Personal loan debt typically involves borrowing from traditional financial institutions with fixed interest rates and structured repayment terms, offering predictability and regulatory protections. Peer-to-peer lending debt connects borrowers directly with individual investors, often providing faster access to funds and potentially lower rates but with varying terms and less regulatory oversight. Choosing between these options depends on factors like credit score, urgency, and willingness to navigate different risk levels and lender requirements.

Table of Comparison

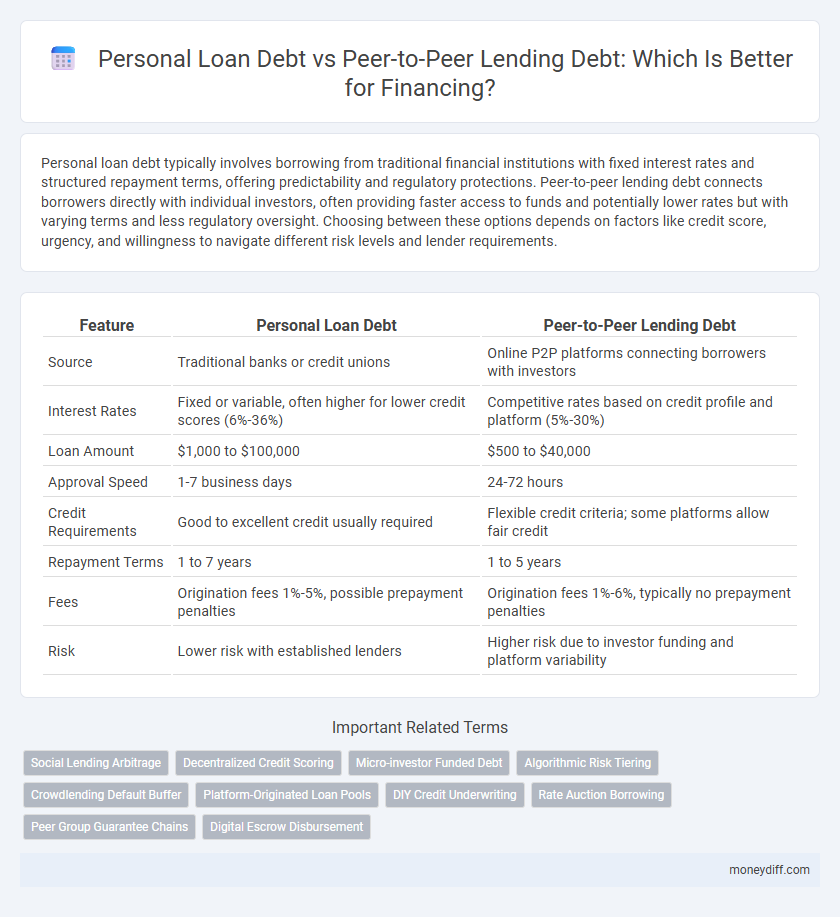

| Feature | Personal Loan Debt | Peer-to-Peer Lending Debt |

|---|---|---|

| Source | Traditional banks or credit unions | Online P2P platforms connecting borrowers with investors |

| Interest Rates | Fixed or variable, often higher for lower credit scores (6%-36%) | Competitive rates based on credit profile and platform (5%-30%) |

| Loan Amount | $1,000 to $100,000 | $500 to $40,000 |

| Approval Speed | 1-7 business days | 24-72 hours |

| Credit Requirements | Good to excellent credit usually required | Flexible credit criteria; some platforms allow fair credit |

| Repayment Terms | 1 to 7 years | 1 to 5 years |

| Fees | Origination fees 1%-5%, possible prepayment penalties | Origination fees 1%-6%, typically no prepayment penalties |

| Risk | Lower risk with established lenders | Higher risk due to investor funding and platform variability |

Understanding Personal Loan Debt: Key Features

Personal loan debt typically involves borrowing a fixed sum from traditional financial institutions with fixed interest rates and predetermined repayment schedules, offering predictable monthly installments. Peer-to-peer lending debt is sourced from individual investors through online platforms, often featuring more flexible terms but varying interest rates based on borrower creditworthiness. Understanding these key features helps individuals evaluate risk, repayment capacity, and cost effectiveness between conventional personal loans and peer-to-peer lending options.

Peer-to-Peer Lending Debt Explained

Peer-to-peer lending debt involves borrowing money directly from individual investors through online platforms, bypassing traditional financial institutions, which often leads to competitive interest rates and flexible repayment terms. This financing method differs from personal loan debt typically offered by banks or credit unions, as it relies on a decentralized network of lenders rather than a centralized entity. Peer-to-peer lending platforms use risk assessment algorithms to match borrowers with suitable investors, offering an alternative solution for individuals seeking funds with potentially lower credit requirements.

Interest Rate Comparison: Personal Loans vs Peer-to-Peer Lending

Personal loan debt typically features fixed interest rates ranging from 6% to 36%, influenced by credit score and lender policies, while peer-to-peer lending debt offers variable interest rates averaging between 5% and 24%, often determined by borrower risk profiles and platform algorithms. Peer-to-peer lending may provide lower rates for high-credit borrowers but can carry higher costs for those with lower credit scores compared to traditional personal loans. Evaluating average APRs and additional fees is crucial when comparing overall financing costs between personal loans and peer-to-peer lending options.

Loan Approval Process: Traditional Banks vs P2P Platforms

Traditional banks require extensive documentation, credit checks, and longer processing times for personal loan debt approval, often leading to stringent eligibility criteria. Peer-to-peer (P2P) lending platforms utilize technology-driven algorithms to assess risk, enabling faster loan approval with more flexible credit requirements. This streamlined process on P2P platforms offers borrowers quicker access to financing compared to traditional bank procedures.

Eligibility Criteria: Who Qualifies for Each Option?

Personal loan debt typically requires a strong credit score, stable income, and proof of employment, making it more accessible to borrowers with established financial histories. Peer-to-peer lending debt often has more flexible eligibility criteria, accommodating borrowers with moderate credit scores or alternative income sources by relying on individual investors' risk assessments. Both options demand thorough evaluation of creditworthiness, but peer-to-peer platforms may offer opportunities for those who face challenges qualifying for traditional personal loans.

Impact on Credit Score: Personal Loans vs P2P Lending

Personal loan debt typically impacts credit scores by reflecting a fixed payment schedule and consistent repayment history, which can improve credit over time if managed responsibly. Peer-to-peer lending debt also affects credit scores, but the reporting practices vary by platform, potentially causing irregular credit updates and differing impacts on credit utilization ratios. Understanding these distinctions helps borrowers choose the financing option that aligns best with their credit management goals.

Repayment Terms and Flexibility

Personal loan debt typically features fixed repayment terms with consistent monthly payments over a set period, offering predictability but limited flexibility. Peer-to-peer lending debt often provides more customizable repayment schedules, allowing borrowers to negotiate terms directly with individual lenders, which can accommodate changes in financial circumstances. Flexibility in peer-to-peer lending may include variable interest rates or early repayment options without penalties, contrasting with the rigid structures of traditional personal loans.

Fees and Hidden Costs: What to Watch Out For

Personal loan debt often involves upfront fees, origination charges, and potential prepayment penalties that can significantly increase the overall cost of borrowing. Peer-to-peer lending debt may have less transparent fee structures, including platform fees and service charges that borrowers should carefully review to avoid unexpected expenses. Monitoring the fine print and understanding all associated costs helps borrowers choose the most cost-effective financing option.

Risk Factors for Borrowers

Personal loan debt typically involves fixed interest rates and repayment schedules, offering more predictable monthly payments but often higher credit requirements and stricter approval processes. Peer-to-peer lending debt may present more flexible terms and potentially lower rates, yet borrowers face increased risk due to less regulatory protection and variability in lender reliability. Understanding the risk factors such as default rates, platform credibility, and borrower creditworthiness is crucial when choosing between these financing options.

Choosing the Right Debt Option for Your Financial Goals

Personal loan debt typically involves fixed interest rates and scheduled repayments, making it suitable for borrowers seeking stability and predictability in their financing. Peer-to-peer lending debt often offers competitive rates and flexible terms by connecting borrowers directly with individual investors, appealing to those looking for customized loan options. Assessing factors like interest rates, repayment flexibility, and credit requirements is essential to align the debt option with your specific financial goals and risk tolerance.

Related Important Terms

Social Lending Arbitrage

Personal loan debt typically involves borrowing from traditional financial institutions at fixed or variable interest rates, often higher than rates available through peer-to-peer (P2P) lending platforms that connect borrowers directly with investors, enabling social lending arbitrage. This arbitrage leverages lower P2P lending rates against higher conventional personal loan rates, optimizing financing costs and expanding access to credit through decentralized social lending networks.

Decentralized Credit Scoring

Personal loan debt typically relies on traditional centralized credit scoring models, which can limit access for borrowers with non-traditional financial histories, while peer-to-peer lending debt benefits from decentralized credit scoring systems that utilize blockchain technology and alternative data sources to provide more inclusive and transparent risk assessments. Decentralized credit scoring enhances borrower eligibility verification and reduces default risk by leveraging real-time, distributed data networks, transforming access to affordable financing options.

Micro-investor Funded Debt

Personal loan debt typically involves borrowing from traditional financial institutions with fixed interest rates and standardized repayment terms, whereas peer-to-peer lending debt, especially micro-investor funded debt, allows individual investors to fund loans directly through online platforms, often resulting in more flexible terms and potentially lower interest rates. Micro-investor funded debt in peer-to-peer lending democratizes the lending process by enabling smaller investors to diversify risk across multiple borrowers while providing borrowers with alternative financing options outside conventional banking systems.

Algorithmic Risk Tiering

Algorithmic risk tiering in personal loan debt leverages borrower credit data and behavioral analytics to assign interest rates, optimizing lender returns while minimizing defaults. Peer-to-peer lending debt utilizes similar algorithms but integrates social network data and platform-specific risk models, offering personalized rates and potentially lower borrowing costs through diversified investor pools.

Crowdlending Default Buffer

Personal loan debt typically involves fixed interest rates and structured repayment terms, whereas peer-to-peer lending debt operates with variable risk profiles influenced by individual borrower creditworthiness. The Crowdlending Default Buffer acts as a financial safeguard in peer-to-peer platforms, mitigating default risks by allocating reserve funds to protect investors from potential loan losses.

Platform-Originated Loan Pools

Platform-originated loan pools in peer-to-peer lending aggregate multiple individual loans, spreading risk and potentially lowering interest rates compared to traditional personal loan debt from banks or credit unions. This decentralized financing model leverages technology to connect borrowers directly with investors, offering more flexible terms and faster approval processes while maintaining transparency in loan repayment performance.

DIY Credit Underwriting

Personal loan debt typically involves traditional banks assessing creditworthiness using standardized criteria, resulting in fixed interest rates and loan terms. Peer-to-peer lending debt leverages DIY credit underwriting through online platforms, enabling individual investors to evaluate borrower profiles with advanced data analytics and flexible risk assessment models.

Rate Auction Borrowing

Personal loan debt typically involves fixed interest rates set by traditional financial institutions, whereas peer-to-peer lending debt utilizes rate auction borrowing, allowing borrowers to obtain more competitive rates through bids from individual lenders. Rate auction borrowing in peer-to-peer platforms often results in lower borrowing costs and increased transparency compared to conventional loan agreements.

Peer Group Guarantee Chains

Peer-to-peer lending debt with peer group guarantee chains offers a collaborative risk-sharing mechanism that reduces default rates compared to traditional personal loan debt, providing borrowers with lower interest rates and flexible terms. This decentralized financial model leverages social trust within groups to improve credit access and repayment accountability, making it a viable alternative for financing personal needs.

Digital Escrow Disbursement

Personal loan debt typically involves traditional financial institutions managing disbursements through centralized systems, whereas peer-to-peer lending debt leverages digital escrow disbursement platforms to ensure transparent, secure fund transfers directly between borrowers and individual lenders. Digital escrow disbursement enhances trust and reduces default risk by holding funds until contractual conditions are met, optimizing the financing process in peer-to-peer lending compared to conventional personal loans.

Personal loan debt vs Peer-to-peer lending debt for financing Infographic

moneydiff.com

moneydiff.com