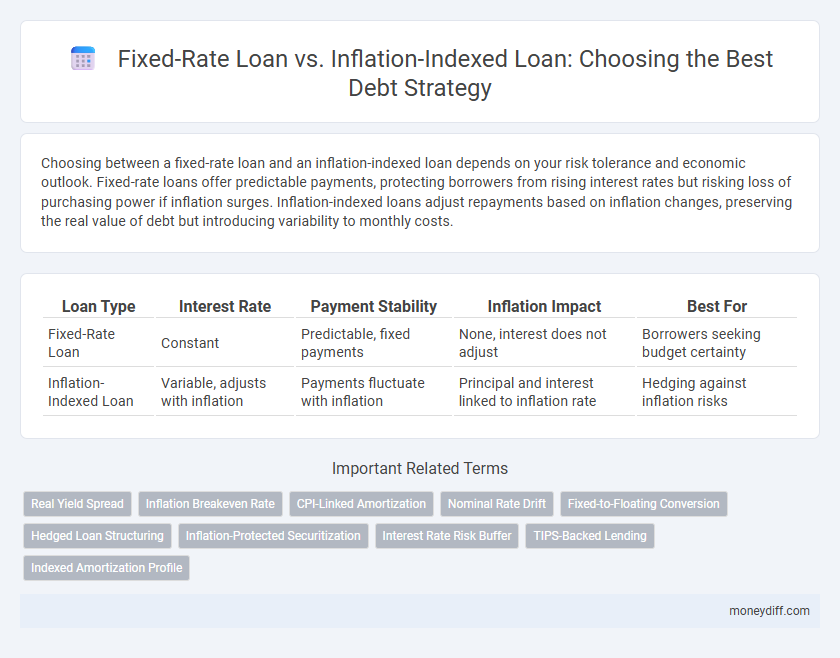

Choosing between a fixed-rate loan and an inflation-indexed loan depends on your risk tolerance and economic outlook. Fixed-rate loans offer predictable payments, protecting borrowers from rising interest rates but risking loss of purchasing power if inflation surges. Inflation-indexed loans adjust repayments based on inflation changes, preserving the real value of debt but introducing variability to monthly costs.

Table of Comparison

| Loan Type | Interest Rate | Payment Stability | Inflation Impact | Best For |

|---|---|---|---|---|

| Fixed-Rate Loan | Constant | Predictable, fixed payments | None, interest does not adjust | Borrowers seeking budget certainty |

| Inflation-Indexed Loan | Variable, adjusts with inflation | Payments fluctuate with inflation | Principal and interest linked to inflation rate | Hedging against inflation risks |

Understanding Fixed-Rate Loans: Stability and Predictability

Fixed-rate loans provide borrowers with stable monthly payments and predictable interest costs throughout the loan term, shielding them from inflation-related increases. This predictability enables effective budgeting, as the principal and interest amounts remain constant regardless of economic fluctuations. Choosing fixed-rate loans supports long-term financial planning by eliminating uncertainty tied to inflation risks inherent in inflation-indexed loans.

Inflation-Indexed Loans: Protection Against Rising Prices

Inflation-indexed loans provide borrowers with payment adjustments tied to inflation rates, offering a hedge against the diminishing purchasing power caused by rising prices. Unlike fixed-rate loans, which maintain constant interest rates regardless of economic changes, inflation-indexed loans align debt service costs with actual inflation, preserving real debt value over time. This loan strategy benefits borrowers during periods of persistent inflation by reducing the risk of real interest rate increases and maintaining affordability of repayments.

Comparing Interest Structures: Fixed vs Inflation-Linked

Fixed-rate loans offer the security of a constant interest rate, ensuring predictable monthly payments regardless of inflation fluctuations. Inflation-indexed loans adjust the principal or interest rate in line with inflation indices, protecting the lender but potentially increasing borrower costs during periods of rising inflation. Borrowers prioritizing budget stability may prefer fixed-rate loans, while those seeking inflation protection and risk mitigation could consider inflation-linked loans as a strategic hedge.

How Inflation Impacts Loan Repayments

Fixed-rate loans maintain consistent monthly payments regardless of inflation changes, protecting borrowers from rising costs over the loan term. Inflation-indexed loans adjust repayments based on inflation rates, which can increase payment amounts when inflation rises, aligning debt value with the current purchasing power. Borrowers with fixed income may prefer fixed-rate loans to ensure predictable expenses, while inflation-indexed loans can benefit lenders by preserving the real value of loan repayments.

Risk Assessment: Choosing the Right Loan for Your Profile

Fixed-rate loans provide predictable monthly payments by locking in interest rates, reducing exposure to inflation risk and offering stability for borrowers with fixed incomes or risk-averse profiles. Inflation-indexed loans adjust interest rates based on inflation indices like the Consumer Price Index (CPI), protecting borrowing power but introducing payment variability that suits borrowers with higher risk tolerance or those expecting rising inflation. Assessing personal financial stability, inflation expectations, and risk appetite is crucial to selecting the appropriate loan type and managing debt effectively.

Long-Term Cost Analysis of Fixed and Inflation-Indexed Loans

Fixed-rate loans provide predictable interest payments, shielding borrowers from inflation volatility but potentially resulting in higher real costs if inflation rises significantly over time. Inflation-indexed loans adjust the principal and interest based on inflation rates, reducing the borrower's inflation risk but potentially increasing payment uncertainty and total costs in deflationary periods. Long-term cost analysis reveals that fixed-rate loans favor low-inflation environments, while inflation-indexed loans offer better protection and potential savings during periods of sustained, high inflation.

Economic Factors Influencing Loan Strategy Decisions

Fixed-rate loans provide predictable monthly payments, protecting borrowers from inflation fluctuations but may become costly during rising inflation periods. Inflation-indexed loans adjust principal and interest according to inflation rates, preserving real debt value and reducing inflation risk for lenders. Economic considerations such as expected inflation trends, interest rate volatility, and borrower cash flow stability critically influence the choice between fixed-rate and inflation-indexed loan strategies.

Borrower Situations: Who Should Choose Which Loan Type?

Borrowers expecting stable or declining inflation rates benefit from fixed-rate loans, as these loans provide predictable payments and protection against interest rate spikes. Inflation-indexed loans suit borrowers anticipating rising inflation or volatile interest rates, as payments adjust to inflation, preserving the loan's real value and potentially lowering costs during inflationary periods. Risk-averse borrowers prioritizing budget certainty generally prefer fixed-rate loans, while those seeking protection against inflationary erosion of debt value tend to select inflation-indexed loans.

Pros and Cons of Fixed-Rate and Inflation-Indexed Loans

Fixed-rate loans provide consistent monthly payments and protect borrowers from rising interest rates, offering budgeting stability, but they can become costly if inflation significantly decreases. Inflation-indexed loans adjust principal and interest payments based on inflation rates, preserving purchasing power and reducing real debt burden during inflationary periods, though they carry uncertainty due to fluctuating payments and potential budget volatility. Evaluating the trade-offs between payment predictability in fixed-rate loans and inflation protection in indexed loans is crucial for aligning debt strategy with economic conditions and risk tolerance.

Strategic Recommendations for Effective Debt Management

Opting for a fixed-rate loan ensures predictable repayments, shielding borrowers from inflation-driven interest hikes and aiding in precise budgeting. Inflation-indexed loans adjust interest with inflation rates, offering protection in declining inflation environments but introducing payment variability. For effective debt management, combining fixed-rate stability with a portion of inflation-linked debt can balance risk and flexibility amid fluctuating economic conditions.

Related Important Terms

Real Yield Spread

Fixed-rate loans offer predictable interest payments unaffected by inflation, resulting in a stable real yield spread that reflects the nominal rate minus the inflation rate. Inflation-indexed loans adjust principal and interest according to inflation, maintaining a consistent real yield spread that protects lenders and borrowers from inflation risk.

Inflation Breakeven Rate

Choosing a loan strategy between fixed-rate and inflation-indexed loans hinges on the inflation breakeven rate, which represents the expected average inflation rate at which both loan types yield equivalent real costs. Borrowers benefit from fixed-rate loans when the actual inflation rate remains below this breakeven point, while inflation-indexed loans provide better protection and lower real costs if inflation exceeds the breakeven rate.

CPI-Linked Amortization

CPI-linked amortization in inflation-indexed loans adjusts principal repayments based on the Consumer Price Index, effectively preserving the loan's real value against inflation. Fixed-rate loans maintain constant nominal payments but expose borrowers to inflation risk, making CPI-linked loans advantageous for long-term debt strategies in inflationary environments.

Nominal Rate Drift

Fixed-rate loans maintain a constant nominal interest rate irrespective of inflation changes, exposing borrowers to potential real value erosion over time, while inflation-indexed loans adjust nominal rates based on inflation indexes, mitigating real interest rate risk but introducing variability in debt service amounts. Nominal rate drift in fixed-rate loans can lead to higher real costs during inflation spikes, whereas inflation-indexed loans align repayments with inflation, preserving purchasing power but complicating cash flow predictability.

Fixed-to-Floating Conversion

Fixed-rate loans provide predictable payments but can become costly during rising inflation, whereas inflation-indexed loans adjust payments based on inflation, protecting purchasing power. A fixed-to-floating conversion strategy allows borrowers to start with stable fixed rates and switch to variable rates, potentially benefiting from lower costs if inflation decreases.

Hedged Loan Structuring

Fixed-rate loans provide predictable payments by locking in interest rates, effectively hedging against inflation risk, whereas inflation-indexed loans adjust payments based on inflation changes, offering protection against purchasing power erosion but adding payment variability. Hedged loan structuring often combines fixed-rate components with inflation-linked instruments to balance cost certainty and inflation protection, optimizing debt portfolio risk management.

Inflation-Protected Securitization

Fixed-rate loans provide predictable payments but risk erosion of real value during inflation, while inflation-indexed loans adjust principal and interest according to inflation, preserving purchasing power and reducing default risk. Inflation-protected securitization leverages inflation-indexed loans by bundling securities tied to inflation metrics, attracting investors seeking stable, inflation-adjusted returns.

Interest Rate Risk Buffer

Fixed-rate loans provide a stable interest rate, offering predictable payments that shield borrowers from rising interest rate risk but may become costly if inflation declines. Inflation-indexed loans adjust payments according to inflation rates, acting as an effective interest rate risk buffer by maintaining real value, yet exposing borrowers to fluctuating payment amounts linked to inflation volatility.

TIPS-Backed Lending

TIPS-backed lending offers a strategic advantage by protecting borrowers from inflation risk through principal adjustments tied to the Consumer Price Index, ensuring real value preservation of loan repayments. Fixed-rate loans provide payment predictability but expose borrowers to inflation volatility, potentially eroding the real value of debt over time.

Indexed Amortization Profile

A fixed-rate loan provides predictable payments with an amortization profile unaffected by inflation, ensuring stable debt service costs over time. An inflation-indexed loan features an amortization profile that adjusts with inflation, protecting against real value erosion but introducing variable payment amounts tied to inflation indices.

Fixed-rate loan vs inflation-indexed loan for loan strategy. Infographic

moneydiff.com

moneydiff.com