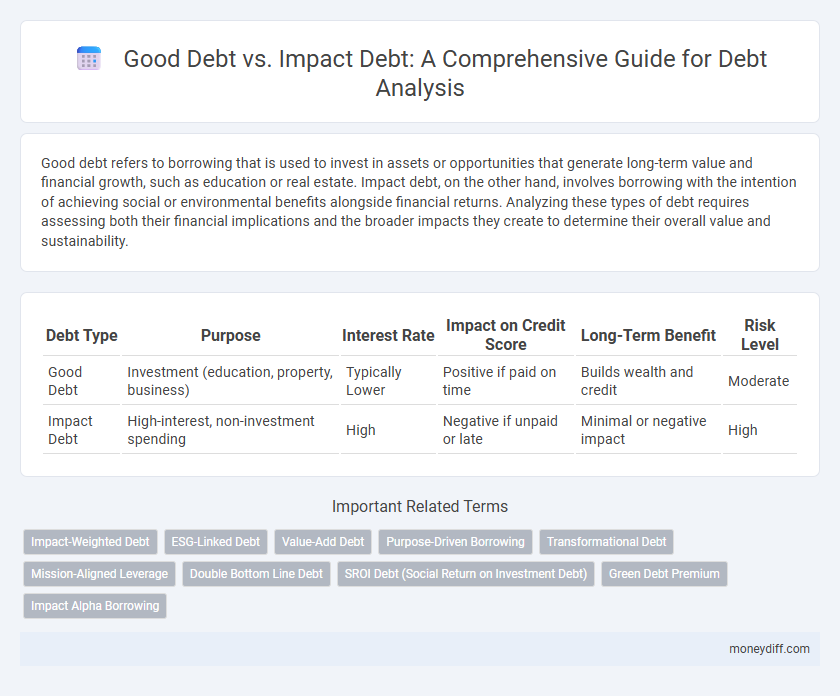

Good debt refers to borrowing that is used to invest in assets or opportunities that generate long-term value and financial growth, such as education or real estate. Impact debt, on the other hand, involves borrowing with the intention of achieving social or environmental benefits alongside financial returns. Analyzing these types of debt requires assessing both their financial implications and the broader impacts they create to determine their overall value and sustainability.

Table of Comparison

| Debt Type | Purpose | Interest Rate | Impact on Credit Score | Long-Term Benefit | Risk Level |

|---|---|---|---|---|---|

| Good Debt | Investment (education, property, business) | Typically Lower | Positive if paid on time | Builds wealth and credit | Moderate |

| Impact Debt | High-interest, non-investment spending | High | Negative if unpaid or late | Minimal or negative impact | High |

Understanding Good Debt vs Impact Debt

Good debt refers to borrowing that is strategically used to invest in assets or opportunities that generate long-term financial returns, such as education, real estate, or business expansion. Impact debt focuses on loans or credit aimed at achieving social or environmental benefits while potentially generating financial returns, commonly used in sustainable investments or social enterprises. Understanding the distinction helps in debt analysis by evaluating both financial viability and ethical impact to make informed borrowing decisions.

Key Differences Between Good Debt and Impact Debt

Good debt typically refers to borrowing that finances assets or investments expected to generate long-term financial returns, such as mortgages or student loans. Impact debt, however, is specifically incurred to fund projects with measurable social or environmental benefits, prioritizing positive societal outcomes alongside financial returns. The key differences lie in their primary objectives: good debt centers on personal or economic gain, while impact debt emphasizes sustainable and ethical impact in financial analysis.

The Role of Good Debt in Financial Growth

Good debt, such as student loans or mortgages, can serve as a catalyst for financial growth by enabling investments in education, property, and business opportunities that generate long-term returns. This type of debt is characterized by manageable interest rates and repayment terms aligned with future income potential, distinguishing it from impact debt, which often emphasizes social or environmental outcomes over financial gain. Analyzing debt portfolios with a focus on good debt highlights its role in building creditworthiness and enhancing net worth, making it a strategic component in effective debt management and wealth accumulation.

Identifying Impact Debt: Warning Signs

Impact debt often manifests through missed payments, increasing interest rates, or inability to meet minimum monthly obligations, signaling financial distress. Identifying rising debt-to-income ratios and consistent reliance on new debt to pay existing obligations highlights unsustainable borrowing patterns. Early recognition of declining credit scores and escalating collection notices serves as critical warning signs in thorough debt analysis.

Criteria for Classifying Debts as Good or Impact

Good debt is typically classified based on its ability to generate long-term financial returns or enhance asset value, such as mortgages or student loans that contribute to wealth building. Impact debt is assessed by its social or environmental return alongside financial performance, often used to fund projects with measurable benefits like renewable energy or affordable housing. Key criteria for classification include the debt's purpose, expected outcomes, risk profile, and alignment with sustainable development goals or investment strategies.

Short-Term vs Long-Term Effects of Debt Types

Good debt, such as mortgages or education loans, typically offers long-term financial benefits by enhancing earning potential or asset value, while impact debt, often related to social or environmental outcomes, may provide both immediate relief and sustained community benefits. Short-term effects of good debt commonly include increased cash flow strain, whereas impact debt can generate prompt social improvements alongside financial costs. Long-term analysis of both debt types requires assessing their return on investment, sustainability, and influence on creditworthiness and overall financial health.

Debt Analysis: Calculating Financial Impact

Good debt enhances long-term financial growth by financing assets that generate income or appreciate in value, such as education loans or mortgages. Impact debt, often linked to high-interest or predatory loans, can destabilize cash flow and increase financial burden without corresponding asset growth. Accurate debt analysis involves calculating the net financial impact by comparing interest rates, payment terms, and the debt's contribution to overall wealth or financial risk.

Strategies for Managing Both Debt Types

Effective strategies for managing good debt and impact debt include prioritizing low-interest borrowing while leveraging investments that generate long-term value. Monitoring cash flow closely and setting clear repayment plans help control both debt types without compromising financial stability. Utilizing debt restructuring and refinancing options can optimize debt portfolios and enhance overall debt sustainability.

How to Convert Impact Debt into Good Debt

Converting impact debt into good debt requires prioritizing investments that generate measurable social or environmental returns alongside financial gains. By implementing rigorous impact measurement frameworks and aligning debt structures with sustainable business models, organizations can enhance creditworthiness while driving positive outcomes. Leveraging stakeholder engagement and transparent reporting further transforms impact debt into valuable capital that supports long-term growth and resilience.

Tools and Resources for Debt Assessment

Tools and resources for debt assessment include credit scoring models, debt-to-income ratio calculators, and cash flow analysis software, all essential for distinguishing good debt from impact debt. Advanced analytics platforms enable comprehensive evaluations of debt sustainability and repayment capacity, helping identify favorable borrowing conditions versus high-impact, risky liabilities. Access to real-time financial data and scenario simulation tools further enhances the accuracy of debt impact assessments and strategic decision-making.

Related Important Terms

Impact-Weighted Debt

Impact-Weighted Debt integrates environmental, social, and governance (ESG) factors into traditional debt analysis by quantifying the positive and negative externalities of borrowing, enabling investors to assess the true sustainability impact of debt portfolios. Unlike Good Debt, which generally refers to borrowing that supports growth and asset acquisition, Impact-Weighted Debt provides a nuanced framework for measuring how debt financing contributes to or detracts from long-term societal and environmental goals.

ESG-Linked Debt

ESG-linked debt integrates environmental, social, and governance criteria into financial obligations, promoting sustainable corporate practices while potentially lowering borrowing costs through performance-based incentives, contrasting traditional good debt which primarily supports growth and capital efficiency. This impact debt framework enhances transparency and accountability, aligning debt servicing with measurable positive societal or environmental outcomes, thereby redefining risk assessment in debt analysis.

Value-Add Debt

Value-add debt strategically finances property improvements that increase asset value and generate higher cash flow, enhancing long-term returns for investors. Unlike impact debt, which prioritizes social or environmental outcomes, value-add debt concentrates on maximizing financial performance through leveraged property upgrades.

Purpose-Driven Borrowing

Purpose-driven borrowing distinguishes good debt, which funds assets or investments with long-term value like education or property, from impact debt aimed at generating positive social or environmental outcomes. Analyzing debt through this lens helps assess whether borrowing aligns with strategic goals and sustainable financial growth.

Transformational Debt

Transformational debt, a subtype of impact debt, is strategically designed to finance projects that generate measurable social and environmental benefits alongside financial returns, distinguishing it from traditional good debt which primarily supports growth and operational efficiency. This form of debt plays a pivotal role in debt analysis by enabling investors to evaluate not only financial performance but also the long-term sustainability and positive impact of the financed initiatives.

Mission-Aligned Leverage

Mission-aligned leverage prioritizes impact debt that supports sustainable social or environmental outcomes over traditional good debt focused solely on financial returns. This strategic approach integrates debt analysis with mission-driven metrics to optimize both risk-adjusted performance and positive societal impact.

Double Bottom Line Debt

Double Bottom Line Debt strategically balances financial returns with measurable social or environmental impact, distinguishing it from traditional Good Debt which primarily seeks profit generation. This approach enables debt analysis to evaluate the dual criteria of economic sustainability and positive societal outcomes, optimizing capital allocation for impact-driven projects.

SROI Debt (Social Return on Investment Debt)

Good debt generates positive cash flow or asset value, enhancing financial stability, while impact debt, particularly SROI debt, prioritizes measurable social and environmental returns alongside financial performance. SROI debt enables investors to quantify the social impact per dollar invested, integrating social value metrics into debt analysis for more holistic decision-making.

Green Debt Premium

Green Debt Premium reflects the added value investors place on impact debt by financing environmentally sustainable projects, differentiating it from conventional good debt that primarily supports profitable ventures. Analyzing this premium highlights how impact debt offers both financial returns and measurable environmental benefits, making it crucial in comprehensive debt evaluation strategies.

Impact Alpha Borrowing

Impact Alpha Borrowing prioritizes financing initiatives that generate positive social and environmental returns alongside financial gains, distinguishing itself from traditional good debt which mainly focuses on growth and asset accumulation. This strategic approach leverages debt to drive measurable impact, enhancing portfolio resilience and aligning investor objectives with sustainable development goals.

Good debt vs impact debt for debt analysis. Infographic

moneydiff.com

moneydiff.com