Mortgage loans provide full ownership of a home through a loan that is repaid with interest over time, offering clear repayment schedules and potential tax benefits. Shared equity agreements involve sharing the property's ownership and future appreciation with an investor, reducing upfront costs but requiring profit sharing upon sale. Choosing between mortgage and shared equity financing depends on financial stability, risk tolerance, and long-term homeownership goals.

Table of Comparison

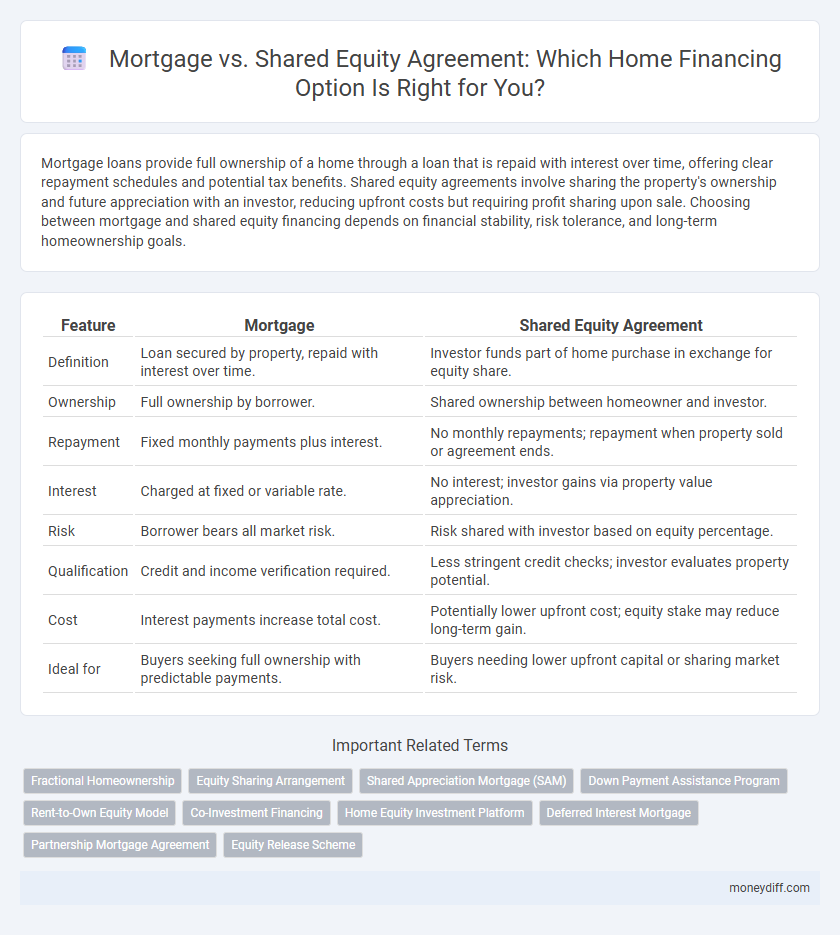

| Feature | Mortgage | Shared Equity Agreement |

|---|---|---|

| Definition | Loan secured by property, repaid with interest over time. | Investor funds part of home purchase in exchange for equity share. |

| Ownership | Full ownership by borrower. | Shared ownership between homeowner and investor. |

| Repayment | Fixed monthly payments plus interest. | No monthly repayments; repayment when property sold or agreement ends. |

| Interest | Charged at fixed or variable rate. | No interest; investor gains via property value appreciation. |

| Risk | Borrower bears all market risk. | Risk shared with investor based on equity percentage. |

| Qualification | Credit and income verification required. | Less stringent credit checks; investor evaluates property potential. |

| Cost | Interest payments increase total cost. | Potentially lower upfront cost; equity stake may reduce long-term gain. |

| Ideal for | Buyers seeking full ownership with predictable payments. | Buyers needing lower upfront capital or sharing market risk. |

Understanding Mortgage and Shared Equity Agreements

A mortgage is a loan secured by real estate, requiring monthly payments of principal and interest over a set term until fully repaid, while a shared equity agreement involves a partnership where an investor provides capital in exchange for a percentage of the property's future appreciation or depreciation. Mortgage agreements obligate borrowers to maintain full responsibility for repayments and property ownership, whereas shared equity agreements often reduce upfront costs and monthly payments but share both risks and gains. Understanding these financing options helps homeowners balance control, affordability, and long-term financial commitments.

Key Differences Between Mortgages and Shared Equity

Mortgages involve borrowing a specific loan amount secured by the property, requiring regular principal and interest repayments until full repayment. Shared equity agreements entail partnering with an investor who provides part of the home's purchase price in exchange for a percentage of future property appreciation or equity. While mortgages place sole responsibility for repayments and ownership on the borrower, shared equity arrangements split financial risk and potential profits between homeowner and investor.

Eligibility Criteria for Mortgages vs Shared Equity

Mortgage eligibility criteria primarily focus on credit score, debt-to-income ratio, employment stability, and down payment amount, ensuring borrowers can manage full loan repayments independently. Shared equity agreements require homeowners to qualify based on property value, equity availability, and often income limits or first-time buyer status, as the financing partner acquires a stake in the home's equity. Lenders assess creditworthiness for mortgages, while shared equity providers evaluate both financial eligibility and willingness to share future property appreciation.

Upfront Costs: Comparing Mortgage and Shared Equity

Mortgage upfront costs typically include down payment, appraisal fees, and loan origination charges, often amounting to 3-6% of the home's purchase price. Shared equity agreements require lower initial cash outlay since investors cover a portion of the purchase price, reducing the buyer's upfront expenses significantly. Evaluating these costs helps homebuyers decide between traditional mortgage financing and shared equity arrangements based on their immediate financial capacity.

Monthly Payments: How Each Option Affects Cash Flow

Mortgage monthly payments consist of principal and interest, typically resulting in higher fixed outflows that can impact monthly cash flow stability. Shared equity agreements generally require lower initial monthly payments since a portion of the home's equity is sold to an investor, reducing immediate financial burden. This arrangement can improve short-term cash flow but may affect long-term equity gains and result in profit sharing upon sale.

Long-Term Financial Impact: Mortgage vs Shared Equity

A traditional mortgage involves fixed monthly payments and accumulating equity over time, often leading to full home ownership and potential property appreciation benefits. Shared equity agreements reduce upfront costs but require sharing future home value gains with the investor, potentially limiting long-term profit from property appreciation. Evaluating the long-term financial impact depends on factors like market appreciation rates, interest costs, and the investor's share percentage in shared equity arrangements.

Homeownership Rights and Responsibilities

Mortgage agreements grant full ownership rights and responsibilities to the homeowner, including the obligation to repay the loan with interest and maintain the property. Shared equity agreements involve co-ownership structures where both the homeowner and investor share equity, responsibilities for property upkeep, and the financial risks upon sale. Understanding the legal implications of ownership percentage and decision-making authority is crucial in choosing between these financing options.

Pros and Cons of Traditional Mortgages

Traditional mortgages offer predictable monthly payments and full ownership of the property, allowing homeowners to build equity over time through principal repayment. However, they typically require a substantial down payment and stringent credit qualifications, which can limit accessibility for some buyers. Borrowers also bear the full risk of property depreciation and interest rate fluctuations if opting for adjustable-rate mortgages.

Pros and Cons of Shared Equity Agreements

Shared equity agreements offer homeowners lower upfront costs and shared financial risk, making homeownership more accessible. However, these agreements often result in shared property appreciation, reducing potential profits upon sale. Limited control over the property and potential complexities in agreement terms are additional disadvantages buyers should consider.

Choosing the Right Home Financing Strategy for You

Mortgage loans provide full home ownership with fixed or variable interest rates, offering stability and long-term equity accumulation, while shared equity agreements involve partnering with an investor who shares property ownership and profits, reducing upfront costs and monthly payments. Assess your financial situation, risk tolerance, and future plans to determine if full control through a mortgage or shared equity with lower initial expenses aligns better with your goals. Consider credit scores, income stability, and market conditions to choose between a traditional mortgage and a shared equity agreement for optimal home financing.

Related Important Terms

Fractional Homeownership

Fractional homeownership through shared equity agreements allows multiple investors to purchase a percentage of a property, reducing mortgage debt and monthly payments compared to traditional mortgage financing. This model offers flexible repayment structures and potential equity growth without the borrower assuming full loan responsibility, appealing to homeowners seeking lower upfront costs and shared financial risk.

Equity Sharing Arrangement

Equity sharing arrangements in home financing allow multiple parties to share ownership and the associated equity appreciation of a property, reducing the initial financial burden on buyers compared to traditional mortgage loans. This structure provides flexibility by enabling co-investors, such as family members or firms, to participate in the property's future value growth without incurring mortgage interest costs.

Shared Appreciation Mortgage (SAM)

A Shared Appreciation Mortgage (SAM) enables homeowners to secure financing by sharing future property appreciation with the lender, reducing initial monthly payments compared to traditional mortgages. This arrangement aligns the lender's return with the home's market performance, often benefiting buyers who anticipate significant property value growth.

Down Payment Assistance Program

Mortgage loans require borrowers to provide a substantial down payment, often ranging from 5% to 20%, which can be challenging for first-time homebuyers. Shared equity agreements offer down payment assistance by allowing investors to share ownership in exchange for a percentage of future home appreciation, reducing upfront cash requirements and increasing affordability.

Rent-to-Own Equity Model

The Rent-to-Own Equity Model offers a hybrid approach to home financing where tenants rent a property with an option to purchase, gradually building equity through monthly payments that partially apply toward the eventual down payment. Unlike traditional mortgages, this model reduces upfront debt burden and provides flexibility in homeownership, often benefiting buyers with limited credit or savings.

Co-Investment Financing

Co-investment financing through shared equity agreements allows homebuyers to reduce initial mortgage debt by partnering with investors who share property equity, minimizing monthly loan payments and interest accumulation. This arrangement contrasts with traditional mortgages where borrowers assume full loan responsibility, often facing higher debt levels and stricter qualification criteria.

Home Equity Investment Platform

Mortgage loans require borrowers to repay principal and interest over a fixed term, leveraging traditional debt financing through banks or lenders. Shared equity agreements on home equity investment platforms provide homeowners with capital in exchange for a percentage of future home appreciation, eliminating monthly payments but sharing potential profits or losses.

Deferred Interest Mortgage

A Deferred Interest Mortgage allows borrowers to postpone interest payments, reducing monthly expenses initially but accumulating interest over time, potentially increasing the total loan cost. In contrast, Shared Equity Agreements involve investors providing home financing in exchange for a percentage of the property's future value, eliminating monthly interest but sharing appreciation risks and rewards.

Partnership Mortgage Agreement

A Partnership Mortgage Agreement combines elements of traditional mortgage financing with shared equity, allowing homeowners to partner with investors who provide capital in exchange for a percentage of the property's future appreciation. This model reduces the borrower's initial debt burden and monthly payments while aligning financial interests through equity participation.

Equity Release Scheme

Mortgage financing involves borrowing a fixed amount against property value, requiring regular repayments with interest, whereas a Shared Equity Agreement under an Equity Release Scheme allows homeowners to access funds by selling a portion of their property's equity without monthly repayments. The Equity Release Scheme is particularly beneficial for aging homeowners seeking to unlock home value while retaining residency, although it reduces future inheritance due to shared ownership with the financing company.

Mortgage vs Shared equity agreement for home financing Infographic

moneydiff.com

moneydiff.com