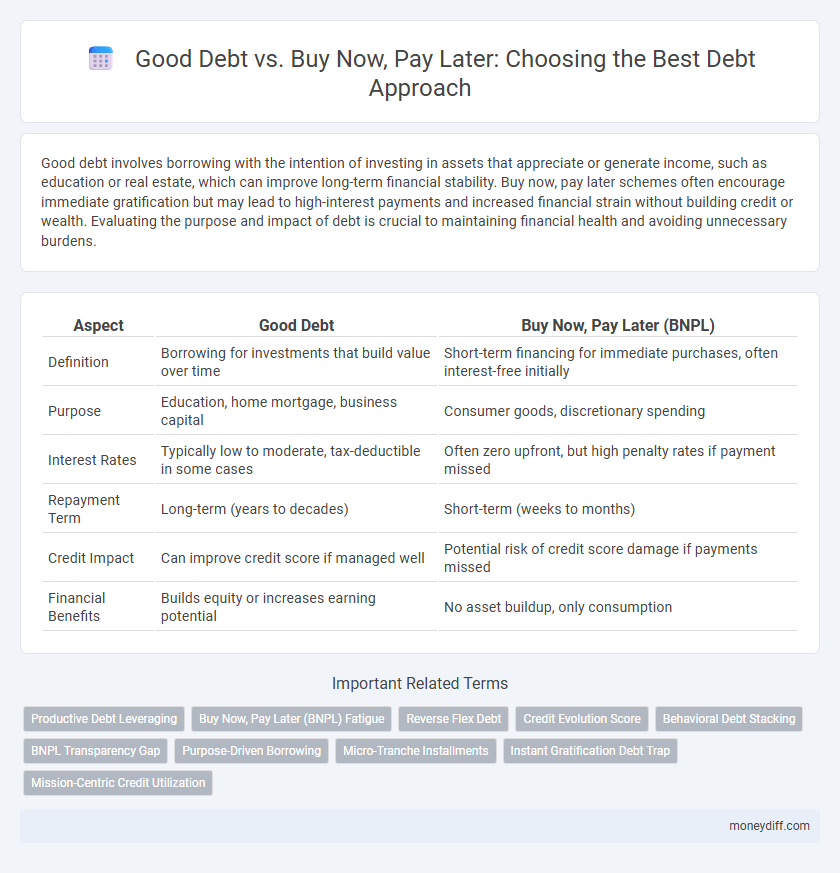

Good debt involves borrowing with the intention of investing in assets that appreciate or generate income, such as education or real estate, which can improve long-term financial stability. Buy now, pay later schemes often encourage immediate gratification but may lead to high-interest payments and increased financial strain without building credit or wealth. Evaluating the purpose and impact of debt is crucial to maintaining financial health and avoiding unnecessary burdens.

Table of Comparison

| Aspect | Good Debt | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Definition | Borrowing for investments that build value over time | Short-term financing for immediate purchases, often interest-free initially |

| Purpose | Education, home mortgage, business capital | Consumer goods, discretionary spending |

| Interest Rates | Typically low to moderate, tax-deductible in some cases | Often zero upfront, but high penalty rates if payment missed |

| Repayment Term | Long-term (years to decades) | Short-term (weeks to months) |

| Credit Impact | Can improve credit score if managed well | Potential risk of credit score damage if payments missed |

| Financial Benefits | Builds equity or increases earning potential | No asset buildup, only consumption |

Understanding Good Debt: Definition and Examples

Good debt refers to borrowed money used for investments that typically generate long-term value or improve financial stability, such as student loans, mortgages, and business loans. Unlike Buy Now, Pay Later (BNPL) plans, which often lead to short-term consumption and higher interest costs, good debt builds equity or enhances earning potential. Understanding the characteristics of good debt helps individuals leverage borrowing opportunities while avoiding the pitfalls of high-cost, impulsive spending.

Buy Now, Pay Later: How It Works

Buy Now, Pay Later (BNPL) allows consumers to purchase items immediately while deferring payments over a short period, often interest-free if paid on time. Unlike traditional good debt, such as mortgages or student loans that build long-term value, BNPL is typically used for smaller, discretionary purchases with fixed installment plans. Careful management of BNPL is crucial to avoid falling into high-interest debt traps or negatively impacting credit scores.

Comparing Good Debt vs Buy Now, Pay Later

Good debt typically involves borrowing for investments that increase net worth or generate income, such as mortgages or student loans, which have lower interest rates and longer repayment terms. Buy Now, Pay Later (BNPL) plans offer short-term financing for immediate purchases but often carry higher interest rates and fees if payments are missed, potentially leading to unmanageable debt. Comparing good debt to BNPL highlights the importance of purpose and cost, where good debt supports financial growth while BNPL risks financial strain due to impulsive spending and high repayment pressures.

Benefits of Taking on Good Debt

Good debt, such as student loans or mortgages, often leads to long-term financial growth by building credit and increasing asset value. Unlike Buy Now, Pay Later plans, good debt typically comes with lower interest rates and structured repayment schedules that encourage disciplined financial habits. Leveraging good debt strategically can improve financial health and provide opportunities for investment and wealth accumulation.

Risks Involved with Buy Now, Pay Later Schemes

Buy Now, Pay Later (BNPL) schemes often carry significant risks, including high interest rates and hidden fees that can quickly accumulate, leading to unmanageable debt. Unlike good debt, which typically involves investments in assets like education or property that appreciate over time, BNPL encourages impulsive spending without asset growth. Consumers using BNPL must carefully assess repayment terms to avoid damaging their credit scores and facing long-term financial challenges.

Financial Impact: Good Debt vs BNPL on Credit Score

Good debt, such as a mortgage or student loan, can positively impact credit scores by demonstrating responsible borrowing and timely payments over time, thereby building credit history. In contrast, Buy Now, Pay Later (BNPL) services often do not report to credit bureaus unless payments are missed, which can lead to unnoticed debt accumulation and sudden negative credit impacts. Responsible management of good debt enhances creditworthiness, while mismanaged BNPL can result in reduced credit scores due to unexpected defaults or increased debt-to-income ratios.

Long-Term Wealth: Investing with Good Debt

Good debt, such as low-interest investment loans or mortgages, can build long-term wealth by leveraging capital to generate returns exceeding borrowing costs. Buy now, pay later schemes often incur high interest and fees, leading to short-term consumption rather than productive asset accumulation. Prioritizing good debt enables strategic investment in real estate, education, or business, fostering sustained financial growth and wealth creation.

Short-Term Gratification: The Lure of BNPL

Good debt, such as mortgages or student loans, often leads to long-term financial growth by enabling asset acquisition or skill development. Buy Now, Pay Later (BNPL) services, however, tempt consumers with short-term gratification, encouraging immediate purchases without considering long-term repayment consequences. This approach can result in higher debt levels and financial strain due to accumulating interest and fees if payments are missed.

Debt Management Strategies for Smart Borrowing

Good debt, such as mortgages or student loans, often leads to asset building and long-term financial growth, while buy now, pay later schemes can encourage impulsive spending and higher debt accumulation. Effective debt management strategies prioritize borrowing from reputable institutions with clear terms and manageable repayment plans to avoid excessive interest and fees. Smart borrowing involves assessing one's repayment capacity and leveraging low-interest, purpose-driven debt to enhance financial stability rather than short-term consumption.

Making the Right Choice: Good Debt or BNPL for Your Finances

Good debt, such as mortgages or student loans, typically offers lower interest rates and potential tax benefits, making it a strategic financial tool for building wealth and credit. Buy Now, Pay Later (BNPL) schemes provide short-term payment flexibility but often lack the long-term financial advantages and can lead to higher overall costs if not managed carefully. Assessing your financial goals, interest rates, and repayment capacity is crucial to making an informed decision between good debt and BNPL solutions.

Related Important Terms

Productive Debt Leveraging

Good debt, such as business loans or education financing, leverages future income to create value and generate returns, whereas Buy Now, Pay Later (BNPL) options primarily fund consumption without long-term productive benefits, often leading to higher overall debt burdens. Productive debt leveraging maximizes financial growth by investing in assets that appreciate or increase earning potential, contrasting with BNPL's short-term, interest-free credit that can diminish financial stability when overused.

Buy Now, Pay Later (BNPL) Fatigue

Buy Now, Pay Later (BNPL) fatigue arises as consumers accumulate multiple short-term installment debts, leading to increased financial strain and reduced credit flexibility compared to traditional good debt like mortgages or student loans. Unlike good debt, which often builds long-term value, BNPL can exacerbate cash flow problems and elevate the risk of default due to its easy access and high usage frequency.

Reverse Flex Debt

Good debt, such as mortgages or student loans, typically builds long-term financial value and credit while buy now, pay later (BNPL) options often lead to short-term convenience but higher risk of accumulating Reverse Flex Debt, a burdensome form where missed payments trigger escalating fees and reduced payment flexibility. Understanding the distinction between productive debt and the pitfalls of BNPL-driven Reverse Flex Debt is essential for maintaining financial stability and avoiding negative credit impacts.

Credit Evolution Score

Good debt strategically leverages credit to build assets and improve financial health, positively influencing your Credit Evolution Score by demonstrating responsible borrowing and timely repayments. In contrast, Buy Now, Pay Later plans often contribute to fragmented debt patterns and missed payments, which can negatively impact your Credit Evolution Score by signaling higher credit risk to lenders.

Behavioral Debt Stacking

Good debt, such as student loans or mortgages, often builds long-term value and creditworthiness, while Buy Now, Pay Later schemes encourage Behavioral Debt Stacking by accumulating multiple short-term liabilities that inflate overall debt burden and impair financial discipline. This pattern can lead to higher default risk and reduced access to traditional credit due to the compounded, less transparent nature of BNPL obligations.

BNPL Transparency Gap

Good debt typically involves borrowing that builds credit or assets, such as mortgages or student loans, whereas Buy Now, Pay Later (BNPL) services often lack transparency on fees and repayment terms, creating a significant BNPL transparency gap. This gap can lead consumers to underestimate the total cost of debt and risks, highlighting the need for clearer regulations and disclosures in BNPL offerings.

Purpose-Driven Borrowing

Purpose-driven borrowing prioritizes using good debt for investments that generate long-term value, such as education or homeownership, while buy now, pay later schemes often encourage impulsive spending without building equity. Maintaining disciplined borrowing aligned with financial goals mitigates risk and promotes sustainable debt management.

Micro-Tranche Installments

Good debt leverages micro-tranche installments to offer manageable repayment plans that build credit and generate long-term financial value, whereas buy now, pay later schemes often encourage short-term spending without sustainable credit benefits. Micro-tranche installments break debt into smaller, controlled amounts, reducing default risk and promoting disciplined financial habits compared to the impulsive nature of buy now, pay later debt.

Instant Gratification Debt Trap

Good debt, such as mortgages or student loans, typically builds long-term value and improves financial stability, whereas Buy Now, Pay Later (BNPL) schemes often lead consumers into an Instant Gratification Debt Trap by encouraging impulsive spending without proper budget assessment. BNPL services can escalate outstanding balances quickly, resulting in high-interest fees and damaged credit scores that outweigh the short-term convenience benefits.

Mission-Centric Credit Utilization

Good debt, such as low-interest loans used for education or business growth, strategically supports mission-centric credit utilization by enhancing long-term value and financial stability. In contrast, Buy Now, Pay Later options often lead to impulsive spending and increased short-term liabilities, detracting from purposeful debt management aligned with financial goals.

Good debt vs Buy now, pay later for debt approach. Infographic

moneydiff.com

moneydiff.com