Good debt strategically boosts long-term financial growth by funding investments like education or real estate that appreciate over time. Bad debt traps individuals in high-interest liabilities for depreciating assets, leading to financial strain and limited cash flow. Differentiating between these debt types is crucial for effective debt management and building sustainable wealth.

Table of Comparison

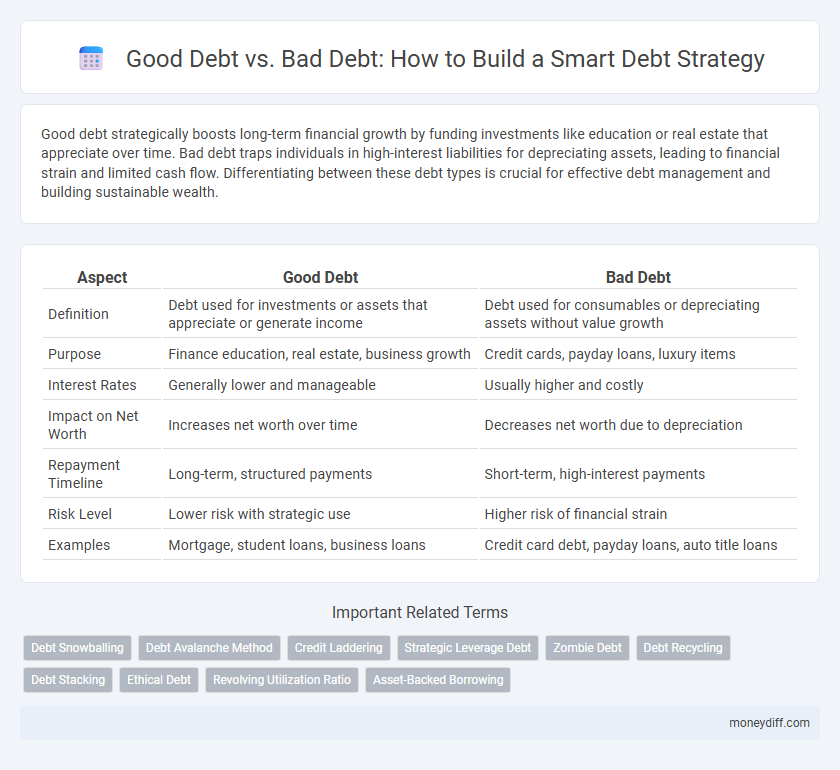

| Aspect | Good Debt | Bad Debt |

|---|---|---|

| Definition | Debt used for investments or assets that appreciate or generate income | Debt used for consumables or depreciating assets without value growth |

| Purpose | Finance education, real estate, business growth | Credit cards, payday loans, luxury items |

| Interest Rates | Generally lower and manageable | Usually higher and costly |

| Impact on Net Worth | Increases net worth over time | Decreases net worth due to depreciation |

| Repayment Timeline | Long-term, structured payments | Short-term, high-interest payments |

| Risk Level | Lower risk with strategic use | Higher risk of financial strain |

| Examples | Mortgage, student loans, business loans | Credit card debt, payday loans, auto title loans |

Understanding Good Debt vs Bad Debt

Understanding good debt versus bad debt is crucial for an effective debt strategy, as good debt typically refers to borrowing that leads to asset growth or income generation, such as student loans or mortgages. In contrast, bad debt usually involves borrowing for depreciating assets or consumables, like high-interest credit card balances and payday loans. Identifying and managing these differences helps optimize financial health and build long-term wealth.

Key Characteristics of Good Debt

Good debt typically involves borrowing funds to invest in assets that generate long-term value, such as education, real estate, or business expansion, which can increase future income or equity. This type of debt usually carries lower interest rates and favorable repayment terms, making it more manageable and cost-effective. Key characteristics include potential for appreciation, tax benefits, and the ability to improve credit scores when managed responsibly.

Warning Signs of Bad Debt

High-interest rates and an inability to meet monthly payments are key warning signs of bad debt, which can quickly spiral out of control and damage credit scores. Debt used for depreciating assets or non-essential purchases often lacks long-term value and should be avoided to maintain financial health. Recognizing these red flags early helps in adopting a debt strategy focused on manageable, good debt like mortgages or education loans that contribute to future growth.

How Good Debt Can Build Wealth

Good debt, such as mortgages or student loans, leverages borrowed capital to acquire assets that typically appreciate or generate income, fostering long-term wealth accumulation. Using good debt strategically allows individuals to invest in education, real estate, or business opportunities, creating financial growth and improving net worth over time. In contrast, managing good debt with low interest rates and disciplined repayment plans maximizes returns while minimizing financial risks.

Risks Associated with Bad Debt

Bad debt carries significant risks including damaging credit scores, increasing financial stress, and potential legal consequences from creditors. Unlike good debt, which typically funds investments with potential returns, bad debt often arises from high-interest consumer loans or credit card balances with depreciating assets. Managing these risks requires vigilant budgeting and prioritizing repayment to avoid long-term financial instability.

Strategies to Prioritize Debt Repayment

Prioritize repayment of high-interest bad debt such as credit cards and payday loans to reduce overall financial burden and improve credit scores. Focus on maintaining good debt, like mortgages or student loans, which often have lower interest rates and can build long-term value. Implement a strategic repayment plan by using methods like the avalanche approach to target debts with the highest interest first, optimizing financial outcomes.

Smart Ways to Leverage Good Debt

Smart ways to leverage good debt include using low-interest loans to invest in appreciating assets such as real estate or education, which can increase future earning potential. Utilizing business loans to expand operations or improve cash flow helps generate higher returns than the debt cost. Strategic use of good debt improves credit scores and financial stability by demonstrating responsible borrowing and timely repayment.

How to Avoid Falling into Bad Debt Traps

Carefully managing credit limits and making timely payments are essential strategies to avoid falling into bad debt traps. Prioritizing low-interest loans for investments that generate long-term value reduces financial strain and improves credit health. Monitoring spending patterns and maintaining an emergency fund provide safeguards against unexpected expenses that often lead to high-interest, detrimental debt.

Real-Life Examples of Good and Bad Debt

Investing in real estate often exemplifies good debt by building equity and generating rental income, while high-interest credit card debt on non-essential purchases typically represents bad debt due to minimal long-term value. For instance, a mortgage that increases net worth contrasts sharply with payday loans that lead to spiraling repayment difficulties. Strategic debt management involves leveraging low-interest loans for asset acquisition while avoiding consumer debt that hampers financial stability.

Tips for Balancing and Managing Both Debt Types

Effective debt strategy involves distinguishing good debt, such as mortgages or student loans that can build wealth, from bad debt, like high-interest credit cards that drain finances. Prioritize paying off bad debt quickly to reduce interest costs while maintaining manageable payments on good debt to leverage future financial benefits. Regularly monitor debt-to-income ratios and create a budget that allocates funds for both debt servicing and savings to maintain a healthy financial balance.

Related Important Terms

Debt Snowballing

Debt snowballing prioritizes paying off smaller debts first, creating momentum and motivation, which is effective for managing good debt like low-interest student loans and bad debt such as high-interest credit card balances. This strategy accelerates overall debt reduction by focusing on balance elimination rather than interest rates, optimizing cash flow and psychological incentives.

Debt Avalanche Method

The Debt Avalanche Method prioritizes paying off high-interest debt first, maximizing interest savings and accelerating overall debt reduction. This strategy capitalizes on good debt by minimizing costly bad debt, enhancing financial health and long-term creditworthiness.

Credit Laddering

Good debt, such as low-interest student loans or mortgages, can build credit and increase net worth when strategically managed through credit laddering, which involves gradually increasing credit limits to improve credit scores and access better loan terms. In contrast, bad debt accumulates from high-interest credit cards or payday loans that hinder financial growth and should be minimized to maintain a healthy debt strategy.

Strategic Leverage Debt

Strategic leverage debt involves using good debt to finance investments that generate higher returns than the cost of borrowing, enhancing long-term wealth and business growth. Unlike bad debt, which funds depreciating assets or consumption, good debt leverages capital efficiently to maximize cash flow and improve creditworthiness in a robust debt strategy.

Zombie Debt

Zombie debt refers to old, forgotten, or discharged debts that reappear on credit reports or in collections, complicating debt management strategies. Differentiating good debt--investments in appreciating assets or essential credit for growth--from bad debt, often high-interest and non-productive, is crucial to avoid the pitfalls of zombie debt and maintain financial health.

Debt Recycling

Good debt, such as mortgage loans or business investment debt, can be leveraged to build wealth through debt recycling by converting non-deductible debt into tax-deductible investment debt, enhancing overall financial growth. Bad debt, including high-interest consumer loans or credit card debt, undermines debt strategy by increasing financial risk and limiting the effectiveness of debt recycling in optimizing tax benefits and asset accumulation.

Debt Stacking

Good debt, such as low-interest mortgages or student loans, can build wealth over time, while bad debt, like high-interest credit card balances, erodes financial stability. Debt stacking strategies prioritize paying off high-interest bad debt first to minimize overall interest costs and accelerate debt freedom.

Ethical Debt

Ethical debt prioritizes investments that generate long-term value and societal benefits, distinguishing good debt used for education, affordable housing, or sustainable businesses from bad debt driven by high-interest consumption or predatory lending. Strategic management of ethical debt enhances creditworthiness and financial stability while fostering responsible borrowing aligned with personal values and community well-being.

Revolving Utilization Ratio

Maintaining a low revolving utilization ratio below 30% optimizes good debt by improving credit scores and reducing interest costs, while high revolving utilization signals bad debt that can lead to financial strain and increased borrowing expenses. Strategic management of revolving credit balances supports healthier debt profiles and enhances overall financial stability.

Asset-Backed Borrowing

Asset-backed borrowing leverages collateral such as real estate or equipment, often classified as good debt due to its potential to generate income or appreciate in value. In contrast, unsecured personal loans or high-interest credit card debt typically represent bad debt, as they do not contribute to asset growth and can hinder financial stability.

Good debt vs Bad debt for debt strategy Infographic

moneydiff.com

moneydiff.com