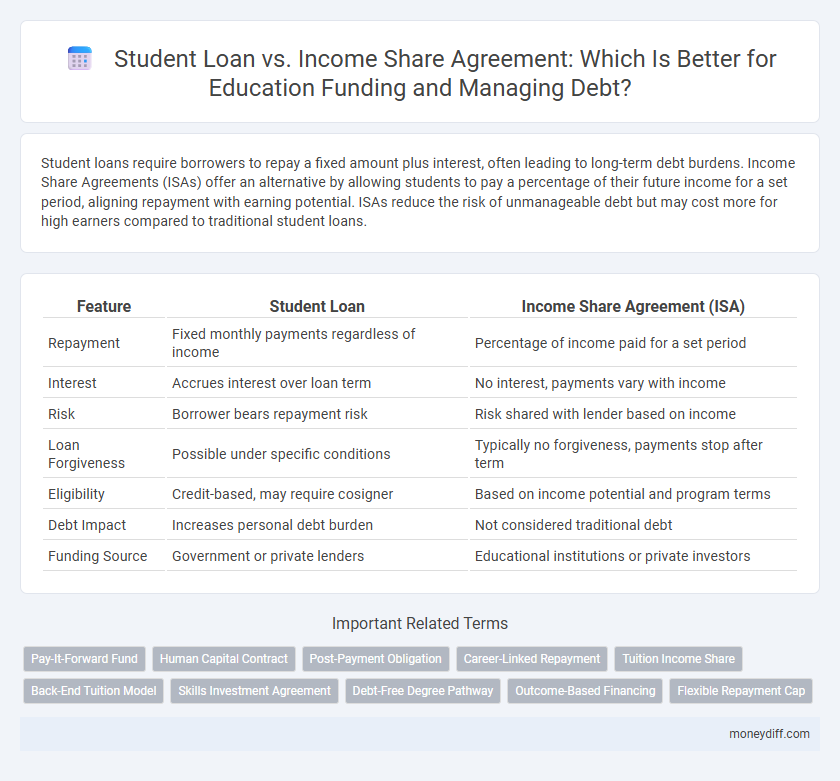

Student loans require borrowers to repay a fixed amount plus interest, often leading to long-term debt burdens. Income Share Agreements (ISAs) offer an alternative by allowing students to pay a percentage of their future income for a set period, aligning repayment with earning potential. ISAs reduce the risk of unmanageable debt but may cost more for high earners compared to traditional student loans.

Table of Comparison

| Feature | Student Loan | Income Share Agreement (ISA) |

|---|---|---|

| Repayment | Fixed monthly payments regardless of income | Percentage of income paid for a set period |

| Interest | Accrues interest over loan term | No interest, payments vary with income |

| Risk | Borrower bears repayment risk | Risk shared with lender based on income |

| Loan Forgiveness | Possible under specific conditions | Typically no forgiveness, payments stop after term |

| Eligibility | Credit-based, may require cosigner | Based on income potential and program terms |

| Debt Impact | Increases personal debt burden | Not considered traditional debt |

| Funding Source | Government or private lenders | Educational institutions or private investors |

Understanding Student Loans: Traditional Education Funding

Student loans are a common method of funding higher education, requiring borrowed money to be repaid with interest over time. These loans often have fixed or variable interest rates, repayment schedules, and potential deferment options depending on the lender or government programs. Unlike income share agreements, student loans do not tie repayment amounts to future income, leading to fixed financial obligations regardless of graduates' earnings.

What Is an Income Share Agreement (ISA)?

An Income Share Agreement (ISA) is a financial arrangement where students receive education funding in exchange for a fixed percentage of their future income over a set period. Unlike traditional student loans, ISAs do not accrue interest or require repayment if the graduate's income does not reach a certain threshold. This model aligns repayment obligations with the borrower's earning potential, offering a risk-sharing alternative to conventional debt-based education financing.

Key Differences Between Student Loans and ISAs

Student loans require fixed repayments with interest over a set period, regardless of the borrower's income, while Income Share Agreements (ISAs) require payments as a percentage of future income, aligning repayment with the borrower's earning capacity. Unlike student loans, ISAs often have a payment cap and a maximum payment term, after which no further payments are required, providing more financial flexibility. Student loans typically accumulate interest independently of income, whereas ISAs adjust payments based on income fluctuations, reducing repayment burden during low-earning periods.

Eligibility Criteria for Student Loans vs ISAs

Student loans typically require applicants to demonstrate financial need, enrollment in an accredited institution, and often a credit check or a co-signer, whereas Income Share Agreements (ISAs) prioritize eligibility based on the potential future income of the student and the program's eligibility rather than credit history. ISAs usually target students in high-demand fields with strong employment prospects, focusing on income-based repayment without traditional debt. Loan eligibility often involves federal or private lending criteria, while ISAs depend on partnerships between educational providers and investors assessing income potential.

Repayment Structures: Fixed Payments vs Income Percentage

Student loans require fixed monthly payments regardless of income, often leading to financial strain if earnings fluctuate. Income share agreements (ISAs) adjust repayments based on a percentage of the borrower's income, offering flexibility aligned with financial capacity. Choosing between fixed payments and income percentage models impacts long-term affordability and risk management for education funding.

Impact on Post-Graduation Finances

Student loans require fixed monthly repayments regardless of income, which can strain post-graduation finances if employment is low-paying. Income share agreements (ISAs) base repayments on a percentage of post-graduation income, providing flexibility and reducing financial stress during lower earning periods. The choice between student loans and ISAs significantly affects long-term financial stability and debt management strategies after completing education.

Risks and Benefits: Student Loans vs ISAs

Student loans provide fixed repayment terms and predictable interest rates but carry the risk of long-term debt accumulation and financial strain if income is insufficient. Income Share Agreements (ISAs) offer flexible repayments tied to actual earnings, reducing default risk but potentially costing more over time if income increases substantially. Evaluating these options requires balancing immediate financial relief against the total repayment burden and income variability after education completion.

Long-Term Financial Implications for Graduates

Student loans create fixed repayment obligations with interest that can strain graduates' finances for years, often limiting financial flexibility and increasing the risk of default. Income Share Agreements (ISAs) link payments directly to income, reducing the burden during low-earning periods and potentially lowering long-term debt stress. However, high earners may pay more over time with ISAs, making the choice dependent on career trajectory and earnings stability.

Choosing the Best Option: Factors to Consider

When choosing between student loans and income share agreements (ISAs) for education funding, consider interest rates, repayment flexibility, and total cost over time. Student loans often have fixed or variable interest rates with set repayment schedules, while ISAs require a percentage of future income, aligning payments with earnings but potentially increasing total cost if income rises. Evaluating job market prospects, expected salary, and risk tolerance helps determine which option offers better financial stability and manageable debt burden.

Future Trends in Education Funding: Loans vs ISAs

Emerging trends in education funding emphasize a shift from traditional student loans to Income Share Agreements (ISAs) as a flexible alternative tied to future earnings, reducing upfront debt burdens. ISAs offer graduates a repayment model based on income percentages, aligning incentives between educational institutions and student success outcomes. Increasing adoption by tech-forward colleges reflects growing confidence in ISAs' ability to democratize access to higher education while mitigating long-term debt risks.

Related Important Terms

Pay-It-Forward Fund

The Pay-It-Forward Fund offers an innovative alternative to traditional student loans by allowing graduates to repay a percentage of their income for a fixed period, reducing financial risk compared to fixed monthly loan payments. This income share agreement model aligns repayment with earnings, promoting accessible education funding and minimizing debt burden for students entering the workforce.

Human Capital Contract

Human Capital Contracts (HCCs) offer a flexible alternative to traditional student loans by tying repayment to a fixed percentage of the graduate's future income, reducing financial risk if earnings are low. Unlike income share agreements, HCCs specifically structure funding as an investment in the student's potential earnings, aligning lender returns with career success and incentivizing educational institutions to support student outcomes.

Post-Payment Obligation

Student loans impose fixed repayment amounts regardless of income, often leading to significant financial strain when earnings are low, whereas income share agreements (ISAs) adjust repayment based on a percentage of post-graduation income, aligning payment obligations with actual earning capacity. This post-payment obligation structure in ISAs reduces the risk of default and offers more flexible financial support for students entering varied income brackets.

Career-Linked Repayment

Income Share Agreements (ISAs) offer career-linked repayment models where students pay a percentage of their future income, reducing debt burden based on actual earnings, unlike traditional student loans with fixed monthly payments regardless of employment status. This alignment of repayment with career success provides financial flexibility and minimizes default risk, promoting equitable education financing.

Tuition Income Share

Tuition Income Share Agreements (ISAs) offer a flexible alternative to traditional student loans by requiring students to pay a fixed percentage of their future income instead of accruing fixed interest debt. This model aligns repayment with earning, reducing financial risk for graduates compared to conventional student loans with set repayment schedules and interest rates.

Back-End Tuition Model

Income Share Agreements (ISAs) offer a back-end tuition model where students repay a percentage of their future income for a fixed period instead of upfront loans, reducing immediate financial burden and aligning costs with earnings. Unlike traditional student loans with fixed payments and interest, ISAs adjust repayments based on income fluctuations, providing a more flexible, income-contingent approach to education funding.

Skills Investment Agreement

Skills Investment Agreements offer an alternative to traditional student loans by linking education funding directly to future income, reducing upfront debt burdens and aligning repayment with graduates' earnings. Unlike fixed-rate loans, these agreements provide a flexible payment structure based on actual income, minimizing financial risk and promoting access to education for diverse economic backgrounds.

Debt-Free Degree Pathway

Student loans require fixed repayments with interest, often leading to long-term debt, while Income Share Agreements (ISAs) allow students to pay a percentage of future income, creating a flexible, debt-free degree pathway. ISAs align education funding with actual earnings, reducing financial risk and promoting access to higher education without traditional loan burdens.

Outcome-Based Financing

Outcome-based financing methods like Income Share Agreements (ISAs) link repayment to post-graduation income, reducing default risk compared to traditional student loans with fixed repayment schedules. ISAs align incentives between students and educational institutions by tying funding costs to career success, offering flexibility for borrowers with variable earnings.

Flexible Repayment Cap

Student loans typically impose fixed monthly payments with interest accruing over time, which can strain borrowers during low-income periods, whereas income share agreements (ISAs) offer a flexible repayment cap tied to a percentage of the borrower's income, ensuring payments adjust based on financial capacity with an upper limit to prevent excessive repayment. This flexible repayment cap in ISAs reduces the risk of default and financial hardship, aligning educational debt obligations with real earnings instead of fixed debt amounts.

Student loan vs Income share agreement for education funding. Infographic

moneydiff.com

moneydiff.com