Personal loan debt involves borrowing directly by individuals for personal use, typically with fixed interest rates and structured repayment schedules, making it easier to manage and forecast personal finances. Circular debt in loan structures refers to a complex chain of unpaid liabilities among businesses or government entities, causing liquidity shortages and disrupting economic stability. Understanding the differences in risk, repayment terms, and impact on credit is crucial for effectively managing these two forms of debt.

Table of Comparison

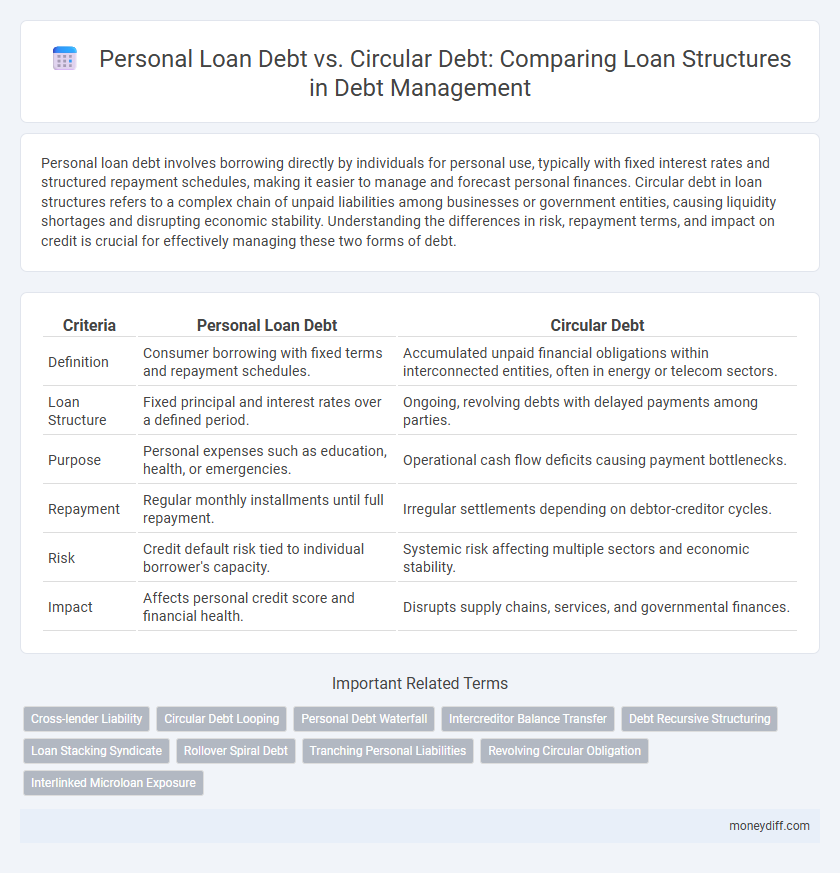

| Criteria | Personal Loan Debt | Circular Debt |

|---|---|---|

| Definition | Consumer borrowing with fixed terms and repayment schedules. | Accumulated unpaid financial obligations within interconnected entities, often in energy or telecom sectors. |

| Loan Structure | Fixed principal and interest rates over a defined period. | Ongoing, revolving debts with delayed payments among parties. |

| Purpose | Personal expenses such as education, health, or emergencies. | Operational cash flow deficits causing payment bottlenecks. |

| Repayment | Regular monthly installments until full repayment. | Irregular settlements depending on debtor-creditor cycles. |

| Risk | Credit default risk tied to individual borrower's capacity. | Systemic risk affecting multiple sectors and economic stability. |

| Impact | Affects personal credit score and financial health. | Disrupts supply chains, services, and governmental finances. |

Understanding Personal Loan Debt: Key Features

Personal loan debt involves fixed repayment terms, typically with higher interest rates due to unsecured lending, affecting individual credit scores directly. Circular debt in loan structures refers to the cycle where new loans are taken to pay off existing debts, often leading to escalating liabilities and financial instability. Understanding personal loan debt requires analyzing interest rates, repayment schedules, and borrower creditworthiness to avoid falling into circular debt traps.

What is Circular Debt in Loan Structures?

Circular debt in loan structures refers to the accumulation of unpaid dues between interconnected entities, creating a cycle where creditors become debtors within the same financial ecosystem. Unlike personal loan debt, which is an individual's obligation to repay borrowed money, circular debt arises from systemic delays and inefficiencies in payments among businesses, suppliers, and financial institutions. This debt loop can destabilize cash flows, disrupt credit availability, and hinder overall economic growth by perpetuating unresolved liabilities within the lending network.

Personal Loan Debt vs Circular Debt: Core Differences

Personal loan debt refers to borrowed funds directly taken by individuals for personal use, characterized by fixed repayment schedules and interest rates. Circular debt involves a chain of unpaid dues within business sectors, often leading to systemic liquidity issues and delayed payments. Understanding these core differences highlights personal loan debt as a consumer credit product, while circular debt reflects interconnected financial obligations disrupting economic flows.

Risk Factors in Personal Loan Debt and Circular Debt

Personal loan debt poses high risk factors due to unsecured borrowing with variable interest rates and limited repayment flexibility, increasing default probability. Circular debt in loan structures often results from interconnected payment delays across multiple entities, exacerbating liquidity crises and systemic financial instability. Managing personal loan debt requires stringent credit assessments, while circular debt demands comprehensive oversight of payment cycles to mitigate cascading defaults.

Interest Rate Implications for Both Debt Types

Interest rate implications for personal loan debt typically involve fixed or variable rates directly affecting borrower repayment amounts, with higher rates increasing overall cost. Circular debt in loan structures often results from delayed payments and government interventions, causing compounded interest and financial inefficiencies across stakeholders. Comparing both, personal loan debt interest rates tend to be more transparent, while circular debt accrues hidden costs impacting systemic liquidity.

Debt Repayment Strategies: Personal Loan vs Circular Debt

Personal loan debt requires fixed monthly payments with interest rates typically higher than those of circular debt, making timely repayments crucial to avoid penalties and credit score damage. Circular debt, often found in corporate or utility sectors, involves complex interlinked liabilities that necessitate strategic cash flow management and renegotiation of terms to prevent default spirals. Effective debt repayment strategies prioritize prioritizing high-interest personal loans while simultaneously addressing circular debt through structured settlements and operational efficiency improvements.

Impact on Credit Score: Personal vs Circular Loan Debt

Personal loan debt impacts credit scores directly through timely repayments and credit utilization ratios, influencing creditworthiness and future borrowing capacity. Circular debt, often prevalent in business or utility sectors, may not always reflect immediately on individual credit reports but can affect corporate credit ratings and access to financing. Understanding the distinction in their impact on credit profiles is crucial for managing both personal and organizational financial health effectively.

Borrower Eligibility and Requirements Compared

Personal loan debt typically requires borrowers to demonstrate steady income, a good credit score, and a manageable debt-to-income ratio, ensuring eligibility based on individual financial stability. Circular debt in loan structures often involves interconnected entities with outstanding obligations, where borrower eligibility depends on creditworthiness assessments of each party within the debt cycle. Lenders prioritize clear documentation, transparent cash flow analysis, and risk mitigation strategies to approve loans in both personal and circular debt scenarios.

Common Use Cases: When to Choose Each Debt Type

Personal loan debt is commonly used for individual financial needs such as home renovations, medical expenses, or education costs, offering flexible repayment terms tailored to personal income. Circular debt, on the other hand, is prevalent in business loan structures where companies face interconnected payables and receivables, often seen in sectors like energy and utilities to manage cash flow gaps. Choosing between personal loan debt and circular debt depends on whether the borrowing is for individual use or managing complex business financial cycles.

Navigating Debt Consolidation for Personal and Circular Loans

Navigating debt consolidation requires understanding the distinctions between personal loan debt and circular debt, as personal loans typically involve fixed repayment terms with interest rates based on credit score and income stability. Circular debt, often arising in corporate or governmental financing, involves revolving credit and can accumulate due to delayed payments in supply chains or incomplete financial cycles. Effective consolidation strategies prioritize restructuring high-interest personal debts while addressing underlying causes of circular debt to improve cash flow and reduce overall liabilities.

Related Important Terms

Cross-lender Liability

Cross-lender liability in personal loan debt ensures that borrowers are held accountable to multiple lenders simultaneously, increasing risk exposure and complicating repayment structures. In circular debt scenarios, this liability creates a complex chain of obligations where defaults reverberate across interconnected lenders, intensifying financial instability in loan portfolios.

Circular Debt Looping

Circular debt looping occurs when unpaid personal loan debt triggers a chain reaction causing delayed payments across multiple lenders and borrowers, exacerbating financial instability within the loan structure. This cycle amplifies liquidity shortages, increases default risks, and complicates debt recovery efforts in the credit market.

Personal Debt Waterfall

Personal loan debt follows a structured repayment hierarchy prioritizing individual obligations, minimizing default risk compared to circular debt, which involves cyclical liabilities among multiple entities and complicates cash flow management. The Personal Debt Waterfall ensures systematic allocation of loan repayments starting with secured debts, then unsecured, optimizing financial stability in personal loan structures.

Intercreditor Balance Transfer

Personal loan debt typically involves individual borrowers with fixed repayment schedules, whereas circular debt in loan structures refers to revolving credit facilities characterized by recurring borrowing and repayment cycles; managing these through Intercreditor Balance Transfer optimizes creditor priority and mitigates default risk. Efficient coordination among lenders during Intercreditor Balance Transfer ensures streamlined cash flow distribution, preserving creditworthiness and enhancing debt restructuring flexibility.

Debt Recursive Structuring

Personal loan debt typically involves fixed repayment schedules and individual credit risk, while circular debt in loan structures refers to recursive debt cycles where obligations are interdependent and perpetuate delays in settlements. Understanding debt recursive structuring is crucial for managing systemic liquidity risks and improving overall financial stability in complex borrowing ecosystems.

Loan Stacking Syndicate

Personal loan debt typically involves individual borrowing with fixed repayment terms, while circular debt within loan structures highlights interconnected borrowing cycles that can lead to systemic risk. The Loan Stacking Syndicate exploits circular debt by orchestrating multiple simultaneous loans across institutions, increasing borrower risk and complicating debt recovery efforts.

Rollover Spiral Debt

Personal loan debt typically involves fixed repayment schedules with clear terms, whereas circular debt in loan structures creates a complex rollover spiral debt scenario where outstanding obligations continuously defer repayment across interconnected entities. This rollover spiral debt exacerbates financial strain as unpaid amounts accumulate interest, leading to escalating liabilities and increased risk of default within the financial system.

Tranching Personal Liabilities

Tranching personal liabilities in loan structures helps differentiate personal loan debt, which is typically unsecured and based on individual creditworthiness, from circular debt that involves interconnected obligations within corporate or financial ecosystems. Effective segmentation of these liabilities enhances risk assessment and repayment prioritization, optimizing financial stability and loan recovery strategies.

Revolving Circular Obligation

Revolving Circular Obligation in loan structures creates a continuous cycle of debt repayment and renewal, contrasting with fixed personal loan debt where repayment terms are predefined and non-recurring. This circular debt often leads to persistent financial liabilities, increasing the risk of prolonged indebtedness compared to the linear payoff model of personal loans.

Interlinked Microloan Exposure

Personal loan debt represents individual borrowing obligations with fixed repayment terms, while circular debt in loan structures arises from interlinked microloan exposure, where unpaid debts cycle among multiple borrowers and lenders, amplifying financial risk. Understanding the dynamics of circular debt is crucial for managing systemic vulnerabilities and ensuring sustainable credit flow in microloan ecosystems.

Personal loan debt vs circular debt for loan structures. Infographic

moneydiff.com

moneydiff.com