A consolidation loan combines multiple debts into a single monthly payment with a fixed interest rate, often lowering overall costs and simplifying repayment. Balance transfers move high-interest credit card debt to a new card with an introductory low or 0% APR, helping reduce interest temporarily but requiring disciplined repayment before the promotional period ends. Choosing between these options depends on individual credit scores, debt amounts, and the ability to pay off balances within specific timeframes.

Table of Comparison

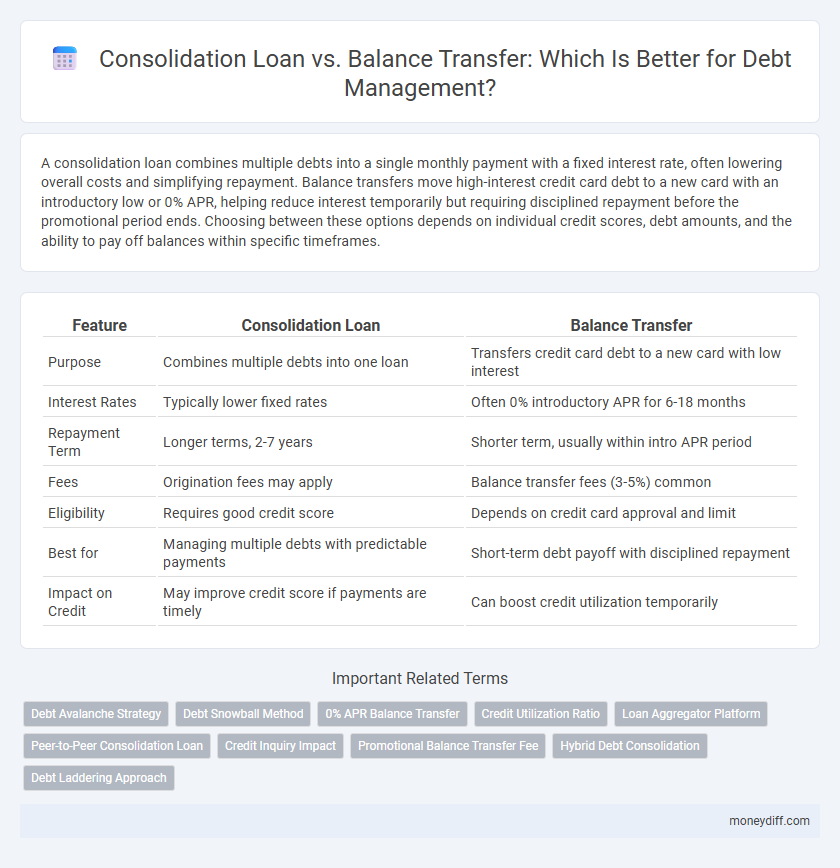

| Feature | Consolidation Loan | Balance Transfer |

|---|---|---|

| Purpose | Combines multiple debts into one loan | Transfers credit card debt to a new card with low interest |

| Interest Rates | Typically lower fixed rates | Often 0% introductory APR for 6-18 months |

| Repayment Term | Longer terms, 2-7 years | Shorter term, usually within intro APR period |

| Fees | Origination fees may apply | Balance transfer fees (3-5%) common |

| Eligibility | Requires good credit score | Depends on credit card approval and limit |

| Best for | Managing multiple debts with predictable payments | Short-term debt payoff with disciplined repayment |

| Impact on Credit | May improve credit score if payments are timely | Can boost credit utilization temporarily |

Understanding Debt Consolidation Loans

Debt consolidation loans combine multiple debts into a single loan with a fixed interest rate, simplifying monthly payments and potentially lowering overall interest costs. These loans often provide longer repayment terms compared to balance transfers, easing financial strain with predictable installments. Understanding key factors like interest rates, loan terms, and fees helps determine if a consolidation loan is more beneficial than a balance transfer for effective debt management.

What is a Balance Transfer?

A balance transfer involves moving existing credit card debt to a new card with a lower interest rate, typically offering a 0% introductory APR for a set period. This strategy helps reduce interest payments, making it easier to pay down the principal faster. Balance transfers often come with fees, usually 3-5% of the transferred amount, which should be factored into overall savings.

Key Differences Between Consolidation Loans and Balance Transfers

Consolidation loans combine multiple debts into a single loan with a fixed interest rate and repayment term, offering predictable monthly payments and potential credit score improvement. Balance transfers involve moving credit card balances to a new card with a lower or 0% introductory APR, which can reduce interest costs but require disciplined repayment before the promotional period ends. The primary differences lie in loan structure, interest terms, eligibility criteria, and the impact on credit utilization and long-term debt payoff strategies.

Pros and Cons of Debt Consolidation Loans

Debt consolidation loans simplify multiple debt payments into a single monthly installment, often with lower interest rates compared to credit cards, enhancing budget management and credit score improvement. However, these loans may require good credit for approval and could extend repayment periods, potentially increasing total interest paid over time. Borrowers should weigh the benefit of reduced monthly payments against the risk of accumulating more debt if spending habits remain unchanged.

Pros and Cons of Balance Transfers

Balance transfers offer lower interest rates, often 0% for an introductory period, which can significantly reduce debt repayment costs and accelerate payoff timelines. However, balance transfers typically include fees ranging from 3% to 5% of the transferred amount and may have stringent credit score requirements, limiting accessibility for some borrowers. The temporary nature of the promotional rate can lead to higher interest charges once the period ends, making it crucial to pay off the balance within the introductory timeframe to avoid increased debt.

Eligibility Criteria for Consolidation Loans vs Balance Transfers

Eligibility criteria for consolidation loans typically require a stable income, good credit score, and proof of debt to be consolidated, often including a minimum credit score of 620 and income verification. Balance transfer eligibility primarily depends on credit card issuer's terms, generally favoring applicants with excellent credit scores above 700 and limited existing credit card debt. Lenders assess risk differently, with consolidation loans demanding documented financial stability, while balance transfers focus on creditworthiness and current card balances.

Interest Rates and Fees: What to Consider

Consolidation loans typically offer fixed interest rates that can be lower than credit card rates, providing predictable monthly payments and easier budgeting. Balance transfers often come with 0% introductory interest rates for a limited period but may include balance transfer fees ranging from 3% to 5% of the transferred amount. Evaluating the long-term interest costs and upfront fees is crucial to choosing the most cost-effective debt management strategy.

Impact on Credit Score: Loan vs Balance Transfer

Consolidation loans can initially cause a slight dip in credit scores due to a hard inquiry and new account opening, but timely payments can improve the score over time by reducing overall debt and improving credit mix. Balance transfers may lower credit utilization rates by moving credit card balances to a new card with a lower interest rate, often boosting credit scores if balances are paid down aggressively. However, the impact varies depending on factors such as credit limits on the new balance transfer card and the borrower's ability to avoid accumulating new debt.

Which Option Suits Your Financial Situation?

Choosing between a consolidation loan and a balance transfer depends on your debt amount, credit score, and repayment timeline. A consolidation loan offers a single monthly payment and can lower interest rates for large or multiple debts, while balance transfers typically provide 0% APR for a limited period, ideal for paying off smaller credit card balances quickly. Assess your ability to pay within promotional periods and compare fees to determine the most cost-effective strategy for managing your debt efficiently.

Choosing the Right Debt Management Strategy

Choosing the right debt management strategy depends on factors like interest rates and repayment terms. Consolidation loans combine multiple debts into a single payment, often with lower interest rates and a fixed repayment schedule, while balance transfers move high-interest credit card debt to a card with a lower or 0% introductory rate. Evaluating credit score, total debt amount, and potential fees is crucial to determine whether a consolidation loan or balance transfer better fits the financial situation for effective debt reduction.

Related Important Terms

Debt Avalanche Strategy

Consolidation loans and balance transfers both support the Debt Avalanche Strategy by enabling higher-interest debts to be paid off quickly, but consolidation loans typically offer fixed interest rates and structured payments ideal for long-term debt management. Balance transfers provide low or 0% introductory rates that accelerate repayment on high-interest credit card balances, though they often require disciplined budgeting to avoid new debt accumulation.

Debt Snowball Method

Consolidation loans streamline multiple debts into a single monthly payment, often with lower interest rates, enabling faster progress using the Debt Snowball Method by focusing on paying off the smallest debts first for psychological momentum. Balance transfers temporarily reduce interest rates on credit card debt, but the Debt Snowball Method benefits more from consolidation loans' structured repayment plan that minimizes payment confusion and accelerates debt elimination.

0% APR Balance Transfer

A 0% APR balance transfer offers a cost-effective way to consolidate high-interest credit card debt by temporarily eliminating interest charges, allowing borrowers to pay down the principal faster. In contrast, a consolidation loan typically involves fixed monthly payments and interest rates, which may be higher but provide predictable repayment terms over a longer period.

Credit Utilization Ratio

Consolidation loans often lower the credit utilization ratio by combining multiple debts into a single, lower-interest loan with a higher credit limit, improving credit score potential. Balance transfers temporarily reduce credit utilization by shifting high-interest balances to a new card with a 0% introductory APR, but must be paid off quickly to avoid increased utilization and interest charges.

Loan Aggregator Platform

Loan aggregator platforms offer tailored options for debt management by comparing consolidation loans and balance transfers, highlighting factors like interest rates, fees, and repayment terms. These platforms streamline the selection process, helping borrowers secure optimal financial solutions by aggregating offers from multiple lenders.

Peer-to-Peer Consolidation Loan

Peer-to-peer consolidation loans offer competitive interest rates by directly connecting borrowers with individual investors, providing an alternative to traditional balance transfers that typically have promotional APRs and limited duration. These loans enable borrowers to combine multiple debts into a single repayment plan, often resulting in lower monthly payments and simplified debt management compared to balance transfer credit cards with high post-promotion interest rates.

Credit Inquiry Impact

Consolidation loans typically involve a single credit inquiry that may cause a minor, temporary dip in credit scores, whereas balance transfers often trigger a hard inquiry that can temporarily lower credit ratings but might be less impactful if managed properly. Both methods can improve debt management, but understanding the credit inquiry impact helps in choosing the optimal strategy to minimize score fluctuations.

Promotional Balance Transfer Fee

Promotional balance transfer fees often offer 0% APR for an introductory period, making them ideal for short-term debt repayment without accruing interest, whereas consolidation loans typically charge fixed fees and interest rates designed for long-term debt management. Choosing a promotional balance transfer can significantly reduce costs during the promotional period, but careful attention to post-promotion rates and fees is crucial to avoid increased debt burden.

Hybrid Debt Consolidation

Hybrid Debt Consolidation combines the benefits of consolidation loans and balance transfers by allowing borrowers to merge multiple debts into a single payment while leveraging low-interest balance transfer offers to reduce overall interest costs. This approach optimizes cash flow management and accelerates debt repayment by minimizing interest accrual and simplifying monthly obligations.

Debt Laddering Approach

The Debt Laddering Approach leverages consolidation loans by structuring multiple debts into a single payment plan with varying interest rates and terms, enhancing repayment efficiency and reducing total interest paid. Balance transfers offer a short-term interest-free period, ideal for prioritizing high-interest credit card debts within the ladder, but require disciplined payments to avoid accruing higher rates after the promotional period.

Consolidation loan vs balance transfer for debt management. Infographic

moneydiff.com

moneydiff.com