Auto loan debt typically involves larger principal amounts, longer repayment terms, and lower interest rates compared to in-app microcredit debt, which is often characterized by smaller, short-term loans with higher interest rates. While auto loans are structured to support long-term vehicle financing with predictable monthly payments, in-app microcredit offers quick access to funds but can lead to higher overall costs due to frequent fees and steeper interest rates. Consumers should carefully evaluate the total repayment obligations and financial impact of each option before choosing vehicle financing solutions.

Table of Comparison

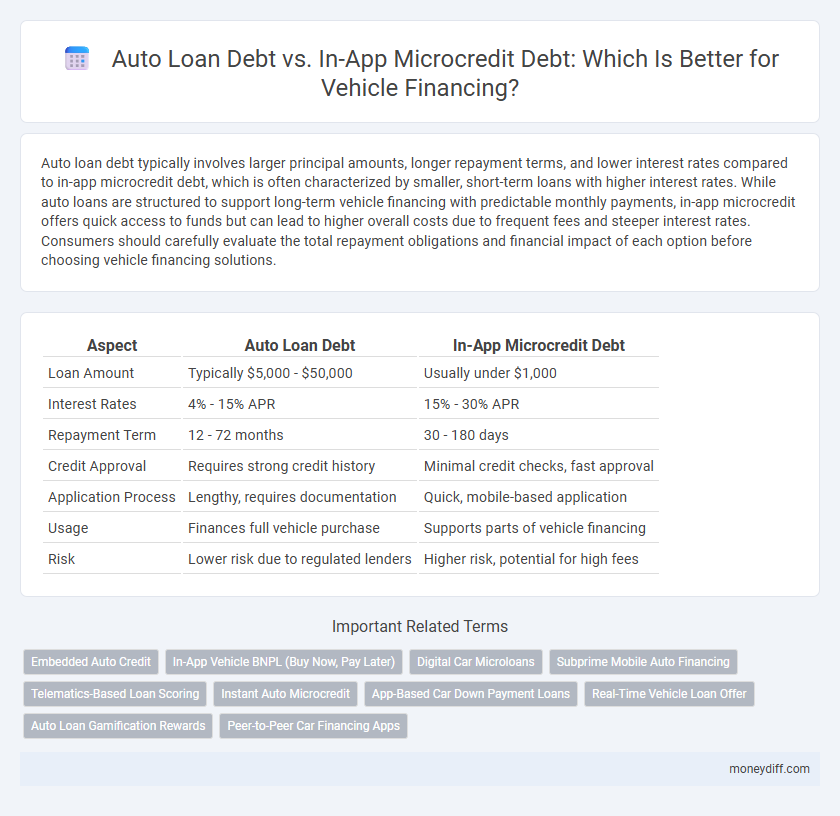

| Aspect | Auto Loan Debt | In-App Microcredit Debt |

|---|---|---|

| Loan Amount | Typically $5,000 - $50,000 | Usually under $1,000 |

| Interest Rates | 4% - 15% APR | 15% - 30% APR |

| Repayment Term | 12 - 72 months | 30 - 180 days |

| Credit Approval | Requires strong credit history | Minimal credit checks, fast approval |

| Application Process | Lengthy, requires documentation | Quick, mobile-based application |

| Usage | Finances full vehicle purchase | Supports parts of vehicle financing |

| Risk | Lower risk due to regulated lenders | Higher risk, potential for high fees |

Understanding Auto Loan Debt vs In-App Microcredit Debt

Auto loan debt typically involves larger principal amounts with longer repayment terms, often secured by the vehicle itself, resulting in lower interest rates and structured monthly payments. In-app microcredit debt for vehicle financing usually offers smaller, short-term loans with higher interest rates and quicker approval processes, appealing to borrowers needing immediate funds but potentially increasing overall cost. Understanding these differences is essential for consumers to choose the financing option that best fits their financial situation and repayment capacity.

Key Differences in Vehicle Financing Options

Auto loan debt typically involves larger loan amounts with longer repayment terms and lower interest rates, making it more suitable for purchasing new or used vehicles. In-app microcredit debt offers smaller, short-term financing options accessible via mobile platforms, often with higher interest rates and quicker approval processes. These key differences influence affordability, repayment flexibility, and overall cost in vehicle financing decisions.

Eligibility and Approval Processes Compared

Auto loan debt typically requires a strong credit history, proof of income, and a detailed approval process involving credit checks and financial documentation, making eligibility more stringent. In-app microcredit debt for vehicle financing offers a faster, often automated approval process with more lenient eligibility criteria, leveraging alternative data like app usage and payment history. This streamlined approach allows more users with limited credit history to access funding quickly, contrasting with traditional auto loan standards.

Interest Rates: Traditional Auto Loans vs Microcredit Platforms

Interest rates on traditional auto loans typically range from 3% to 7% for borrowers with good credit, offering more predictable long-term repayment terms. In contrast, in-app microcredit platforms often impose higher interest rates, frequently exceeding 10%, due to shorter repayment periods and increased risk exposure. Comparing these financing options highlights a trade-off between affordability and accessibility in vehicle financing debt.

Loan Terms, Repayment Flexibility, and Hidden Fees

Auto loan debt typically offers longer loan terms of 36 to 72 months with structured repayment schedules and lower interest rates compared to in-app microcredit debt, which often involves shorter terms and higher interest due to convenience and rapid approval. Repayment flexibility in auto loans is generally higher, allowing for refinancing and prepayment without penalties, whereas microcredit loans usually have rigid repayment deadlines and limited options for extensions. Hidden fees are more prevalent in in-app microcredit financing, including processing fees and late payment penalties that are less common or more transparent in traditional auto loan agreements.

Impact on Credit Score: Traditional vs Digital Microcredit

Auto loan debt typically involves larger amounts and longer repayment terms, which can have a more substantial impact on credit scores due to consistent payment history reflected in credit bureaus. In contrast, in-app microcredit debt for vehicle financing often consists of smaller, short-term loans that may not be reported to credit agencies, resulting in limited or no effect on credit scores. The transparency and reporting practices of traditional lenders generally provide clearer credit benefits compared to digital microcredit platforms.

Accessibility and Convenience of Application

Auto loan debt typically requires extensive documentation and longer approval times, limiting accessibility for many borrowers, whereas in-app microcredit debt offers quick, streamlined applications accessible directly via smartphones. The convenience of microcredit platforms enables potential vehicle buyers to secure financing anytime and anywhere without visiting traditional lenders. This digital approach significantly lowers barriers to entry, especially for individuals with limited credit history or those seeking smaller loan amounts.

Risk Factors: Default, Repossession, and Late Fees

Auto loan debt typically involves larger principal amounts and longer repayment terms, increasing the risk of default and repossession if borrowers struggle to make payments. In contrast, in-app microcredit debt for vehicle financing usually features smaller, short-term loans with higher interest rates, leading to frequent late fees and increased financial strain on borrowers. Both debt types pose significant risks, but microcredit's immediate penalties and less flexible terms can escalate defaults more quickly.

Long-Term Financial Implications of Each Debt Type

Auto loan debt typically offers lower interest rates and fixed repayment schedules, making it more predictable for long-term financial planning and preserving credit scores over time. In-app microcredit debt for vehicle financing often carries higher interest rates and shorter repayment terms, which can lead to increased financial strain and potential negative impacts on credit if repayments are missed. Choosing traditional auto loans generally supports better wealth accumulation and financial stability, while microcredit debt may create ongoing cash flow challenges and higher total repayment costs.

Choosing the Right Vehicle Financing Solution

Auto loan debt typically involves larger loan amounts with structured repayment terms and lower interest rates, making it suitable for long-term vehicle financing. In-app microcredit debt offers smaller, short-term credit with faster approval but often comes with higher interest rates and fees, ideal for immediate or incidental expenses related to vehicle purchase or maintenance. Choosing the right vehicle financing solution depends on evaluating loan amount needs, repayment capacity, and interest cost to optimize debt management and affordability.

Related Important Terms

Embedded Auto Credit

Embedded auto credit offers seamless vehicle financing by integrating microcredit options directly within mobile apps, enabling faster approval and flexible repayment compared to traditional auto loan debt. This in-app microcredit reduces reliance on conventional lenders, streamlining consumer access to auto financing while often incurring lower interest rates and enhanced user convenience.

In-App Vehicle BNPL (Buy Now, Pay Later)

In-app Vehicle BNPL (Buy Now, Pay Later) offers flexible, short-term financing for vehicle purchases with minimal upfront costs, contrasting traditional auto loan debt that typically involves longer terms and higher interest rates. This microcredit model leverages digital platforms to provide instant approval and seamless repayment schedules, appealing to consumers seeking quick, manageable payments without extensive credit checks.

Digital Car Microloans

Digital car microloans provide a flexible alternative to traditional auto loan debt, enabling consumers to secure vehicle financing through in-app platforms with faster approval and lower credit requirements. These microcredits cater to underserved borrowers by offering smaller loan amounts and shorter repayment terms, reducing the barriers to vehicle ownership in emerging markets.

Subprime Mobile Auto Financing

Subprime mobile auto financing through in-app microcredit presents higher interest rates and shorter repayment terms compared to traditional auto loan debt, increasing the financial strain on borrowers with low credit scores. This emerging trend leverages digital platforms to offer rapid vehicle financing but often leads to deeper debt cycles due to less regulatory oversight and inflated fees.

Telematics-Based Loan Scoring

Telematics-based loan scoring enhances risk assessment by analyzing real-time driving behavior, making auto loan debt more accurately priced compared to traditional in-app microcredit debt for vehicle financing. This technology reduces default rates and offers personalized interest rates, improving lending outcomes in the automotive credit sector.

Instant Auto Microcredit

Instant Auto Microcredit offers rapid vehicle financing through in-app microloans, providing a convenient alternative to traditional auto loan debt that typically involves lengthy approval processes and higher interest rates. This innovative approach leverages digital platforms to grant smaller, short-term credits with flexible repayment terms, reducing the financial burden and improving accessibility for lower-income borrowers.

App-Based Car Down Payment Loans

App-based car down payment loans offer a streamlined alternative to traditional auto loan debt by providing instant microcredit financing through mobile platforms, enabling quicker vehicle purchases with lower credit barriers. These in-app microcredits often carry higher interest rates but improve accessibility and convenience compared to conventional bank auto loans, appealing particularly to credit-challenged consumers seeking flexible payment options.

Real-Time Vehicle Loan Offer

Real-time vehicle loan offers streamline financing by instantly comparing auto loan debt with in-app microcredit debt options, enabling consumers to choose the most cost-effective and flexible repayment terms. Access to immediate credit assessments and interest rate updates reduces approval time and enhances transparency in vehicle financing decisions.

Auto Loan Gamification Rewards

Auto loan gamification rewards enhance traditional vehicle financing by incentivizing timely payments and reducing default rates, contrasting with typically higher-interest in-app microcredit debt that lacks structured reward systems. Leveraging game mechanics in auto loans increases borrower engagement and financial discipline, promoting long-term credit health compared to microcredit's short-term, high-cost borrowing for vehicles.

Peer-to-Peer Car Financing Apps

Peer-to-peer car financing apps offer a competitive alternative to traditional auto loan debt by providing microcredit options with flexible repayment terms and lower interest rates. These platforms leverage social lending networks to facilitate quick access to funds, reducing dependency on conventional lenders and improving affordability for vehicle financing.

Auto loan debt vs in-app microcredit debt for vehicle financing. Infographic

moneydiff.com

moneydiff.com