Debt consolidation apps simplify repayment by combining multiple debts into a single loan with a lower interest rate, reducing monthly payments and overall interest costs. Debt snowball apps focus on psychological motivation by prioritizing paying off smaller debts first, building momentum and encouraging consistent progress. Choosing between the two depends on whether the goal is to save money on interest or boost motivation through quick wins.

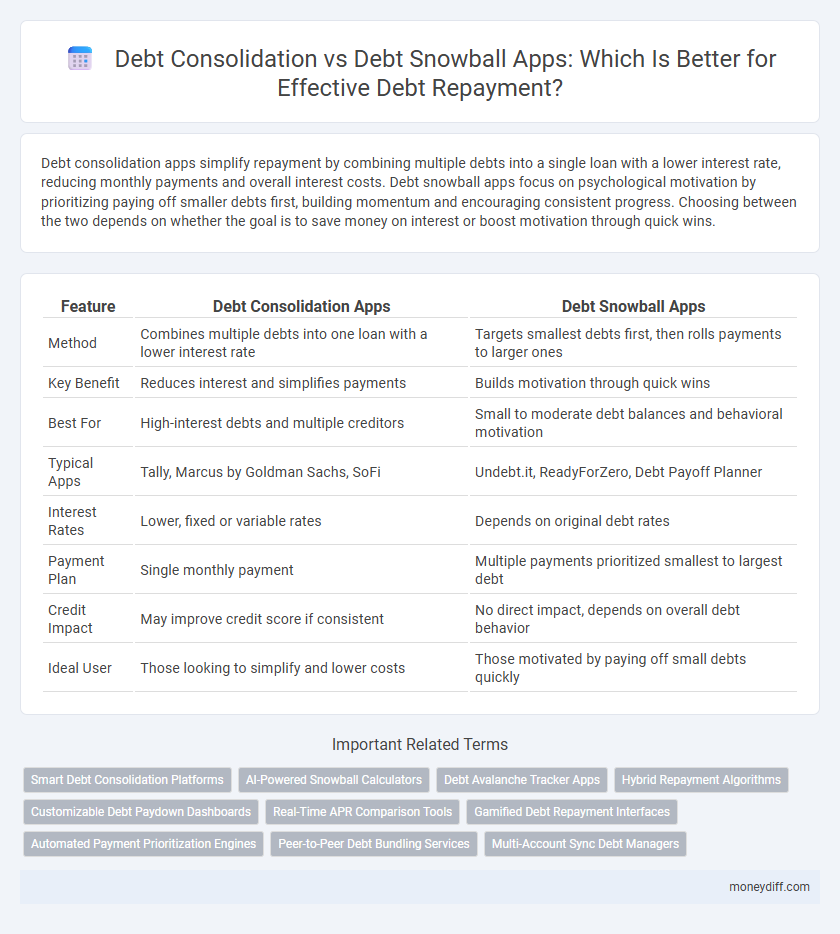

Table of Comparison

| Feature | Debt Consolidation Apps | Debt Snowball Apps |

|---|---|---|

| Method | Combines multiple debts into one loan with a lower interest rate | Targets smallest debts first, then rolls payments to larger ones |

| Key Benefit | Reduces interest and simplifies payments | Builds motivation through quick wins |

| Best For | High-interest debts and multiple creditors | Small to moderate debt balances and behavioral motivation |

| Typical Apps | Tally, Marcus by Goldman Sachs, SoFi | Undebt.it, ReadyForZero, Debt Payoff Planner |

| Interest Rates | Lower, fixed or variable rates | Depends on original debt rates |

| Payment Plan | Single monthly payment | Multiple payments prioritized smallest to largest debt |

| Credit Impact | May improve credit score if consistent | No direct impact, depends on overall debt behavior |

| Ideal User | Those looking to simplify and lower costs | Those motivated by paying off small debts quickly |

Debt Consolidation vs Debt Snowball: Key Differences

Debt consolidation apps streamline multiple debts into a single loan with a fixed interest rate, potentially lowering monthly payments and simplifying management. Debt snowball apps prioritize paying off smaller balances first, leveraging psychological motivation despite possibly higher overall interest costs. Choosing between these methods depends on individual financial goals, interest rates, and repayment discipline.

How Debt Consolidation Apps Work

Debt consolidation apps streamline debt repayment by combining multiple debts into a single loan with a lower interest rate, simplifying monthly payments and reducing overall interest costs. These apps often provide personalized loan options, automate payments, and track progress to enhance financial discipline. Users benefit from improved credit scores and faster debt payoff compared to traditional methods.

Understanding the Debt Snowball Method

The Debt Snowball Method focuses on paying off the smallest debts first to build momentum and motivation for tackling larger balances, making it a popular behavioral finance strategy. Debt snowball apps assist users by organizing debts from smallest to largest, automating payments, and tracking progress to ensure consistent repayment. These apps contrast with debt consolidation tools, which focus on merging multiple debts into a single loan with a lower interest rate to reduce overall financial burden.

Best Debt Consolidation Apps in 2024

Best debt consolidation apps in 2024 streamline debt repayment by merging multiple debts into a single lower-interest loan, reducing monthly payments and interest accumulation efficiently. Popular apps like Tally, Marcus by Goldman Sachs, and Payoff provide tailored consolidation solutions with user-friendly interfaces and financial planning tools. These platforms offer advantages over debt snowball apps by prioritizing interest savings and accelerating overall debt reduction, which can lead to faster financial freedom.

Leading Debt Snowball Apps for Fast Repayment

Leading debt snowball apps like Debt Payoff Planner, Tally, and Undebt.it prioritize paying off smaller debts first to build momentum and motivation. These apps provide clear visual progress tracking, customizable repayment plans, and reminders to help users stay consistent. By focusing on quick wins, debt snowball apps accelerate psychological reinforcement, encouraging faster overall debt repayment compared to traditional consolidation methods.

Pros and Cons of Debt Consolidation Apps

Debt consolidation apps streamline multiple debts into a single monthly payment, often with lower interest rates, simplifying repayment and potentially reducing total interest costs. These apps provide automated payment schedules and better interest management but may require good credit scores and sometimes charge fees. Users risk extending repayment periods, which can increase overall costs despite initial savings.

Advantages and Drawbacks of Debt Snowball Apps

Debt snowball apps offer the advantage of psychological motivation by focusing on paying off smaller debts first, which can boost user confidence and encourage consistent repayments. However, their drawback lies in potentially higher overall interest costs since larger debts with higher rates are paid off later, extending the total repayment period. Users should consider individual debt structures and interest rates to determine if the intuitive appeal of debt snowball apps aligns with their financial goals.

Debt Consolidation vs Debt Snowball: Which Saves More?

Debt consolidation apps streamline multiple debts into a single loan with a lower interest rate, often reducing total repayment time and saving more on interest compared to debt snowball methods. Debt snowball apps prioritize paying off the smallest balances first, boosting motivation, but may incur higher long-term costs due to accruing interest on larger debts. For borrowers seeking maximum savings, debt consolidation apps typically offer a more cost-effective strategy by minimizing interest and simplifying payments.

Choosing the Right App for Your Debt Repayment Strategy

Choosing the right app for debt repayment depends on your financial goals and habits, with debt consolidation apps simplifying multiple debts into a single loan with lower interest rates, promoting faster repayment. Debt snowball apps focus on paying off smaller balances first to build momentum and motivation, making them ideal for those who benefit from visual progress tracking and quick wins. Evaluate features like interest rate management, payment reminders, and user interface to find an app that aligns with your repayment strategy for maximum effectiveness.

Tips for Successful Debt Repayment with Financial Apps

Maximize debt repayment success by using apps that combine the debt snowball method's motivation boost with debt consolidation's interest reduction benefits. Prioritize apps offering real-time tracking, customizable payment plans, and automated payments to maintain consistency and avoid missed deadlines. Leverage features like goal setting, progress visualizations, and educational resources to enhance financial discipline and accelerate debt freedom.

Related Important Terms

Smart Debt Consolidation Platforms

Smart debt consolidation platforms streamline repayment by combining multiple debts into a single loan with lower interest rates, reducing monthly payments and accelerating payoff timelines. Unlike debt snowball apps that prioritize smallest balances first, these platforms leverage algorithms and credit assessments to tailor optimal consolidation strategies, improving financial efficiency and credit health.

AI-Powered Snowball Calculators

AI-powered snowball calculators enhance debt repayment by analyzing multiple debts to create personalized payoff plans that prioritize smaller balances first, accelerating motivation and reducing interest costs. These tools use machine learning algorithms to optimize payment schedules and predict payoff timelines, outperforming traditional consolidation apps by offering tailored strategies for individual financial situations.

Debt Avalanche Tracker Apps

Debt Avalanche Tracker Apps prioritize paying off high-interest debts first, optimizing overall interest savings and accelerating debt freedom compared to Debt Snowball methods that focus on payoff order by balance size. These apps use algorithms to allocate payments strategically, providing users with detailed progress insights and tailored repayment plans that enhance financial efficiency in debt consolidation.

Hybrid Repayment Algorithms

Hybrid repayment algorithms combine the strategic benefits of debt consolidation by lowering interest rates with the motivational momentum of debt snowball methods, optimizing debt repayment efficiency. Utilizing hybrid apps, users experience accelerated payoff timelines and reduced overall interest costs by dynamically targeting debts based on balance size and interest rates.

Customizable Debt Paydown Dashboards

Customizable debt paydown dashboards in debt consolidation apps provide a unified overview of all debts, enabling users to track balances, interest rates, and payment progress with precision. Debt snowball apps emphasize personalized goal-setting and visual progress bars that motivate users by highlighting the elimination of smaller balances first, enhancing user engagement through interactive and incremental milestones.

Real-Time APR Comparison Tools

Real-time APR comparison tools in debt consolidation and debt snowball apps enable users to identify the most cost-effective loan options by instantly evaluating interest rates across multiple lenders, optimizing repayment strategies. These tools enhance financial decision-making by providing dynamic, personalized insights that reduce overall debt burden faster than static methods.

Gamified Debt Repayment Interfaces

Gamified debt repayment interfaces in debt consolidation apps leverage behavioral psychology to increase user engagement by rewarding milestones and progress tracking, making large debt amounts feel more manageable. Debt snowball apps incorporate game-like elements such as point systems and challenges that motivate consistent payments toward smaller debts first, accelerating the payoff process through visible achievements.

Automated Payment Prioritization Engines

Automated payment prioritization engines in debt consolidation and debt snowball apps optimize repayment strategies by dynamically allocating funds based on interest rates or smallest balances, enhancing efficiency and reducing overall debt faster. These engines use algorithms to automate decision-making, minimize human error, and maximize the impact of each payment to improve financial outcomes.

Peer-to-Peer Debt Bundling Services

Peer-to-peer debt bundling services enable borrowers to consolidate multiple debts into a single loan with potentially lower interest rates compared to traditional debt snowball apps, improving repayment efficiency. These platforms leverage social lending networks to offer customized consolidation options that can reduce total interest paid and accelerate debt payoff timelines.

Multi-Account Sync Debt Managers

Multi-account sync debt managers streamline debt consolidation and debt snowball repayment strategies by aggregating balances from multiple credit sources into a single platform, enabling optimized payment prioritization and real-time tracking. These apps enhance user control over debt payoff schedules by automatically syncing accounts and providing analytical tools to visualize interest savings and acceleration of debt freedom.

Debt consolidation vs debt snowball apps for debt repayment. Infographic

moneydiff.com

moneydiff.com