Legacy debt settlement often involves lengthy negotiations with creditors, resulting in slower resolution and potentially higher fees. AI-powered debt negotiation leverages advanced algorithms to analyze financial data and craft personalized repayment plans, offering faster, more efficient debt relief. This technological approach enhances accuracy and increases the likelihood of favorable outcomes compared to traditional methods.

Table of Comparison

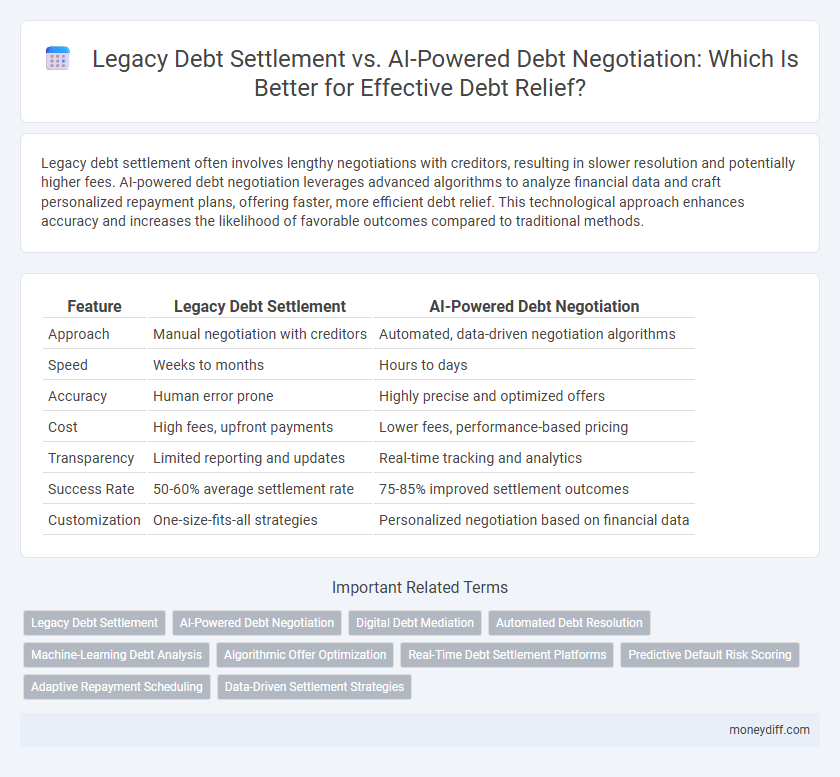

| Feature | Legacy Debt Settlement | AI-Powered Debt Negotiation |

|---|---|---|

| Approach | Manual negotiation with creditors | Automated, data-driven negotiation algorithms |

| Speed | Weeks to months | Hours to days |

| Accuracy | Human error prone | Highly precise and optimized offers |

| Cost | High fees, upfront payments | Lower fees, performance-based pricing |

| Transparency | Limited reporting and updates | Real-time tracking and analytics |

| Success Rate | 50-60% average settlement rate | 75-85% improved settlement outcomes |

| Customization | One-size-fits-all strategies | Personalized negotiation based on financial data |

Understanding Legacy Debt Settlement Approaches

Legacy debt settlement approaches rely heavily on manual negotiation processes, often involving direct communication between debtors and creditors or third-party debt settlement companies. These traditional methods can result in extended negotiation timelines and inconsistent outcomes due to human error and limited data analysis capabilities. Contrastingly, AI-powered debt negotiation leverages advanced algorithms and machine learning to optimize settlement offers, predict creditor responses, and accelerate resolution efficiently.

The Rise of AI-Powered Debt Negotiation Tools

AI-powered debt negotiation tools leverage advanced algorithms and machine learning to analyze debt profiles and create personalized settlement strategies, improving success rates compared to legacy debt settlement methods. These tools offer real-time data processing and automated communications, reducing human error and accelerating the negotiation process. AI-driven platforms also provide scalable solutions that adapt to evolving financial regulations and debtor behaviors, setting a new standard in debt relief services.

Key Differences: Manual vs. Automated Debt Negotiation

Legacy debt settlement relies on manual negotiation processes where agents contact creditors directly, often resulting in slower resolutions and inconsistent outcomes. AI-powered debt negotiation automates data analysis and communication, enabling faster, more accurate settlement offers tailored to individual financial situations. This automation enhances efficiency, reduces human error, and increases the likelihood of favorable debt relief agreements.

Cost Comparison: Traditional Settlement vs. AI Solutions

Traditional legacy debt settlement often incurs high fees and prolonged negotiation periods, leading to increased overall costs for borrowers. AI-powered debt negotiation platforms reduce expenses by automating analysis and offering instant, data-driven repayment options, enhancing affordability and efficiency. Cost comparisons reveal AI solutions can lower debtor costs by up to 30% compared to conventional settlement services.

Speed and Efficiency in Resolving Debt

Legacy debt settlement methods often involve prolonged negotiations, manual paperwork, and extended waiting periods, leading to slower debt resolution. AI-powered debt negotiation leverages machine learning algorithms and real-time data analysis to quickly identify optimal repayment options, significantly reducing resolution time. This technological approach enhances efficiency by automating communication and decision-making processes, resulting in faster, more effective debt relief outcomes.

Personalization: Human Touch or Algorithmic Precision?

Legacy debt settlement relies on personalized human interactions to understand individual financial situations, offering tailored solutions based on empathy and nuanced judgment. AI-powered debt negotiation leverages algorithmic precision, analyzing vast data sets to optimize repayment plans quickly and objectively for maximum debt relief efficiency. The choice between human touch and AI algorithms impacts the customization and responsiveness of debt relief strategies.

Transparency and Trust in Debt Relief Processes

Legacy debt settlement methods often lack transparency, leading to mistrust due to opaque fee structures and unclear negotiation outcomes. AI-powered debt negotiation platforms enhance transparency by providing real-time updates and data-driven insights, fostering greater trust between debtors and service providers. These advanced technologies enable more accurate, impartial assessments, improving accountability and consumer confidence in the debt relief process.

Success Rates: Which Method Delivers Better Outcomes?

Legacy debt settlement methods often yield success rates between 40-60%, largely depending on creditor cooperation and debtor financial stability. AI-powered debt negotiation leverages data analytics and machine learning algorithms to optimize settlement offers, resulting in success rates exceeding 70%. Enhanced predictive modeling and real-time decision-making in AI systems contribute significantly to better debt relief outcomes compared to traditional approaches.

Consumer Experience: Simplicity, Support, and Satisfaction

Legacy debt settlement often involves lengthy paperwork and limited customer support, leading to frustration and prolonged stress for consumers. AI-powered debt negotiation streamlines communication through automated, personalized interactions, providing clear guidance and real-time updates that enhance user satisfaction. Consumers benefit from a simplified process with continuous support, resulting in faster resolutions and improved overall debt relief experiences.

Future Trends: The Evolving Landscape of Debt Management

Legacy debt settlement relies on traditional negotiation tactics and manual processes, often resulting in prolonged resolution times and variable success rates. AI-powered debt negotiation leverages machine learning algorithms and real-time data analysis to optimize settlement offers, predict creditor behavior, and accelerate debt relief outcomes. Future trends indicate a growing shift towards AI-driven platforms that enhance efficiency, personalize strategies, and improve overall debt management effectiveness.

Related Important Terms

Legacy Debt Settlement

Legacy debt settlement relies on manual negotiation between debtors and creditors, often resulting in longer resolution times and less personalized repayment plans. Traditional methods typically involve fixed settlements that may not leverage real-time financial data or predictive analytics, limiting optimized debt relief outcomes.

AI-Powered Debt Negotiation

AI-powered debt negotiation leverages machine learning algorithms and real-time financial data to offer personalized debt relief solutions, improving negotiation outcomes and reducing settlement time compared to traditional legacy debt settlement methods. By automating offer generation and continuously analyzing creditor behavior, AI platforms maximize repayment efficiency and lower overall debt burden more effectively.

Digital Debt Mediation

Digital debt mediation leverages AI-powered debt negotiation to analyze financial data, personalize repayment plans, and facilitate real-time communication between creditors and debtors, enhancing efficiency and success rates compared to traditional legacy debt settlement methods. This AI-driven approach reduces human error, accelerates resolution times, and optimizes debt relief outcomes by utilizing advanced algorithms and machine learning techniques.

Automated Debt Resolution

Legacy debt settlement often involves manual processes and prolonged negotiation periods, whereas AI-powered debt negotiation leverages machine learning algorithms to analyze debtor profiles and optimize settlement offers rapidly. Automated Debt Resolution significantly reduces processing time, enhances accuracy in assessing creditor terms, and improves overall debt relief outcomes by utilizing data-driven strategies.

Machine-Learning Debt Analysis

Machine-learning debt analysis enhances AI-powered debt negotiation by accurately predicting repayment capabilities and personalized settlement strategies, outperforming legacy debt settlement methods that rely on static, rule-based approaches. This dynamic analysis improves debt relief outcomes through real-time data processing and adaptive negotiation tactics, reducing default rates and optimizing creditor recovery.

Algorithmic Offer Optimization

Legacy debt settlement relies on static, generic offers that often fail to maximize creditor concessions, whereas AI-powered debt negotiation utilizes algorithmic offer optimization to analyze vast financial data and predict acceptance probabilities, resulting in personalized settlement proposals that improve debt relief outcomes. Algorithmic models continuously adapt to market trends and creditor behavior, enhancing negotiation precision and increasing the likelihood of favorable debt reductions.

Real-Time Debt Settlement Platforms

Real-time debt settlement platforms leverage AI algorithms to analyze debtor profiles and creditor behaviors, enabling dynamic and personalized negotiation strategies that adjust instantly to market conditions. These AI-powered systems significantly outperform legacy debt settlement methods by increasing settlement success rates and reducing overall debt resolution timelines through continuous data-driven optimizations.

Predictive Default Risk Scoring

Legacy debt settlement relies on historical payment data and broad credit scores, often resulting in generic settlement offers with limited accuracy in assessing individual risk. AI-powered debt negotiation utilizes predictive default risk scoring by analyzing real-time financial behavior and multiple data points, enabling personalized debt relief strategies with higher success rates and optimized repayment plans.

Adaptive Repayment Scheduling

Legacy debt settlement often relies on fixed repayment plans that struggle to accommodate fluctuating income, leading to higher default rates. AI-powered debt negotiation leverages adaptive repayment scheduling by analyzing real-time financial data to customize payments dynamically, improving affordability and accelerating debt relief.

Data-Driven Settlement Strategies

Legacy debt settlement relies on historical negotiation tactics and fixed settlement offers that often overlook personalized debtor profiles, whereas AI-powered debt negotiation utilizes advanced algorithms and machine learning to analyze real-time financial data and optimize settlement terms. Data-driven settlement strategies enable tailored debt relief plans by assessing payment behavior, credit scores, and negotiation patterns to maximize settlement efficiency and minimize outstanding balances.

Legacy debt settlement vs AI-powered debt negotiation for debt relief. Infographic

moneydiff.com

moneydiff.com