Bankruptcy offers a legal solution for debt relief by discharging or reorganizing debts under court supervision, often resulting in asset liquidation or a structured repayment plan. Debt restructuring allows borrowers to negotiate modified terms with creditors, such as reduced interest rates or extended payment schedules, aiming to avoid bankruptcy and preserve assets. Choosing between bankruptcy and debt restructuring depends on factors like the severity of debt, financial goals, and the impact on credit ratings.

Table of Comparison

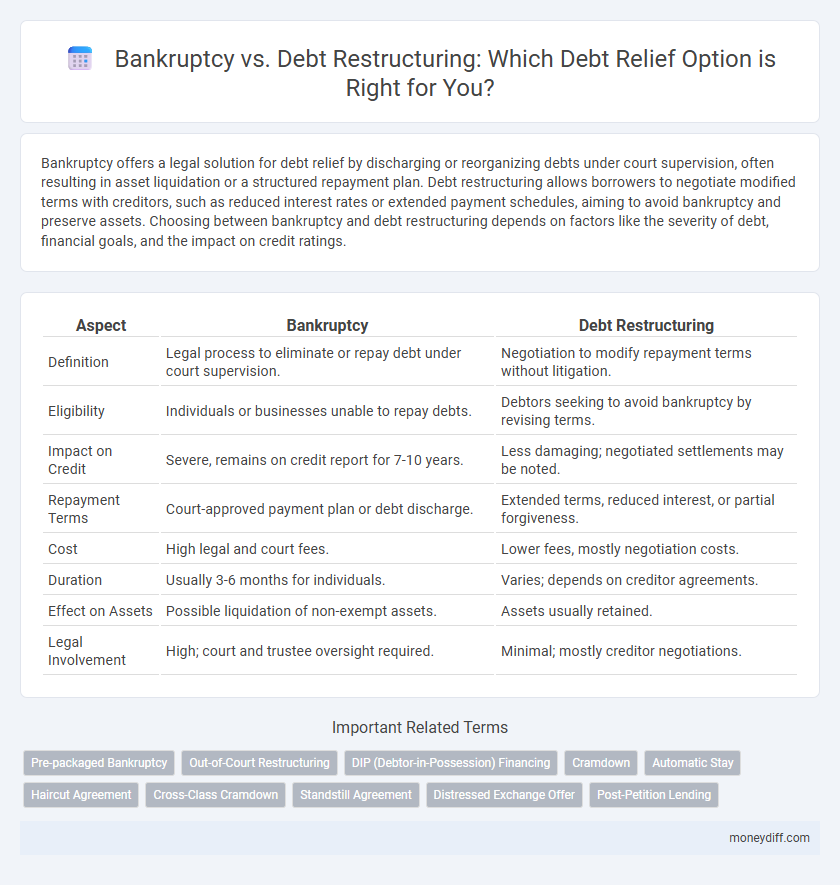

| Aspect | Bankruptcy | Debt Restructuring |

|---|---|---|

| Definition | Legal process to eliminate or repay debt under court supervision. | Negotiation to modify repayment terms without litigation. |

| Eligibility | Individuals or businesses unable to repay debts. | Debtors seeking to avoid bankruptcy by revising terms. |

| Impact on Credit | Severe, remains on credit report for 7-10 years. | Less damaging; negotiated settlements may be noted. |

| Repayment Terms | Court-approved payment plan or debt discharge. | Extended terms, reduced interest, or partial forgiveness. |

| Cost | High legal and court fees. | Lower fees, mostly negotiation costs. |

| Duration | Usually 3-6 months for individuals. | Varies; depends on creditor agreements. |

| Effect on Assets | Possible liquidation of non-exempt assets. | Assets usually retained. |

| Legal Involvement | High; court and trustee oversight required. | Minimal; mostly creditor negotiations. |

Understanding Bankruptcy and Debt Restructuring

Bankruptcy is a legal process that provides individuals or businesses relief from overwhelming debt by discharging or reorganizing liabilities under court supervision, often leading to liquidation or a structured repayment plan. Debt restructuring involves negotiated modifications to the terms of existing debt agreements, such as reduced interest rates, extended payment periods, or debt forgiveness, aiming to improve the debtor's financial stability without court intervention. Understanding the differences between bankruptcy and debt restructuring helps identify the most effective strategy for managing debt relief based on financial circumstances and long-term goals.

Key Differences Between Bankruptcy and Debt Restructuring

Bankruptcy involves a legal process where a debtor's assets may be liquidated to pay creditors, often resulting in a negative impact on credit scores and long-term financial reputation. Debt restructuring is a negotiated agreement between debtors and creditors to modify the terms of existing debt, such as extending payment periods or reducing interest rates, aiming to avoid the bankruptcy process. While bankruptcy provides a legal discharge of debts, restructuring preserves business operations and credit relationships by offering flexible repayment solutions.

Pros and Cons of Filing for Bankruptcy

Filing for bankruptcy offers the advantage of immediate legal protection from creditors and can discharge many types of unsecured debts, providing a fresh financial start. However, bankruptcy severely impacts credit scores, remains on credit reports for up to 10 years, and may result in the loss of certain assets depending on the chapter filed. Compared to debt restructuring, bankruptcy is often faster but carries more significant long-term consequences for creditworthiness and financial reputation.

Benefits and Drawbacks of Debt Restructuring

Debt restructuring offers significant benefits such as improved cash flow, reduced interest rates, and avoidance of bankruptcy's severe credit impact, enabling businesses to continue operations while repaying creditors under more manageable terms. However, drawbacks include the potential for damaged creditor relationships, limited access to future credit, and the risk of restructuring failure leading to eventual bankruptcy. This approach provides a strategic alternative to bankruptcy but requires careful negotiation and financial discipline to succeed.

Eligibility Criteria for Bankruptcy vs Debt Restructuring

Bankruptcy eligibility primarily depends on an individual's or business's inability to repay debts, with requirements varying by jurisdiction but generally including proof of insolvency and failed attempts at repayment. Debt restructuring eligibility focuses on viable debtor financials that indicate potential to meet modified payment terms, often requiring creditor approval and evidence of temporary cash flow issues rather than complete insolvency. Key factors distinguishing eligibility include the debtor's ongoing asset value, income stability, and willingness to negotiate revised debt obligations outside of court-imposed bankruptcy proceedings.

Impact on Credit Score: Bankruptcy vs Debt Restructuring

Bankruptcy typically causes a significant and long-lasting negative impact on credit scores, remaining on credit reports for up to 10 years and making it harder to secure new credit. Debt restructuring, on the other hand, may lower credit scores temporarily but generally has a less severe impact since it involves negotiating new payment terms without complete default. Choosing debt restructuring over bankruptcy often preserves more future borrowing opportunities and reduces damage to creditworthiness.

The Legal Process: Bankruptcy Procedures Explained

Bankruptcy procedures involve a court-supervised process where individuals or businesses legally declare inability to repay debts, leading to asset liquidation or reorganization under chapters such as Chapter 7 or Chapter 13 in the U.S. legal system. Debt restructuring, conversely, involves negotiated agreements between debtors and creditors to modify loan terms without court intervention, aiming to improve repayment feasibility while avoiding formal bankruptcy filings. Understanding these distinct legal processes is crucial for selecting the optimal debt relief strategy based on financial status and long-term goals.

Steps Involved in Successful Debt Restructuring

Successful debt restructuring involves a detailed assessment of the debtor's financial situation, followed by negotiation with creditors to modify the terms of the debt, such as extending payment periods or reducing interest rates. A comprehensive restructuring plan is then formulated and approved by all stakeholders, ensuring alignment with the debtor's cash flow capabilities and long-term viability. Implementation includes continuous monitoring and adjustment, maintaining transparent communication with creditors to prevent default and support financial recovery.

Choosing the Best Debt Relief Strategy for Your Situation

Evaluating bankruptcy versus debt restructuring depends on the severity of your financial obligations and credit impact. Bankruptcy offers a legal discharge of most debts but can significantly damage your credit score and remain on your credit report for up to 10 years. Debt restructuring, such as negotiating lower interest rates or extended payment terms, preserves creditworthiness while providing manageable repayment options tailored to your financial situation.

Seeking Professional Help: When to Consult a Financial Advisor

Consulting a financial advisor is crucial when evaluating bankruptcy versus debt restructuring as options for debt relief, particularly if debt amounts exceed manageable levels or income is insufficient to cover obligations. Professional advisors analyze individual financial situations, negotiate with creditors, and design tailored debt management plans to avoid the long-term credit impacts of bankruptcy. Early consultation improves outcomes by identifying the most viable solution based on debt type, repayment capacity, and asset protection goals.

Related Important Terms

Pre-packaged Bankruptcy

Pre-packaged bankruptcy offers a streamlined debt relief option by allowing companies to negotiate a restructuring plan with creditors before filing, reducing court time and preserving value. Unlike traditional debt restructuring, this approach provides greater certainty and faster resolution, minimizing operational disruption and enhancing creditor recoveries.

Out-of-Court Restructuring

Out-of-court restructuring offers a flexible alternative to bankruptcy by allowing debtors and creditors to negotiate revised terms without formal court intervention, preserving business operations and credit standing. This approach reduces legal costs and time delays, facilitating quicker debt relief and enhanced recovery prospects compared to bankruptcy proceedings.

DIP (Debtor-in-Possession) Financing

Debt restructuring offers strategic alternatives to bankruptcy by allowing distressed companies to renegotiate terms with creditors, often preserving operations and value. DIP (Debtor-in-Possession) financing plays a critical role in bankruptcy by providing debtor companies with new capital to maintain liquidity and continue operations during the court-supervised restructuring process.

Cramdown

Cramdown is a powerful tool in debt restructuring that allows courts to reduce the principal balance or interest rate on secured debts, providing significant debt relief without the full consequences of bankruptcy. Unlike bankruptcy, where assets may be liquidated, cramdown restructures debt terms to make repayment feasible while preserving the debtor's property and credit prospects.

Automatic Stay

Bankruptcy triggers an automatic stay, immediately halting all creditor actions, including lawsuits and wage garnishments, to protect the debtor from further financial harm. Debt restructuring typically does not invoke an automatic stay, requiring negotiation with creditors while maintaining the risk of collection efforts during the process.

Haircut Agreement

Haircut agreements in debt restructuring involve creditors consenting to accept less than the full amount owed, reducing the principal or interest to alleviate the debtor's financial burden while avoiding bankruptcy's severe credit impact. Bankruptcy typically results in more extensive asset liquidation and credit damage, whereas haircut agreements provide a negotiated compromise that preserves ongoing business operations and maximizes creditor recovery.

Cross-Class Cramdown

Cross-class cramdown enables a bankruptcy court to approve a debt restructuring plan despite opposition from certain creditor classes, offering a strategic advantage over traditional bankruptcy by allowing debtor companies to impose terms on dissenting unsecured creditors while maintaining operational continuity. This mechanism efficiently balances creditor rights and debtor relief, promoting reorganization and financial stability without the complete liquidation triggered by bankruptcy filings.

Standstill Agreement

A Standstill Agreement in debt relief temporarily halts creditor actions, allowing debt restructuring to reorganize obligations without the formal liquidation process of bankruptcy. This mechanism provides a controlled environment for negotiations, preserving business value and creditor relationships while avoiding the severe consequences of insolvency proceedings.

Distressed Exchange Offer

A Distressed Exchange Offer enables financially troubled companies to swap existing debt for new securities with altered terms, often avoiding the complexities of bankruptcy while providing creditors with potentially higher recoveries. This debt restructuring strategy offers a flexible alternative to bankruptcy by facilitating negotiated agreements that reduce debt burdens and improve cash flow without formal court involvement.

Post-Petition Lending

Post-petition lending provides critical financing to companies undergoing bankruptcy, enabling continued operations and facilitating successful reorganization. In debt restructuring, such financing is less formal but essential for maintaining liquidity and negotiating revised debt terms outside court protections.

Bankruptcy vs Debt restructuring for debt relief Infographic

moneydiff.com

moneydiff.com