Good debt, such as mortgages or student loans, can enhance financial health by building assets and increasing earning potential, while bad debt, like high-interest credit card balances, often drains resources and hinders wealth accumulation. Prioritizing the repayment of bad debt reduces financial stress and improves credit scores, enabling better borrowing terms in the future. Managing debt wisely ensures long-term financial stability and supports overall economic well-being.

Table of Comparison

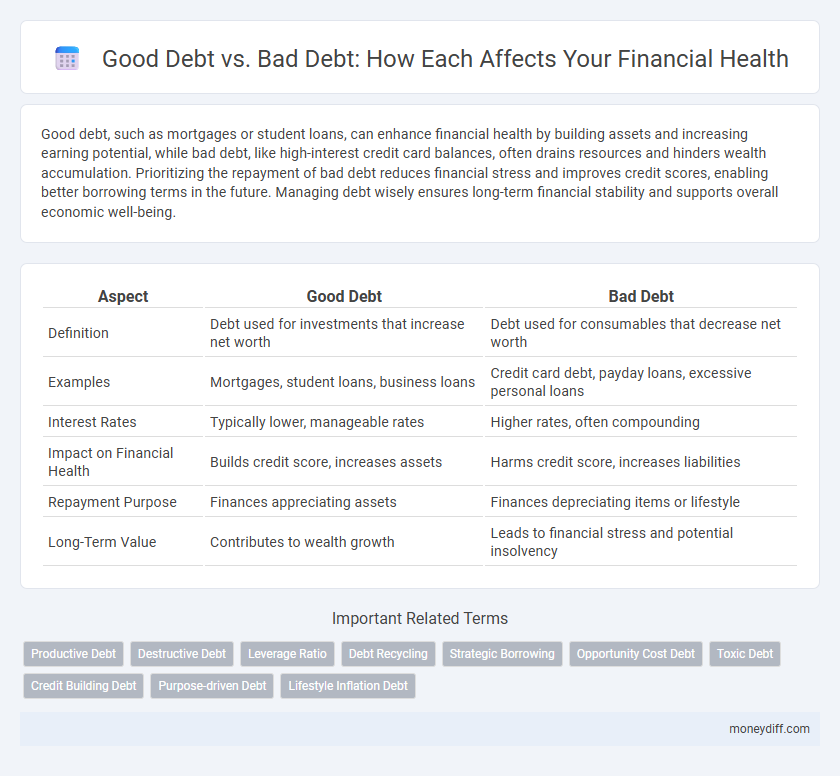

| Aspect | Good Debt | Bad Debt |

|---|---|---|

| Definition | Debt used for investments that increase net worth | Debt used for consumables that decrease net worth |

| Examples | Mortgages, student loans, business loans | Credit card debt, payday loans, excessive personal loans |

| Interest Rates | Typically lower, manageable rates | Higher rates, often compounding |

| Impact on Financial Health | Builds credit score, increases assets | Harms credit score, increases liabilities |

| Repayment Purpose | Finances appreciating assets | Finances depreciating items or lifestyle |

| Long-Term Value | Contributes to wealth growth | Leads to financial stress and potential insolvency |

Understanding the Concept of Good Debt vs Bad Debt

Good debt involves borrowing that contributes to building wealth or improving financial stability, such as student loans or mortgages, which typically have lower interest rates and potential tax benefits. In contrast, bad debt arises from high-interest borrowing for depreciating assets or non-essential expenses, leading to financial strain and decreased creditworthiness. Understanding these distinctions helps individuals make strategic decisions that enhance long-term financial health and avoid the pitfalls of excessive or irresponsible borrowing.

Key Differences Between Good Debt and Bad Debt

Good debt typically includes investments like mortgages or student loans that enhance financial stability and generate future income, while bad debt involves high-interest consumer credit such as credit card balances that do not produce long-term value. Key differences lie in the purpose, interest rates, and impact on net worth; good debt usually has lower interest rates and contributes to asset growth, whereas bad debt incurs high costs and depletes financial resources. Managing these differences is crucial for maintaining healthy cash flow and building sustainable wealth.

Examples of Good Debt That Build Wealth

Good debt types, such as student loans for higher education, mortgages for real estate investment, and business loans that fund income-generating ventures, contribute positively to long-term financial health by building assets and increasing earning potential. These debts typically have lower interest rates and the potential to appreciate or create cash flow, which enhances net worth over time. In contrast, consumer debt used for depreciating assets or immediate consumption rarely contributes to wealth accumulation and can undermine financial stability.

Common Types of Bad Debt to Avoid

High-interest credit card balances, payday loans, and unsecured personal loans are common types of bad debt that can severely damage financial health due to their exorbitant interest rates and unfavorable repayment terms. Auto loans with negative equity and excessive student loans without a clear return on investment also contribute to financial strain by limiting cash flow and increasing long-term liabilities. Avoiding these bad debts helps maintain healthy credit scores and ensures sustainable financial growth.

How Good Debt Can Improve Your Financial Health

Good debt, such as student loans or mortgages, can enhance financial health by building assets and increasing future earning potential. Investing in education or property often leads to better financial stability and wealth accumulation over time. Proper management of good debt improves credit scores and provides access to lower interest rates, facilitating further financial growth.

The Risks of Relying on Bad Debt

Relying on bad debt, such as high-interest credit cards or payday loans, increases financial vulnerability by escalating debt burdens and reducing cash flow flexibility. This type of debt often leads to higher default risks and damaged credit scores, impairing long-term financial stability. Managing bad debt is crucial to avoid spiraling interest expenses and maintain healthy creditworthiness.

Tips for Managing Good Debt Responsibly

Maintaining financial health involves managing good debt, such as mortgages or student loans, by making timely payments and avoiding excessive borrowing that strains budget limits. Prioritize debts with lower interest rates and invest borrowed funds in assets that appreciate or generate income, ensuring debt contributes to net worth growth. Regularly reviewing debt terms and refinancing when possible can reduce costs and improve cash flow, promoting sustainable financial stability.

Strategies to Eliminate Bad Debt Efficiently

Prioritize paying off high-interest bad debt such as credit cards and payday loans first to reduce financial strain and improve credit scores. Implement a debt snowball or avalanche method to systematically target smaller balances or highest interest rates, accelerating debt elimination. Consolidating bad debts into a lower-interest loan can streamline payments and reduce overall interest costs, enhancing financial health.

The Long-Term Impact of Debt Choices on Net Worth

Good debt, such as mortgages or student loans, often contributes to building long-term net worth by increasing asset value or enhancing earning potential. Bad debt, including high-interest credit card balances or payday loans, typically diminishes net worth due to escalating interest costs and limited value appreciation. Making informed debt choices influences financial health by balancing leverage for growth against the risk of capital erosion over time.

Making Smart Debt Decisions for a Stronger Financial Future

Good debt, such as mortgages and student loans, can build credit and increase net worth by financing assets or education with long-term benefits, while bad debt from high-interest credit cards or payday loans depletes financial resources and hampers wealth accumulation. Prioritizing low-interest, purpose-driven borrowing improves cash flow management and supports investment in appreciating assets, thus enhancing financial stability. Smart debt decisions involve evaluating interest rates, repayment terms, and the potential return on investment to ensure debts contribute positively to overall financial health.

Related Important Terms

Productive Debt

Productive debt, often classified as good debt, includes loans or credit used to invest in assets that generate income or appreciate over time, such as education, real estate, or business expansion. This type of debt enhances financial health by boosting earning potential and building wealth, contrasting with bad debt, which typically funds depreciating assets or consumption and can lead to financial strain.

Destructive Debt

Destructive debt, characterized by high-interest rates and unsecured loans, undermines financial health by increasing the risk of default and reducing creditworthiness. Unlike good debt that fosters asset growth or income generation, destructive debt traps individuals in a cycle of repayment that hampers long-term financial stability.

Leverage Ratio

Good debt, such as mortgages or student loans, can improve financial health by increasing assets and enhancing the leverage ratio, which measures the proportion of debt relative to equity. Bad debt, often from high-interest credit cards or payday loans, negatively impacts the leverage ratio by inflating liabilities without generating asset growth, leading to poor financial stability.

Debt Recycling

Debt recycling leverages good debt by converting non-deductible consumer debt into tax-deductible investment debt, enhancing cash flow and accelerating wealth building. This strategy improves financial health by using investment returns to pay down bad debt while growing assets through disciplined repayment and reinvestment.

Strategic Borrowing

Strategic borrowing distinguishes good debt, such as low-interest loans used for investments in education or property, from bad debt characterized by high-interest consumer credit that hampers financial health. Prioritizing good debt enhances asset growth and creditworthiness, while avoiding bad debt prevents cash flow constraints and long-term financial stress.

Opportunity Cost Debt

Opportunity cost debt impacts financial health by diverting funds from potential investments with higher returns to debt repayment, often categorized as bad debt when the cost of borrowing exceeds the benefits gained. Good debt typically includes low-interest loans that finance assets likely to appreciate or generate income, minimizing opportunity costs and supporting long-term wealth building.

Toxic Debt

Toxic debt, characterized by high-interest rates and unmanageable repayment terms, undermines financial health by trapping individuals in a cycle of escalating obligations and diminishing creditworthiness. Unlike good debt, which can build assets or improve cash flow, toxic debt exacerbates financial instability and limits opportunities for wealth accumulation.

Credit Building Debt

Credit building debt, such as responsibly managed credit card balances or student loans, can improve credit scores by demonstrating timely payments and diverse credit usage. Unlike bad debt, which often carries high interest and minimal long-term value, good debt enhances financial health by increasing borrowing capacity and lowering future loan costs.

Purpose-driven Debt

Purpose-driven debt, such as student loans or mortgages, typically enhances financial health by investing in long-term assets that generate value or income. In contrast, bad debt usually involves high-interest consumer loans or credit card debt used for non-essential spending, which can hinder financial stability and growth.

Lifestyle Inflation Debt

Good debt, such as low-interest mortgages or education loans, can build financial assets and improve long-term wealth, while bad debt, often fueled by lifestyle inflation like high-interest credit card balances from unnecessary spending, erodes net worth and hampers financial health. Managing lifestyle inflation by prioritizing essential expenses and avoiding consumer debt traps helps maintain sustainable financial stability and prevents the accumulation of detrimental bad debt.

Good debt vs Bad debt for financial health Infographic

moneydiff.com

moneydiff.com