Payday loans provide immediate cash but often come with high interest rates and fees, making them expensive for short-term borrowing. Buy Now, Pay Later (BNPL) services offer interest-free installments over a set period, promoting greater affordability and flexibility. Choosing BNPL can reduce the risk of debt spirals compared to the costly repayment demands of payday loans.

Table of Comparison

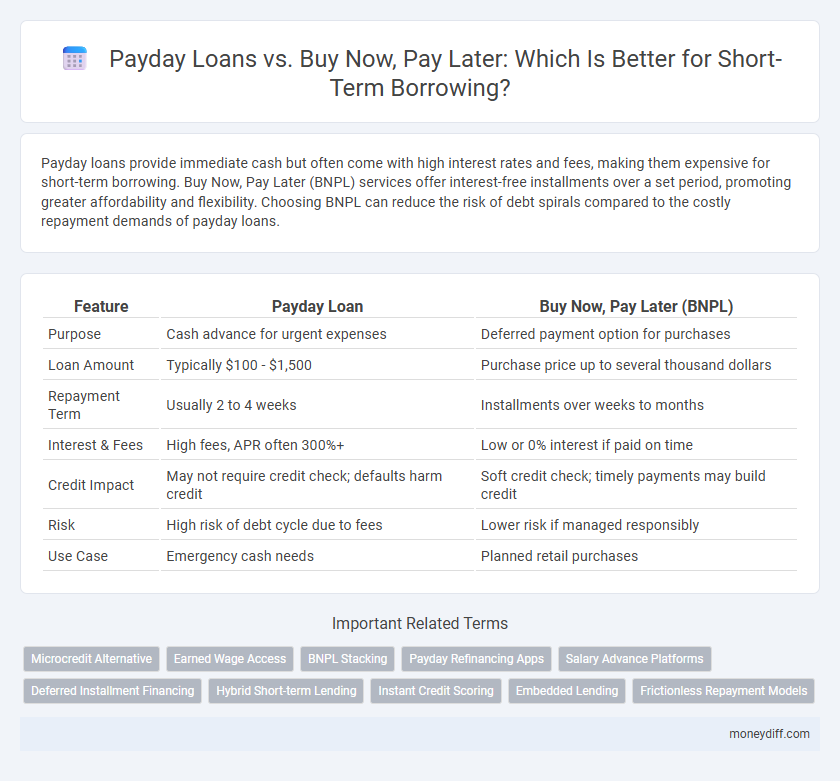

| Feature | Payday Loan | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Purpose | Cash advance for urgent expenses | Deferred payment option for purchases |

| Loan Amount | Typically $100 - $1,500 | Purchase price up to several thousand dollars |

| Repayment Term | Usually 2 to 4 weeks | Installments over weeks to months |

| Interest & Fees | High fees, APR often 300%+ | Low or 0% interest if paid on time |

| Credit Impact | May not require credit check; defaults harm credit | Soft credit check; timely payments may build credit |

| Risk | High risk of debt cycle due to fees | Lower risk if managed responsibly |

| Use Case | Emergency cash needs | Planned retail purchases |

Introduction to Short-Term Borrowing Options

Payday loans offer immediate cash with high interest rates and strict repayment terms, making them a costly option for short-term borrowing. Buy now, pay later (BNPL) services provide flexible, interest-free installments spread over weeks or months, appealing to consumers seeking manageable payment solutions. Both options serve distinct needs in short-term finance, with payday loans suited for urgent cash needs and BNPL ideal for planned expenses with minimal financial impact.

What Are Payday Loans?

Payday loans are high-interest, short-term loans designed to provide immediate cash advances, typically due on the borrower's next payday. These loans often come with steep fees and APRs that can exceed 400%, making them expensive and risky for consumers seeking quick financial relief. Unlike Buy Now, Pay Later plans, payday loans require immediate repayment and do not spread out payments over time, increasing the likelihood of debt cycles.

Understanding Buy Now, Pay Later (BNPL) Services

Buy Now, Pay Later (BNPL) services offer a flexible short-term borrowing option by allowing consumers to split purchases into interest-free installments, typically over weeks or months. Unlike payday loans, BNPL avoids high-interest rates and predatory fees, making it a more affordable alternative for managing cash flow. However, BNPL requires timely payments to prevent late fees and negative impacts on credit scores.

Eligibility Criteria: Payday Loans vs BNPL

Payday loans typically require proof of steady income, active employment, and a valid bank account, with lenders often performing credit checks or verifying income to assess short-term borrowing risk. Buy Now, Pay Later (BNPL) services generally have more accessible eligibility criteria, allowing consumers with limited credit history or lower income levels to qualify by simply providing basic identification and a payment method linked to a debit or credit card. BNPL platforms prioritize speed and convenience, offering instant approval with minimal financial documentation compared to the stricter verification process of payday loans.

Interest Rates and Fees Comparison

Payday loans often carry exorbitant interest rates exceeding 300% APR, with fees that can quickly escalate the total repayment amount, making them a costly short-term borrowing option. Buy now, pay later (BNPL) services typically offer interest-free periods and lower fees if payments are made on time, but missing deadlines can result in high late fees and increased overall costs. Consumers should carefully compare the Annual Percentage Rate (APR), fee structures, and repayment terms to determine the most affordable option for immediate financial needs.

Impact on Credit Score: Which Affects You More?

Payday loans often lead to immediate credit score damage due to high interest rates and frequent defaults, while Buy Now, Pay Later (BNPL) services typically do not impact credit scores unless payments are significantly late or defaults occur. BNPL providers may report to credit bureaus only after substantial delinquency, making short-term missed payments less likely to lower scores compared to payday loans. Consumers seeking short-term credit should consider payday loans' higher risk of rapid credit deterioration versus BNPL's generally more credit-friendly reporting practices.

Repayment Terms and Flexibility

Payday loans typically require full repayment on the borrower's next payday, resulting in high short-term pressure and limited flexibility. Buy now, pay later services offer installment-based repayment plans that extend over weeks or months, providing more manageable and flexible payment schedules. This flexibility reduces the risk of default and eases financial strain compared to the rigid terms of payday loans.

Risks and Consequences of Late Payments

Payday loans often carry extremely high interest rates and fees, causing late payments to rapidly increase the overall debt, leading to potential default and damage to credit scores. Buy now, pay later services usually offer interest-free periods, but missing payments can trigger late fees, increased interest rates, and negative credit reporting, affecting future borrowing capacity. Both options risk escalating financial strain if payments are delayed, emphasizing the importance of timely repayment to avoid severe economic consequences.

When to Choose Payday Loans or BNPL

Payday loans are suitable for urgent cash needs with immediate repayment capability despite high interest rates, while Buy Now, Pay Later (BNPL) options fit planned purchases with installment flexibility and lower fees. Choose payday loans when facing unexpected expenses and short-term cash flow gaps requiring quick access to funds. Opt for BNPL when managing discretionary spending on retail items with defined repayment schedules to avoid compounding debt.

Tips for Responsible Short-Term Borrowing

Choosing between payday loans and Buy Now, Pay Later (BNPL) options requires evaluating interest rates, repayment terms, and potential fees to avoid escalating debt. Prioritize borrowing only what can be repaid within the agreed timeframe to maintain financial stability and prevent negative credit impact. Monitoring repayment schedules and understanding all contractual obligations ensure responsible short-term borrowing and protect against unnecessary financial strain.

Related Important Terms

Microcredit Alternative

Payday loans typically charge annual percentage rates (APRs) exceeding 400%, making them a costly form of short-term borrowing compared to Buy Now, Pay Later (BNPL) services that often offer interest-free installments for microcredit needs. BNPL platforms provide structured repayment plans without high-interest fees, positioning themselves as a more affordable microcredit alternative for consumers requiring immediate funds.

Earned Wage Access

Earned Wage Access offers immediate access to earned income without incurring the high-interest rates typical of payday loans, providing a safer alternative for short-term borrowing. Buy Now, Pay Later services facilitate deferred payments but may lead to debt accumulation, whereas Earned Wage Access supports financial stability by allowing workers to manage funds responsibly before payday.

BNPL Stacking

Buy Now, Pay Later (BNPL) stacking enables consumers to combine multiple short-term credit offers, often leading to accumulated debt beyond initial limits, unlike payday loans which provide single lump-sum advances with high fees. This cumulative borrowing risk in BNPL stacking can escalate financial strain due to overlapping payment schedules and compounded fees, making short-term debt management more complex.

Payday Refinancing Apps

Payday loan refinancing apps offer users a streamlined way to manage high-interest payday loans by consolidating multiple debts into one payment with potentially lower interest rates and extended terms. These apps differ from Buy Now, Pay Later services by focusing specifically on reducing the burden of short-term, high-cost borrowing rather than facilitating new credit purchases.

Salary Advance Platforms

Salary advance platforms offer a flexible alternative to payday loans by allowing employees to access earned wages before payday with lower fees and less risk of debt cycles. Unlike buy now, pay later options that defer payments on purchases, salary advances provide immediate liquidity without increasing overall spending, supporting short-term borrowing needs responsibly.

Deferred Installment Financing

Deferred installment financing through Buy Now, Pay Later (BNPL) offers a structured repayment plan with fixed installments, often without interest if paid on time, making it a more transparent alternative to payday loans. Payday loans typically carry higher interest rates and fees with short repayment periods, increasing the risk of debt cycles compared to BNPL's flexible, deferred payment schedules.

Hybrid Short-term Lending

Hybrid short-term lending combines the immediacy of payday loans with the flexible payment structure of Buy Now, Pay Later (BNPL) options, offering borrowers quick access to funds while spreading repayments over time. This model reduces the risk of high-interest accumulation typical of payday loans and enhances affordability, making it a more consumer-friendly alternative for urgent financial needs.

Instant Credit Scoring

Instant credit scoring in payday loans provides rapid approval based primarily on limited financial data, often resulting in higher interest rates due to increased risk. Buy now, pay later services use advanced algorithms for real-time credit assessments, offering flexible repayment options with potentially lower fees for short-term borrowing.

Embedded Lending

Embedded lending in payday loans offers immediate, high-interest short-term cash advances directly within apps, while buy now, pay later (BNPL) integrates payments into e-commerce platforms with typically lower fees and flexible installments; both options provide fast credit access but differ in cost structures and repayment terms, influencing borrower preferences and risk profiles. Understanding these distinctions helps optimize financial planning and debt management strategies.

Frictionless Repayment Models

Payday loans typically involve high-interest rates and rigid repayment schedules that can exacerbate debt cycles, whereas Buy Now, Pay Later (BNPL) offers frictionless repayment models with flexible installments and transparent fees, enhancing consumer affordability and control. BNPL platforms integrate seamless payment options directly at checkout, leveraging technology to reduce borrowing friction and improve short-term credit access without immediate financial strain.

Payday loan vs Buy now, pay later for short-term borrowing. Infographic

moneydiff.com

moneydiff.com