Secured debt involves borrowing funds backed by tangible assets, offering lenders a lower risk and often resulting in lower interest rates due to the collateral provided. Crowdfunding debt, by contrast, aggregates smaller loans from numerous investors and may not always be asset-backed, leading to higher risk perception and potentially higher costs for borrowers. Choosing between secured debt and crowdfunding debt depends on the availability of assets to pledge and the borrower's preference for traditional versus alternative financing routes.

Table of Comparison

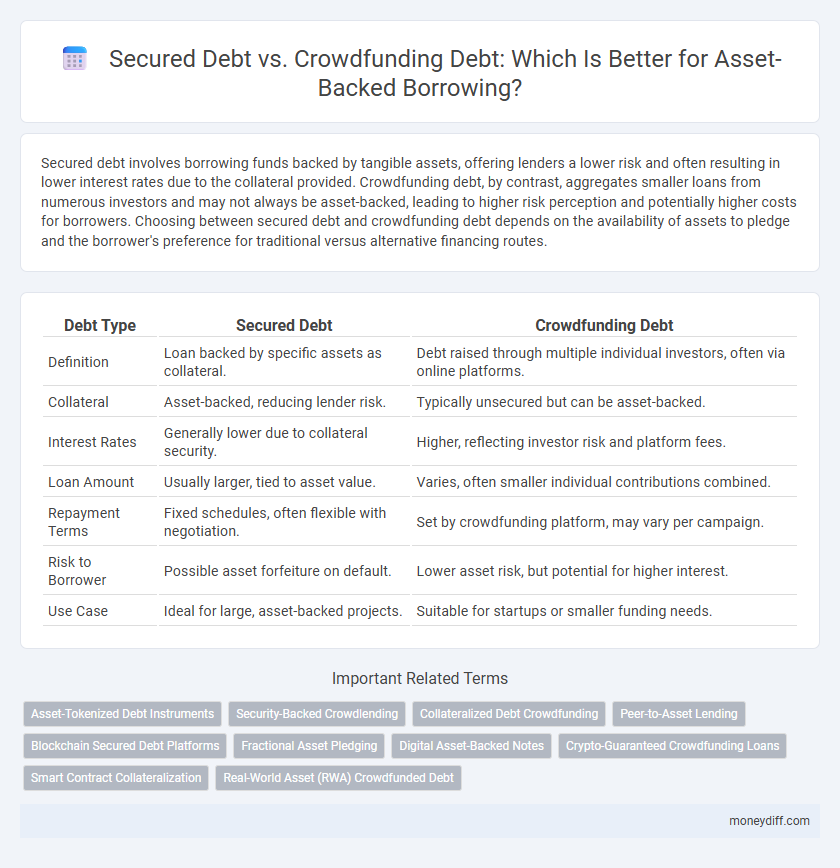

| Debt Type | Secured Debt | Crowdfunding Debt |

|---|---|---|

| Definition | Loan backed by specific assets as collateral. | Debt raised through multiple individual investors, often via online platforms. |

| Collateral | Asset-backed, reducing lender risk. | Typically unsecured but can be asset-backed. |

| Interest Rates | Generally lower due to collateral security. | Higher, reflecting investor risk and platform fees. |

| Loan Amount | Usually larger, tied to asset value. | Varies, often smaller individual contributions combined. |

| Repayment Terms | Fixed schedules, often flexible with negotiation. | Set by crowdfunding platform, may vary per campaign. |

| Risk to Borrower | Possible asset forfeiture on default. | Lower asset risk, but potential for higher interest. |

| Use Case | Ideal for large, asset-backed projects. | Suitable for startups or smaller funding needs. |

Understanding Secured Debt: Definition and Key Features

Secured debt involves borrowing funds backed by specific assets that act as collateral, reducing the lender's risk and often resulting in lower interest rates for the borrower. Key features include the right of the lender to seize the collateral if the borrower defaults, fixed repayment schedules, and legal agreements that clearly define the asset and terms. Unlike crowdfunding debt, secured debt typically requires formal appraisal and registration of the asset to enforce claims efficiently.

What Is Crowdfunding Debt? Structure and Mechanisms

Crowdfunding debt involves raising capital through small loans from a large number of individual investors via online platforms, often used as an alternative to traditional financing. This debt structure typically features fixed interest rates and scheduled repayments, providing transparency and predictable cash flow for asset-backed borrowing. Unlike secured debt, which is backed directly by assets as collateral, crowdfunding debt relies on the collective trust and creditworthiness established through the platform's mechanisms.

Asset-Backed Borrowing: Exploring Your Options

Asset-backed borrowing offers secured debt as a traditional option where loans are backed by tangible assets like property or equipment, providing lenders with collateral and typically lower interest rates. Crowdfunding debt, an emerging alternative, allows multiple investors to fund a loan secured by assets, diversifying risk and granting access to capital without relying on conventional financial institutions. Comparing secured debt and crowdfunding debt highlights differences in flexibility, approval processes, and cost structures crucial for borrowers leveraging asset-backed financing.

Comparing Security: Collateral in Secured Debt vs Crowdfunding Debt

Secured debt typically involves collateral such as real estate, vehicles, or equipment that lenders can claim if the borrower defaults, providing a tangible asset-backed guarantee. Crowdfunding debt, on the other hand, often lacks traditional collateral, relying instead on the collective trust and repayment capability of a diverse group of investors, making it less secured. The presence of physical collateral in secured debt reduces lender risk significantly compared to the unsecured or less-collateralized nature of crowdfunding debt.

Interest Rates and Repayment Terms: How They Differ

Secured debt typically offers lower interest rates due to the collateral backing the loan, reducing lender risk and resulting in more favorable repayment terms such as longer durations and fixed installments. Crowdfunding debt often carries higher interest rates because investors face greater uncertainty and shorter repayment periods, sometimes with variable or less structured payment schedules. These differences impact borrower cost and flexibility, with secured debt providing more predictable financial planning and crowdfunding debt allowing access to diverse funding sources at potentially higher costs.

Accessibility and Approval Process: Traditional Lenders vs Crowdfunding Platforms

Secured debt from traditional lenders typically requires extensive credit checks and collateral verification, leading to a more stringent approval process that can limit accessibility for borrowers with lower credit scores or unconventional assets. Crowdfunding debt platforms offer a more accessible alternative by leveraging a larger pool of individual investors, often resulting in faster approvals and more flexible criteria without the need for traditional collateral. This democratization of asset-backed borrowing enables broader participation but may come with varied interest rates and risk levels compared to conventional secured loans.

Risk Assessment: Both for Borrowers and Lenders

Secured debt involves collateralized loans where asset valuation directly impacts risk exposure for both borrowers and lenders, reducing default risk through tangible security. Crowdfunding debt distributes risk among multiple lenders, increasing diversification but raising concerns about borrower creditworthiness and transparency. Risk assessment for secured debt prioritizes asset liquidity, while crowdfunding debt requires rigorous due diligence on borrower credibility and repayment capacity.

Impact on Credit Score: Secured Debt vs Crowdfunding Debt

Secured debt, backed by collateral such as real estate or vehicles, typically has a more positive impact on credit scores due to consistent payment history and reduced lender risk. Crowdfunding debt, often unsecured and reliant on multiple small lenders, may not impact credit scores as strongly but carries higher risk of default, which can negatively affect credit if payments are missed. Lenders and credit reporting agencies generally view secured debt as more favorable, influencing creditworthiness and borrowing capacity.

Legal Protections and Recovery in Case of Default

Secured debt offers borrowers strong legal protections by granting lenders a lien on specific assets, ensuring priority recovery in case of default through asset liquidation. Crowdfunding debt, while allowing multiple small investors to fund borrowing, typically provides less clear legal claims and complicates asset recovery due to dispersed ownership and varied investor agreements. Asset-backed borrowing under secured debt reduces lender risk with enforceable rights, whereas crowdfunding debt may face challenges in creditor coordination and enforcement during default events.

Which Should You Choose? Factors to Consider for Asset-Backed Loans

Secured debt offers lower interest rates and priority claims on assets, making it suitable for borrowers seeking predictable repayment terms and lower risk for lenders. Crowdfunding debt provides access to diverse funding sources and flexible terms but may involve higher interest rates and less regulatory oversight. Choosing between these options depends on factors such as collateral availability, cost of capital, borrower creditworthiness, and the urgency of funding needs in asset-backed lending.

Related Important Terms

Asset-Tokenized Debt Instruments

Secured debt leverages asset-tokenized debt instruments to provide investors with collateral-backed claims ensuring lower risk and higher confidence in repayments. Crowdfunding debt, while enabling broader access to capital, often lacks the direct asset linkage found in tokenized secured debt, resulting in potentially higher risk profiles and less predictable recovery options.

Security-Backed Crowdlending

Security-backed crowdlending offers a hybrid approach combining the asset-backed security of traditional secured debt with the diversified funding sources of crowdfunding platforms, enabling borrowers to leverage physical collateral while accessing multiple investors. This method enhances risk mitigation through tangible asset guarantees, often resulting in competitive interest rates and broader accessibility compared to conventional secured loans.

Collateralized Debt Crowdfunding

Collateralized debt crowdfunding leverages asset-backed borrowing by using tangible collateral to secure funds from multiple investors, reducing lender risk and often lowering interest rates compared to traditional secured debt. This approach democratizes access to capital, enabling smaller investors to participate in secured lending opportunities typically reserved for institutional lenders.

Peer-to-Asset Lending

Peer-to-Asset lending in secured debt leverages tangible assets as collateral, reducing lender risk and often securing lower interest rates compared to crowdfunding debt, which pools multiple investors but may carry higher costs and less direct asset linkage. This approach enhances borrowing efficiency by directly tying loan repayment to asset performance, offering a more transparent and structured financing alternative to traditional crowdfunding methods in asset-backed borrowing.

Blockchain Secured Debt Platforms

Blockchain secured debt platforms enable asset-backed borrowing by leveraging secured debt, where tangible assets act as collateral to reduce lender risk and enhance borrower credibility. Compared to crowdfunding debt, these platforms offer increased transparency, faster transaction settlement, and immutable records, optimizing trust and efficiency in the debt financing process.

Fractional Asset Pledging

Secured debt leverages fractional asset pledging by allowing multiple lenders to have proportional claims on a specific asset, optimizing risk distribution and enhancing borrowing capacity. Crowdfunding debt similarly uses fractional asset pledging but crowdsources capital from numerous investors, providing flexible access to asset-backed financing while maintaining transparency and diversified risk exposure.

Digital Asset-Backed Notes

Digital Asset-Backed Notes in asset-backed borrowing utilize secured debt structures by pledging specific digital assets as collateral, ensuring lower risk and priority repayment for investors. Crowdfunding debt, often unsecured and reliant on collective funding without direct collateral, generally presents higher risk and less protection for lenders in the digital asset space.

Crypto-Guaranteed Crowdfunding Loans

Crypto-guaranteed crowdfunding loans offer an innovative alternative to traditional secured debt by leveraging digital assets as collateral, enabling faster access to capital without the need for physical asset appraisal. This form of asset-backed borrowing reduces lender risk through blockchain transparency while expanding funding opportunities beyond conventional secured debt frameworks.

Smart Contract Collateralization

Secured debt leverages tangible assets as collateral, ensuring lender protection through legal claims on property, while crowdfunding debt pools funds from multiple investors without direct asset backing. Smart contract collateralization automates the enforcement of security interests by encoding asset-backed terms, increasing transparency and reducing default risk in both secured and crowdfunding debt models.

Real-World Asset (RWA) Crowdfunded Debt

Secured debt involves borrowing backed by physical assets or collateral, reducing lender risk and often resulting in lower interest rates for asset-backed loans. In Real-World Asset (RWA) crowdfunded debt, multiple investors pool funds to finance tangible assets, diversifying risk while providing accessible capital for borrowers through blockchain or alternative finance platforms.

Secured debt vs Crowdfunding debt for asset-backed borrowing Infographic

moneydiff.com

moneydiff.com