Credit card balance transfers consolidate high-interest debt onto a single card with a lower promotional rate, reducing interest costs if paid off within the transfer period. Debt laddering involves paying off smaller debts first to free up funds and accelerate repayment, which can minimize total interest by targeting higher-rate balances progressively. Choosing between these strategies depends on available credit offers and individual discipline to avoid accumulating new debt during repayment.

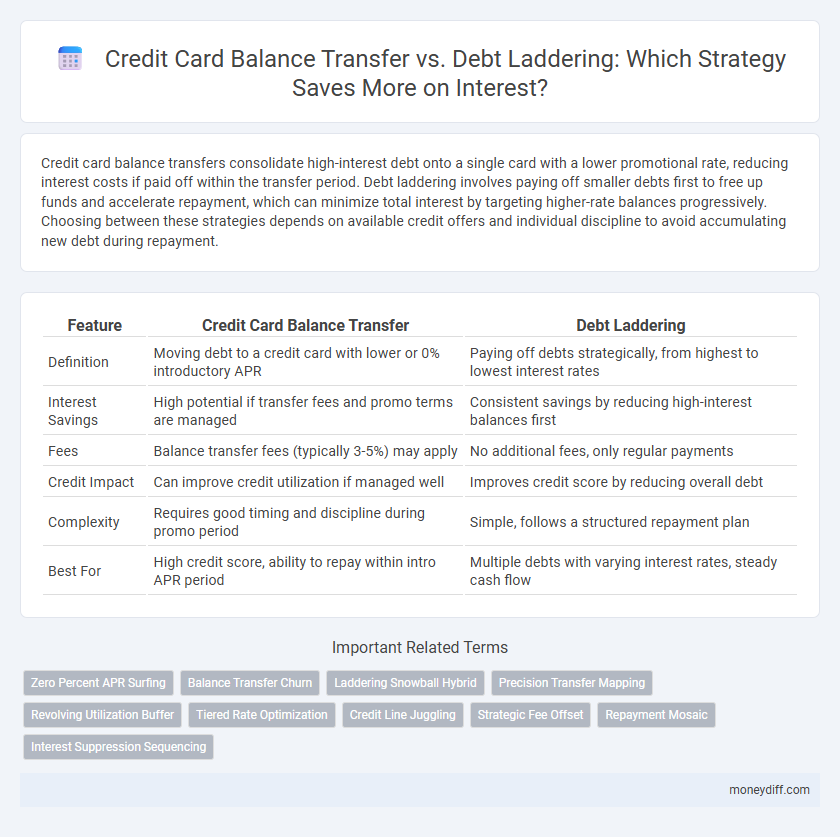

Table of Comparison

| Feature | Credit Card Balance Transfer | Debt Laddering |

|---|---|---|

| Definition | Moving debt to a credit card with lower or 0% introductory APR | Paying off debts strategically, from highest to lowest interest rates |

| Interest Savings | High potential if transfer fees and promo terms are managed | Consistent savings by reducing high-interest balances first |

| Fees | Balance transfer fees (typically 3-5%) may apply | No additional fees, only regular payments |

| Credit Impact | Can improve credit utilization if managed well | Improves credit score by reducing overall debt |

| Complexity | Requires good timing and discipline during promo period | Simple, follows a structured repayment plan |

| Best For | High credit score, ability to repay within intro APR period | Multiple debts with varying interest rates, steady cash flow |

Understanding Credit Card Balance Transfers

Credit card balance transfers allow consumers to move existing debt from high-interest cards to one with a lower or 0% introductory APR, reducing interest payments and accelerating debt payoff. Key factors include transfer fees, promotional period duration, and credit score requirements, which directly impact the total savings achievable. Understanding these elements helps optimize interest savings compared to debt laddering, which prioritizes paying off debts incrementally based on interest rates or balances.

What Is Debt Laddering?

Debt laddering is a strategic repayment method that prioritizes paying off debts from the smallest balance to the largest, effectively reducing overall interest costs by minimizing the number of accounts accruing interest simultaneously. Unlike credit card balance transfers, which consolidate balances to a lower interest rate card, debt laddering focuses on systematic elimination of individual debts, enhancing credit score through consistent payments. This approach leverages psychological motivation by providing quick wins, encouraging continuous progress and long-term financial discipline.

How Each Strategy Works

Credit card balance transfer involves moving high-interest credit card debt to a new card with a lower or 0% introductory interest rate, allowing users to save on interest while paying down the balance faster. Debt laddering focuses on systematically paying off debts from smallest to largest balance, gaining momentum through psychological motivation and gradually freeing up funds to tackle larger debts with higher interest rates. Both strategies aim to minimize interest payments and accelerate debt repayment, with balance transfers relying on rate reduction and debt laddering leveraging structured payoff prioritization.

Pros and Cons of Balance Transfers

Credit card balance transfers offer the advantage of consolidating high-interest debt into a single account with lower or zero introductory interest rates, potentially saving significant interest costs during the promotional period. However, balance transfers often come with fees ranging from 3% to 5% of the transferred amount and may lead to higher interest rates once the introductory period ends, increasing the risk of accumulating debt. Compared to debt laddering, balance transfers provide immediate relief but require disciplined repayment to avoid costly interest after the promotional phase.

Pros and Cons of Debt Laddering

Debt laddering optimizes interest savings by prioritizing repayment of smaller debts first, creating psychological motivation and quicker progress. This method reduces the number of active debts over time, potentially lowering credit utilization rates and improving credit scores. However, interest rates on larger debts may remain high longer, possibly increasing total interest paid compared to balance transfer offers with low introductory rates.

Interest Savings: Comparing Results

Credit card balance transfers typically offer low or 0% introductory interest rates, enabling significant interest savings if the transferred balance is paid off within the promotional period. Debt laddering targets high-interest debts first, systematically reducing the overall interest burden by allocating extra payments to the highest-rate balances, yielding long-term savings through accelerated payoff. Comparing both, balance transfers provide immediate relief on interest costs, while debt laddering ensures consistent, strategic reductions in accrued interest across multiple debts.

Impact on Credit Score

Credit card balance transfers can improve your credit score by lowering your credit utilization ratio, especially if the new card has a higher credit limit and you avoid accumulating new debt. Debt laddering, or the debt avalanche method, can also positively affect your credit score by systematically reducing high-interest balances, leading to lower overall debt and improved payment history over time. Both strategies require disciplined payments; missed payments can significantly harm your credit score regardless of the chosen method.

Fees and Hidden Expenses

Credit card balance transfers often come with fees ranging from 3% to 5% of the transferred amount, which can increase overall debt if not accounted for, while promotional interest rates typically last 6 to 18 months before reverting to standard APRs above 15%. Debt laddering may involve no upfront fees but requires disciplined payments across multiple debts, with the risk of hidden expenses such as late payment penalties and fluctuating interest rates on individual accounts. Carefully comparing transfer fees, promotional periods, and the effective cost of managing multiple balances is essential to maximize interest savings and avoid unexpected charges.

Choosing the Right Strategy for You

Selecting between credit card balance transfers and debt laddering depends on your financial situation and goals. Balance transfers offer lower interest rates by consolidating debt onto a single card, ideal for those with good credit who can pay off balances within promotional periods. Debt laddering reduces interest by progressively paying off smaller debts first, improving cash flow and motivation, which suits those managing multiple debts with varying interest rates.

Tips for Maximizing Interest Savings

Optimize interest savings by strategically combining credit card balance transfers with debt laddering techniques. Prioritize transferring high-interest balances to cards offering 0% introductory APR periods while simultaneously structuring payments to tackle smaller debts first, accelerating overall debt reduction. Monitor promotional rates closely and avoid new debt accumulation to maximize financial benefits and minimize interest expenses.

Related Important Terms

Zero Percent APR Surfing

Zero Percent APR surfing leverages introductory 0% interest offers on credit card balance transfers to minimize interest payments and accelerate debt payoff. Debt laddering systematically targets higher-interest balances first but may result in higher overall interest costs compared to strategically timing zero percent APR promotions to optimize savings.

Balance Transfer Churn

Credit card balance transfer churn involves repeatedly moving outstanding balances to new cards with promotional 0% interest rates, maximizing interest savings by extending interest-free periods. In contrast, debt laddering prioritizes paying off smaller debts first to reduce interest over time, but lacks the immediate interest-free benefit that balance transfer churn can provide.

Laddering Snowball Hybrid

The Laddering Snowball Hybrid strategy combines the psychological boost of paying off smaller credit card balances first with the financial efficiency of targeting higher-interest debts, optimizing interest savings over time. By systematically rolling payments from cleared debts into larger ones while maintaining consistent progress, this method accelerates overall debt reduction compared to traditional balance transfers or pure snowball approaches.

Precision Transfer Mapping

Credit card balance transfer offers a precise method to map high-interest debt onto 0% APR promotional periods, optimizing interest savings by consolidating balances into a single, lower-rate account. Debt laddering strategically allocates payments across multiple debts in ascending order of interest rates, maximizing savings through targeted reductions, but requires meticulous tracking to maintain precision in transfer mapping and payment allocation.

Revolving Utilization Buffer

Credit card balance transfers offer a revolving utilization buffer by shifting high-interest debt to a card with a lower APR, effectively reducing interest expenses and improving credit utilization ratios. Debt laddering targets multiple debts with varying rates, prioritizing payments to minimize overall interest, but may not optimize the revolving utilization buffer as effectively as a strategic balance transfer.

Tiered Rate Optimization

Credit card balance transfers strategically leverage tiered interest rates by shifting high-interest debt to cards with lower introductory APRs, maximizing savings within limited timeframes. Debt laddering optimizes tiered rates through structured payments targeting the highest-rate debts first, ensuring sustained interest reduction across multiple balances.

Credit Line Juggling

Credit card balance transfer leverages a low or zero-interest promotional period to consolidate high-interest debt, maximizing interest savings by shifting balances strategically across credit lines. In contrast, debt laddering manages multiple debts by prioritizing repayments on smaller balances first, requiring precise credit line juggling to optimize available credit and avoid over-utilization fees.

Strategic Fee Offset

Strategic fee offset plays a crucial role in maximizing interest savings when choosing between credit card balance transfers and debt laddering, as balance transfers often incur upfront fees that may negate potential savings unless carefully calculated. Debt laddering, by prioritizing high-interest debts without additional fees, can offer a more cost-effective approach to reducing overall interest payments over time.

Repayment Mosaic

Repayment Mosaic leverages a strategic blend of credit card balance transfer and debt laddering techniques to maximize interest savings by targeting high-interest debts first while consolidating balances onto lower-rate cards. This approach optimizes cash flow management and accelerates debt reduction, reducing overall interest payments more effectively than using either method alone.

Interest Suppression Sequencing

Credit card balance transfers consolidate high-interest debt at a lower promotional rate, effectively suppressing interest accumulation and accelerating repayment. Debt laddering sequences payments from the smallest to largest balances, minimizing interest by quickly eliminating debts with higher interest rates first, optimizing overall interest suppression.

Credit Card Balance Transfer vs Debt Laddering for interest savings. Infographic

moneydiff.com

moneydiff.com