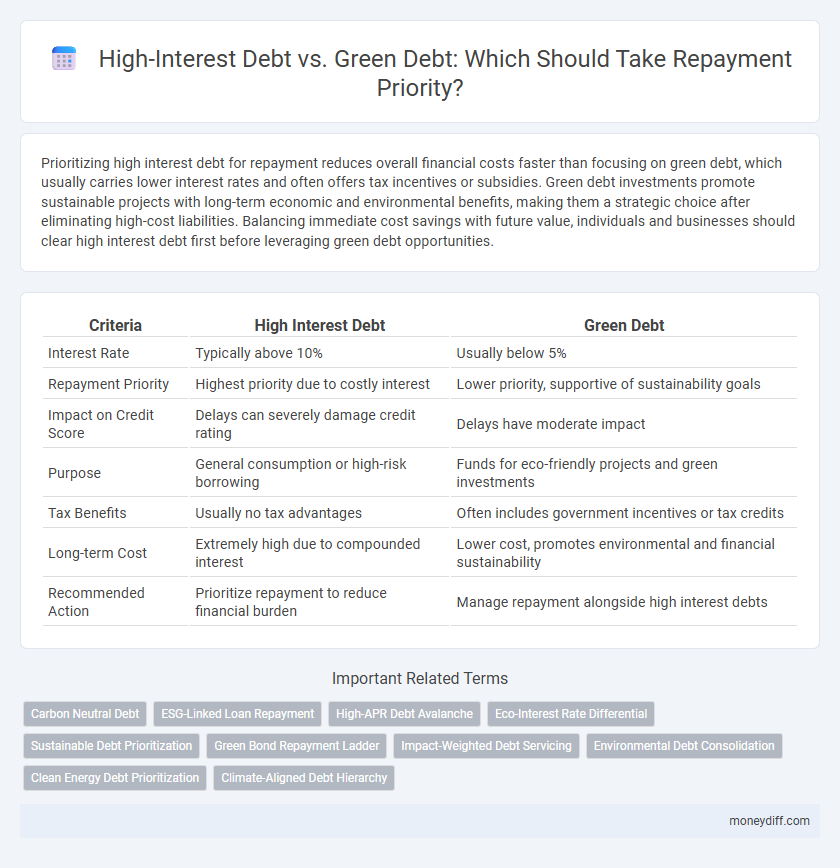

Prioritizing high interest debt for repayment reduces overall financial costs faster than focusing on green debt, which usually carries lower interest rates and often offers tax incentives or subsidies. Green debt investments promote sustainable projects with long-term economic and environmental benefits, making them a strategic choice after eliminating high-cost liabilities. Balancing immediate cost savings with future value, individuals and businesses should clear high interest debt first before leveraging green debt opportunities.

Table of Comparison

| Criteria | High Interest Debt | Green Debt |

|---|---|---|

| Interest Rate | Typically above 10% | Usually below 5% |

| Repayment Priority | Highest priority due to costly interest | Lower priority, supportive of sustainability goals |

| Impact on Credit Score | Delays can severely damage credit rating | Delays have moderate impact |

| Purpose | General consumption or high-risk borrowing | Funds for eco-friendly projects and green investments |

| Tax Benefits | Usually no tax advantages | Often includes government incentives or tax credits |

| Long-term Cost | Extremely high due to compounded interest | Lower cost, promotes environmental and financial sustainability |

| Recommended Action | Prioritize repayment to reduce financial burden | Manage repayment alongside high interest debts |

Understanding High Interest Debt vs Green Debt

High interest debt, such as credit card balances and payday loans, compounds rapidly, increasing the total repayment amount and financial burden over time. Green debt, typically associated with environmentally sustainable projects, often carries lower interest rates and favorable terms aimed at promoting positive social impact. Prioritizing repayment of high interest debt reduces immediate financial strain and prevents escalating costs, while managing green debt strategically supports long-term environmental goals without compromising fiscal responsibility.

Key Differences Between High Interest and Green Debt

High interest debt typically involves loans or credit with elevated interest rates, leading to faster accumulation of repayment costs and prioritization for swift clearance to reduce financial burden. Green debt, often issued to fund environmentally beneficial projects, usually carries lower interest rates and may offer tax incentives or subsidies, influencing repayment strategies toward longer-term investment returns. Distinguishing between immediate cost minimization of high interest debt and the sustainability goals of green debt is crucial for effective debt management and financial planning.

Why High Interest Debt Demands Immediate Attention

High interest debt demands immediate attention due to its rapidly compounding costs that significantly increase the total repayment amount over time. Prioritizing high interest debt repayment reduces financial strain and prevents escalating interest fees that can hinder overall financial stability. Conversely, green debt typically features lower interest rates and longer terms, allowing for more flexible repayment schedules.

The Impact of Interest Rates on Debt Repayment

High interest debt demands accelerated repayment due to escalating costs from compounding interest, significantly increasing the total amount owed over time. In contrast, green debt often features lower interest rates or government-backed incentives, making it less financially burdensome and a strategic choice for sustainable investment. Prioritizing high interest debt repayment reduces long-term financial strain, freeing resources to support environmentally responsible green debt commitments.

Green Debt: Definition, Examples, and Benefits

Green debt refers to bonds or loans specifically earmarked for financing environmentally sustainable projects such as renewable energy, energy efficiency, and pollution reduction initiatives. Examples of green debt include green bonds issued by governments or corporations to fund wind farms, solar installations, and clean transportation infrastructure. Prioritizing repayment of green debt supports sustainability goals while potentially offering lower interest rates and positive environmental impact compared to high interest debt, which often carries financial strain and limited societal benefits.

Evaluating Repayment Strategies: Which Debt Comes First?

High interest debt typically takes priority in repayment strategies due to its rapidly accumulating costs, which can significantly impact overall financial health if left unaddressed. Green debt, often associated with environmentally focused projects and usually offering lower interest rates or tax incentives, can be strategically deprioritized to minimize interest expenses. Evaluating repayment priorities involves balancing the urgency of high interest obligations with the long-term benefits and potential savings of green debt investments.

Financial Risks of Ignoring High Interest Debt

Ignoring high interest debt significantly increases financial risks by allowing debt balances to grow rapidly due to compounding interest, often surpassing the cost and urgency of green debt obligations. High interest debt can deteriorate credit scores, restrict access to future financing, and escalate the total repayment amount, which jeopardizes long-term financial stability. Prioritizing high interest debt repayment mitigates these risks, ensuring more manageable cash flows and preserving creditworthiness while green debt often carries lower rates and potential environmental incentives.

Environmental and Ethical Considerations with Green Debt

High interest debt typically demands immediate repayment due to escalating financial costs, yet green debt prioritizes funding eco-friendly projects that promote sustainability and ethical responsibility. Choosing green debt supports environmental benefits such as reduced carbon emissions and renewable energy development, aligning repayment strategies with long-term ecological impact. Ethical considerations emphasize social accountability and climate action, making green debt a strategic priority despite potentially lower immediate financial pressure compared to high interest debt.

Balancing Financial Health and Sustainability Goals

Prioritizing high interest debt repayment reduces overall financial burden by minimizing costly interest accrual, enhancing cash flow and credit scores. Green debt, often linked to sustainability projects, offers lower interest rates and tax incentives that support long-term environmental goals while stabilizing finances. Balancing repayment strategies ensures immediate financial health without compromising commitments to sustainable development and corporate social responsibility.

Creating a Personalized Repayment Plan for Mixed Debt

Prioritize high interest debt repayment first to reduce the overall financial burden and accelerate debt freedom. Incorporating green debt into the repayment plan offers environmental benefits and may include lower interest rates or incentives from sustainable lenders. Tailoring a personalized repayment strategy balances immediate cost savings from high interest debt with long-term advantages of green debt, optimizing both financial health and sustainability goals.

Related Important Terms

Carbon Neutral Debt

High interest debt demands urgent repayment due to escalating financial charges, but prioritizing green debt, especially carbon neutral debt, aligns with sustainability goals by funding eco-friendly projects and reducing overall carbon footprints. Carbon neutral debt not only supports environmental responsibility but can also attract incentives and lower risk premiums, making it a strategic choice for long-term financial and ecological benefits.

ESG-Linked Loan Repayment

Prioritizing repayment of high-interest debt reduces overall financial burden, while focusing on ESG-linked loans aligns with sustainability goals and enhances corporate social responsibility. Balancing repayment strategies ensures improved credit ratings and supports long-term environmental, social, and governance (ESG) performance.

High-APR Debt Avalanche

High interest debt, often characterized by APRs exceeding 20%, demands immediate repayment to minimize overwhelming interest costs, making the Debt Avalanche method most effective by targeting these high-APR balances first. In contrast, green debt, typically associated with environmentally focused loans at lower rates, can be prioritized after eliminating costly high-interest obligations to optimize financial savings and sustainability goals.

Eco-Interest Rate Differential

High interest debt typically demands priority repayment due to its financial burden, but green debt often offers lower Eco-Interest Rate Differentials, incentivizing sustainable investment by reducing borrowing costs tied to environmental impact. Prioritizing green debt repayment can leverage these differential benefits, optimizing long-term financial and ecological returns.

Sustainable Debt Prioritization

Prioritizing repayment of high-interest debt reduces financial costs rapidly, enabling increased capacity to invest in green debt that supports sustainable projects. Sustainable debt prioritization balances immediate fiscal relief with long-term environmental benefits, driving responsible financial management aligned with ecological goals.

Green Bond Repayment Ladder

High interest debt demands urgent repayment due to escalating costs, yet prioritizing green debt, especially through the Green Bond Repayment Ladder, aligns financial strategy with sustainability goals and investor confidence. The Green Bond Repayment Ladder structures repayments to enhance liquidity and risk management while supporting environmental projects, thereby offering a strategic balance between immediate cost savings and long-term ecological impact.

Impact-Weighted Debt Servicing

High interest debt demands immediate repayment attention due to its escalating financial burden and negative impact on creditworthiness, while green debt, often backed by sustainable projects, offers impact-weighted debt servicing that aligns repayment priorities with environmental and social benefits. Prioritizing high interest debt reduces costlier liabilities quickly, but incorporating green debt into repayment strategies enhances long-term value by supporting sustainable development and potentially unlocking favorable refinancing opportunities.

Environmental Debt Consolidation

High interest debt typically demands quicker repayment due to escalating costs and financial strain, while green debt focuses on funding environmentally sustainable projects with potentially lower interest rates and longer terms. Prioritizing environmental debt consolidation can reduce overall expenses and promote eco-friendly investment, aligning financial recovery with sustainability goals.

Clean Energy Debt Prioritization

High interest debt typically demands immediate repayment due to steep financial charges, but prioritizing green debt, specifically clean energy loans, supports sustainable development and long-term economic stability. Allocating funds toward clean energy debt repayment accelerates the transition to renewable resources while leveraging potential government incentives and reduced environmental risks.

Climate-Aligned Debt Hierarchy

High interest debt typically demands immediate repayment to reduce overall financial burden, whereas green debt, aligned with sustainability goals, often benefits from preferential treatment under the Climate-Aligned Debt Hierarchy due to its positive environmental impact. Prioritizing repayment of high interest debt can alleviate short-term financial strain, but accelerating green debt servicing supports long-term climate commitments and access to favorable lending conditions.

High interest debt vs green debt for repayment priorities. Infographic

moneydiff.com

moneydiff.com