Debt consolidation simplifies multiple loans into a single payment, often with lower interest rates, improving manageability and reducing financial stress. Robo-advisor debt service uses automated algorithms to optimize repayment plans based on individual financial profiles, offering personalized strategies and ongoing adjustments. Comparing both options, debt consolidation provides straightforward lump-sum relief while robo-advisors deliver dynamic, data-driven management tailored for long-term financial health.

Table of Comparison

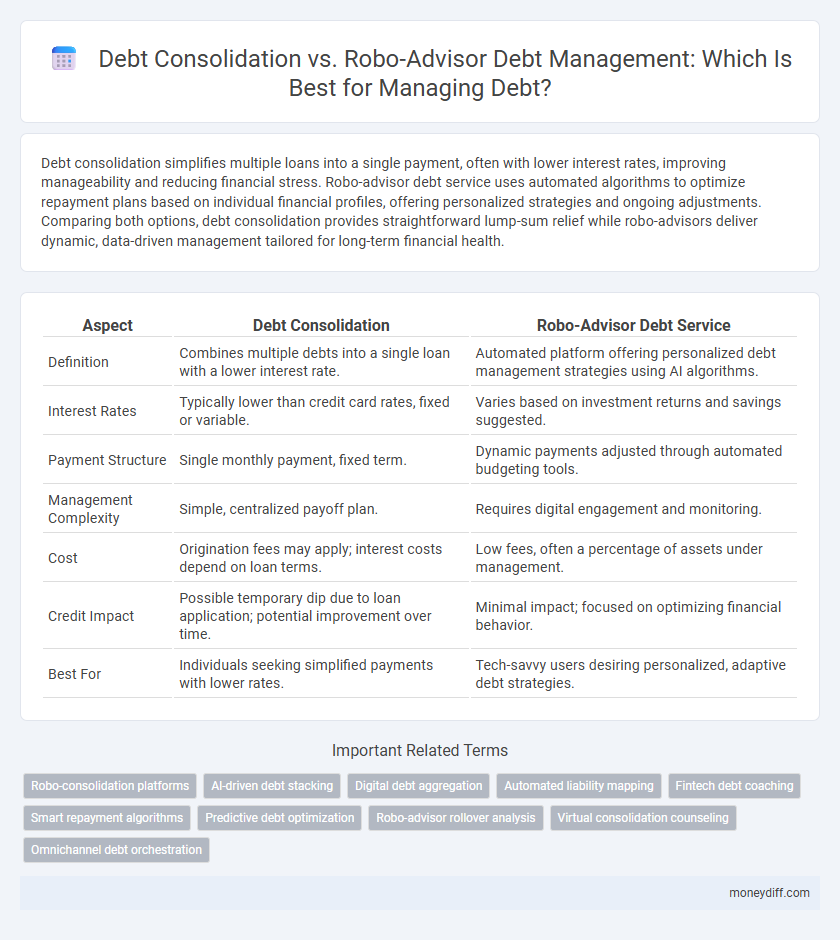

| Aspect | Debt Consolidation | Robo-Advisor Debt Service |

|---|---|---|

| Definition | Combines multiple debts into a single loan with a lower interest rate. | Automated platform offering personalized debt management strategies using AI algorithms. |

| Interest Rates | Typically lower than credit card rates, fixed or variable. | Varies based on investment returns and savings suggested. |

| Payment Structure | Single monthly payment, fixed term. | Dynamic payments adjusted through automated budgeting tools. |

| Management Complexity | Simple, centralized payoff plan. | Requires digital engagement and monitoring. |

| Cost | Origination fees may apply; interest costs depend on loan terms. | Low fees, often a percentage of assets under management. |

| Credit Impact | Possible temporary dip due to loan application; potential improvement over time. | Minimal impact; focused on optimizing financial behavior. |

| Best For | Individuals seeking simplified payments with lower rates. | Tech-savvy users desiring personalized, adaptive debt strategies. |

Understanding Debt Consolidation: A Quick Overview

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, simplifying monthly payments and potentially reducing overall debt costs. Robo-advisor debt service uses algorithm-driven platforms to automate debt management and repayment strategies based on user financial data. Understanding these options helps borrowers choose the most effective method for optimizing debt repayment and improving financial stability.

What Is a Robo-Advisor Debt Service?

A robo-advisor debt service is an automated financial management platform that uses algorithms to optimize debt repayment strategies tailored to individuals' financial situations. It analyzes factors such as interest rates, outstanding balances, and monthly income to prioritize debt payments, reduce interest costs, and improve credit scores efficiently. This technology-driven approach contrasts with traditional debt consolidation by offering continuous monitoring, personalized advice, and adjustments without requiring manual intervention.

Key Differences Between Debt Consolidation and Robo-Advisors

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, simplifying repayment and potentially reducing overall costs. Robo-advisors use algorithms to create personalized debt management plans, focusing on payment optimization and investment strategies. While debt consolidation reduces payment complexity through loan restructuring, robo-advisors provide ongoing financial guidance using technology-driven analytics to improve debt repayment efficiency.

Pros and Cons of Debt Consolidation for Money Management

Debt consolidation simplifies multiple debt payments into a single monthly installment, potentially lowering interest rates and improving credit scores by reducing missed payments. However, it may extend the repayment period, increasing overall interest costs, and often requires good credit to qualify for favorable terms. Unlike robo-advisor debt management, consolidation offers less automation and personalized financial planning, which can impact long-term money management effectiveness.

Advantages and Drawbacks of Robo-Advisor Debt Solutions

Robo-advisor debt solutions offer automated portfolio management with algorithms that optimize debt repayment strategies, providing personalized plans based on income, expenses, and credit profiles. Advantages include lower fees compared to traditional financial advisors, 24/7 access to data-driven insights, and the ability to diversify payments efficiently across multiple loans. Drawbacks involve limited human judgment for complex financial situations, potential security concerns with digital platforms, and less flexibility in negotiating directly with creditors compared to debt consolidation loans.

Cost Comparison: Debt Consolidation vs Robo-Advisor Fees

Debt consolidation typically involves fixed fees or interest rates that can be lower than individual debts, potentially reducing overall monthly payments and total interest costs. Robo-advisor debt service fees usually range from 0.25% to 0.50% of assets managed, which may add up over time but offer automated portfolio adjustments and personalized advice. Evaluating the cost effectiveness depends on the total debt amount, management fees, and the interest rate environment, with debt consolidation often providing immediate cost savings while robo-advisors offer long-term financial optimization.

Which Is Faster: Speed of Debt Relief Compared

Debt consolidation typically offers faster debt relief by combining multiple debts into a single loan with lower interest rates and fixed repayment terms, allowing borrowers to pay off their balances more quickly. Robo-advisor debt service focuses on optimizing payment strategies through automated, algorithm-driven plans but may result in a longer timeline as it prioritizes cost-effectiveness and credit score improvement. Speed of debt relief is generally quicker with debt consolidation due to immediate restructuring and reduced payment complexity.

Impact on Credit Score: Consolidation vs Robo-Advisors

Debt consolidation typically improves credit scores by reducing credit utilization and simplifying payments, leading to fewer missed deadlines and more consistent on-time payments. Robo-advisors, while offering automated debt management and personalized repayment plans, may have a varied impact on credit scores depending on their approach to handling accounts and payment frequency. Monitoring credit reports regularly is essential when choosing between debt consolidation and robo-advisor services for optimal credit score outcomes.

Choosing the Best Option for Your Debt Profile

Debt consolidation simplifies multiple loans into a single payment with potentially lower interest rates, improving cash flow and credit management. Robo-advisor debt management uses algorithms to create personalized payoff strategies based on your financial data, optimizing repayment timelines and interest savings. Evaluating your debt profile, interest rates, and financial discipline helps determine whether debt consolidation or a robo-advisor's automated plan best aligns with your goals.

Future Trends: Technology in Debt Management Services

Future trends in debt management services emphasize the integration of AI-driven platforms, which enhance debt consolidation and robo-advisor strategies by providing personalized repayment plans based on real-time financial data analysis. Machine learning algorithms improve predictive analytics for debt servicing, enabling proactive adjustments to optimize cash flow and minimize interest costs. The adoption of blockchain technology ensures greater transparency and security in debt transactions, revolutionizing how users manage and consolidate debt through automated, efficient processes.

Related Important Terms

Robo-consolidation platforms

Robo-consolidation platforms leverage advanced algorithms and AI to streamline debt management by automatically prioritizing payments, optimizing interest rates, and consolidating multiple debts into a single manageable plan, reducing overall costs and improving credit scores. These digital solutions offer personalized strategies and real-time monitoring that surpass traditional debt consolidation, enhancing user control and financial outcomes.

AI-driven debt stacking

AI-driven debt stacking through robo-advisors optimizes debt repayment by analyzing multiple liabilities and prioritizing high-interest debts to reduce overall interest costs efficiently. Debt consolidation simplifies payments by combining debts into a single loan but may lack the dynamic, data-driven prioritization offered by robo-advisor algorithms.

Digital debt aggregation

Debt consolidation streamlines multiple debts into a single loan with a fixed interest rate, simplifying management and potentially lowering monthly payments. Robo-advisor debt services leverage digital debt aggregation to analyze and optimize repayment strategies using AI-driven algorithms, offering personalized, data-driven insights for faster debt reduction.

Automated liability mapping

Debt consolidation streamlines multiple liabilities into a single payment, simplifying debt management and reducing interest rates through negotiated terms. Robo-advisor debt services leverage automated liability mapping to dynamically allocate payments, optimize repayment schedules, and adapt strategies based on real-time financial data for improved long-term debt reduction.

Fintech debt coaching

Debt consolidation simplifies multiple liabilities into a single loan with lower interest rates, improving repayment efficiency, while robo-advisor debt service provides personalized, algorithm-driven fintech debt coaching to optimize repayment strategies based on individual financial data and spending habits. Fintech platforms leverage AI to deliver real-time debt management insights and automated budgeting, enhancing user engagement and reducing overall financial stress more effectively than traditional consolidation methods.

Smart repayment algorithms

Smart repayment algorithms in robo-advisor debt services optimize debt consolidation by analyzing interest rates, payment schedules, and borrower cash flow to minimize total repayment costs and duration. These algorithms dynamically adjust payment strategies, prioritizing high-interest debts and leveraging user financial data for personalized, efficient debt management.

Predictive debt optimization

Predictive debt optimization through robo-advisor debt service leverages advanced algorithms and machine learning to forecast repayment outcomes, enabling personalized debt management strategies that minimize interest and accelerate payoff. Debt consolidation simplifies multiple debts into a single loan with potentially lower interest rates but lacks the dynamic, data-driven adjustments offered by robo-advisors for ongoing debt optimization.

Robo-advisor rollover analysis

Robo-advisor rollover analysis leverages AI algorithms to optimize debt repayment strategies by continuously evaluating interest rates, payment schedules, and credit utilization, enhancing cost-efficiency more effectively than traditional debt consolidation methods. This data-driven approach dynamically reallocates debt portfolios to minimize interest expenses and improve credit scores, providing personalized, scalable debt management solutions.

Virtual consolidation counseling

Virtual consolidation counseling streamlines debt management by combining multiple debts into a single payment, reducing interest rates through expert negotiation and personalized plans. Robo-advisor debt service automates portfolio adjustments and budgeting guidance but lacks the tailored negotiation strategies and in-depth financial advice delivered by virtual counselors.

Omnichannel debt orchestration

Omnichannel debt orchestration integrates debt consolidation strategies with robo-advisor debt service management to optimize repayment plans, enhance customer engagement, and improve financial outcomes across multiple channels. Leveraging AI-driven robo-advisors within an omnichannel framework enables personalized debt restructuring, real-time monitoring, and seamless communication, resulting in higher efficiency and reduced default rates.

Debt consolidation vs Robo-advisor debt service for management. Infographic

moneydiff.com

moneydiff.com