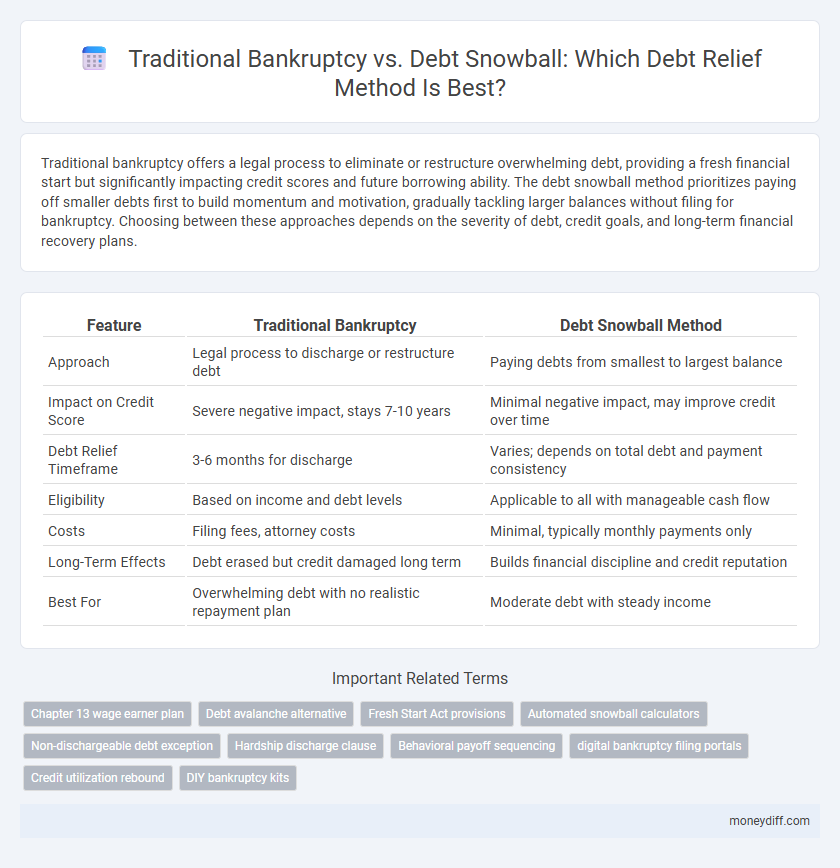

Traditional bankruptcy offers a legal process to eliminate or restructure overwhelming debt, providing a fresh financial start but significantly impacting credit scores and future borrowing ability. The debt snowball method prioritizes paying off smaller debts first to build momentum and motivation, gradually tackling larger balances without filing for bankruptcy. Choosing between these approaches depends on the severity of debt, credit goals, and long-term financial recovery plans.

Table of Comparison

| Feature | Traditional Bankruptcy | Debt Snowball Method |

|---|---|---|

| Approach | Legal process to discharge or restructure debt | Paying debts from smallest to largest balance |

| Impact on Credit Score | Severe negative impact, stays 7-10 years | Minimal negative impact, may improve credit over time |

| Debt Relief Timeframe | 3-6 months for discharge | Varies; depends on total debt and payment consistency |

| Eligibility | Based on income and debt levels | Applicable to all with manageable cash flow |

| Costs | Filing fees, attorney costs | Minimal, typically monthly payments only |

| Long-Term Effects | Debt erased but credit damaged long term | Builds financial discipline and credit reputation |

| Best For | Overwhelming debt with no realistic repayment plan | Moderate debt with steady income |

Understanding Traditional Bankruptcy and Debt Snowball

Traditional bankruptcy offers legal protection by discharging or reorganizing debt, often severely impacting credit scores and involving court procedures. The debt snowball method targets paying off smaller debts first to build momentum and motivation without court involvement, improving financial habits gradually. Evaluating credit impact, long-term financial goals, and debt amounts helps determine whether bankruptcy or the debt snowball method provides effective debt relief.

Key Differences Between Bankruptcy and Debt Snowball

Bankruptcy involves legally declaring inability to repay debts, often resulting in discharge of most obligations but significant long-term credit impact and potential asset loss. The debt snowball method prioritizes paying off smaller debts first to build momentum and improve credit over time without legal proceedings. Bankruptcy provides immediate relief but damages credit severely, whereas debt snowball requires discipline but supports gradual financial recovery and credit improvement.

Pros and Cons of Bankruptcy for Debt Relief

Bankruptcy offers immediate relief by legally discharging most unsecured debts and stopping creditor actions, providing a fresh financial start for overwhelmed individuals. However, it severely impacts credit scores and remains on credit reports for up to 10 years, complicating future loan approvals and housing opportunities. While it eliminates debt quickly, bankruptcy may also involve asset liquidation and does not discharge all types of debt, making it a serious financial decision with long-term consequences.

Advantages of the Debt Snowball Method

The Debt Snowball Method accelerates motivation by focusing on paying off smaller debts first, creating a psychological boost through quick wins that encourage continued progress. This strategy simplifies debt management by eliminating accounts one at a time, reducing stress and increasing confidence as balances disappear. Unlike traditional bankruptcy, the Debt Snowball preserves credit scores and avoids long-term financial consequences, making it a more sustainable solution for gradual debt relief.

Impact on Credit Score: Bankruptcy vs Debt Snowball

Filing for traditional bankruptcy typically causes a significant and immediate drop in credit score, with the bankruptcy record remaining on credit reports for up to 10 years, severely limiting access to new credit. In contrast, the debt snowball method gradually improves credit scores by systematically paying off smaller debts first, which reduces overall credit utilization and demonstrates consistent payment behavior. This approach positively impacts credit health over time, making it a less damaging option compared to bankruptcy for debt relief.

Legal and Financial Implications of Bankruptcy

Traditional bankruptcy involves a legal process that can discharge many types of unsecured debts, providing individuals with a fresh financial start but significantly impacting credit scores for up to ten years. The debt snowball method focuses on paying off smaller debts first to build momentum without legal intervention, preserving credit history while reducing financial obligations incrementally. Choosing bankruptcy can lead to asset liquidation or structured repayment plans under court supervision, whereas the debt snowball approach relies entirely on personal discipline and cash flow management to avoid potential legal consequences.

Psychological Effects: Bankruptcy vs Debt Snowball

Traditional bankruptcy often leads to feelings of shame and anxiety due to its drastic impact on credit scores and public record stigma. The debt snowball method fosters a sense of accomplishment and motivation by allowing individuals to see gradual progress through paying off smaller debts first. This psychological boost can improve financial discipline and reduce stress, making the debt snowball approach more emotionally manageable than bankruptcy.

Eligibility Requirements: Bankruptcy vs Debt Snowball

Bankruptcy requires meeting strict eligibility criteria such as passing the means test to confirm insufficient income for debt repayment, while the debt snowball method has no formal eligibility requirements and can be started by anyone regardless of income or credit score. Bankruptcy typically involves legal filings that can stay on credit reports for up to 10 years, impacting future credit opportunities. The debt snowball focuses on systematically paying off smaller debts first, providing psychological motivation but does not offer automatic debt discharge like bankruptcy.

Long-Term Financial Outcomes

Traditional bankruptcy offers immediate relief by discharging or restructuring debt but can severely damage credit scores and limit financial opportunities for up to a decade. The debt snowball method promotes long-term financial health by systematically paying off smaller debts first, boosting credit through consistent repayments and fostering disciplined budgeting habits. Over time, the debt snowball approach supports sustainable credit recovery and wealth building, unlike bankruptcy's prolonged credit impact and potential asset loss.

Choosing the Right Debt Relief Strategy

Traditional bankruptcy provides a legal process to discharge or reorganize debts, offering protection from creditors but significantly impacting credit scores and financial stability long-term. The Debt Snowball method focuses on paying off smaller debts first to build momentum and motivation, promoting disciplined financial habits without legal intervention. Choosing the right debt relief strategy depends on individual financial situations, debt amounts, credit status, and the urgency of relief, with bankruptcy suited for overwhelming debt levels and the Debt Snowball effective for manageable, smaller debts.

Related Important Terms

Chapter 13 wage earner plan

Chapter 13 wage earner plans offer structured debt relief by allowing individuals to repay debts over three to five years while protecting assets, contrasting with the immediate liquidation process of traditional bankruptcy. Utilizing the debt snowball method within a Chapter 13 framework can accelerate repayment of smaller debts first, improving motivation and financial control during the court-approved repayment period.

Debt avalanche alternative

The Debt Avalanche method accelerates debt relief by targeting high-interest debts first, unlike the Debt Snowball which prioritizes smaller balances, and can be a more cost-effective alternative to traditional bankruptcy by minimizing overall interest paid and preserving credit standing. This strategy reduces total repayment time and financial burden, making it a viable option for individuals seeking structured debt management without the long-term consequences of bankruptcy filings.

Fresh Start Act provisions

The Fresh Start Act provisions enhance traditional bankruptcy by streamlining asset exemptions and reducing debtor eligibility barriers, providing a faster route to debt relief compared to the Debt Snowball method, which relies on incremental payments to eliminate smaller debts first. While the Debt Snowball boosts motivation through manageable milestones, bankruptcy under the Fresh Start Act offers comprehensive discharge options, often wiping out unsecured debts entirely, thereby accelerating financial recovery.

Automated snowball calculators

Automated snowball calculators streamline the debt snowball method by prioritizing debts from smallest to largest, enabling efficient repayment strategies without the complexities of traditional bankruptcy processes. These tools provide users with clear payoff timelines and interest savings, making debt relief more manageable compared to the extended legal and credit repercussions associated with bankruptcy.

Non-dischargeable debt exception

Traditional bankruptcy provides a legal process for debt relief but excludes non-dischargeable debts such as student loans, child support, and certain tax obligations, which remain payable after discharge. The debt snowball method targets small debts first to build momentum, offering full control over non-dischargeable debts without the risk of losing assets or credit damage associated with bankruptcy.

Hardship discharge clause

Traditional bankruptcy offers a hardship discharge clause that can relieve specific debts if the debtor proves chronic financial hardship, providing legal protection and debt elimination. In contrast, the debt snowball method requires consistent payments from the debtor without legal discharge options, making it less effective for those facing severe financial distress.

Behavioral payoff sequencing

Traditional bankruptcy offers rapid legal discharge of debts but can severely damage credit scores and long-term financial standing, whereas the debt snowball method emphasizes behavioral payoff sequencing by prioritizing small debt balances first, fostering psychological motivation and momentum to maintain consistent repayment habits. This behavioral approach leverages cognitive reinforcement, often leading to sustained financial discipline and gradual debt elimination without the adverse credit implications of bankruptcy.

digital bankruptcy filing portals

Digital bankruptcy filing portals streamline traditional bankruptcy processes by providing accessible, user-friendly platforms that automate document submission and deadlines, making chapter 7 and chapter 13 filings more efficient. In contrast, the debt snowball method, favored for its psychological benefits, relies on consistent, incremental payments tracked via budgeting apps but lacks integration with official court systems offered by digital bankruptcy services.

Credit utilization rebound

Traditional bankruptcy often results in a significant credit utilization rebound by eliminating most debts but severely damaging credit scores, requiring years to rebuild financial credibility. The debt snowball method targets smaller balances first, gradually improving credit utilization and boosting credit scores over time without the drastic credit repercussions of bankruptcy.

DIY bankruptcy kits

Traditional bankruptcy often involves complex legal proceedings and higher costs, whereas debt snowball focuses on paying off smaller debts first to build momentum and motivation. DIY bankruptcy kits offer a more affordable, self-managed alternative for those seeking structured debt relief without extensive legal fees.

Traditional bankruptcy vs Debt snowball for debt relief Infographic

moneydiff.com

moneydiff.com