The debt snowball method prioritizes paying off the smallest debts first to build motivation through quick wins, while the debt avalanche method targets debts with the highest interest rates to minimize overall interest paid. Choosing between these strategies depends on whether psychological momentum or financial efficiency is more important to the individual. Both approaches help reduce debt systematically but differ in payoff speed and motivation factors.

Table of Comparison

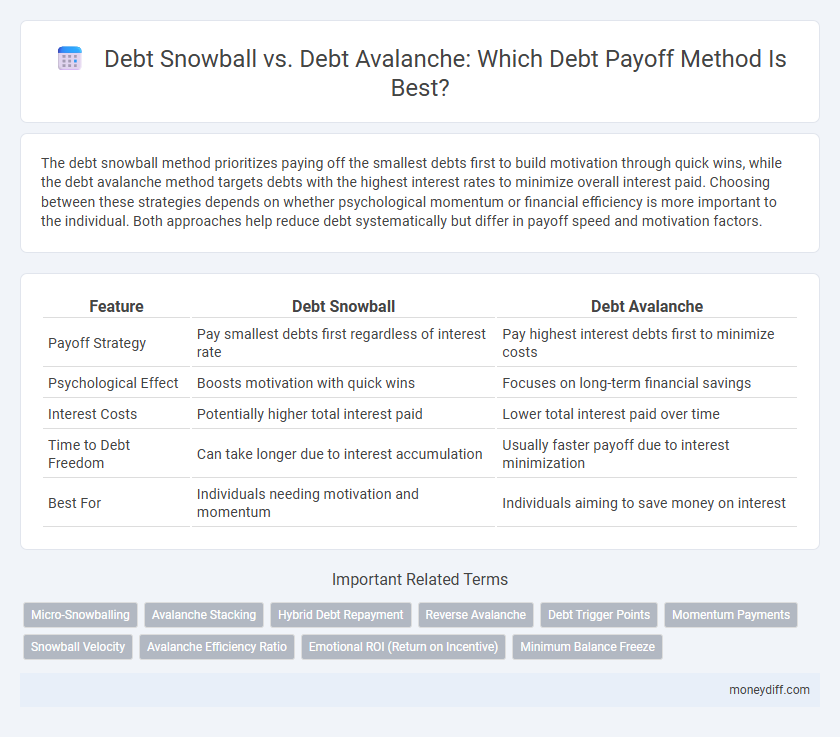

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Payoff Strategy | Pay smallest debts first regardless of interest rate | Pay highest interest debts first to minimize costs |

| Psychological Effect | Boosts motivation with quick wins | Focuses on long-term financial savings |

| Interest Costs | Potentially higher total interest paid | Lower total interest paid over time |

| Time to Debt Freedom | Can take longer due to interest accumulation | Usually faster payoff due to interest minimization |

| Best For | Individuals needing motivation and momentum | Individuals aiming to save money on interest |

Understanding the Debt Snowball Method

The Debt Snowball method focuses on paying off the smallest debts first to build momentum and motivation, regardless of interest rates. This approach accelerates psychological wins, encouraging consistent payments and financial discipline. While it may result in higher overall interest costs compared to the Debt Avalanche method, its behavioral advantages often lead to sustained commitment and eventual debt elimination.

What is the Debt Avalanche Approach?

The Debt Avalanche approach prioritizes paying off debts with the highest interest rates first, minimizing overall interest paid and accelerating debt repayment. This method targets debts like credit cards, personal loans, or high-interest balances to reduce financial burden efficiently. Compared to other strategies, the Debt Avalanche maximizes savings by focusing payments on costly debts while maintaining minimum payments on lower-interest obligations.

Key Differences Between Snowball and Avalanche

The debt snowball method prioritizes paying off the smallest debts first to build momentum, while the debt avalanche targets debts with the highest interest rates to minimize overall interest payments. Snowball offers psychological motivation by celebrating quick wins, whereas avalanche provides a mathematically optimized path to debt reduction. Choosing between them depends on whether emotional reinforcement or interest cost savings are the primary goal in debt payoff strategy.

Psychological Benefits of the Debt Snowball

The Debt Snowball method offers significant psychological benefits by providing quick wins as smaller debts are paid off first, boosting motivation and confidence. This momentum helps sustain commitment to the payoff plan, reducing feelings of overwhelm and increasing a sense of accomplishment. Studies show that the tangible progress made visible through the Debt Snowball can improve adherence to debt repayment habits more effectively than mathematically optimal methods like the Debt Avalanche.

Interest Savings with the Debt Avalanche

The Debt Avalanche method targets high-interest debts first, maximizing interest savings by reducing the principal faster on loans with the highest rates. This approach minimizes the total interest paid over time compared to the Debt Snowball, which prioritizes smaller balances regardless of interest rate. Borrowers using the Debt Avalanche often experience quicker payoff timelines and significant cost savings on interest payments.

Which Method is Faster for Debt Repayment?

The debt avalanche method is typically faster for debt repayment because it targets high-interest debts first, minimizing the overall interest accrued and reducing the total payoff time. In contrast, the debt snowball method prioritizes smaller balances, which can boost motivation but usually extends the repayment period due to accumulating interest. Choosing the avalanche approach can save money and shorten the debt-free timeline by strategically focusing on interest rates rather than balance size.

Pros and Cons of the Debt Snowball Method

The Debt Snowball method accelerates motivation by prioritizing paying off smaller debts first, creating quick wins that boost psychological momentum and adherence to the payoff plan. However, this approach may result in higher overall interest costs compared to methods targeting larger, high-interest debts first. Despite potentially increased costs, the Debt Snowball method's structured payments and emotional reinforcement can improve consistency and long-term success in debt elimination.

Pros and Cons of the Debt Avalanche Method

The Debt Avalanche method prioritizes paying off debts with the highest interest rates first, which can lead to significant interest savings and faster overall payoff compared to other methods. This strategy requires disciplined budgeting and motivation, as it may take longer to eliminate smaller balances, potentially impacting psychological momentum. While the Debt Avalanche approach maximizes financial efficiency, it may be less emotionally rewarding than methods that provide quick wins by paying off smaller debts first.

Choosing the Right Debt Payoff Strategy

Choosing the right debt payoff strategy depends on individual financial goals and psychological preferences, balancing between the debt snowball and debt avalanche methods. The debt snowball method prioritizes paying off the smallest balances first, creating quick wins that boost motivation, while the debt avalanche targets debts with the highest interest rates to minimize total interest paid over time. Analyzing debt amounts, interest rates, and personal discipline helps determine whether accelerating payments on high-interest debt or gaining momentum from small victories better supports long-term financial freedom.

Real-Life Success Stories: Snowball vs Avalanche

Real-life success stories demonstrate that the debt snowball method, favored for its psychological momentum by paying off smaller debts first, helps many individuals stay motivated and steadily eliminate debt. Conversely, the debt avalanche approach, which targets high-interest debts first, often results in significant financial savings and faster payoff for those disciplined in managing large balances. Personal testimonies highlight that choosing between snowball and avalanche depends on individual financial habits and emotional resilience during the repayment journey.

Related Important Terms

Micro-Snowballing

Micro-snowballing, a variation of the debt snowball method, emphasizes paying off smaller debts first to build momentum and motivation, contrasting with the debt avalanche approach that targets high-interest debts for cost efficiency. This technique leverages psychological benefits by providing quick wins, which can increase adherence and accelerate overall debt payoff despite potentially higher total interest paid.

Avalanche Stacking

The debt avalanche method prioritizes paying off debts with the highest interest rates first, maximizing interest savings and reducing total payoff time. Avalanche stacking enhances this strategy by simultaneously allocating extra payments to multiple high-interest debts, accelerating debt elimination and minimizing overall interest accrual.

Hybrid Debt Repayment

Hybrid debt repayment combines the psychological motivation of the debt snowball method, which prioritizes paying off the smallest balances first, with the cost-efficiency of the debt avalanche approach, targeting debts with the highest interest rates to minimize total interest paid. This strategy accelerates debt elimination by balancing quick wins and interest savings, optimizing financial discipline and long-term payoff outcomes.

Reverse Avalanche

The Reverse Avalanche method targets debts with the lowest interest rates first, allowing quicker psychological wins and motivation gains while minimizing the number of payments. By prioritizing smaller balances with lower rates, this strategy can boost momentum despite potentially paying more interest over time compared to the traditional debt avalanche approach.

Debt Trigger Points

Debt trigger points influence payoff strategies by identifying when accumulating interest or balances reach critical levels that demand prioritization. The debt snowball method targets smallest balances first to build momentum, while the debt avalanche prioritizes high-interest debts to minimize total interest paid over time.

Momentum Payments

Debt snowball method accelerates momentum payments by focusing on paying off the smallest debts first, creating psychological wins that boost motivation and momentum. Debt avalanche prioritizes high-interest debts, maximizing interest savings and accelerating payoffs through optimized payment allocation focusing on cost efficiency.

Snowball Velocity

The debt snowball method accelerates payoff velocity by targeting the smallest balances first, generating quick wins that boost motivation and maintain momentum. This approach contrasts with the debt avalanche, which prioritizes high-interest debts but may delay psychological benefits essential for sustained progress.

Avalanche Efficiency Ratio

The debt avalanche method prioritizes paying off debts with the highest interest rates first, maximizing interest savings and accelerating overall payoff time. The Avalanche Efficiency Ratio measures this method's effectiveness by comparing interest saved relative to total payments, consistently outperforming the debt snowball approach in long-term financial efficiency.

Emotional ROI (Return on Incentive)

The Debt Snowball method generates a higher emotional ROI by fostering quick wins and boosting motivation through early debt eliminations, while the Debt Avalanche maximizes financial efficiency by targeting high-interest debts first but may delay emotional gratification. Choosing between these payoff strategies depends on whether immediate psychological rewards or long-term interest savings better sustain your commitment to debt freedom.

Minimum Balance Freeze

The Debt Snowball method prioritizes paying off debts with the smallest balances first, creating momentum through quick wins, while the Debt Avalanche method targets debts with the highest interest rates to minimize overall interest paid. Implementing a Minimum Balance Freeze limits additional borrowing on accounts once the balance drops to a pre-set minimum, enhancing discipline and accelerating payoff regardless of the chosen method.

Debt snowball vs debt avalanche for payoff method. Infographic

moneydiff.com

moneydiff.com