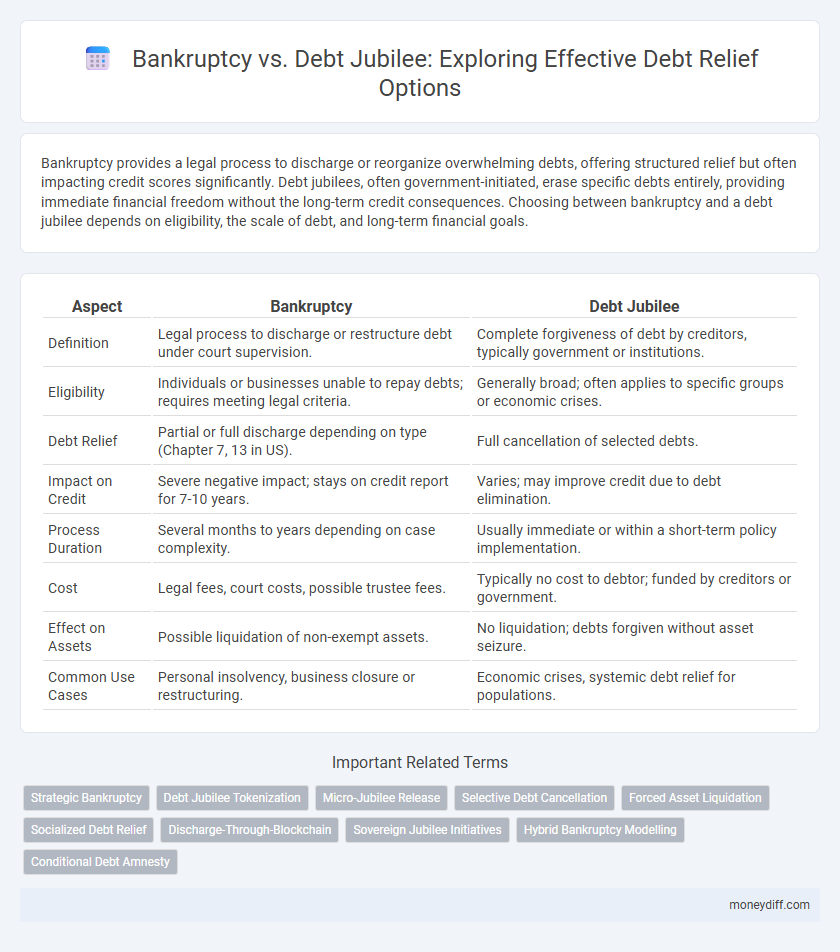

Bankruptcy provides a legal process to discharge or reorganize overwhelming debts, offering structured relief but often impacting credit scores significantly. Debt jubilees, often government-initiated, erase specific debts entirely, providing immediate financial freedom without the long-term credit consequences. Choosing between bankruptcy and a debt jubilee depends on eligibility, the scale of debt, and long-term financial goals.

Table of Comparison

| Aspect | Bankruptcy | Debt Jubilee |

|---|---|---|

| Definition | Legal process to discharge or restructure debt under court supervision. | Complete forgiveness of debt by creditors, typically government or institutions. |

| Eligibility | Individuals or businesses unable to repay debts; requires meeting legal criteria. | Generally broad; often applies to specific groups or economic crises. |

| Debt Relief | Partial or full discharge depending on type (Chapter 7, 13 in US). | Full cancellation of selected debts. |

| Impact on Credit | Severe negative impact; stays on credit report for 7-10 years. | Varies; may improve credit due to debt elimination. |

| Process Duration | Several months to years depending on case complexity. | Usually immediate or within a short-term policy implementation. |

| Cost | Legal fees, court costs, possible trustee fees. | Typically no cost to debtor; funded by creditors or government. |

| Effect on Assets | Possible liquidation of non-exempt assets. | No liquidation; debts forgiven without asset seizure. |

| Common Use Cases | Personal insolvency, business closure or restructuring. | Economic crises, systemic debt relief for populations. |

Understanding Bankruptcy: A Traditional Debt Relief Option

Bankruptcy offers a legal framework for individuals or businesses to eliminate or restructure overwhelming debt under court supervision, providing a fresh financial start. It involves detailed asset evaluation, debt categorization, and adherence to specific eligibility criteria, often resulting in either liquidation or repayment plans. While it severely impacts credit scores and remains on records for years, bankruptcy can relieve unmanageable debt burdens that other relief options cannot address.

What Is a Debt Jubilee? Historical and Modern Perspectives

A debt jubilee is a historical financial practice where creditors forgive debts to restore economic balance, dating back to ancient Mesopotamian and biblical times. In modern contexts, a debt jubilee involves mass debt cancellation or relief initiatives aimed at alleviating widespread financial distress without the personal credit consequences associated with bankruptcy. This approach contrasts with bankruptcy, which legally restructures or eliminates debts for individuals or businesses but may result in long-term credit damage and asset forfeiture.

Key Differences Between Bankruptcy and Debt Jubilee

Bankruptcy legally restructures or eliminates debt through court proceedings, impacting credit scores and financial records for years, while a debt jubilee involves the cancellation or forgiveness of debt on a large scale, often initiated by governments or institutions without adverse credit effects. Bankruptcy typically requires strict qualification criteria and leads to asset liquidation or repayment plans, whereas a debt jubilee is a broad relief measure aimed at resetting economic conditions and providing immediate financial freedom. Understanding these key differences helps debtors evaluate long-term consequences, eligibility, and overall financial recovery options.

Eligibility Criteria: Bankruptcy vs Debt Jubilee

Bankruptcy eligibility typically requires proof of insolvency and inability to meet debt obligations, often determined by specific income and debt thresholds, while a debt jubilee involves a broader, sometimes government-initiated cancellation of debts without strict individual criteria. Bankruptcy processes demand formal legal filings and adherence to court procedures, whereas debt jubilees may apply universally or target certain debt categories like student loans or credit card debt. Understanding eligibility criteria helps debtors choose between structured repayment plans through bankruptcy or outright debt forgiveness during a debt jubilee.

Legal Processes Involved in Bankruptcy and Debt Jubilee

Bankruptcy involves a formal legal process where debtors file petitions in court to obtain relief from creditors, often resulting in asset liquidation or debt reorganization under judicial supervision. Debt jubilees are typically informal or government-sanctioned debt cancellations that erase obligations without court intervention, aiming to provide widespread financial relief quickly. Legal proceedings in bankruptcy require adherence to federal laws such as the U.S. Bankruptcy Code, while debt jubilees depend on policy decisions and may lack a standardized legal framework.

Impact on Credit Score: Bankruptcy vs Debt Jubilee

Bankruptcy severely damages credit scores, often remaining on credit reports for up to 10 years, significantly hindering future borrowing capabilities. Debt jubilees, by contrast, may not always impact credit scores directly if managed through negotiated settlements or government programs, offering a less damaging alternative for debt relief. Understanding these differences is crucial for individuals prioritizing long-term credit health while seeking financial recovery.

Pros and Cons of Filing for Bankruptcy

Filing for bankruptcy offers a structured legal process to discharge or reorganize debts, providing relief from creditor harassment and a fresh financial start, but it remains on credit reports for up to 10 years, significantly impacting creditworthiness. Bankruptcy can eliminate unsecured debts like credit card balances and medical bills yet often requires surrendering non-exempt assets, posing a risk of property loss. While it halts collection actions immediately, the complexity and costs of bankruptcy proceedings and potential social stigma are notable disadvantages compared to debt jubilee options.

Benefits and Drawbacks of a Debt Jubilee

A debt jubilee offers widespread financial relief by erasing large amounts of debt, reducing economic inequality and preventing prolonged financial distress for borrowers. However, it may incentivize reckless borrowing, undermine credit markets, and create inflationary pressures by increasing disposable income without corresponding economic growth. While debt jubilees alleviate immediate financial burdens, they pose risks to long-term fiscal stability and creditworthiness.

Long-Term Financial Consequences: Bankruptcy vs Debt Jubilee

Bankruptcy results in a significant long-term impact on credit scores, remaining on credit reports for up to 10 years and limiting access to loans and credit at favorable terms. In contrast, a debt jubilee, which involves the forgiveness of debt by creditors or governing bodies, eradicates financial obligations entirely without directly harming credit history, fostering quicker economic recovery. While bankruptcy restructures or eliminates debts under legal supervision, a debt jubilee can offer broader relief but is often rare and contingent on policy decisions.

Choosing the Right Debt Relief Option for Your Situation

Bankruptcy offers a structured legal process to discharge or reorganize significant debt but can severely impact credit scores and asset ownership. Debt jubilee, often government-initiated, completely forgives specific debts without legal proceedings, providing relief without the long-term credit damage associated with bankruptcy. Selecting the appropriate option depends on factors such as debt amount, financial stability, long-term credit goals, and eligibility criteria for relief programs.

Related Important Terms

Strategic Bankruptcy

Strategic bankruptcy offers a structured legal framework allowing individuals or businesses to discharge or reorganize debts while protecting key assets and credit future opportunities. Unlike a debt jubilee, which is an unconditional debt forgiveness often initiated by governments or institutions, strategic bankruptcy requires careful planning to maximize debt relief and minimize financial damage.

Debt Jubilee Tokenization

Debt jubilee tokenization leverages blockchain technology to digitize and fractionalize debt forgiveness, enabling transparent debt relief distribution and investor participation. Unlike traditional bankruptcy, which involves court-mandated debt discharge, tokenized debt jubilees create tradeable assets that can unlock liquidity and democratize debt cancellation processes.

Micro-Jubilee Release

Micro-jubilee release provides targeted debt relief by partially canceling small-scale debts to alleviate financial strain without the long-term credit damage associated with bankruptcy. Unlike bankruptcy, which involves legal proceedings and asset liquidation, micro-jubilee offers a community-focused approach enabling selective forgiveness for manageable debt burdens.

Selective Debt Cancellation

Selective debt cancellation targets specific debts for relief, allowing debtors to eliminate burdensome obligations without erasing their entire financial history like bankruptcy does. This option preserves creditworthiness while offering tailored financial recovery, making it a strategic alternative to comprehensive debt discharge.

Forced Asset Liquidation

Bankruptcy often results in forced asset liquidation, where debtor's properties are sold to repay creditors, significantly impacting personal or business holdings. In contrast, a debt jubilee cancels debt without compulsory asset sales, offering relief without asset forfeiture but is rarely implemented on a broad scale.

Socialized Debt Relief

Socialized debt relief offers a community-driven alternative to bankruptcy by redistributing financial burdens through collective mechanisms, reducing individual liability and promoting economic stability. Unlike bankruptcy's legal liquidation process, a debt jubilee resets debts on a large scale, enabling widespread recovery and mitigating systemic financial stress.

Discharge-Through-Blockchain

Bankruptcy offers a legal discharge of debts through court-approved processes, while a Debt Jubilee utilizes blockchain technology to enable transparent, automated debt forgiveness by recording and validating discharges on an immutable ledger. This blockchain-based discharge system increases efficiency, reduces fraud, and enhances creditor-debtor trust in debt relief programs.

Sovereign Jubilee Initiatives

Sovereign bankruptcy involves a formal legal process allowing a nation to restructure or discharge its debt under court supervision, often leading to partial debt forgiveness. Sovereign Jubilee Initiatives propose large-scale debt jubilees that cancel entire or significant portions of national debt to promote economic recovery and social equity without the constraints of structured bankruptcy proceedings.

Hybrid Bankruptcy Modelling

Hybrid bankruptcy modeling combines elements of traditional bankruptcy and debt jubilee by allowing partial debt forgiveness alongside structured repayment plans, optimizing relief for debtors while ensuring creditor participation. This approach leverages algorithmic assessments to balance financial recovery and economic stability, offering a nuanced alternative to full debt discharge or complete debt cancellation.

Conditional Debt Amnesty

Conditional debt amnesty offers targeted relief by forgiving specific debts under predefined criteria, providing an alternative to bankruptcy's court-administered process that often involves asset liquidation. This strategic approach can help individuals or businesses avoid the long-term credit damage associated with bankruptcy while receiving essential financial reprieve.

Bankruptcy vs Debt jubilee for relief options. Infographic

moneydiff.com

moneydiff.com