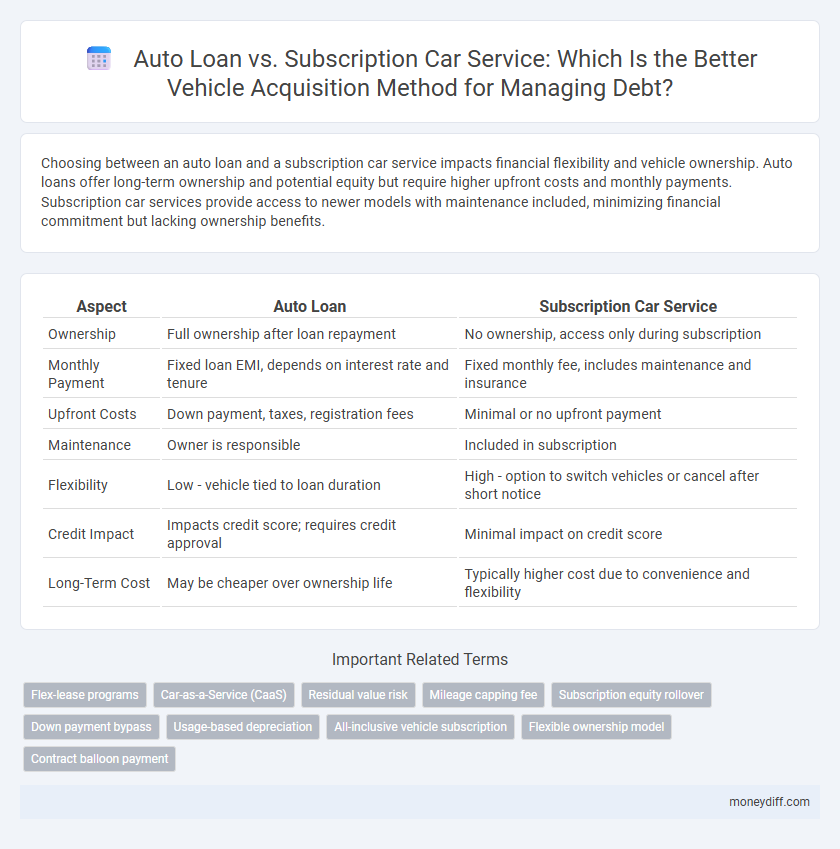

Choosing between an auto loan and a subscription car service impacts financial flexibility and vehicle ownership. Auto loans offer long-term ownership and potential equity but require higher upfront costs and monthly payments. Subscription car services provide access to newer models with maintenance included, minimizing financial commitment but lacking ownership benefits.

Table of Comparison

| Aspect | Auto Loan | Subscription Car Service |

|---|---|---|

| Ownership | Full ownership after loan repayment | No ownership, access only during subscription |

| Monthly Payment | Fixed loan EMI, depends on interest rate and tenure | Fixed monthly fee, includes maintenance and insurance |

| Upfront Costs | Down payment, taxes, registration fees | Minimal or no upfront payment |

| Maintenance | Owner is responsible | Included in subscription |

| Flexibility | Low - vehicle tied to loan duration | High - option to switch vehicles or cancel after short notice |

| Credit Impact | Impacts credit score; requires credit approval | Minimal impact on credit score |

| Long-Term Cost | May be cheaper over ownership life | Typically higher cost due to convenience and flexibility |

Understanding Auto Loans vs Subscription Car Services

Auto loans involve borrowing a fixed amount to purchase a vehicle, requiring monthly payments with interest over a set term, ultimately building equity in the car. Subscription car services offer flexibility with a flat monthly fee covering the vehicle, insurance, maintenance, and often the option to switch cars, without ownership or long-term financial commitment. Comparing cost structures, ownership benefits, and financial impact helps consumers decide between a traditional auto loan or the convenience and adaptability of a subscription service.

Key Differences Between Auto Loans and Car Subscriptions

Auto loans involve purchasing a vehicle by borrowing money and repaying it with interest over a fixed term, resulting in eventual ownership. Car subscription services offer a flexible, all-inclusive monthly fee covering the vehicle, maintenance, insurance, and taxes without ownership commitment. The key differences lie in financial responsibility, long-term cost implications, and flexibility, with loans building equity and subscriptions providing convenience and reduced upfront costs.

Upfront and Ongoing Costs: Auto Loans vs Subscription Services

Auto loans typically require a substantial upfront down payment and monthly installments covering principal and interest, leading to long-term financial commitments. Subscription car services eliminate large initial payments, instead charging a single monthly fee that covers insurance, maintenance, and depreciation, resulting in more predictable ongoing costs. Evaluating total cost of ownership, including fees, taxes, and potential penalties, helps determine the more cost-effective vehicle acquisition method.

Flexibility and Commitment: Subscription vs Car Ownership

Subscription car services offer greater flexibility compared to traditional auto loans by allowing users to switch vehicles or cancel subscriptions without long-term financial commitments. Auto loans require a fixed repayment schedule and vehicle ownership, leading to higher financial obligations and less adaptability. Subscription models appeal to consumers seeking short-term use and reduced responsibility for maintenance and depreciation.

Impact on Personal Debt: Loan Financing vs Subscription Payments

Auto loans increase personal debt by adding a fixed principal and interest repayment obligation, often extending for several years and impacting credit utilization and debt-to-income ratios. Subscription car services, however, typically require smaller, consistent monthly payments without incurring traditional debt, preserving credit capacity and reducing long-term financial liabilities. Choosing subscription over loan financing minimizes balance sheet leverage and may improve short-term cash flow management by avoiding large principal debts.

Credit Score Implications: Auto Loan vs Subscription Service

Auto loans typically require a credit check and timely payments that directly impact your credit score, potentially improving it with consistent on-time payments. Subscription car services often do not involve credit checks or report payment activity to credit bureaus, meaning they generally have no effect on your credit score. Choosing an auto loan can build credit history, while a subscription service offers flexibility without credit score risk or benefit.

Vehicle Maintenance and Insurance: What’s Included?

Auto loans require borrowers to handle maintenance and insurance costs independently, often leading to variable expenses based on the vehicle's condition and driver history. Subscription car services typically include comprehensive maintenance and insurance fees within the monthly payment, offering predictable and fixed costs. This integrated model minimizes unexpected financial burdens and simplifies budgeting for subscribers compared to traditional auto loan ownership.

Long-Term Value: Investing in a Car vs Paying for Access

Auto loans provide long-term ownership and asset value accumulation, allowing vehicle customization and potential resale benefits. Subscription car services offer flexibility and convenience without the burden of depreciation or maintenance costs but lack equity build-up. Evaluating total cost of ownership versus ongoing access fees is critical in determining the best financial approach for vehicle acquisition.

Financial Risks: Depreciation, Fees, and Hidden Costs

Auto loans involve fixed monthly payments and eventual vehicle ownership, but carry financial risks such as rapid depreciation, interest charges, and potential hidden fees like early repayment penalties. Subscription car services reduce upfront costs and offer flexible usage but often include higher overall fees, usage limits, and unexpected charges for excess mileage or wear and tear. Evaluating depreciation impact and fee structures is crucial to minimize risks and optimize total vehicle acquisition costs.

Choosing the Right Vehicle Acquisition Method for Your Budget

Comparing auto loans and subscription car services reveals distinct budget impacts; auto loans require upfront down payments and long-term interest expenses, while subscriptions offer fixed monthly fees with maintenance included, reducing unexpected costs. Evaluating total cost of ownership, credit impact, and flexibility helps determine which option aligns with financial goals and cash flow. For those prioritizing predictable expenses and short-term use, subscription services may be more budget-friendly, whereas auto loans can be advantageous for long-term ownership and equity building.

Related Important Terms

Flex-lease programs

Flex-lease programs combine benefits of traditional auto loans and subscription car services by offering flexible terms, reduced upfront costs, and inclusive maintenance, appealing to consumers seeking both affordability and convenience in vehicle acquisition. Unlike standard auto loans which require down payments and long-term commitments, flex-lease options empower users with customizable lease durations and simplified budgeting, optimizing financial management within the auto financing landscape.

Car-as-a-Service (CaaS)

Car-as-a-Service (CaaS) offers an alternative to traditional auto loans by bundling vehicle usage, maintenance, and insurance into a single subscription fee, reducing upfront costs and financial liabilities. This model enhances cash flow management and mitigates depreciation risk compared to conventional auto financing, appealing to cost-conscious consumers seeking flexibility.

Residual value risk

Auto loans expose borrowers to residual value risk as they bear the full depreciation cost if the vehicle's market value falls below expected levels by the end of the loan term. Subscription car services mitigate residual value risk by including depreciation and maintenance costs in a fixed monthly fee, transferring the financial uncertainty of vehicle value fluctuations to the provider.

Mileage capping fee

Auto loans typically do not impose mileage capping fees, allowing unlimited driving without additional charges, whereas subscription car services often include strict mileage limits with costly fees for exceeding those caps. Understanding these differences is crucial for consumers seeking to avoid unexpected expenses and manage debt effectively when acquiring a vehicle.

Subscription equity rollover

Subscription car services offer a unique advantage through subscription equity rollover, allowing customers to apply the invested value from previous subscription payments toward future vehicle access, reducing the total cost compared to traditional auto loans. Unlike auto loans that require fixed monthly payments with interest and long-term commitment, subscription models provide flexible access without depreciation risk, preserving financial liquidity while maintaining access to newer or different vehicle models.

Down payment bypass

Auto loans typically require a substantial down payment, impacting upfront cash flow, whereas subscription car services bypass this requirement by offering monthly fees that include vehicle use, maintenance, and insurance. This model reduces initial financial burden and improves budget predictability, appealing to consumers seeking flexibility without large upfront debt.

Usage-based depreciation

Auto loans typically factor in usage-based depreciation, with monthly payments reflecting the vehicle's declining value influenced by mileage and wear. Subscription car services often incorporate usage-based depreciation indirectly through flexible pricing models that adjust based on driving habits and mileage limits.

All-inclusive vehicle subscription

All-inclusive vehicle subscriptions offer a streamlined alternative to traditional auto loans by bundling insurance, maintenance, and depreciation costs into a single monthly fee, eliminating upfront down payments and long-term financial commitments. This flexible model reduces debt accumulation and enhances budget predictability compared to the fixed repayment structure and fluctuating interest rates of standard auto financing.

Flexible ownership model

Auto loans offer traditional vehicle ownership with fixed payment schedules and eventual asset acquisition, while subscription car services provide flexible ownership models that include maintenance, insurance, and the ability to switch vehicles without long-term commitments. This flexibility appeals to consumers seeking lower upfront costs and adaptable transportation solutions amid changing financial circumstances.

Contract balloon payment

Auto loans typically require a contract balloon payment at the end of the term, which can lead to a substantial lump-sum debt obligation, whereas subscription car services eliminate such large end-of-contract payments by offering fixed monthly fees with vehicle maintenance included. Managing debt is often more predictable with subscription models since they avoid the financial risk associated with balloon payments on auto loans.

Auto loan vs Subscription car service for vehicle acquisition. Infographic

moneydiff.com

moneydiff.com