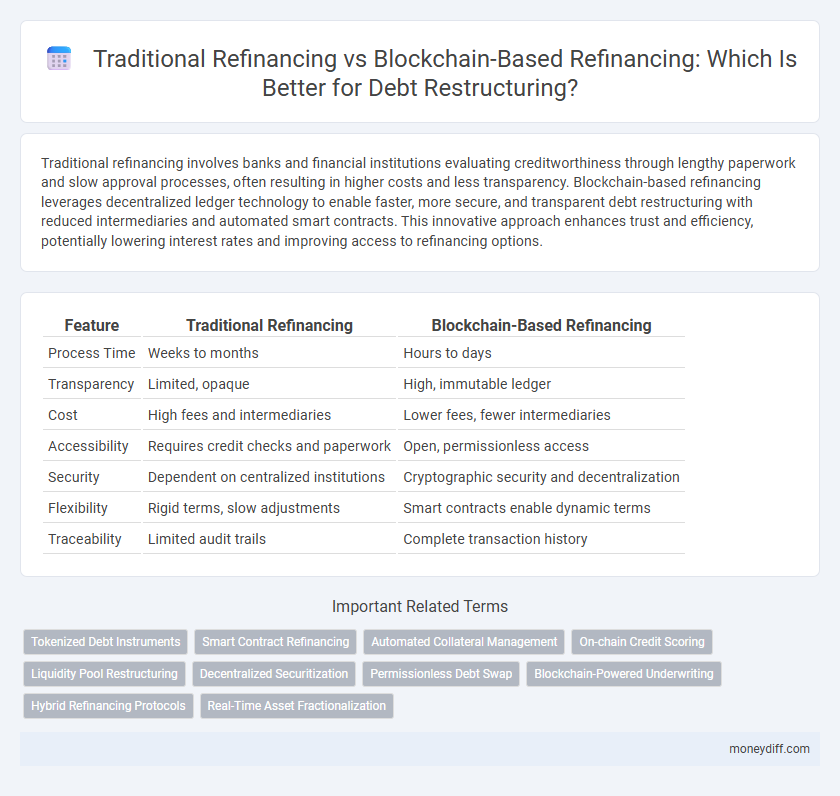

Traditional refinancing involves banks and financial institutions evaluating creditworthiness through lengthy paperwork and slow approval processes, often resulting in higher costs and less transparency. Blockchain-based refinancing leverages decentralized ledger technology to enable faster, more secure, and transparent debt restructuring with reduced intermediaries and automated smart contracts. This innovative approach enhances trust and efficiency, potentially lowering interest rates and improving access to refinancing options.

Table of Comparison

| Feature | Traditional Refinancing | Blockchain-Based Refinancing |

|---|---|---|

| Process Time | Weeks to months | Hours to days |

| Transparency | Limited, opaque | High, immutable ledger |

| Cost | High fees and intermediaries | Lower fees, fewer intermediaries |

| Accessibility | Requires credit checks and paperwork | Open, permissionless access |

| Security | Dependent on centralized institutions | Cryptographic security and decentralization |

| Flexibility | Rigid terms, slow adjustments | Smart contracts enable dynamic terms |

| Traceability | Limited audit trails | Complete transaction history |

Understanding Traditional Debt Refinancing

Traditional debt refinancing involves replacing existing debt with new loans that offer better terms, typically through banks or financial institutions with credit checks and lengthy approval processes. This method often requires extensive documentation, higher fees, and longer timelines, making it less accessible for some borrowers. Understanding these limitations highlights the potential efficiency gains offered by blockchain-based refinancing alternatives.

Blockchain-Based Refinancing: An Overview

Blockchain-based refinancing leverages decentralized ledger technology to increase transparency and reduce costs in debt restructuring, enabling secure peer-to-peer transactions without intermediaries. Smart contracts automate repayment schedules and enforce loan terms, minimizing the risk of default and delays. This innovation enhances efficiency by providing real-time access to immutable financial records, streamlining creditor-borrower interactions in the refinancing process.

Key Differences Between Traditional and Blockchain Approaches

Traditional refinancing for debt restructuring typically involves intermediaries such as banks and financial institutions, resulting in longer processing times and higher transaction costs. Blockchain-based refinancing leverages decentralized ledger technology to enable real-time settlement, increased transparency, and reduced reliance on intermediaries. Smart contracts on blockchain automatically enforce loan terms and repayment schedules, enhancing security and efficiency compared to conventional manual processes.

Costs and Fees: Traditional vs Blockchain-Based Refinancing

Traditional refinancing for debt restructuring often involves high costs, including hefty loan origination fees, underwriting charges, and third-party intermediary expenses, which can significantly increase the overall financial burden. Blockchain-based refinancing leverages decentralized platforms that reduce or eliminate intermediaries, resulting in lower transaction fees, faster processing times, and enhanced transparency. This cost efficiency makes blockchain refinancing a more attractive option for borrowers seeking to minimize expenses during debt restructuring.

Speed and Efficiency in Debt Restructuring

Traditional refinancing for debt restructuring often involves lengthy approval processes, extensive paperwork, and intermediary delays, resulting in slower turnaround times. Blockchain-based refinancing leverages smart contracts and decentralized verification, enabling near-instant transactions and automatic compliance checks that significantly enhance speed and operational efficiency. This technological innovation reduces human error and administrative overhead, expediting debt restructuring while maintaining transparency and security.

Transparency and Security: Blockchain’s Advantages

Blockchain-based refinancing offers unparalleled transparency by recording every transaction on an immutable ledger, eliminating risks of data manipulation inherent in traditional refinancing methods. Enhanced security protocols based on cryptographic algorithms protect sensitive debt restructuring information from unauthorized access and cyber threats. This decentralization fosters trust among stakeholders, streamlining debt management processes and reducing the potential for fraud.

Accessibility and Inclusivity for Borrowers

Traditional refinancing often requires extensive credit checks and rigid approval processes, limiting accessibility for many borrowers, especially those with poor credit or from underserved regions. Blockchain-based refinancing leverages decentralized finance (DeFi) platforms to enable more inclusive access by reducing intermediaries and utilizing transparent smart contracts that streamline loan approvals. This technology broadens opportunities for borrowers globally, enhancing financial inclusion through improved transparency and lower entry barriers.

Regulatory Considerations and Compliance

Traditional refinancing involves stringent regulatory frameworks enforced by financial authorities to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) standards, often resulting in lengthy approval processes. Blockchain-based refinancing leverages decentralized ledger technology to enhance transparency and real-time auditability, but faces evolving regulatory scrutiny, especially concerning data privacy laws and cross-border compliance. Both methods require rigorous adherence to local and international financial regulations, though blockchain solutions offer potential for streamlined regulatory reporting through immutable transaction records.

Risks and Challenges of Blockchain-Based Refinancing

Blockchain-based refinancing for debt restructuring faces significant risks including regulatory uncertainty, cybersecurity threats, and potential technology failures. Smart contract vulnerabilities and the lack of standardized legal frameworks amplify the complexity of enforcing debt agreements. These challenges require robust risk management strategies to ensure secure and compliant refinancing transactions on blockchain platforms.

The Future of Debt Restructuring: Hybrid and Emerging Models

Traditional refinancing relies heavily on banks and credit institutions, often involving lengthy approval processes and centralized control, which can hinder efficient debt restructuring. Blockchain-based refinancing leverages decentralized ledgers to enhance transparency, reduce intermediaries, and accelerate transaction times, offering a more streamlined and secure alternative. Emerging hybrid models integrate traditional financial systems with blockchain technology, promising increased flexibility, improved risk management, and broader access to refinancing options in the evolving debt restructuring landscape.

Related Important Terms

Tokenized Debt Instruments

Tokenized debt instruments enable blockchain-based refinancing by offering transparent, secure, and fractionalized ownership compared to traditional refinancing methods that rely on cumbersome paperwork and centralized intermediaries. This innovation reduces transaction costs, accelerates settlement times, and enhances liquidity, revolutionizing debt restructuring efficiency.

Smart Contract Refinancing

Smart Contract Refinancing leverages blockchain technology to automate debt restructuring by executing pre-defined terms securely and transparently, reducing intermediaries and minimizing errors. Traditional refinancing relies on manual processes and centralized institutions, often resulting in slower settlements and higher costs compared to efficient, trustless smart contract systems.

Automated Collateral Management

Traditional refinancing relies on manual processes for collateral management, which often leads to delays and increased operational risks. Blockchain-based refinancing leverages automated collateral management through smart contracts, ensuring real-time asset verification, reduced settlement times, and enhanced transparency in debt restructuring.

On-chain Credit Scoring

Traditional refinancing relies heavily on centralized credit scoring agencies that assess debt restructuring eligibility using historical financial data, often resulting in delays and limited transparency. Blockchain-based refinancing utilizes on-chain credit scoring, leveraging real-time transaction data and smart contracts to provide immutable, transparent, and faster credit evaluations, enhancing efficiency and democratizing access to debt restructuring.

Liquidity Pool Restructuring

Traditional refinancing for debt restructuring relies on centralized institutions and fixed terms, limiting access to diverse capital sources and often resulting in slower liquidity adjustments. Blockchain-based refinancing leverages decentralized liquidity pools, enabling real-time asset reallocation, enhanced transparency, and increased access to global investors, which significantly improves flexibility and efficiency in liquidity pool restructuring.

Decentralized Securitization

Traditional refinancing relies on centralized financial institutions and lengthy approval processes, often limiting access and increasing costs. Blockchain-based refinancing enables decentralized securitization, enhancing transparency, reducing intermediaries, and accelerating debt restructuring through smart contracts and tokenized assets.

Permissionless Debt Swap

Traditional refinancing relies on centralized institutions, lengthy approval processes, and limited transparency, often leading to higher costs and slower debt restructuring. Blockchain-based refinancing through Permissionless Debt Swap enables instant, transparent, and secure debt transfers without intermediaries, reducing costs and increasing accessibility for a global pool of investors.

Blockchain-Powered Underwriting

Blockchain-powered underwriting enhances debt restructuring by providing transparent, real-time verification of borrower creditworthiness and asset collateral through immutable ledgers, reducing fraud risks and due diligence costs. Traditional refinancing relies on centralized credit assessments and slower manual processes, often lacking the efficiency and security benefits offered by decentralized blockchain technology.

Hybrid Refinancing Protocols

Hybrid refinancing protocols combine traditional debt restructuring methods with blockchain technology to enhance transparency, reduce transaction times, and lower costs. These protocols enable secure, decentralized verification of loan terms while maintaining regulatory compliance, facilitating more efficient and flexible debt refinancing solutions.

Real-Time Asset Fractionalization

Traditional refinancing relies on lengthy, centralized processes with limited liquidity and transparency, often delaying debt restructuring outcomes. Blockchain-based refinancing leverages real-time asset fractionalization, enabling instant, transparent, and divisible ownership transfer, which enhances liquidity and accelerates debt restructuring efficiency.

Traditional refinancing vs blockchain-based refinancing for debt restructuring. Infographic

moneydiff.com

moneydiff.com