainable investment in vulnerable housing markets.

Net-Zero Housing Finance

Mortgage debt traditionally funds conventional housing, often overlooking environmental risks and contributing to carbon emissions, while climate-resilient debt prioritizes investments in net-zero housing finance by supporting energy-efficient, sustainable building practices and materials to reduce carbon footprints. Net-zero housing finance aligns with global climate goals by facilitating affordable, resilient homes through green bonds, climate-linked loans, and incentive structures that promote renewable energy integration and lower long-term operational costs.

Transitional Resilience Loan Programs

Transitional Resilience Loan Programs prioritize climate-resilient debt by offering mortgage financing that supports sustainable housing developments designed to withstand environmental stresses. These programs integrate risk assessment models that factor in climate vulnerabilities, enabling borrowers to secure affordable loans while promoting resilient infrastructure and reducing long-term financial exposure to climate-related damages.

Mortgage debt vs climate-resilient debt for housing finance. Infographic

moneydiff.com

moneydiff.com