Traditional loans offer fixed repayment schedules and interest rates, providing predictable long-term financing for significant purchases. Buy Now Pay Later (BNPL) services allow consumers to split payments into smaller, interest-free installments, enhancing short-term affordability and cash flow management. Understanding the differences in interest, fees, and credit impact helps consumers choose the most suitable payment option for their financial needs.

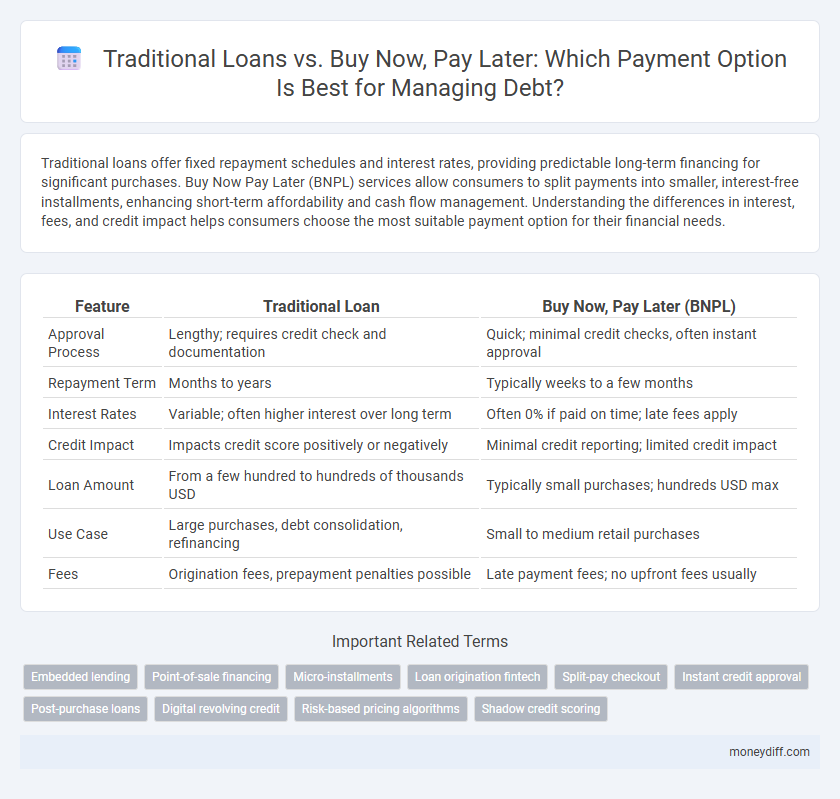

Table of Comparison

| Feature | Traditional Loan | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Approval Process | Lengthy; requires credit check and documentation | Quick; minimal credit checks, often instant approval |

| Repayment Term | Months to years | Typically weeks to a few months |

| Interest Rates | Variable; often higher interest over long term | Often 0% if paid on time; late fees apply |

| Credit Impact | Impacts credit score positively or negatively | Minimal credit reporting; limited credit impact |

| Loan Amount | From a few hundred to hundreds of thousands USD | Typically small purchases; hundreds USD max |

| Use Case | Large purchases, debt consolidation, refinancing | Small to medium retail purchases |

| Fees | Origination fees, prepayment penalties possible | Late payment fees; no upfront fees usually |

Understanding Traditional Loans vs Buy Now Pay Later

Traditional loans involve borrowing a fixed amount with scheduled repayments over time and interest charges, often requiring credit checks and longer approval processes. Buy Now Pay Later (BNPL) offers delayed payments on purchases without interest if paid within a set period, making it a flexible option for short-term financing but potentially leading to fees or debt accumulation if payments are missed. Consumers should assess interest rates, repayment terms, and credit impact when choosing between traditional loans and BNPL to manage debt responsibly.

Key Differences in Payment Structures

Traditional loans require fixed monthly payments over a predetermined term with interest applied from the loan's inception, creating a consistent repayment schedule. Buy Now Pay Later (BNPL) options typically offer interest-free periods with payments split into smaller installments due over a few weeks or months, promoting short-term affordability. The key difference lies in BNPL's deferred interest and installment flexibility versus traditional loans' structured amortization and long-term cost implications.

Eligibility Criteria: Who Qualifies?

Traditional loans typically require a thorough credit check, proof of stable income, and a strong credit history to qualify, making them more suitable for borrowers with established financial backgrounds. Buy Now Pay Later (BNPL) options often have lenient eligibility criteria, requiring minimal credit checks and allowing approval based on basic identity and payment capability, which makes them accessible to younger consumers or those with limited credit history. Eligibility for BNPL is generally faster and simpler, but may come with lower transaction limits compared to traditional loans.

Interest Rates and Hidden Fees

Traditional loans often feature fixed or variable interest rates that accumulate over the loan term, potentially resulting in higher overall costs compared to Buy Now Pay Later (BNPL) plans, which typically offer interest-free periods but may impose steep late fees. Hidden fees in traditional loans can include origination charges and prepayment penalties, whereas BNPL services might charge surcharges, deferred interest, or penalty fees if payments are missed or deferred beyond the promotional period. Consumers must scrutinize the total cost of borrowing, as BNPL's seemingly low or zero interest can be offset by hidden fees that increase the effective interest rate significantly.

Impact on Credit Score

Traditional loans typically have a significant impact on credit scores due to credit inquiries and monthly payment histories being reported to credit bureaus. Buy now pay later (BNPL) services often do not report regular payments to credit bureaus, which may result in less influence on credit scores unless payments are missed. Consumers seeking to build or maintain credit should consider that responsible management of traditional loans can improve credit scores, whereas BNPL might have limited credit score benefits.

Flexibility and Repayment Terms

Traditional loans often require fixed monthly payments over a set term, offering less flexibility but predictable repayment schedules essential for long-term financial planning. Buy now pay later (BNPL) options provide more flexible repayment terms, allowing consumers to split purchases into smaller, interest-free installments over weeks or months, though this may encourage overspending. Choosing between these depends on individual cash flow needs and the ability to manage short-term versus long-term debt obligations effectively.

User Experience: Application and Approval Process

Traditional loans typically involve a lengthy application process requiring extensive documentation, credit checks, and longer approval times which can be cumbersome for users. Buy now pay later (BNPL) services streamline the user experience with quick, minimal information submissions and instant approval, often integrated directly at the point of sale. This ease of access and speed dramatically enhance user convenience and decision-making efficiency compared to conventional loan procedures.

Potential Risks and Pitfalls

Traditional loans typically involve fixed interest rates and structured repayment schedules, creating a clear debt obligation that can affect credit scores if payments are missed. Buy now, pay later (BNPL) options often lack stringent credit checks but can lead to overspending, late fees, and accumulating short-term debt that may escalate quickly without proper budgeting. Both payment methods carry risks of increased financial strain, but BNPL's ease of access and deferred payments can obscure true debt levels, increasing the likelihood of default and damage to credit health.

Suitability for Different Types of Purchases

Traditional loans are suitable for large, long-term purchases such as homes or cars, offering fixed interest rates and structured repayment plans. Buy Now Pay Later (BNPL) services cater to smaller, short-term consumer goods with interest-free periods, making them ideal for everyday electronics or fashion items. The choice depends on purchase size, repayment capacity, and the need for flexible payment schedules.

Which Option Is Right for Your Financial Health?

Traditional loans offer structured repayment plans with fixed interest rates, making them suitable for borrowers seeking predictable monthly payments and long-term credit building. Buy Now Pay Later (BNPL) services provide short-term, interest-free installments, ideal for managing immediate purchases without accruing debt but may lead to overspending if not carefully managed. Evaluating your financial stability, repayment capacity, and spending habits helps determine whether a traditional loan or BNPL aligns better with your overall financial health.

Related Important Terms

Embedded lending

Embedded lending integrates traditional loan facilities directly into the purchasing process, offering seamless access to credit with potentially lower interest rates and longer repayment terms. Buy Now Pay Later (BNPL) solutions emphasize short-term, interest-free installments embedded in checkout, appealing for smaller purchases but often lacking the credit-building benefits and flexibility of traditional loans.

Point-of-sale financing

Traditional loans generally require extensive credit checks and fixed monthly repayments with interest, making them less flexible for immediate point-of-sale financing. Buy Now Pay Later options offer consumers interest-free, installment-based payments directly at checkout, enhancing purchasing power without impacting credit scores.

Micro-installments

Traditional loans typically involve fixed repayment schedules and interest rates over a longer term, often requiring credit checks and higher income thresholds. Buy Now Pay Later (BNPL) services emphasize micro-installments with flexible, short-term payments, allowing consumers to split purchases into smaller, interest-free or low-interest installments without extensive credit evaluation.

Loan origination fintech

Loan origination fintech platforms streamline traditional loan approvals with detailed credit assessments and fixed repayment schedules, offering borrowers predictable financial planning. Buy Now Pay Later (BNPL) services provide instant credit with minimal credit checks and flexible, interest-free installments, but often lack comprehensive underwriting, increasing risk of consumer over-indebtedness.

Split-pay checkout

Split-pay checkout in Buy Now Pay Later (BNPL) services offers consumers the flexibility to divide payments into manageable installments without accruing interest, contrasting with traditional loans that often involve fixed monthly payments and higher interest rates. This payment option enhances affordability and accessibility for buyers, reducing the immediate financial burden compared to conventional credit products.

Instant credit approval

Traditional loans often require extensive credit checks and longer approval times, whereas buy now pay later (BNPL) services provide instant credit approval, enabling immediate purchases without lengthy credit assessments. This instant approval process enhances consumer convenience and accelerates transaction completion, making BNPL a popular alternative for those seeking fast, flexible payment options.

Post-purchase loans

Post-purchase loans such as Buy Now Pay Later (BNPL) offer flexible repayment terms without immediate full payment, making them popular alternatives to traditional loans, which typically involve fixed interest rates and longer approval processes. While BNPL provides short-term credit with zero or low interest, traditional loans often support larger purchases with structured monthly payments and credit-building benefits.

Digital revolving credit

Digital revolving credit in Buy Now Pay Later (BNPL) offers flexible payment options with interest-free periods, contrasting with traditional loans that involve fixed schedules and typically higher interest rates. BNPL's seamless integration with e-commerce platforms increases consumer purchasing power without impacting credit scores, unlike conventional loans that require thorough credit checks and longer approval times.

Risk-based pricing algorithms

Traditional loans rely heavily on risk-based pricing algorithms that assess credit scores, income, and debt-to-income ratios to determine interest rates, often resulting in higher costs for borrowers with lower creditworthiness. In contrast, Buy Now Pay Later (BNPL) services use streamlined risk models emphasizing transaction history and short-term repayment behavior, which can reduce upfront barriers but may obscure longer-term credit risks and lead to increased consumer debt.

Shadow credit scoring

Traditional loans rely heavily on formal credit scores and extensive financial documentation, limiting approval to borrowers with established credit histories. Buy Now Pay Later (BNPL) services utilize shadow credit scoring by analyzing alternative data such as transaction behavior and social signals, enabling access to credit for consumers with thin or no credit files.

Traditional loan vs Buy now pay later for payment options Infographic

moneydiff.com

moneydiff.com