Personal borrowing typically involves obtaining funds from traditional financial institutions with set interest rates and strict credit requirements, often limiting accessibility. Peer-to-peer lending offers a more flexible alternative by connecting borrowers directly with individual investors, potentially providing lower interest rates and faster approval processes. This modern borrowing method enhances capital access, especially for those who may face challenges qualifying for conventional loans.

Table of Comparison

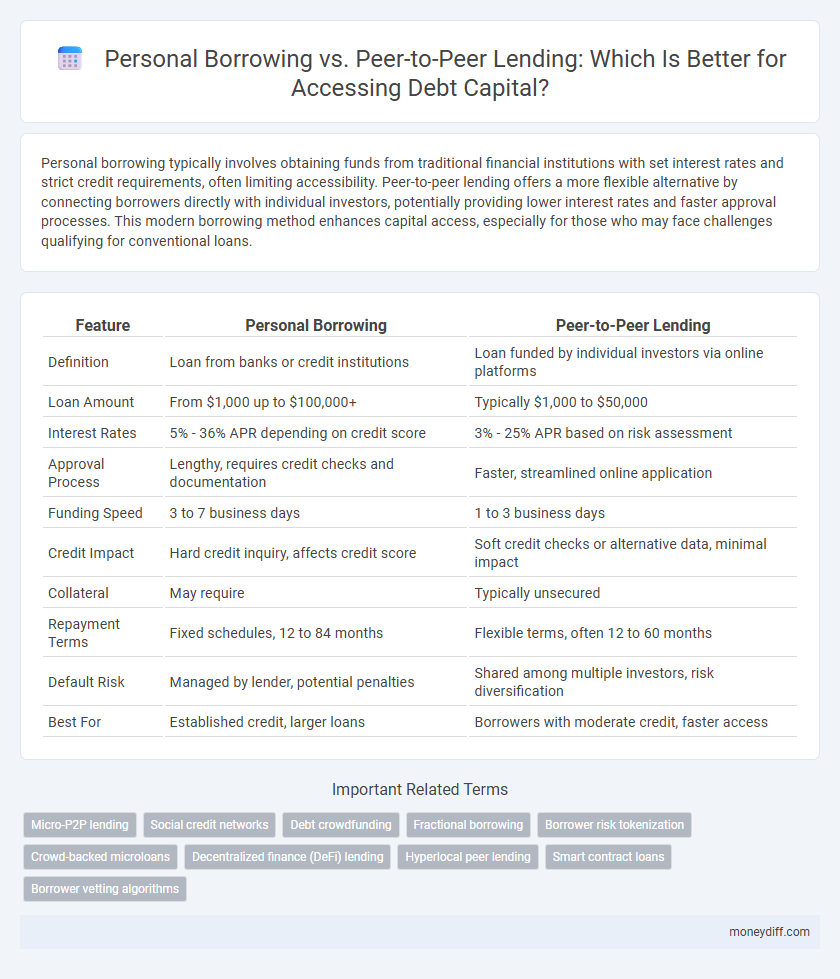

| Feature | Personal Borrowing | Peer-to-Peer Lending |

|---|---|---|

| Definition | Loan from banks or credit institutions | Loan funded by individual investors via online platforms |

| Loan Amount | From $1,000 up to $100,000+ | Typically $1,000 to $50,000 |

| Interest Rates | 5% - 36% APR depending on credit score | 3% - 25% APR based on risk assessment |

| Approval Process | Lengthy, requires credit checks and documentation | Faster, streamlined online application |

| Funding Speed | 3 to 7 business days | 1 to 3 business days |

| Credit Impact | Hard credit inquiry, affects credit score | Soft credit checks or alternative data, minimal impact |

| Collateral | May require | Typically unsecured |

| Repayment Terms | Fixed schedules, 12 to 84 months | Flexible terms, often 12 to 60 months |

| Default Risk | Managed by lender, potential penalties | Shared among multiple investors, risk diversification |

| Best For | Established credit, larger loans | Borrowers with moderate credit, faster access |

Understanding Personal Borrowing: Traditional Options

Traditional personal borrowing options include bank loans, credit cards, and home equity lines of credit, each offering varying interest rates and repayment terms depending on creditworthiness. These conventional financial products typically require thorough credit checks and often enforce stricter qualification criteria compared to alternative methods. Understanding the cost structure, such as APR and potential fees, is essential to evaluate the true cost of capital through personal borrowing effectively.

What Is Peer-to-Peer Lending?

Peer-to-peer lending is an online platform that connects individual borrowers with private investors, bypassing traditional financial institutions. This method offers often lower interest rates and faster access to capital compared to personal borrowing from banks or credit cards. Borrowers benefit from streamlined approval processes and the opportunity to negotiate loan terms directly with lenders, enhancing flexibility and affordability in debt management.

Key Differences Between Personal Borrowing and P2P Lending

Personal borrowing typically involves obtaining funds from traditional financial institutions like banks or credit unions, often requiring a strong credit history and offering fixed interest rates with structured repayment terms. Peer-to-peer (P2P) lending connects borrowers directly with individual investors through online platforms, usually providing more flexible eligibility criteria and potentially lower interest rates due to reduced overhead costs. Risk assessment in personal borrowing is conducted by financial institutions, whereas in P2P lending, risk is distributed among multiple investors, influencing both loan approval and interest rates.

Pros and Cons of Personal Borrowing

Personal borrowing offers quick access to funds with familiar terms and established relationships, but often comes with higher interest rates and stringent credit requirements. It provides flexibility in loan use without the need for platform intermediaries, yet may lack transparency and involves limited borrowing capacity compared to peer-to-peer lending. Borrowers face potential risks of damaging credit scores and incurring penalties for late payments, impacting future financial opportunities.

Benefits and Risks of Peer-to-Peer Lending

Peer-to-peer lending offers borrowers competitive interest rates and faster access to capital compared to traditional personal borrowing or bank loans. It provides flexibility in loan terms and expands access to funds for individuals with varying credit profiles but carries risks such as less regulatory protection and potential platform insolvency. Borrowers must carefully assess peer-to-peer platforms' credibility and understand the risk of borrower default or loss in case of platform failure.

Interest Rates: Personal Loans vs Peer-to-Peer Lending

Personal loans typically feature fixed interest rates ranging from 6% to 36%, influenced by credit scores and lender policies, while peer-to-peer lending platforms often offer more competitive rates between 5% and 30%, driven by market demand and investor risk appetite. Borrowers with strong credit profiles may secure lower rates via peer-to-peer lending due to streamlined processes and reduced overhead costs. Interest rates in peer-to-peer lending fluctuate with platform algorithms and loan term lengths, potentially providing cost advantages over traditional personal loan products.

Credit Requirements and Application Processes

Personal borrowing typically requires a strong credit score and a rigorous application process including credit checks and income verification, which can limit access for those with poor credit histories. Peer-to-peer lending platforms often have more flexible credit requirements and faster application processes, leveraging alternative data points to evaluate borrower risk. This accessibility allows individuals with non-traditional credit profiles to secure capital more easily through peer-to-peer lending networks.

Speed of Accessing Funds: Traditional vs P2P Platforms

Personal borrowing from banks typically involves lengthy approval processes, often taking days to weeks due to extensive credit checks and documentation requirements. Peer-to-peer (P2P) lending platforms leverage technology and a decentralized network of investors to expedite fund disbursement, frequently enabling access within 24 to 72 hours. This accelerated timeline makes P2P lending a faster alternative for individuals seeking immediate capital compared to traditional personal loans.

Safety, Security, and Regulation Concerns

Personal borrowing often involves traditional financial institutions regulated by government agencies, offering robust consumer protection and established security protocols. Peer-to-peer lending platforms, while regulated, may pose higher risks due to less stringent oversight and variable security measures, leading to concerns over borrower verification and fund safeguarding. Evaluating regulatory frameworks and platform transparency is crucial when choosing between these capital access methods for minimizing fraud and financial exposure.

Choosing the Right Option: Factors to Consider for Borrowers

Personal borrowing typically involves traditional lenders such as banks or credit cards, offering fixed interest rates and structured repayment plans, which can provide predictable costs for borrowers. Peer-to-peer lending platforms connect borrowers directly with individual investors, often resulting in competitive rates and faster approval processes, but may involve variable terms and less regulatory protection. Borrowers should consider factors like interest rates, repayment flexibility, credit requirements, approval speed, and risk tolerance when choosing between personal loans and peer-to-peer lending to access capital effectively.

Related Important Terms

Micro-P2P lending

Personal borrowing often involves traditional bank loans with stringent credit requirements, whereas Micro-P2P lending offers access to smaller loans through online platforms connecting individual lenders and borrowers directly. This emerging Micro-P2P lending market caters to underserved individuals seeking flexible, faster capital without the bureaucratic hurdles of conventional lending institutions.

Social credit networks

Personal borrowing typically involves traditional financial institutions requiring credit history and collateral, limiting access for individuals with low credit scores. Peer-to-peer lending leverages social credit networks by assessing trustworthiness through community-based relationships, enabling wider capital access without stringent credit requirements.

Debt crowdfunding

Personal borrowing typically involves obtaining loans from traditional financial institutions with fixed interest rates and repayment schedules, while peer-to-peer lending, a form of debt crowdfunding, connects individual borrowers directly with investors online, often offering more flexible terms and competitive rates. Debt crowdfunding platforms like LendingClub and Prosper leverage technology to streamline loan approvals and expand access to capital, making them a compelling alternative to conventional personal loans.

Fractional borrowing

Personal borrowing typically involves obtaining loans from traditional financial institutions, with fixed terms and interest rates, while peer-to-peer lending enables fractional borrowing by dividing loan amounts into smaller shares funded by multiple investors, enhancing access to capital. Fractional borrowing through peer-to-peer platforms reduces risk for lenders and provides borrowers with more flexible financing options and potentially lower interest rates.

Borrower risk tokenization

Personal borrowing typically involves traditional credit assessments with centralized risk evaluation, whereas peer-to-peer lending leverages borrower risk tokenization to distribute and quantify risk more transparently across a decentralized network. This tokenization enables precise risk pricing and increased accessibility to capital for borrowers who might be underserved by conventional financial institutions.

Crowd-backed microloans

Personal borrowing often involves traditional banks or credit cards with higher interest rates and rigid approval criteria, while peer-to-peer lending offers access to crowd-backed microloans that provide lower rates and faster approval by connecting individual lenders directly with borrowers through online platforms. Crowd-backed microloans leverage the collective power of many small investors to distribute risk and enable capital access for individuals with limited credit history or those seeking flexible repayment terms.

Decentralized finance (DeFi) lending

Personal borrowing traditionally relies on banks or credit unions, often involving stringent credit checks and slower approval processes, while peer-to-peer lending platforms leverage Decentralized Finance (DeFi) to enable direct capital access through blockchain technology, reducing intermediaries and enhancing transparency. DeFi lending protocols utilize smart contracts to automate loans, offering lower interest rates and faster transactions compared to conventional personal borrowing methods.

Hyperlocal peer lending

Personal borrowing often involves traditional banks or credit cards with rigid approval criteria and higher interest rates, whereas hyperlocal peer-to-peer lending connects borrowers directly with lenders within the same community, offering faster access to capital and personalized terms. This hyperlocal model leverages geographic proximity and social trust to reduce default risks and increase financial inclusion for individuals who may lack access to mainstream credit.

Smart contract loans

Smart contract loans in peer-to-peer lending streamline personal borrowing by automating loan agreements and repayments through blockchain technology, reducing the need for traditional intermediaries and lowering costs. This decentralized approach enhances transparency and security, making capital access faster and more efficient compared to conventional personal loans from banks or financial institutions.

Borrower vetting algorithms

Personal borrowing typically relies on traditional credit scores and manual underwriting, which may result in slower approval times and less flexible terms. Peer-to-peer lending platforms utilize advanced borrower vetting algorithms incorporating alternative data sources, enhancing risk assessment accuracy and enabling more competitive interest rates.

Personal borrowing vs Peer-to-peer lending for accessing capital Infographic

moneydiff.com

moneydiff.com