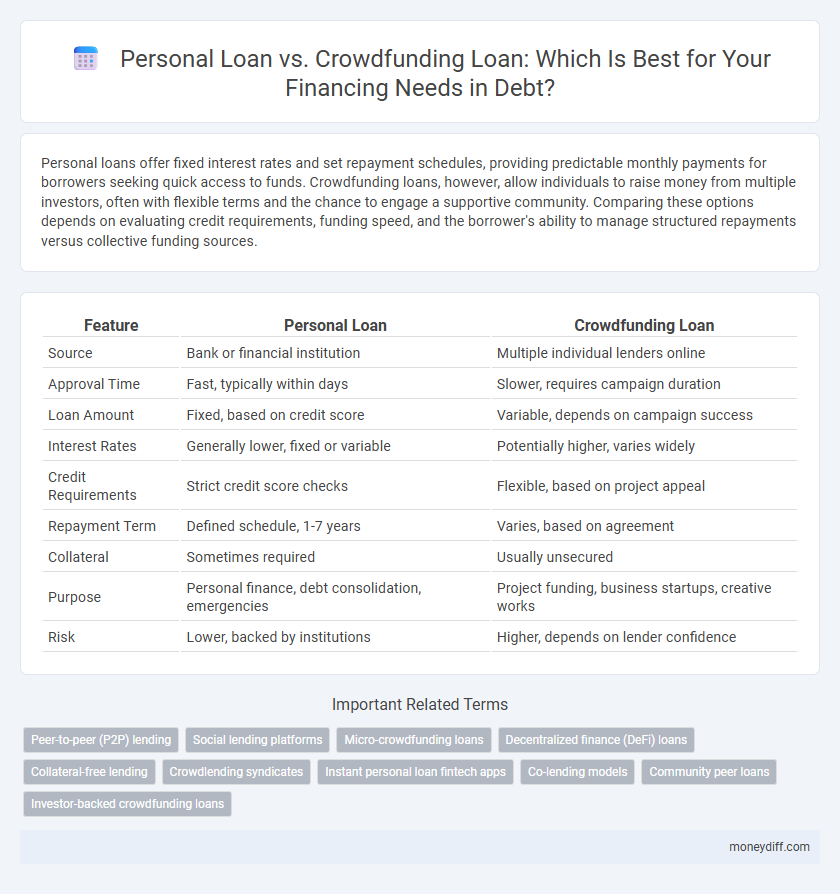

Personal loans offer fixed interest rates and set repayment schedules, providing predictable monthly payments for borrowers seeking quick access to funds. Crowdfunding loans, however, allow individuals to raise money from multiple investors, often with flexible terms and the chance to engage a supportive community. Comparing these options depends on evaluating credit requirements, funding speed, and the borrower's ability to manage structured repayments versus collective funding sources.

Table of Comparison

| Feature | Personal Loan | Crowdfunding Loan |

|---|---|---|

| Source | Bank or financial institution | Multiple individual lenders online |

| Approval Time | Fast, typically within days | Slower, requires campaign duration |

| Loan Amount | Fixed, based on credit score | Variable, depends on campaign success |

| Interest Rates | Generally lower, fixed or variable | Potentially higher, varies widely |

| Credit Requirements | Strict credit score checks | Flexible, based on project appeal |

| Repayment Term | Defined schedule, 1-7 years | Varies, based on agreement |

| Collateral | Sometimes required | Usually unsecured |

| Purpose | Personal finance, debt consolidation, emergencies | Project funding, business startups, creative works |

| Risk | Lower, backed by institutions | Higher, depends on lender confidence |

Understanding Personal Loans: An Overview

Personal loans offer fixed amounts with set repayment terms, making them ideal for predictable financing needs and stable budgeting. Crowdfunding loans rely on multiple investors who pool funds, often providing more flexible amounts but less certainty in approval and timelines. Understanding the interest rates, eligibility criteria, and repayment structures of personal loans helps borrowers assess their suitability compared to the communal nature of crowdfunding financing.

What Is a Crowdfunding Loan?

A crowdfunding loan is a type of financing where multiple investors contribute small amounts of money online to fund a borrower's loan request. Unlike traditional personal loans from banks or credit unions, crowdfunding loans are facilitated through digital platforms that connect borrowers directly with individual lenders. This method can offer competitive interest rates and flexible terms but may involve varying approval criteria based on the platform's policies.

Eligibility Criteria: Personal Loans vs Crowdfunding

Personal loans typically require a strong credit score, stable income, and proof of employment to qualify, making them accessible primarily to individuals with established financial histories. Crowdfunding loans offer more flexible eligibility criteria, often relying on social networks and public support rather than creditworthiness or income verification. While personal loans involve a conventional credit check, crowdfunding platforms focus on project viability and community trust, broadening access to funding for those with limited credit history.

Application Process: Personal vs Crowdfunding Loans

Personal loans require a straightforward application process involving credit checks, income verification, and approval from financial institutions, often resulting in quick access to funds. Crowdfunding loans demand creating a detailed campaign profile, attracting multiple lenders or investors by demonstrating project viability and appealing storytelling. The personal loan process is more rigid but faster, whereas crowdfunding loans provide flexible financing options at the cost of higher effort and time spent on campaign management.

Interest Rates and Fees Comparison

Personal loans typically feature fixed interest rates ranging from 6% to 36% APR, with additional origination fees averaging 1% to 6%, whereas crowdfunding loans often have variable costs influenced by platform fees, averaging around 5% to 10% of the total amount raised. Crowdfunding loan interest rates can be lower than traditional personal loans but include service charges and potential success fees that increase the overall cost. Borrowers must evaluate total repayment obligations, factoring in both interest rates and platform fees, to determine the most cost-effective financing solution.

Funding Speed: Which Option Is Faster?

Personal loans typically provide faster funding as approvals can occur within 24 to 48 hours, especially with online lenders offering instant decisions and quick disbursements. Crowdfunding loans, however, depend on campaign duration and donor engagement, often taking weeks or even months to reach the required funding amount. For urgent financing needs, personal loans generally outperform crowdfunding in terms of speed and predictability.

Credit Score Impact: Personal vs Crowdfunding Loans

Personal loans typically require a good credit score for approval and timely payments can improve credit ratings, while missed payments negatively affect scores. Crowdfunding loans usually have less impact on credit scores since they often don't involve traditional credit checks and rely on community support. Borrowers with lower credit scores might find crowdfunding loans more accessible without immediate credit score repercussions.

Flexibility and Customization of Loan Terms

Personal loans offer fixed repayment schedules and interest rates, providing predictable monthly payments but limited flexibility. Crowdfunding loans allow borrowers to negotiate terms directly with multiple lenders, enabling customized repayment plans and potential interest adjustments. Flexibility and customization in crowdfunding loans can better accommodate unique financial situations compared to the standardized structure of personal loans.

Risks and Considerations: Personal vs Crowdfunding Debts

Personal loans often carry fixed interest rates and set repayment schedules, creating predictable monthly obligations but risking credit score impacts if defaults occur. Crowdfunding loans, while potentially offering lower interest rates or flexible terms, expose borrowers to reputational risks and less regulatory protection, as success depends on public approval and platform policies. Both options require thorough evaluation of debt servicing capacity and legal recourse in case of non-payment to minimize financial vulnerability.

Which Financing Option Suits Your Needs?

Personal loans offer fixed interest rates, predictable repayment terms, and quick access to funds, making them ideal for borrowers with a stable credit history and urgent financing needs. Crowdfunding loans provide flexible funding sources through multiple backers, suitable for entrepreneurs or projects lacking traditional credit approval but requiring varied contributions. Evaluating factors such as credit score, loan purpose, repayment capacity, and time sensitivity helps determine whether a personal loan or crowdfunding loan best suits your financial goals.

Related Important Terms

Peer-to-peer (P2P) lending

Peer-to-peer (P2P) lending offers a streamlined alternative to traditional personal loans by connecting borrowers directly with individual investors, often resulting in lower interest rates and faster approval times. Unlike crowdfunding loans, which pool funds from multiple backers without guaranteed repayment terms, P2P loans typically involve formal lending agreements, providing clearer repayment structures and legal protection for both parties.

Social lending platforms

Social lending platforms facilitate personal loans by connecting borrowers directly with individual lenders, often offering lower interest rates and flexible terms compared to traditional crowdfunding loans, which rely on numerous small contributions from a larger pool of backers. Personal loans through these platforms provide more predictable repayment schedules and credit reporting benefits, whereas crowdfunding loans are typically reward-based and less structured for debt repayment.

Micro-crowdfunding loans

Micro-crowdfunding loans offer a flexible alternative to traditional personal loans by enabling borrowers to raise small amounts of capital from a broad network of individual lenders, often with lower interest rates and less stringent credit requirements. Unlike personal loans that rely heavily on credit scores and fixed repayment terms, micro-crowdfunding leverages community support and social proof, making it ideal for entrepreneurs or individuals with limited access to conventional financing options.

Decentralized finance (DeFi) loans

Personal loans typically involve traditional banks or financial institutions with fixed interest rates and credit checks, while crowdfunding loans leverage decentralized finance (DeFi) platforms that enable peer-to-peer lending without intermediaries, offering greater accessibility and transparency. DeFi loans use blockchain technology for secure, fast transactions, allowing borrowers to access funds globally with flexible terms and often lower fees compared to conventional personal loans.

Collateral-free lending

Personal loans offer collateral-free lending directly from banks or financial institutions with fixed interest rates and set repayment terms, providing predictable debt servicing for borrowers with good credit. Crowdfunding loans involve raising funds from multiple individual lenders without collateral but typically carry variable repayment schedules and can involve higher risk due to dependency on public support and platform fees.

Crowdlending syndicates

Crowdlending syndicates offer a shared risk model by pooling funds from multiple investors, often resulting in lower interest rates and more flexible terms compared to traditional personal loans. This collective approach enables borrowers to access diverse capital sources while benefiting from streamlined approval processes and enhanced credit opportunities.

Instant personal loan fintech apps

Instant personal loan fintech apps offer quick access to funds with streamlined approval processes and competitive interest rates, making them ideal for urgent financing needs. Unlike crowdfunding loans, these apps provide guaranteed amounts without relying on public contributions, ensuring faster and more reliable personal loan disbursement.

Co-lending models

Personal loans typically involve direct borrowing from banks or financial institutions with fixed interest rates and repayment terms, while crowdfunding loans leverage multiple individual investors pooling funds through online platforms, often under co-lending models where traditional lenders partner with crowdfunding sites to share risk and expand credit access. Co-lending models optimize financing by combining the credit evaluation strength of banks with the diversified capital base of crowdfunding, enhancing loan availability and competitive rates for borrowers.

Community peer loans

Community peer loans through crowdfunding platforms offer a personalized financing approach by connecting borrowers directly with multiple individual lenders, often resulting in flexible terms and potentially lower interest rates compared to traditional personal loans. Personal loans from banks or credit unions provide a streamlined process with fixed interest rates and predictable repayment schedules but may involve stricter credit requirements and less community engagement.

Investor-backed crowdfunding loans

Investor-backed crowdfunding loans offer a viable alternative to traditional personal loans by connecting borrowers with multiple investors through online platforms, often providing competitive interest rates and flexible repayment terms. Unlike conventional personal loans issued by banks, these loans leverage a diversified pool of investor capital, which can result in quicker approval times and access to funds for borrowers with varying credit profiles.

Personal loan vs Crowdfunding loan for financing needs. Infographic

moneydiff.com

moneydiff.com