Revolving debt offers flexible repayment options with varying monthly minimum payments based on the outstanding balance, while installment debt requires fixed payments over a set period until fully paid off. Revolving debt is commonly seen in credit cards, allowing continuous borrowing up to a limit, whereas installment debt is typical in loans like mortgages or auto loans with predetermined schedules. Understanding these structures helps in managing cash flow and interest costs effectively to optimize debt repayment.

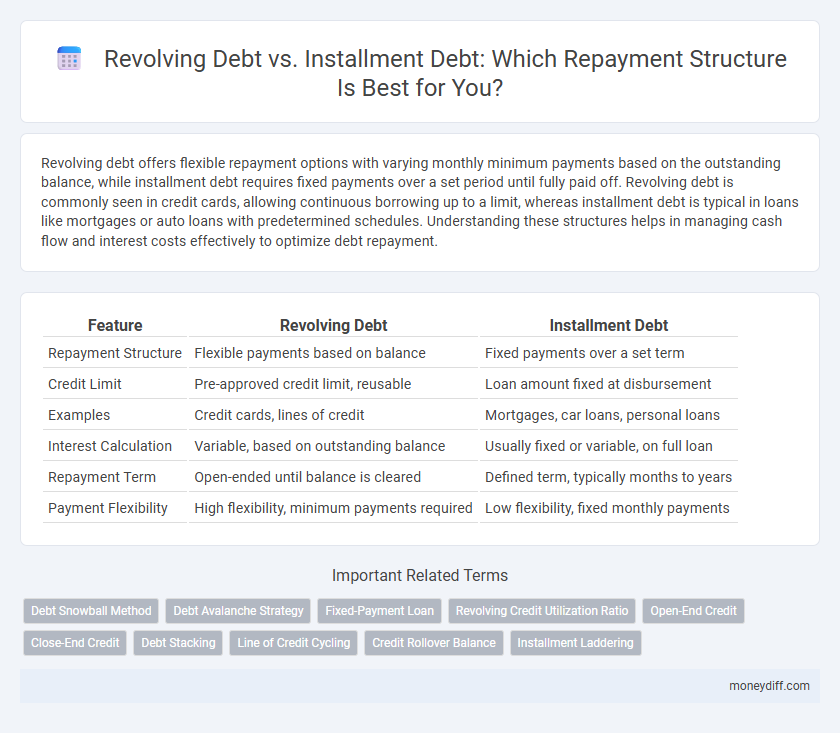

Table of Comparison

| Feature | Revolving Debt | Installment Debt |

|---|---|---|

| Repayment Structure | Flexible payments based on balance | Fixed payments over a set term |

| Credit Limit | Pre-approved credit limit, reusable | Loan amount fixed at disbursement |

| Examples | Credit cards, lines of credit | Mortgages, car loans, personal loans |

| Interest Calculation | Variable, based on outstanding balance | Usually fixed or variable, on full loan |

| Repayment Term | Open-ended until balance is cleared | Defined term, typically months to years |

| Payment Flexibility | High flexibility, minimum payments required | Low flexibility, fixed monthly payments |

Understanding Revolving Debt and Its Features

Revolving debt allows borrowers to access credit up to a preset limit, with minimum monthly payments based on the outstanding balance, offering flexibility in repayment and borrowing. Interest accrues on the remaining balance, and payments reduce the principal, enabling continuous use of credit as long as the limit is not exceeded. Common examples include credit cards and lines of credit, characterized by variable interest rates and the ability to carry a balance month-to-month without a fixed payoff schedule.

What Is Installment Debt? Key Characteristics

Installment debt is a type of loan repaid over a fixed period through regular, scheduled payments that include both principal and interest, such as mortgages, auto loans, and personal loans. Key characteristics include a predetermined repayment term, consistent monthly payments, and a declining balance as principal is paid down. Unlike revolving debt, installment debt has a set payoff date and does not allow for repeated borrowing once the balance is repaid.

Comparing Repayment Structures: Revolving vs. Installment Debt

Revolving debt, such as credit cards, offers flexible repayment with minimum monthly payments based on outstanding balances, allowing borrowers to carry debt indefinitely but often at higher interest rates. Installment debt, including auto and mortgage loans, requires fixed monthly payments over a predetermined period, promoting consistent repayment and typically lower interest rates. The structured nature of installment debt aids in budgeting and accelerates debt reduction, whereas revolving debt provides convenience but can lead to prolonged repayment and increased total interest paid.

Interest Rate Differences: Revolving vs. Installment Loans

Revolving debt typically carries higher interest rates compared to installment loans due to the flexible repayment structure and the unsecured nature of many revolving credit accounts. Installment debt usually offers lower, fixed interest rates since it involves a set repayment schedule and often secured or credit-checked terms. Understanding these interest rate differences is crucial for effective debt management and minimizing overall borrowing costs.

How Minimum Payments Work in Revolving Debt

Minimum payments in revolving debt are typically calculated as a small percentage of the outstanding balance, often around 2-4%, allowing borrowers to maintain flexibility in repayment. This structure results in slower principal reduction compared to installment debt, where fixed payments cover both principal and interest over a set term. Borrowers making only minimum payments on revolving debt can incur significant interest charges, prolonging the repayment period and increasing the total cost of borrowing.

Fixed Payment Schedules of Installment Loans

Installment debt features fixed payment schedules with predetermined amounts and due dates, providing borrowers a clear timeline for full repayment. Revolving debt, by contrast, offers flexible payment amounts, often tied to outstanding balances and interest rates, without a fixed end date. Fixed payment schedules in installment loans enhance budget predictability and facilitate structured debt reduction.

Impact on Credit Scores: Revolving vs. Installment Debt

Revolving debt, such as credit card balances, impacts credit scores by influencing credit utilization ratios, where high utilization can lower scores significantly. Installment debt, like mortgages or auto loans, affects credit through consistent payment history and reducing loan balances over time, typically supporting score improvement. Both types contribute differently to credit mix, an important factor in scoring models, emphasizing the need for balanced management of each debt category.

Flexibility and Risks of Revolving Credit

Revolving debt offers greater flexibility by allowing borrowers to access funds up to a credit limit and repay at varying amounts each month, unlike installment debt which requires fixed payments over a set term. However, revolving credit carries higher risks, including variable interest rates and potential for accumulating significant balances if not managed carefully. This increased risk can lead to prolonged debt cycles and negatively impact credit scores if payments are missed or only minimum amounts paid.

Strategic Repayment Approaches for Both Debt Types

Revolving debt repayment strategies emphasize maintaining low balances and paying above minimum amounts to reduce interest over time, leveraging flexibility in payment amounts and timing. Installment debt requires fixed, scheduled payments that strategically focus on consistent principal reduction to minimize total interest paid and shorten the loan term. Employing targeted repayment methods for each debt type enhances credit score management and overall financial stability.

Choosing the Right Debt Structure for Your Financial Goals

Revolving debt offers flexible repayment with variable monthly payments, ideal for managing short-term expenses and maintaining cash flow, while installment debt provides fixed payments over a set period, suited for budgeting and long-term financial goals. Assess your cash flow stability, interest rates, and repayment discipline when choosing between credit cards or personal loans (revolving) and mortgages or auto loans (installment). Aligning debt structure with your financial objectives enhances repayment efficiency and minimizes the risk of default.

Related Important Terms

Debt Snowball Method

Revolving debt involves flexible repayment with varying interest rates, while installment debt requires fixed payments over a set period, influencing the effectiveness of the Debt Snowball Method by allowing quick elimination of smaller balances. Prioritizing installment debt in the Debt Snowball Method accelerates momentum through predictable payments, whereas revolving debt may extend repayment due to fluctuating balances and interest accrual.

Debt Avalanche Strategy

Revolving debt, such as credit card balances, carries variable interest rates and allows flexible payments, often leading to prolonged repayment if minimum payments are made. The Debt Avalanche Strategy prioritizes paying off installment debt with higher interest rates first to minimize total interest costs, accelerating debt freedom by targeting high-rate loans like personal or auto loans before lower-rate revolving debts.

Fixed-Payment Loan

Revolving debt offers flexible repayment amounts with varying interest based on outstanding balances, while installment debt, such as fixed-payment loans, requires consistent monthly payments covering principal and interest over a set term. Fixed-payment loans ensure predictable budgeting and scheduled debt reduction, making them ideal for structured financial planning and long-term liability management.

Revolving Credit Utilization Ratio

Revolving debt is characterized by a flexible repayment structure allowing borrowers to carry balances and make variable payments, heavily influenced by the Revolving Credit Utilization Ratio, which measures the percentage of available credit being used and directly impacts credit scores. Installment debt involves fixed payments over a set period, with no impact from utilization ratios, making revolving debt more sensitive to changes in credit usage and repayment behavior.

Open-End Credit

Revolving debt, a form of open-end credit, allows borrowers to repeatedly draw and repay funds up to a preset credit limit, providing flexibility in repayment structure and payment amounts. Installment debt, conversely, entails fixed payments over a defined term but is classified as closed-end credit, differing fundamentally from the continuous borrowing feature of revolving debt.

Close-End Credit

Close-end credit, a form of installment debt, requires fixed payments over a specified term until the balance is fully repaid, providing predictable repayment structures. Revolving debt allows flexible borrowing and payments with variable balances, but close-end credit offers clarity through its predetermined amortization schedule.

Debt Stacking

Revolving debt, such as credit cards, allows flexible repayment with varying balances and interest rates, making it critical to prioritize higher-interest revolving accounts in debt stacking strategies to minimize overall costs. Installment debt involves fixed payments over a set period, enabling predictable budgeting, but stacking should emphasize reducing high-rate revolving debt first to optimize repayment efficiency.

Line of Credit Cycling

Revolving debt allows continuous borrowing up to a credit limit with flexible repayment, making the line of credit cycle by repeatedly drawing and repaying funds, while installment debt requires fixed payments over a set term with no reuse of funds once repaid. The line of credit cycling in revolving debt provides more liquidity and adaptability compared to the structured, predictable repayment schedule of installment debt.

Credit Rollover Balance

Revolving debt features a credit rollover balance, allowing borrowers to carry over unpaid amounts with interest, providing flexible repayment but potentially higher costs over time. Installment debt requires fixed payments over a set term, offering predictable repayment schedules without the option to revolve the balance.

Installment Laddering

Installment debt repayment structures benefit from installment laddering, which schedules fixed payments over set intervals to gradually reduce principal and interest, enhancing cash flow predictability. Unlike revolving debt, where balances fluctuate and minimum payments vary, installment laddering ensures a clear payoff timeline and minimizes interest costs through consistent, systematic repayments.

Revolving debt vs Installment debt for repayment structure Infographic

moneydiff.com

moneydiff.com