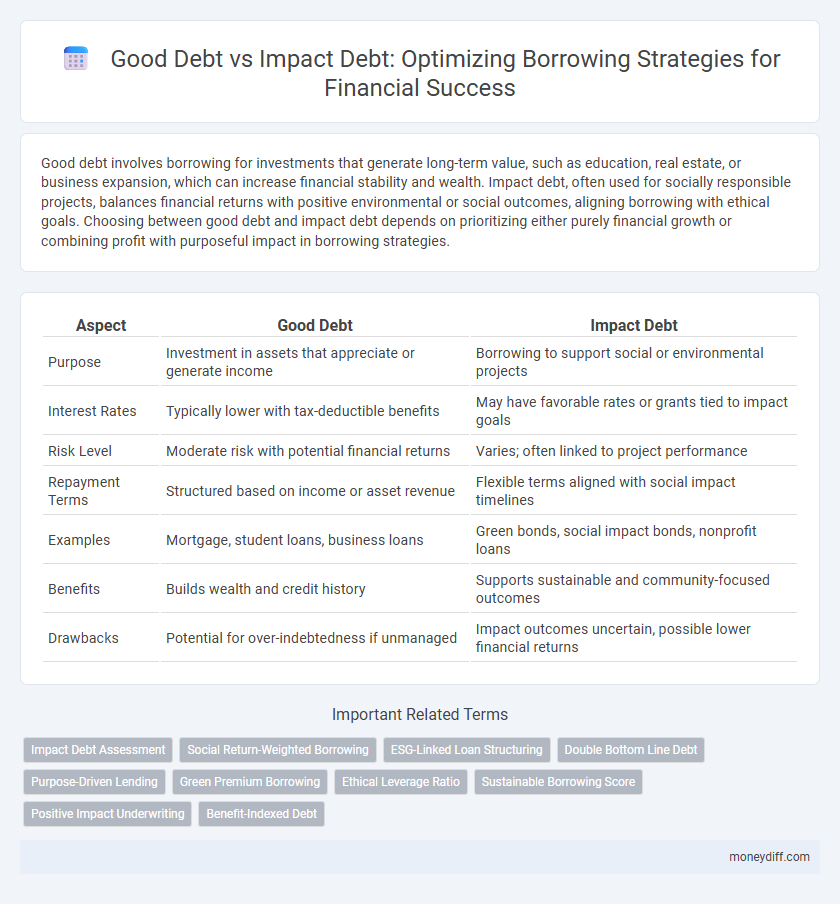

Good debt involves borrowing for investments that generate long-term value, such as education, real estate, or business expansion, which can increase financial stability and wealth. Impact debt, often used for socially responsible projects, balances financial returns with positive environmental or social outcomes, aligning borrowing with ethical goals. Choosing between good debt and impact debt depends on prioritizing either purely financial growth or combining profit with purposeful impact in borrowing strategies.

Table of Comparison

| Aspect | Good Debt | Impact Debt |

|---|---|---|

| Purpose | Investment in assets that appreciate or generate income | Borrowing to support social or environmental projects |

| Interest Rates | Typically lower with tax-deductible benefits | May have favorable rates or grants tied to impact goals |

| Risk Level | Moderate risk with potential financial returns | Varies; often linked to project performance |

| Repayment Terms | Structured based on income or asset revenue | Flexible terms aligned with social impact timelines |

| Examples | Mortgage, student loans, business loans | Green bonds, social impact bonds, nonprofit loans |

| Benefits | Builds wealth and credit history | Supports sustainable and community-focused outcomes |

| Drawbacks | Potential for over-indebtedness if unmanaged | Impact outcomes uncertain, possible lower financial returns |

Understanding Good Debt vs Impact Debt

Good debt typically refers to borrowing that is used to finance investments with potential for growth, such as education, real estate, or business expansion, which can increase future income and net worth. Impact debt, on the other hand, is borrowing aimed at generating positive social or environmental outcomes alongside financial returns, often linked to sustainable projects or social enterprises. Understanding the differences helps borrowers optimize strategies by balancing financial benefits with social impact goals in their debt management plans.

Key Differences Between Good Debt and Impact Debt

Good debt typically includes loans used for investments that generate income or appreciate in value, such as mortgages or student loans, enhancing long-term financial stability. Impact debt, by contrast, is borrowed specifically to fund projects or businesses that generate positive social or environmental outcomes alongside financial returns. Key differences hinge on the primary purpose: good debt prioritizes financial growth, whereas impact debt emphasizes measurable societal or ecological impact.

Criteria for Identifying Good Debt

Good debt is identified by its ability to generate long-term value, such as investments in education, real estate, or business expansion that increase future income or asset worth. Key criteria include low interest rates, manageable repayment terms, and alignment with financial goals that enhance net worth over time. Borrowers should evaluate debt impact by assessing potential returns, risk levels, and the debt's contribution to overall financial stability.

How Impact Debt Affects Financial Health

Impact debt can enhance financial health by aligning borrowing with positive social and environmental outcomes, attracting investors who prioritize sustainability. Unlike good debt, which typically focuses on growth and asset accumulation, impact debt integrates measurable social or environmental returns into the financial strategy. This approach can improve portfolio diversification and stakeholder trust, potentially leading to better long-term creditworthiness and reduced risk.

Smart Borrowing: Leveraging Good Debt

Smart borrowing focuses on leveraging good debt, such as low-interest loans and mortgages, that can enhance credit scores and generate long-term financial growth. In contrast, impact debt--often high-interest or unsecured borrowing--can strain cash flow and increase financial risk without contributing to asset building. Prioritizing good debt maximizes borrowing benefits and supports sustainable wealth accumulation.

Warning Signs of Impact Debt

Impact debt often carries hidden risks such as unpredictable returns, misaligned social objectives, and potential reputational damage for borrowers. Warning signs include unclear impact metrics, high-interest rates disproportionate to social benefits, and stringent reporting requirements that can strain resources. Recognizing these red flags helps in avoiding financial distress and ensuring borrowing strategies align with both fiscal responsibility and social impact goals.

Strategies to Minimize Impact Debt

Strategies to minimize impact debt focus on prioritizing low-interest, high-return borrowing options such as student loans or mortgages, which are considered good debt. Implementing strict budgeting and repayment plans reduces the risk of high-interest impact debt, like credit card balances or payday loans. Leveraging debt consolidation and refinancing options can also lower overall interest rates and improve financial stability.

Balancing Good Debt for Wealth Building

Balancing good debt involves strategically using loans with low interest rates and long-term benefits, such as mortgages or student loans, to build wealth over time. Impact debt focuses on borrowing for investments that generate measurable social or environmental benefits alongside financial returns. Effective borrowing strategies weigh the cost of debt against potential asset appreciation and positive societal impact to optimize long-term financial growth.

Case Studies: Good Debt vs Impact Debt Outcomes

Case studies reveal that good debt, often leveraged for asset acquisition or business expansion, consistently drives higher returns and sustainable growth compared to impact debt, which targets social or environmental projects with longer payoff horizons and variable financial outcomes. Analysis of multiple borrower profiles shows that good debt improves credit profiles and cash flow stability, while impact debt frequently yields non-financial benefits like community development but may present higher risk and lower immediate financial returns. Financial institutions increasingly assess these outcomes to balance portfolio risk, optimize borrowing strategies, and align lending practices with both economic performance and social impact goals.

Practical Tips for Responsible Borrowing

Good debt, such as mortgages or education loans, typically generates long-term financial benefits and enhances creditworthiness, while impact debt specifically funds projects with positive social or environmental outcomes. Borrowers should evaluate loan terms carefully, aiming for manageable interest rates and repayment schedules that align with their income and financial goals. Prioritizing transparency from lenders and assessing the potential returns--both financial and societal--ensures responsible borrowing strategies that leverage debt as a tool for growth rather than risk.

Related Important Terms

Impact Debt Assessment

Impact debt assessment evaluates borrowing strategies by measuring both financial returns and social or environmental outcomes, helping organizations prioritize loans that generate positive societal impact alongside economic benefits. Good debt typically supports growth and asset acquisition, while impact debt emphasizes funding projects with measurable contributions to sustainability, community development, or social equity.

Social Return-Weighted Borrowing

Good debt strategically funds projects with predictable returns that enhance financial stability, while impact debt prioritizes social and environmental outcomes with measurable benefits through Social Return-Weighted Borrowing, aligning capital allocation to maximize both fiscal performance and societal impact. This approach quantifies social value in borrowing decisions, optimizing debt portfolios for stakeholders committed to long-term positive change.

ESG-Linked Loan Structuring

Good debt, characterized by favorable interest rates and positive cash flow impact, enhances corporate growth while aligning with sustainable objectives, whereas impact debt specifically targets measurable environmental, social, and governance (ESG) outcomes through structured loan agreements. ESG-linked loan structuring integrates performance-based pricing mechanisms tied to sustainability metrics, incentivizing borrowers to achieve predefined ESG targets and thereby optimizing both financial and social returns.

Double Bottom Line Debt

Double Bottom Line Debt strategically balances financial returns with measurable social or environmental impact, distinguishing it from traditional good debt focused solely on economic gain. This borrowing approach attracts investors prioritizing sustainable outcomes, enhancing capital access while driving positive societal change alongside business growth.

Purpose-Driven Lending

Purpose-driven lending distinguishes good debt, used for assets and investments that generate long-term value, from impact debt, which targets social and environmental outcomes alongside financial returns. Borrowing strategies that prioritize impact debt align capital deployment with sustainable development goals, fostering measurable positive change without sacrificing fiscal responsibility.

Green Premium Borrowing

Good debt, such as Green Premium Borrowing, strategically finances environmentally sustainable projects with lower interest rates and enhanced repayment terms, driving long-term value and positive impact. Impact debt prioritizes social and environmental outcomes but often involves higher costs and greater risk, making Green Premium Borrowing a more cost-effective approach in sustainable borrowing strategies.

Ethical Leverage Ratio

Good debt enhances financial growth by leveraging assets with manageable risk, while impact debt aligns borrowing with measurable social or environmental outcomes, optimizing ethical leverage ratio to balance profit and purpose; prioritizing impact debt improves sustainability in borrowing strategies without compromising financial stability.

Sustainable Borrowing Score

Good debt enhances long-term financial growth by funding assets that generate income or increase in value, while impact debt prioritizes environmental and social outcomes alongside financial returns. Incorporating a Sustainable Borrowing Score helps borrowers evaluate loan options based on sustainability criteria, balancing profitability with positive ecological and community impact.

Positive Impact Underwriting

Good debt leverages borrowed capital to finance investments that generate long-term value and sustainable returns, enhancing economic growth and creditworthiness. Impact debt focuses on funding projects with measurable social and environmental benefits, requiring Positive Impact Underwriting methodologies to assess risks alongside positive outcomes for optimized borrowing strategies.

Benefit-Indexed Debt

Benefit-indexed debt aligns repayment obligations with the borrower's revenue or social impact metrics, offering a flexible borrowing strategy that minimizes financial strain during downturns. This approach contrasts with traditional good debt by prioritizing measurable, positive social outcomes alongside financial return, enhancing both sustainability and impact-driven growth.

Good debt vs impact debt for borrowing strategies. Infographic

moneydiff.com

moneydiff.com