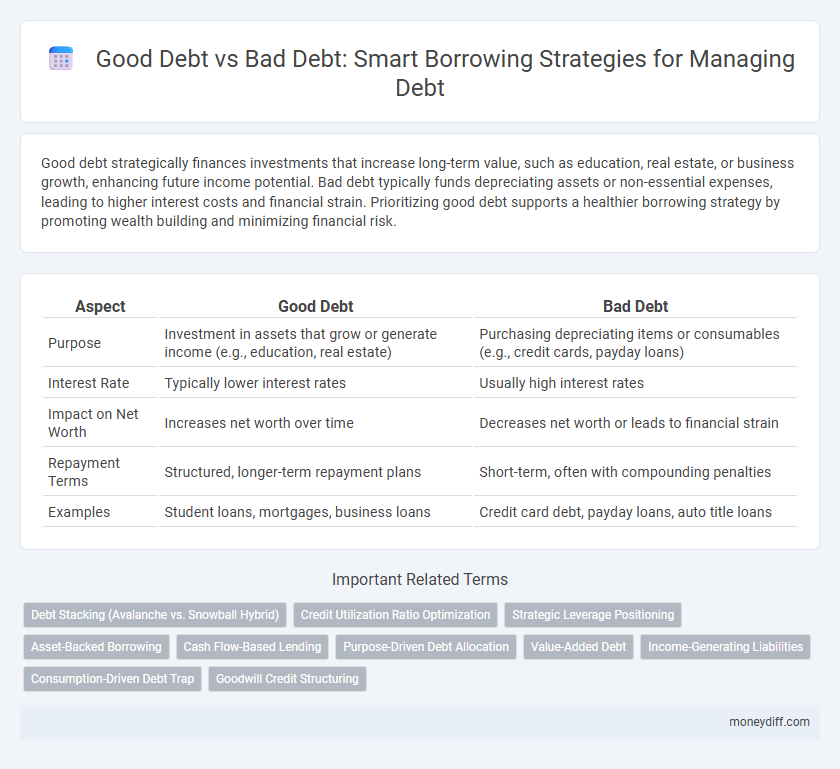

Good debt strategically finances investments that increase long-term value, such as education, real estate, or business growth, enhancing future income potential. Bad debt typically funds depreciating assets or non-essential expenses, leading to higher interest costs and financial strain. Prioritizing good debt supports a healthier borrowing strategy by promoting wealth building and minimizing financial risk.

Table of Comparison

| Aspect | Good Debt | Bad Debt |

|---|---|---|

| Purpose | Investment in assets that grow or generate income (e.g., education, real estate) | Purchasing depreciating items or consumables (e.g., credit cards, payday loans) |

| Interest Rate | Typically lower interest rates | Usually high interest rates |

| Impact on Net Worth | Increases net worth over time | Decreases net worth or leads to financial strain |

| Repayment Terms | Structured, longer-term repayment plans | Short-term, often with compounding penalties |

| Examples | Student loans, mortgages, business loans | Credit card debt, payday loans, auto title loans |

Understanding the Concept of Good Debt and Bad Debt

Good debt refers to borrowing that is used for investments expected to generate long-term value or income, such as student loans or mortgages. Bad debt typically involves borrowing for items that depreciate quickly and do not improve financial standing, like high-interest credit card debt or consumer electronics. Understanding the distinction helps borrowers make strategic financial decisions and maintain healthy credit profiles.

Key Differences Between Good Debt and Bad Debt

Good debt typically involves borrowing for investments that generate long-term value, such as education loans, mortgages, or business financing, which can enhance income potential and creditworthiness. Bad debt arises from borrowing for depreciating assets or consumables like credit card debt, high-interest payday loans, or financing luxury purchases, often leading to financial strain and lower credit scores. Key differences include purpose, interest rates, and impact on financial health, where good debt supports wealth building and bad debt undermines it.

Examples of Good Debt: Investments for the Future

Good debt typically includes borrowing for investments that enhance future financial stability, such as student loans for higher education, mortgages for property ownership, and business loans to start or expand a company. These types of debt often have lower interest rates and potential tax benefits, making them strategic financial decisions. Leveraging good debt responsibly can increase net worth and generate long-term income streams, distinguishing it from bad debt used for depreciating assets or consumption.

Identifying Common Types of Bad Debt

High-interest credit card balances and payday loans represent common types of bad debt, often leading to financial strain due to exorbitant interest rates. Auto loans for depreciating vehicles and unsecured personal loans without clear investment return also categorize as bad debt. These debts limit cash flow and hinder wealth accumulation by prioritizing consumption over productive asset building.

How Good Debt Supports Financial Growth

Good debt, such as student loans or mortgages, serves as a strategic borrowing tool that invests in long-term financial growth by building assets and increasing earning potential. Unlike bad debt characterized by high-interest credit card balances that depreciate value, good debt often has lower interest rates and tax advantages, enhancing cash flow management. Properly managed good debt leverages borrowed capital to generate higher returns, contributing to improved credit scores and sustainable wealth accumulation.

The Risks and Consequences of Bad Debt

Bad debt often leads to high-interest rates and compounding fees that can quickly escalate financial burdens, damaging credit scores and limiting future borrowing capacity. The inability to manage bad debt increases the risk of default, foreclosure, and long-term financial instability. Poor debt management can also result in legal actions and wage garnishment, severely impacting personal and business financial health.

Borrowing Strategies: Maximizing Good Debt Benefits

Effective borrowing strategies emphasize leveraging good debt, such as low-interest loans for education or property investment, which typically appreciate in value or enhance earning potential. Prioritizing good debt enables borrowers to build credit and create long-term financial growth, while avoiding bad debt linked to high-interest consumer loans or depreciating assets. Strategic use of good debt supports wealth accumulation and improves overall financial stability.

Avoiding Bad Debt: Practical Tips and Red Flags

Avoiding bad debt requires careful evaluation of borrowing terms, high-interest rates, and unnecessary loans for depreciating assets. Prioritize borrowing for investments that generate income or appreciate in value, such as education or real estate, while steering clear of credit card debt or payday loans with exorbitant fees. Recognize red flags like frequent refinancing, minimum payments that extend debt duration, and pressure sales tactics to prevent financial pitfalls.

Evaluating Your Debt: Is It Helping or Hurting Your Finances?

Evaluating your debt involves distinguishing between good debt, which typically includes loans that build equity or improve earning potential such as mortgages or education loans, and bad debt, often characterized by high-interest consumer debt like credit cards that deplete financial stability. Analyzing interest rates, repayment terms, and the impact on cash flow helps determine whether your borrowing strategy supports wealth accumulation or exacerbates financial strain. Prioritizing good debt can enhance credit scores and net worth, while managing or eliminating bad debt reduces stress and improves financial health.

Creating a Borrowing Plan for Long-Term Financial Health

Good debt, such as low-interest mortgages or student loans, strategically leverages borrowing to build assets and increase future earning potential. Bad debt, characterized by high-interest credit card balances or payday loans, detracts from long-term financial stability by escalating costs and limiting cash flow. Crafting a borrowing plan prioritizes manageable repayments, aligns loans with investment in appreciating assets, and avoids liabilities that erode net worth over time.

Related Important Terms

Debt Stacking (Avalanche vs. Snowball Hybrid)

Debt stacking strategies like the Avalanche and Snowball Hybrid optimize borrowing by prioritizing high-interest debts while maintaining motivation through small wins, enhancing repayment efficiency and reducing overall interest paid. The Avalanche method targets debts with the highest interest rates first, whereas the Snowball Hybrid combines this with the psychological boost of clearing smaller balances, making it a balanced approach to managing good debt versus bad debt.

Credit Utilization Ratio Optimization

Maintaining an optimal credit utilization ratio below 30% enhances credit scores, allowing borrowers to leverage good debt like low-interest mortgages or student loans for wealth-building purposes. In contrast, high credit utilization driven by bad debt such as high-interest credit card balances can deteriorate credit health and increase borrowing costs.

Strategic Leverage Positioning

Strategic leverage positioning distinguishes good debt, which finances assets that appreciate or generate income, from bad debt that funds depreciating liabilities or consumer spending. Effective borrowing strategies prioritize good debt to enhance cash flow, build equity, and maximize return on investment while minimizing financial risk.

Asset-Backed Borrowing

Asset-backed borrowing leverages valuable assets such as real estate or investments to secure credit, enabling access to good debt that can enhance net worth and generate income. In contrast, bad debt typically involves unsecured borrowing for depreciating assets or consumption, leading to financial strain without asset growth.

Cash Flow-Based Lending

Cash flow-based lending prioritizes good debt by focusing on borrowers' ability to generate consistent income streams that cover debt obligations, enhancing financial stability and growth potential. Bad debt, conversely, arises from borrowing without sufficient cash flow to service repayments, increasing the risk of default and deteriorating creditworthiness.

Purpose-Driven Debt Allocation

Purpose-driven debt allocation prioritizes borrowing only for investments that generate long-term value, such as education, real estate, or business expansion, which classify as good debt. In contrast, bad debt arises from financing depreciating assets or consumption, leading to negative cash flow and financial strain.

Value-Added Debt

Value-added debt leverages borrowed funds to generate long-term wealth, such as investments in education, real estate, or business expansion, distinguishing it from bad debt associated with depreciating assets or high-interest consumer credit. Prioritizing value-added debt enhances borrowing strategy by optimizing returns and building equity rather than increasing financial liabilities.

Income-Generating Liabilities

Income-generating liabilities, often classified as good debt, include loans used to invest in assets that produce regular cash flow such as rental properties or business expansions. These debts enhance wealth by generating income that exceeds borrowing costs, unlike bad debt which typically finances depreciating liabilities without financial returns.

Consumption-Driven Debt Trap

Good debt, such as loans for education or real estate, typically generates long-term value and wealth accumulation, while bad debt often arises from consumption-driven borrowing on high-interest credit cards or personal loans that do not build assets. Falling into a consumption-driven debt trap leads to escalating interest payments and reduced financial stability, making it crucial to distinguish between productive borrowing and debt incurred for non-essential spending.

Goodwill Credit Structuring

Goodwill Credit Structuring emphasizes leveraging good debt, such as low-interest loans for investments that generate positive cash flow or enhance asset value, while avoiding bad debt that drains resources without return. Strategic borrowing through goodwill credit optimizes capital allocation, improves creditworthiness, and supports sustainable financial growth.

Good Debt vs Bad Debt for borrowing strategy. Infographic

moneydiff.com

moneydiff.com