Credit card debt typically carries high interest rates and rigid repayment schedules, often leading to prolonged financial burdens for consumers. Decentralized finance (DeFi) protocol debt offers greater transparency and potentially lower interest rates by removing intermediaries, enabling more flexible and accessible borrowing options. However, DeFi borrowing involves risks such as smart contract vulnerabilities and market volatility, which consumers must carefully consider.

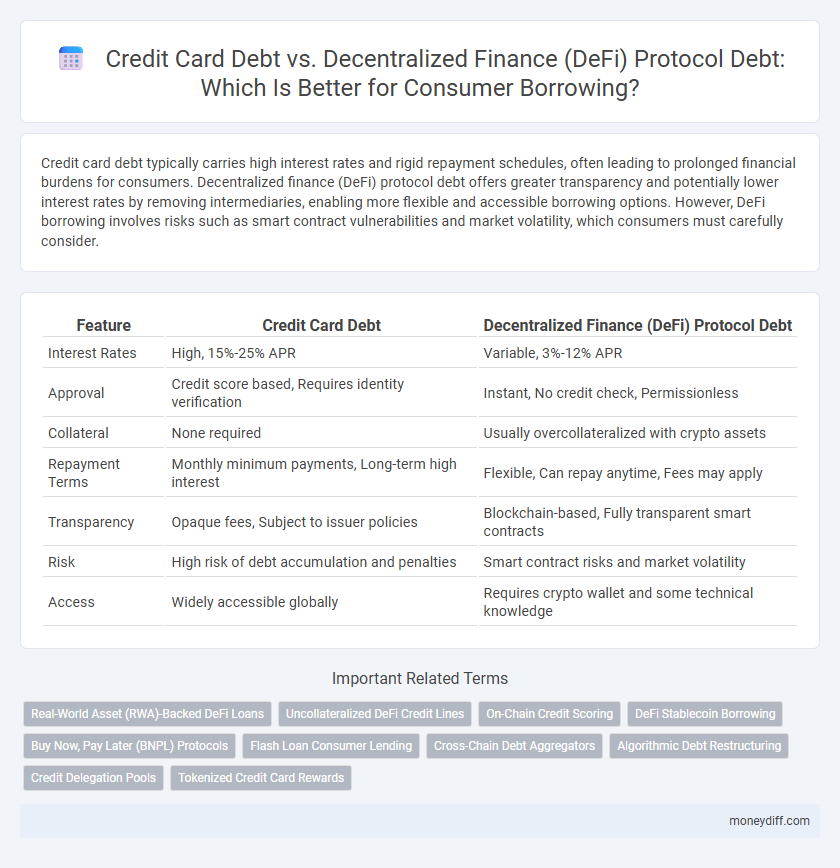

Table of Comparison

| Feature | Credit Card Debt | Decentralized Finance (DeFi) Protocol Debt |

|---|---|---|

| Interest Rates | High, 15%-25% APR | Variable, 3%-12% APR |

| Approval | Credit score based, Requires identity verification | Instant, No credit check, Permissionless |

| Collateral | None required | Usually overcollateralized with crypto assets |

| Repayment Terms | Monthly minimum payments, Long-term high interest | Flexible, Can repay anytime, Fees may apply |

| Transparency | Opaque fees, Subject to issuer policies | Blockchain-based, Fully transparent smart contracts |

| Risk | High risk of debt accumulation and penalties | Smart contract risks and market volatility |

| Access | Widely accessible globally | Requires crypto wallet and some technical knowledge |

Understanding Credit Card Debt: Basics and Implications

Credit card debt typically involves high-interest rates and revolving balances, which can lead to escalating costs and long-term financial strain for consumers. In contrast, decentralized finance (DeFi) protocol debt offers transparent, blockchain-based lending options with potentially lower interest rates and programmable terms, enhancing borrower autonomy. Understanding the implications of credit card debt highlights the risks of traditional borrowing methods compared to the innovative, yet emerging, DeFi solutions in consumer finance.

What is Decentralized Finance (DeFi) Protocol Debt?

Decentralized Finance (DeFi) protocol debt refers to borrowing funds through blockchain-based platforms without intermediaries, using smart contracts to automate loans. Unlike traditional credit card debt, DeFi loans offer transparent interest rates, instant access to liquidity, and the ability to collateralize cryptocurrencies. Consumers benefit from reduced fees and global accessibility while assuming risks like smart contract vulnerabilities and market volatility.

Interest Rates: Comparing Credit Cards and DeFi Loans

Credit card debt often carries interest rates ranging from 15% to 25%, significantly higher than typical decentralized finance (DeFi) protocol loans, which can offer rates as low as 3% to 10% depending on market conditions and collateral. DeFi loans leverage blockchain technology to provide more transparent, automated interest calculations and flexible repayment options, potentially reducing overall borrowing costs for consumers. Consumers should assess the variability and risk factors associated with DeFi interest rates compared to the fixed and often punitive rates of traditional credit cards.

Accessibility: Who Can Borrow and How?

Credit card debt is accessible to consumers with a qualified credit score and income verification, typically through traditional banks or financial institutions requiring extensive personal information. Decentralized finance (DeFi) protocol debt enables borrowing through blockchain platforms without credit checks, relying instead on digital assets as collateral, making it accessible to anyone with an internet connection and cryptocurrency holdings. This decentralized model democratizes borrowing by removing intermediaries and credit barriers, expanding financial access globally.

Credit Checks vs. Crypto Collateral: Borrowing Requirements

Credit card debt requires a thorough credit check that evaluates a consumer's credit score, income stability, and debt-to-income ratio before approval, ensuring lenders manage risk based on traditional financial history. In decentralized finance (DeFi) protocol debt, borrowing hinges on crypto collateral, allowing users to access loans without credit checks by locking digital assets in smart contracts as security. This shift eliminates reliance on credit scores, enabling broader access but introduces volatility risk tied to the fluctuating value of collateralized cryptocurrencies.

Repayment Flexibility: Traditional Cards vs. DeFi Protocols

Credit card debt typically features fixed minimum monthly payments and higher interest rates, limiting repayment flexibility for consumers. DeFi protocols often allow users to customize repayment schedules and amounts based on smart contract terms, providing greater control over debt management. This flexibility in DeFi can reduce the risk of default and improve financial planning compared to rigid traditional credit card structures.

Security and Fraud Risks in Credit Cards and DeFi Loans

Credit card debt exposes consumers to significant security risks such as data breaches and fraudulent charges due to centralized storage of sensitive information by banks and payment networks. In contrast, decentralized finance (DeFi) protocol debt offers enhanced security through blockchain's transparency and cryptographic safeguards, though it remains vulnerable to smart contract exploits and phishing scams. While credit cards provide fraud protection via chargebacks, DeFi loans lack regulatory oversight, increasing borrower risk in case of protocol vulnerabilities or platform insolvency.

Consumer Protections: Regulatory Oversight in Both Systems

Credit card debt is regulated by federal laws such as the Truth in Lending Act (TILA) and the Credit CARD Act, providing consumers with protections like clear disclosure of terms, limits on interest rate increases, and dispute resolution mechanisms. In contrast, decentralized finance (DeFi) protocol debt operates on blockchain platforms with minimal regulatory oversight, exposing borrowers to higher risks including smart contract vulnerabilities and lack of recourse in case of disputes. The absence of established consumer protections in DeFi highlights the critical need for comprehensive regulatory frameworks to ensure borrower security and transparency.

Impact on Credit Scores and Financial Health

Credit card debt typically leads to increased credit utilization ratios, directly lowering credit scores and signaling higher risk to lenders, whereas borrowing through decentralized finance (DeFi) protocols often lacks traditional credit reporting, leaving credit scores unaffected but posing risks to financial health through market volatility and smart contract vulnerabilities. The absence of credit score impact in DeFi lending may encourage borrowers to accumulate unsustainable debt levels without traditional credit limits or consumer protections. Understanding these divergent effects is crucial for managing overall financial health and creditworthiness in mixed borrowing environments.

The Future of Consumer Borrowing: Credit Cards vs. DeFi

Credit card debt remains a significant source of consumer borrowing with high interest rates and centralized control by banks, leading to less transparency and limited access for underserved populations. Decentralized finance (DeFi) protocol debt introduces a transparent, permissionless lending ecosystem powered by blockchain technology, offering lower fees, programmable smart contracts, and broader access without traditional credit checks. The future of consumer borrowing will likely shift towards DeFi platforms as they mature, providing more efficient, trustless borrowing alternatives that challenge credit card dominance.

Related Important Terms

Real-World Asset (RWA)-Backed DeFi Loans

Real-World Asset (RWA)-backed DeFi loans offer consumer borrowing an innovative alternative to traditional credit card debt by leveraging blockchain technology for transparency and reduced interest rates. Unlike credit cards, which often carry high fees and variable APRs, RWA-backed decentralized finance protocols enable users to collateralize tangible assets, providing increased security and potentially lower borrowing costs.

Uncollateralized DeFi Credit Lines

Credit card debt typically involves high-interest rates and rigid repayment terms, while uncollateralized DeFi credit lines offer consumer borrowing without requiring asset backing, leveraging smart contracts for flexible, permissionless access. Uncollateralized DeFi debt protocols reduce reliance on traditional credit scores by using on-chain transaction history and reputational scoring, potentially lowering barriers for underserved borrowers.

On-Chain Credit Scoring

On-chain credit scoring leverages blockchain transparency to provide real-time, immutable data for assessing decentralized finance (DeFi) protocol debt, offering a more accurate risk evaluation compared to traditional credit card debt. This method enables consumers to access borrowing options with personalized interest rates and limits based on their verified on-chain activity and repayment history.

DeFi Stablecoin Borrowing

DeFi stablecoin borrowing offers lower interest rates and increased transparency compared to traditional credit card debt, enabling consumers to access more affordable and flexible borrowing options through decentralized finance protocols. Unlike credit cards, DeFi platforms eliminate intermediaries and credit checks, relying on blockchain technology to secure loans and provide real-time collateral management.

Buy Now, Pay Later (BNPL) Protocols

Buy Now, Pay Later (BNPL) protocols within decentralized finance (DeFi) offer consumers an alternative to traditional credit card debt by enabling interest-free or low-interest installment payments directly through blockchain-based smart contracts. Unlike credit card debt, BNPL DeFi protocols reduce credit risk and increase transparency by eliminating intermediaries and leveraging decentralized credit scoring mechanisms.

Flash Loan Consumer Lending

Credit card debt typically involves high-interest rates and prolonged repayment schedules, while decentralized finance (DeFi) protocols, particularly through flash loan consumer lending, offer instant, permissionless borrowing without traditional credit checks but require immediate repayment within a single transaction block. Flash loan mechanisms reduce the risk of default by enforcing atomic loan execution, presenting a novel alternative to conventional consumer debt with enhanced efficiency and transparency.

Cross-Chain Debt Aggregators

Cross-chain debt aggregators enable consumers to manage and optimize credit card debt alongside decentralized finance protocol debt by integrating multiple blockchain networks, reducing interest costs and improving borrowing flexibility. These platforms leverage smart contracts to consolidate liabilities, offering seamless refinancing options and enhanced transparency compared to traditional credit systems.

Algorithmic Debt Restructuring

Algorithmic debt restructuring in decentralized finance protocols offers automated, transparent repayment schedules that reduce the risk of default compared to traditional credit card debt, which often involves high interest rates and opaque terms. By leveraging smart contracts, DeFi enables real-time adjustments to loan conditions based on borrower behavior and market conditions, enhancing consumer borrowing efficiency and financial inclusion.

Credit Delegation Pools

Credit Delegation Pools within decentralized finance protocols enable consumers to access borrowing with reduced reliance on traditional credit card debt, offering lower interest rates and programmable collateral management. Unlike credit card debt, which often entails high fees and limited transparency, credit delegation leverages blockchain technology to facilitate peer-to-peer lending with enhanced security and customizable credit limits.

Tokenized Credit Card Rewards

Tokenized credit card rewards enhance consumer borrowing by offering instant cashback and tradable digital assets, contrasting decentralized finance protocol debt which relies on blockchain-based lending with variable interest rates and collateral requirements. While credit card debt typically incurs higher interest rates, decentralized finance protocols provide greater transparency and lower fees, reshaping consumer borrowing dynamics through innovative tokenized incentives.

Credit card debt vs decentralized finance protocol debt for consumer borrowing. Infographic

moneydiff.com

moneydiff.com