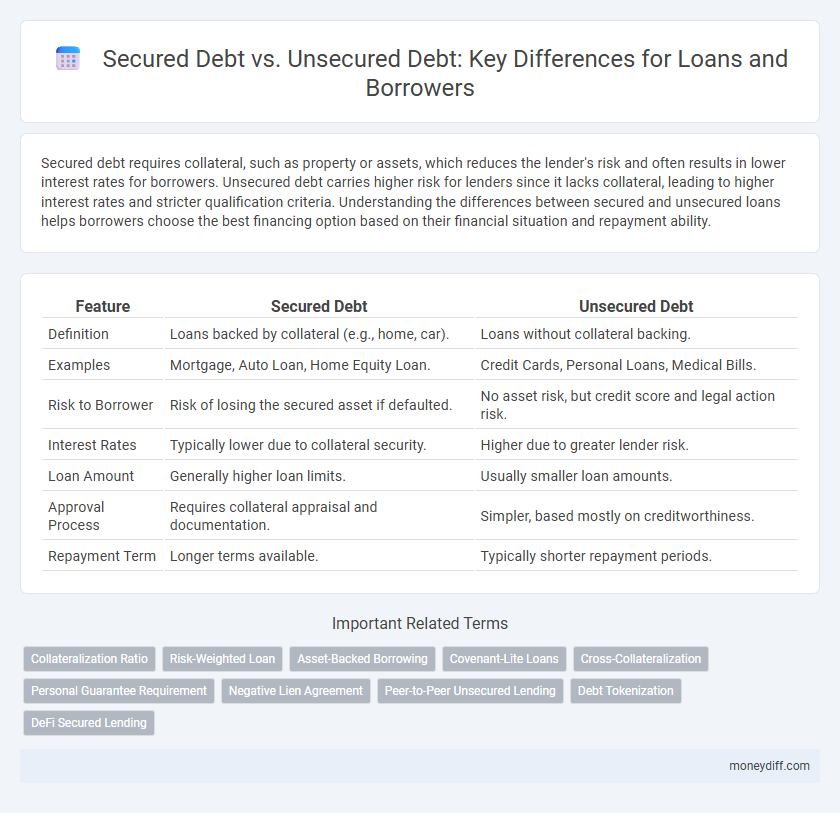

Secured debt requires collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates for borrowers. Unsecured debt carries higher risk for lenders since it lacks collateral, leading to higher interest rates and stricter qualification criteria. Understanding the differences between secured and unsecured loans helps borrowers choose the best financing option based on their financial situation and repayment ability.

Table of Comparison

| Feature | Secured Debt | Unsecured Debt |

|---|---|---|

| Definition | Loans backed by collateral (e.g., home, car). | Loans without collateral backing. |

| Examples | Mortgage, Auto Loan, Home Equity Loan. | Credit Cards, Personal Loans, Medical Bills. |

| Risk to Borrower | Risk of losing the secured asset if defaulted. | No asset risk, but credit score and legal action risk. |

| Interest Rates | Typically lower due to collateral security. | Higher due to greater lender risk. |

| Loan Amount | Generally higher loan limits. | Usually smaller loan amounts. |

| Approval Process | Requires collateral appraisal and documentation. | Simpler, based mostly on creditworthiness. |

| Repayment Term | Longer terms available. | Typically shorter repayment periods. |

Understanding Secured Debt: Definition and Examples

Secured debt refers to loans backed by collateral, such as a house or car, which the lender can claim if the borrower defaults. Common examples include mortgages and auto loans, where the asset secures the loan amount, reducing risk for lenders and often resulting in lower interest rates. Understanding secured debt is crucial for borrowers to assess risks and benefits, as default can lead to the loss of the pledged property.

Unsecured Debt Explained: Key Characteristics

Unsecured debt refers to loans or credit extended without collateral, relying solely on the borrower's creditworthiness and income for approval. Key characteristics include higher interest rates compared to secured debt, increased risk for lenders, and potential impact on credit score upon default. Common examples are credit cards, personal loans, and medical bills.

Collateral: The Core Difference Between Secured and Unsecured Loans

Secured debt requires collateral, such as property or assets, to back the loan, reducing the lender's risk and often resulting in lower interest rates. Unsecured debt lacks collateral, making it riskier for lenders and typically leading to higher interest rates and stricter credit requirements. The presence or absence of collateral fundamentally distinguishes secured loans like mortgages and auto loans from unsecured obligations such as credit cards and personal loans.

Interest Rates: How Security Affects Borrowing Costs

Secured debt typically features lower interest rates because lenders have collateral to reduce their risk, which directly affects borrowing costs. Unsecured debt carries higher interest rates due to the increased risk lenders face without collateral protection. The presence of security in loans incentivizes lenders to offer more favorable terms, reflecting the reduced likelihood of loss.

Approval Process: Qualifying for Secured vs. Unsecured Loans

Qualifying for secured loans typically requires collateral, such as property or assets, which reduces lender risk and often results in a faster approval process with lower interest rates. Unsecured loans do not require collateral, making the approval process more stringent, relying heavily on the borrower's credit score, income, and financial history. Lenders assess unsecured loan applicants more rigorously due to higher default risk, leading to longer approval times and potentially higher interest rates.

Risk Factors: What Happens if You Default?

Secured debt carries lower risk for lenders as the loan is backed by collateral that can be seized if you default, potentially leading to asset loss such as your home or vehicle. Unsecured debt poses higher risk since no specific asset backs the loan, resulting in credit score damage, increased interest rates, and possible legal action like wage garnishment. Understanding these risk factors helps borrowers assess potential consequences and manage repayment strategies effectively.

Credit Score Impact: Secured vs. Unsecured Debt

Secured debt, such as mortgage or auto loans, typically has a more positive impact on credit scores because it is backed by collateral, reducing risk for lenders and often leading to lower interest rates and better payment terms. Unsecured debt, like credit card balances and personal loans, carries a higher risk for lenders, which can result in higher interest rates and greater potential damage to credit scores if payments are missed. Consistently managing secured debt responsibly can improve credit history and score over time, whereas missed payments on unsecured debt often lead to quicker and more severe credit score declines.

Pros and Cons of Secured Debt for Borrowers

Secured debt requires collateral, which lowers interest rates and increases loan approval chances for borrowers by reducing lender risk. However, the risk of losing the pledged asset, such as a home or vehicle, poses a significant downside if the borrower defaults. This type of debt often involves longer repayment terms, providing flexibility but potentially increasing total interest paid over time.

Advantages and Disadvantages of Unsecured Debt

Unsecured debt, such as credit cards and personal loans, offers the advantage of not requiring collateral, making it accessible for borrowers without assets to pledge. However, this type of debt typically comes with higher interest rates due to increased risk for lenders, and defaulting can severely impact credit scores without the protection of secured asset repossession. The flexibility in usage contrasts with the stricter terms and potential asset forfeiture linked to secured debt, presenting both opportunities and risks for borrowers.

Choosing the Right Loan: Secured or Unsecured for Your Needs

Secured debt requires collateral, typically resulting in lower interest rates and higher borrowing limits, making it ideal for those with valuable assets to leverage. Unsecured debt, lacking collateral, often involves higher interest rates but offers greater flexibility and faster approval, suitable for individuals with strong credit profiles seeking smaller loan amounts. Evaluating your financial stability, asset ownership, and repayment capacity is crucial when choosing between secured and unsecured loans to ensure the option aligns with your specific borrowing needs and long-term goals.

Related Important Terms

Collateralization Ratio

Secured debt involves loans backed by collateral, where the collateralization ratio measures the loan amount relative to the asset's value, typically expressed as a percentage and influencing lending terms and risk assessment. Unsecured debt lacks collateral, resulting in higher interest rates due to increased lender risk and the absence of a collateralization ratio to mitigate default exposure.

Risk-Weighted Loan

Secured debt involves collateral that reduces lender risk and typically results in lower risk-weighted loan assets compared to unsecured debt, which lacks collateral and carries higher default risk. Financial institutions assign higher risk weights to unsecured loans, increasing capital requirements and impacting overall loan portfolio risk management.

Asset-Backed Borrowing

Secured debt involves loans backed by specific assets such as property or vehicles, reducing lender risk through collateral that can be seized upon default, resulting in typically lower interest rates and higher borrowing limits. Unsecured debt lacks collateral, relying solely on the borrower's creditworthiness, leading to higher interest rates and increased lender risk compared to asset-backed borrowing.

Covenant-Lite Loans

Covenant-lite loans are a subset of secured debt characterized by fewer restrictions and less frequent financial maintenance covenants compared to traditional secured loans, posing higher risk for lenders while offering more flexibility to borrowers. Unlike unsecured debt, which lacks collateral, covenant-lite secured loans provide lenders with asset backing but rely more heavily on borrower goodwill due to the diminished protective covenants.

Cross-Collateralization

Secured debt involves loans backed by collateral, allowing lenders to claim specific assets if the borrower defaults, while unsecured debt lacks such backing, increasing lender risk. Cross-collateralization occurs when one asset secures multiple loans, amplifying recovery options for lenders but raising complexity and risk for borrowers in default scenarios.

Personal Guarantee Requirement

Secured debt typically requires a personal guarantee, often involving collateral like property or assets to secure the loan, which reduces lender risk. Unsecured debt does not require collateral or a personal guarantee, resulting in higher interest rates due to increased lender exposure to default risk.

Negative Lien Agreement

A Negative Lien Agreement restricts a borrower from granting additional liens on secured assets, protecting existing secured creditors by preserving their priority in case of default. Unlike unsecured debt, which lacks collateral and relies solely on the borrower's creditworthiness, secured debt with a Negative Lien Agreement ensures asset-backed protection, reducing lender risk significantly.

Peer-to-Peer Unsecured Lending

Peer-to-peer unsecured lending involves loans without collateral, relying solely on the borrower's creditworthiness and financial history, contrasting with secured debt which is backed by assets like property or vehicles. This model offers higher interest rates due to increased risk for lenders and faster access to funds for borrowers lacking tangible assets to pledge.

Debt Tokenization

Secured debt involves loans backed by collateral, reducing risk for lenders and often resulting in lower interest rates, while unsecured debt lacks collateral, leading to higher rates and increased lender risk. Debt tokenization leverages blockchain technology to convert both secured and unsecured loans into tradable digital assets, enhancing liquidity, transparency, and accessibility in debt markets.

DeFi Secured Lending

DeFi secured lending involves collateral-backed loans where borrowers lock digital assets as security, reducing lender risk and enabling lower interest rates compared to unsecured debt, which lacks collateral and results in higher risk premiums. The transparency and automation of smart contracts in DeFi platforms enhance trust and efficiency in managing secured debt, while unsecured loans in traditional finance often rely heavily on creditworthiness and carry increased default risk.

Secured debt vs Unsecured debt for loans Infographic

moneydiff.com

moneydiff.com