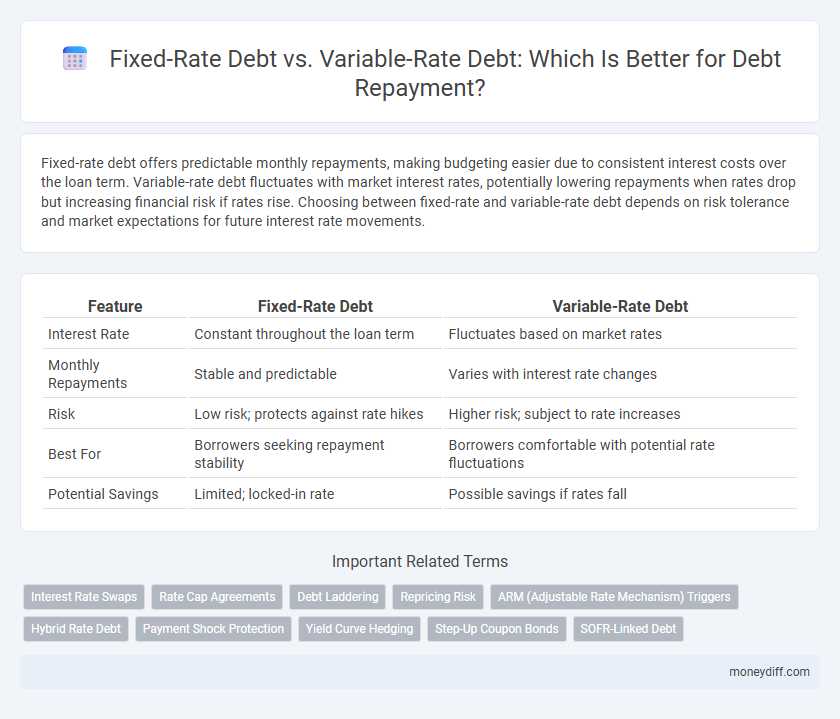

Fixed-rate debt offers predictable monthly repayments, making budgeting easier due to consistent interest costs over the loan term. Variable-rate debt fluctuates with market interest rates, potentially lowering repayments when rates drop but increasing financial risk if rates rise. Choosing between fixed-rate and variable-rate debt depends on risk tolerance and market expectations for future interest rate movements.

Table of Comparison

| Feature | Fixed-Rate Debt | Variable-Rate Debt |

|---|---|---|

| Interest Rate | Constant throughout the loan term | Fluctuates based on market rates |

| Monthly Repayments | Stable and predictable | Varies with interest rate changes |

| Risk | Low risk; protects against rate hikes | Higher risk; subject to rate increases |

| Best For | Borrowers seeking repayment stability | Borrowers comfortable with potential rate fluctuations |

| Potential Savings | Limited; locked-in rate | Possible savings if rates fall |

Understanding Fixed-Rate Debt: Stability in Repayments

Fixed-rate debt offers borrowers predictable monthly repayments by locking in an interest rate for the entire loan term, shielding them from market fluctuations. This stability allows for easier budgeting and financial planning, reducing the risk of payment shocks during economic changes. Fixed-rate loans are especially advantageous in a rising interest rate environment where variable rates could increase repayments.

What Is Variable-Rate Debt?

Variable-rate debt features an interest rate that fluctuates based on market indices, causing repayment amounts to vary over time. This type of debt offers potential savings when rates drop but increases financial uncertainty during rate hikes. Borrowers must carefully consider their risk tolerance and the likelihood of interest rate changes when choosing variable-rate debt for repayments.

Key Differences Between Fixed and Variable Rates

Fixed-rate debt offers consistent repayments throughout the loan term, providing budget certainty and protection from interest rate fluctuations. Variable-rate debt repayments change periodically based on market interest rates, which can result in lower initial payments but higher risk of increased costs if rates rise. Understanding the impact of interest rate trends on repayment amounts is crucial for selecting between fixed and variable-rate debt options.

Pros of Choosing Fixed-Rate Debt for Repayments

Fixed-rate debt offers predictable monthly repayments, ensuring financial stability and easier budget management regardless of market interest rate fluctuations. Borrowers benefit from protection against rising interest rates, which can result in significant long-term savings. This stability makes fixed-rate debt an attractive option for individuals and businesses seeking to lock in consistent repayment terms over the loan period.

Pros and Cons of Variable-Rate Debt

Variable-rate debt offers lower initial interest rates compared to fixed-rate debt, enabling borrowers to benefit from potential decreases in market rates and reduce early repayment costs. However, variable interest rates can increase unexpectedly due to economic fluctuations, leading to higher monthly payments and greater repayment uncertainty. This unpredictability may complicate budgeting and increase the risk of financial strain during periods of rising interest rates.

Impact of Interest Rate Fluctuations on Debt Payments

Fixed-rate debt offers predictable repayment amounts as the interest rate remains constant throughout the loan term, insulating borrowers from market interest rate volatility. Variable-rate debt exposes borrowers to fluctuating repayment costs since interest rates adjust periodically based on benchmark indexes such as LIBOR or the federal funds rate. Interest rate increases can significantly raise monthly payments on variable-rate loans, posing higher financial risk compared to the stability of fixed-rate debt.

Budgeting Strategies for Fixed vs Variable-Rate Debts

Fixed-rate debt offers predictable monthly payments, simplifying budgeting by locking in interest costs over the loan term. Variable-rate debt can lead to fluctuating repayments, necessitating flexible budgeting strategies and contingency funds to accommodate potential interest rate increases. Effective management involves analyzing market trends and personal cash flow stability to determine the optimal balance between fixed and variable-rate debt for financial planning.

Risk Assessment: Financial Security and Debt Types

Fixed-rate debt offers financial security by locking in a consistent repayment amount, reducing exposure to interest rate fluctuations and enabling predictable budgeting. Variable-rate debt carries increased risk due to potential interest rate rises, which can lead to higher repayment amounts and financial strain. Assessing personal risk tolerance and market interest rate trends is critical when choosing between fixed-rate and variable-rate debt for effective debt management.

Long-Term Cost Comparison: Fixed vs Variable Rates

Fixed-rate debt offers predictable repayments over the long term, shielding borrowers from interest rate volatility and enabling precise financial planning. Variable-rate debt may start with lower interest costs but exposes borrowers to rising rates, potentially increasing total repayment amounts significantly over time. Long-term cost comparisons favor fixed-rate debt for budget stability, while variable rates carry the risk of fluctuating payments and higher cumulative interest expenses.

How to Choose the Best Debt Structure for Your Needs

Choosing the best debt structure depends on your financial stability and market interest rate predictions. Fixed-rate debt offers predictable monthly repayments, ideal for budgeting in stable or rising interest rate environments, while variable-rate debt can provide lower initial rates but comes with fluctuating payments that may increase your financial risk. Assessing your risk tolerance, cash flow consistency, and the potential for interest rate changes helps determine if the certainty of fixed rates or the flexibility of variable rates aligns better with your repayment capacity.

Related Important Terms

Interest Rate Swaps

Interest rate swaps enable borrowers with variable-rate debt to exchange fluctuating interest payments for fixed-rate obligations, stabilizing repayment amounts and mitigating interest rate risk. This financial derivative optimizes cash flow predictability and budgeting by converting uncertain variable rates into fixed payments, enhancing debt management efficiency.

Rate Cap Agreements

Fixed-rate debt ensures consistent repayment amounts by locking interest rates, providing predictability in budgeting, while variable-rate debt can fluctuate based on market rates, potentially lowering payments but increasing risk. Rate cap agreements mitigate this risk by setting an upper limit on interest rates for variable debt, protecting borrowers from excessive rate hikes during repayment periods.

Debt Laddering

Debt laddering involves structuring a portfolio of fixed-rate and variable-rate debts to optimize repayment stability and cost efficiency, allowing borrowers to balance predictable fixed payments with potentially lower variable interest expenses. Leveraging fixed-rate debt provides protection against interest rate fluctuations, while variable-rate debt can offer savings when rates decline, creating a strategic blend to manage cash flow and minimize overall repayment risk.

Repricing Risk

Fixed-rate debt eliminates repricing risk by locking in interest rates for the loan's duration, providing predictable repayment amounts, while variable-rate debt exposes borrowers to repricing risk as interest rates fluctuate, potentially increasing repayment costs over time. Managing repricing risk is crucial for financial planning, especially when interest rate volatility impacts variable-rate debt servicing.

ARM (Adjustable Rate Mechanism) Triggers

Fixed-rate debt offers predictable repayment amounts, ensuring stability regardless of market changes, while variable-rate debt, especially with Adjustable Rate Mechanism (ARM) triggers, fluctuates based on interest rate indexes like LIBOR or SOFR, potentially increasing repayments when triggers activate. ARM triggers often include caps, floors, and adjustment intervals that directly impact borrower repayment schedules by resetting rates periodically, which can lead to financial uncertainty during rising interest rate environments.

Hybrid Rate Debt

Hybrid rate debt combines the stability of fixed-rate debt with the flexibility of variable-rate debt, offering borrowers predictable repayments initially while allowing adjustment to market rates later. This debt structure helps manage interest rate risk by balancing fixed repayment schedules with potential savings when rates decline.

Payment Shock Protection

Fixed-rate debt offers consistent repayment amounts, providing reliable payment shock protection by shielding borrowers from interest rate fluctuations. Variable-rate debt may expose borrowers to sudden increases in payments, increasing the risk of payment shock during periods of rising interest rates.

Yield Curve Hedging

Fixed-rate debt provides predictable repayment amounts shielded from interest rate fluctuations, making yield curve hedging effective for managing long-term liabilities by locking in rates. Variable-rate debt exposes repayments to changes in interest rates, requiring dynamic yield curve hedging strategies to mitigate the risk of rising costs along different maturities.

Step-Up Coupon Bonds

Step-up coupon bonds feature increasing fixed interest payments over time, offering predictable cash flows and protection against rising interest rates compared to variable-rate debt, which exposes borrowers to fluctuating repayment amounts. Investors prioritize step-up coupon bonds for stable, gradually escalating income streams while managing the risk of rising market rates inherent in variable-rate debt repayments.

SOFR-Linked Debt

SOFR-linked debt offers variable interest rates tied to the Secured Overnight Financing Rate, allowing borrowers to benefit from potentially lower repayment costs during periods of declining rates compared to fixed-rate debt with stable but higher interest obligations. However, fixed-rate debt provides predictability and budget certainty for repayments, insulating borrowers from SOFR fluctuations and interest rate spikes that can increase variable-rate repayment burdens.

Fixed-rate debt vs Variable-rate debt for repayments. Infographic

moneydiff.com

moneydiff.com