Revolving debt offers flexible repayment options, allowing borrowers to pay varying amounts each month based on their balance, while installment debt requires fixed monthly payments over a set period until fully repaid. Revolving debt, such as credit card balances, can lead to fluctuating interest costs, whereas installment debt typically has a fixed interest rate, providing predictable repayment schedules. Understanding the differences between these repayment types helps consumers manage debt more effectively by choosing the option that fits their financial goals and cash flow.

Table of Comparison

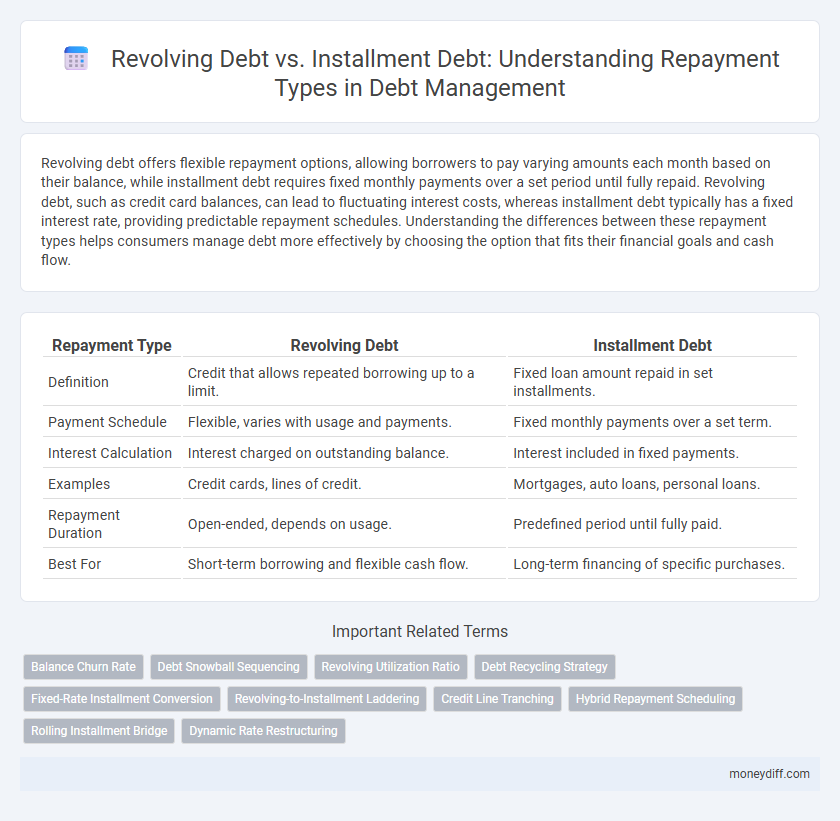

| Repayment Type | Revolving Debt | Installment Debt |

|---|---|---|

| Definition | Credit that allows repeated borrowing up to a limit. | Fixed loan amount repaid in set installments. |

| Payment Schedule | Flexible, varies with usage and payments. | Fixed monthly payments over a set term. |

| Interest Calculation | Interest charged on outstanding balance. | Interest included in fixed payments. |

| Examples | Credit cards, lines of credit. | Mortgages, auto loans, personal loans. |

| Repayment Duration | Open-ended, depends on usage. | Predefined period until fully paid. |

| Best For | Short-term borrowing and flexible cash flow. | Long-term financing of specific purchases. |

Understanding Revolving Debt and Installment Debt

Revolving debt allows borrowers to access credit repeatedly up to a set limit, with flexible repayment amounts based on outstanding balances, commonly seen in credit cards. Installment debt involves fixed payments over a predetermined period, typically used for loans like mortgages or auto financing. Understanding these differences helps consumers manage repayment strategies and impacts credit scores differently due to payment consistency and credit utilization.

Key Differences Between Revolving and Installment Debt

Revolving debt allows borrowers to spend up to a credit limit with flexible repayment amounts each month, commonly seen in credit cards, while installment debt involves fixed monthly payments over a set period, such as auto or mortgage loans. Interest rates on revolving debt tend to be variable and higher due to ongoing borrowing capacity, whereas installment debt often has fixed or lower rates tied to loan terms. The key difference lies in repayment structure: revolving debt offers continuous access to credit with varying balances, whereas installment debt requires systematic payoff of a principal amount within a defined timeframe.

How Revolving Debt Works in Practice

Revolving debt allows borrowers to access a credit limit repeatedly as they repay, with minimum monthly payments based on the outstanding balance and interest accrued. Interest is typically charged only on the unpaid balance, making it flexible but potentially more costly if balances are not paid in full each month. This contrasts with installment debt, where fixed payments reduce principal and interest over a set period until the debt is fully repaid.

The Structure of Installment Debt Explained

Installment debt features a fixed repayment schedule with equal monthly payments over a set period, including both principal and interest. This structured repayment plan provides predictability and helps borrowers manage budgets effectively. Common examples include auto loans, mortgages, and personal loans, where the debt is fully paid off by the end of the term.

Credit Impact: Revolving vs Installment Debt

Revolving debt, such as credit card balances, can negatively impact credit scores if utilization rates remain high, as credit scoring models emphasize credit utilization ratios. Installment debt, like mortgages or auto loans, typically shows consistent payment history over time, positively influencing credit scores by demonstrating reliability and reducing credit risk. Both repayment types affect credit profiles differently, with revolving debt requiring careful management to avoid score drops, while installment debt builds credit strength through regular, on-time payments.

Pros and Cons of Repaying Revolving Debt

Repaying revolving debt offers flexibility in payment amounts and timing, helping manage cash flow during fluctuating income periods. However, it often carries higher interest rates compared to installment debt, increasing the total cost if balances are not paid off quickly. Despite the convenience, revolving debt can lead to prolonged repayment periods and potential credit score decline if minimum payments are consistently prioritized over full repayment.

Advantages and Drawbacks of Installment Debt Repayment

Installment debt repayment offers predictable monthly payments and a fixed repayment schedule, making budgeting easier and fostering disciplined financial habits. However, it often comes with less flexibility, as early repayment may incur penalties and additional fees, limiting the borrower's ability to adjust payments based on changing financial situations. Borrowers should also consider that installment loans typically have higher interest rates than revolving debt, which can increase the overall cost of borrowing.

Strategies for Managing Revolving Debt

Effective strategies for managing revolving debt include prioritizing payments above the minimum to reduce interest costs and avoid prolonged debt cycles. Utilizing balance transfers to lower interest rates and consolidating balances can streamline repayment and improve financial discipline. Regularly reviewing credit card statements and setting strict budget limits help prevent overspending and accelerate debt payoff.

Best Approaches for Paying Off Installment Debt

Focusing on paying off installment debt, the best approach involves consistent, fixed monthly payments that reduce the principal balance systematically over time. Prioritizing higher-interest installment loans can minimize total interest paid and accelerate debt freedom. Utilizing strategies like the debt avalanche method maximizes efficiency by targeting debts with the highest interest rates first, ensuring effective repayment of installment debt.

Choosing the Right Repayment Type for Your Financial Goals

Revolving debt, such as credit cards, offers flexible repayment schedules with variable interest rates, ideal for managing ongoing expenses and improving cash flow. Installment debt, including personal loans and mortgages, features fixed payments over a set term, providing predictable budgeting that suits long-term financial goals. Selecting between revolving and installment debt depends on your repayment capacity, interest rate preferences, and the stability of your income stream.

Related Important Terms

Balance Churn Rate

Revolving debt features a high balance churn rate due to continuous borrowing and repayment cycles, leading to fluctuating outstanding balances that impact credit utilization ratios. Installment debt maintains a low balance churn rate with fixed monthly payments and a steadily decreasing balance, providing predictable repayment schedules and stable credit usage patterns.

Debt Snowball Sequencing

Revolving debt, such as credit card balances, allows flexible repayment but often carries higher interest rates, making it a critical target in Debt Snowball Sequencing for faster debt elimination. Installment debt, including auto or student loans, features fixed payments and terms, typically addressed after revolving debts to build momentum and maintain consistent repayment progress.

Revolving Utilization Ratio

Revolving debt repayment is influenced heavily by the Revolving Utilization Ratio, which measures the percentage of available credit currently in use and directly impacts credit scores and borrowing costs. Installment debt involves fixed payments over time, contrasting with revolving debt's flexible repayment but variable utilization that can fluctuate monthly based on spending and repayments.

Debt Recycling Strategy

Revolving debt offers flexible repayment options with varying interest rates, making it suitable for short-term borrowing, while installment debt provides fixed payments over a set period, ideal for long-term financial planning. In a debt recycling strategy, converting high-interest revolving debt into tax-deductible investment loan installment debt can optimize cash flow and accelerate wealth building.

Fixed-Rate Installment Conversion

Fixed-rate installment conversion transforms revolving debt, such as credit card balances, into a structured repayment plan with a consistent interest rate and fixed monthly payments, enhancing budget predictability. This method reduces the risk of fluctuating rates and extends repayment terms, improving debt management efficiency.

Revolving-to-Installment Laddering

Revolving-to-installment laddering involves converting high-interest revolving debt into fixed installment payments, enabling structured repayment schedules and reducing interest costs over time. This strategy improves credit utilization and payment predictability by progressively replacing unsecured credit card balances with secured or personal loans featuring fixed terms.

Credit Line Tranching

Revolving debt allows flexible borrowing up to a credit limit with variable repayments, while installment debt involves fixed payments over a set period. Credit line tranching segments a credit line into multiple portions with distinct terms and repayment schedules, optimizing cash flow management for revolving debt structures.

Hybrid Repayment Scheduling

Hybrid repayment scheduling combines the flexibility of revolving debt with the structured payments of installment debt, allowing borrowers to adjust repayment amounts while maintaining a fixed payment schedule. This approach optimizes cash flow management by balancing variable credit limits with predictable amortization, enhancing financial stability and reducing default risk.

Rolling Installment Bridge

Revolving debt allows borrowers to maintain a flexible credit limit with variable payments, whereas installment debt requires fixed payments over a set period. The Rolling Installment Bridge combines these features by enabling structured installments that periodically reset, optimizing repayment schedules and improving cash flow management.

Dynamic Rate Restructuring

Revolving debt allows for flexible repayment schedules with variable interest rates that can be adjusted dynamically based on market conditions, making it suitable for borrowers seeking adaptive rate restructuring options. Installment debt offers fixed, periodic payments over a set term, providing predictable repayment but less flexibility for dynamic rate adjustments during restructuring.

Revolving debt vs installment debt for repayment type. Infographic

moneydiff.com

moneydiff.com