Personal loans offer fixed interest rates and set repayment terms, providing predictable monthly payments and a clear payoff timeline. Buy Now Pay Later (BNPL) services often feature interest-free periods but can lead to higher costs if payments are missed or extended. Consumers should evaluate their credit score, repayment ability, and total cost before choosing between personal loans and BNPL options for financing purchases.

Table of Comparison

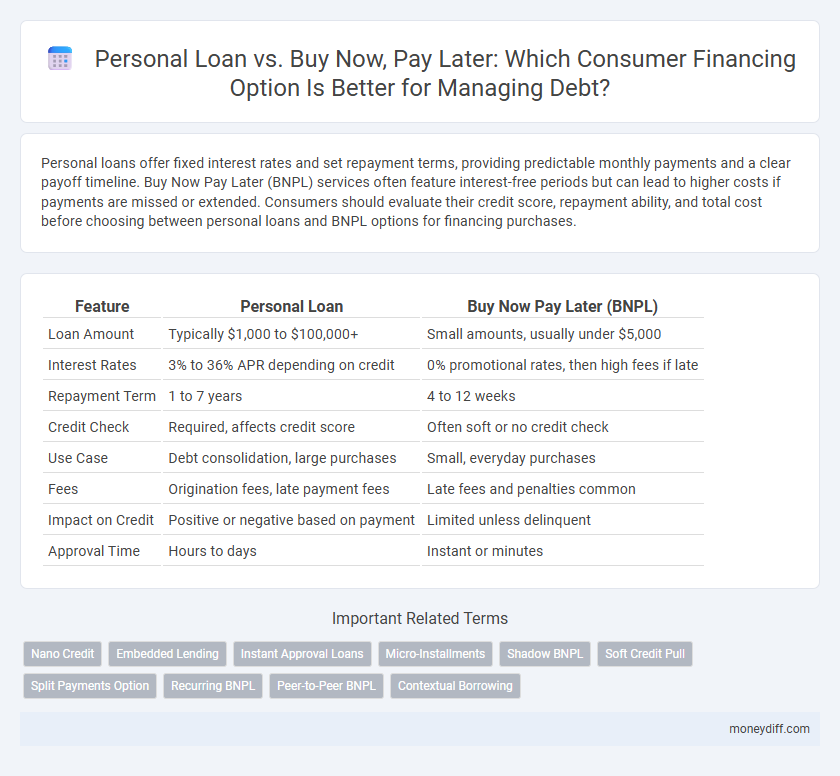

| Feature | Personal Loan | Buy Now Pay Later (BNPL) |

|---|---|---|

| Loan Amount | Typically $1,000 to $100,000+ | Small amounts, usually under $5,000 |

| Interest Rates | 3% to 36% APR depending on credit | 0% promotional rates, then high fees if late |

| Repayment Term | 1 to 7 years | 4 to 12 weeks |

| Credit Check | Required, affects credit score | Often soft or no credit check |

| Use Case | Debt consolidation, large purchases | Small, everyday purchases |

| Fees | Origination fees, late payment fees | Late fees and penalties common |

| Impact on Credit | Positive or negative based on payment | Limited unless delinquent |

| Approval Time | Hours to days | Instant or minutes |

Understanding Personal Loans and Buy Now Pay Later

Personal loans offer fixed interest rates and repayment terms, providing predictable monthly payments for consumers seeking larger or long-term financing. Buy Now Pay Later (BNPL) services allow consumers to split purchases into interest-free installments, typically with shorter repayment periods and no credit check requirements. Understanding the cost, flexibility, and impact on credit scores helps consumers decide between personal loans and BNPL for managing debt effectively.

Key Differences Between Personal Loans and BNPL

Personal loans offer fixed loan amounts with predetermined repayment schedules and interest rates, providing predictable monthly payments over a set term, typically ranging from 12 to 84 months. Buy Now Pay Later (BNPL) services allow consumers to split purchases into multiple interest-free installments, often paid over weeks or months, but may impose high late fees and impact credit scores differently than personal loans. Unlike personal loans that require credit approval and generate long-term debt, BNPL is usually integrated at the point of sale, appealing for short-term financing but lacking the comprehensive credit benefits and protections of traditional loans.

Pros and Cons of Personal Loans

Personal loans offer fixed interest rates and set repayment terms, providing predictability and a clear payment schedule for consumers. They typically allow for higher borrowing amounts compared to Buy Now Pay Later (BNPL) options, making them suitable for larger expenses or debt consolidation. However, personal loans may require a strong credit score for approval and often come with stricter qualification criteria than BNPL services, which can limit accessibility for some borrowers.

Advantages and Disadvantages of Buy Now Pay Later

Buy Now Pay Later (BNPL) offers consumers quick, interest-free short-term financing, making it easier to manage immediate purchases without impacting credit scores. However, BNPL often comes with higher late fees and the risk of accumulating debt due to its easy access and lack of traditional credit checks. Compared to personal loans, BNPL lacks flexible repayment terms and long-term financial planning benefits, potentially leading to impulsive spending and financial strain.

Credit Impact: Personal Loan vs BNPL

Personal loans typically have a more substantial impact on credit scores because they involve a hard credit inquiry and contribute to credit utilization and debt-to-income ratios. Buy Now Pay Later (BNPL) services often perform soft credit checks, which do not immediately affect credit scores, but missed payments can lead to reports to credit bureaus and damage credit health. Understanding the credit impact helps consumers choose financing options that align with their credit management goals.

Interest Rates and Fees Comparison

Personal loans typically offer fixed interest rates ranging from 6% to 36%, with fees including origination charges and possible prepayment penalties, making them a transparent but sometimes costly financing option. Buy Now Pay Later (BNPL) services often feature zero or low upfront interest but can impose high late fees and variable penalty charges if payments are missed, which may increase the overall cost. Comparing these options requires evaluating the effective annual percentage rate (APR) and fee structures to ensure the total repayment burden aligns with the consumer's financial capacity.

Repayment Flexibility: Which Option is Better?

Personal loans typically offer fixed repayment schedules with set monthly installments over a predetermined term, providing predictability but less flexibility in adjusting payments. Buy Now Pay Later (BNPL) services usually allow for more flexible, interest-free installments spread over weeks or months, appealing to consumers who prioritize short-term repayment ease. For long-term financial planning and higher borrowing amounts, personal loans are generally better, while BNPL suits smaller purchases with quicker repayment cycles.

Eligibility and Approval Process

Personal loans typically require a thorough credit check, proof of income, and a detailed application process, with eligibility depending on credit score, income stability, and debt-to-income ratio. Buy Now Pay Later (BNPL) options often have a faster, simplified approval process with minimal credit checks, making them more accessible to consumers with lower or no credit history. However, BNPL limits are usually lower compared to personal loans, which offer higher borrowing amounts and longer repayment terms.

Which Consumer Financing Option Suits You?

Choosing between a personal loan and Buy Now Pay Later (BNPL) depends on your financial needs and repayment capacity. Personal loans typically offer lower interest rates and flexible terms suitable for larger expenses or debt consolidation, while BNPL provides short-term, interest-free installments ideal for smaller purchases with quick paybacks. Assess your budget, purchase amount, and ability to meet payment deadlines to select the option that aligns best with your financial goals.

Tips for Responsible Borrowing and Debt Management

Evaluate interest rates and repayment terms carefully when choosing between a personal loan and Buy Now Pay Later options to avoid excessive debt accumulation. Prioritize budgeting by calculating monthly payments within your income limits, and avoid borrowing beyond your repayment capacity. Regularly track your expenses and set reminders for payment due dates to maintain a strong credit score and prevent late fees or penalties.

Related Important Terms

Nano Credit

Nano Credit offers a streamlined alternative to traditional personal loans and Buy Now Pay Later (BNPL) schemes by providing instant, small-scale financing with lower interest rates and flexible repayment options. Unlike BNPL, which often targets short-term purchases with deferred payments, Nano Credit supports broader consumer financing needs, enabling borrowers to manage debt more effectively and avoid high late fees.

Embedded Lending

Embedded lending integrates personal loans directly within the purchase process, offering consumers seamless credit options with fixed interest rates and structured repayment schedules, which typically provide more transparency and longer-term financial planning compared to Buy Now Pay Later (BNPL) services. BNPL schemes often appeal with interest-free short-term installments but can lead to higher cumulative costs and credit score risks due to deferred payments and less formal credit assessments.

Instant Approval Loans

Instant approval loans for personal financing offer a fixed repayment schedule and predictable interest rates, providing greater transparency and control compared to Buy Now Pay Later (BNPL) plans that often carry variable fees and deferred payment risks. Consumers seeking immediate access to funds without the uncertainty of escalating costs may benefit more from personal loans with instant approval features over BNPL options.

Micro-Installments

Micro-installments in Buy Now Pay Later (BNPL) plans provide consumers with flexible repayment options spread over short periods, often with zero or low interest, making them appealing for small purchases. Personal loans typically offer larger sums with fixed interest rates and longer terms, which may result in higher total costs despite more predictable monthly payments.

Shadow BNPL

Shadow BNPL services often lack the regulatory oversight of traditional personal loans, resulting in higher interest rates and hidden fees that increase consumer debt risk. Personal loans typically offer fixed interest rates and structured repayment terms, providing clearer financial planning compared to the unpredictable costs associated with Shadow BNPL options.

Soft Credit Pull

Soft credit pulls allow consumers to access personal loans with minimal impact on their credit scores, offering a more discreet borrowing solution compared to Buy Now Pay Later (BNPL) options that often perform hard inquiries. Personal loans typically provide fixed interest rates and longer repayment terms, while BNPL services might lead to higher costs due to late fees and shorter payment windows despite easier approval processes.

Split Payments Option

Personal loans provide a structured repayment plan with fixed interest rates and terms, offering predictable monthly payments and often lower overall costs compared to Buy Now Pay Later (BNPL) services. BNPL options enable consumers to split purchases into interest-free installments over a short period, but they may incur high fees or interest if payments are missed, making personal loans a more secure choice for larger or long-term financing.

Recurring BNPL

Personal loans offer fixed interest rates and predictable monthly payments, providing a structured repayment plan ideal for managing long-term debt, while recurring Buy Now Pay Later (BNPL) services enable consumers to split purchases into smaller, interest-free installments but may encourage overspending and lead to accumulating revolving debt with variable fees. Recurring BNPL can negatively impact credit scores if payments are missed, whereas personal loans typically report to credit bureaus consistently, aiding credit building efforts when managed responsibly.

Peer-to-Peer BNPL

Peer-to-peer Buy Now Pay Later (BNPL) platforms offer consumers flexible, interest-free installments for purchases, contrasting with personal loans that typically involve fixed interest rates and longer repayment terms. BNPL's streamlined approval process and integration with e-commerce make it a popular choice for short-term consumer financing, while personal loans provide larger loan amounts and credit-building opportunities.

Contextual Borrowing

Personal loans offer fixed interest rates and longer repayment terms, providing predictable monthly payments and potentially lower overall costs for substantial purchases. Buy Now Pay Later services provide short-term, interest-free financing but often encourage impulsive spending and may lead to higher expenses if payments are missed or extended beyond promotional periods.

Personal Loan vs Buy Now Pay Later for consumer financing. Infographic

moneydiff.com

moneydiff.com