Refinancing a mortgage allows homeowners to replace their existing loan with a new one, often securing lower interest rates or better terms to reduce monthly payments and improve cash flow. Home equity sharing involves partnering with an investor who provides funds in exchange for a share of the home's future appreciation, offering leverage without increasing monthly debt obligations. Choosing between these strategies depends on individual financial goals, risk tolerance, and the desire to retain full ownership versus sharing potential profits.

Table of Comparison

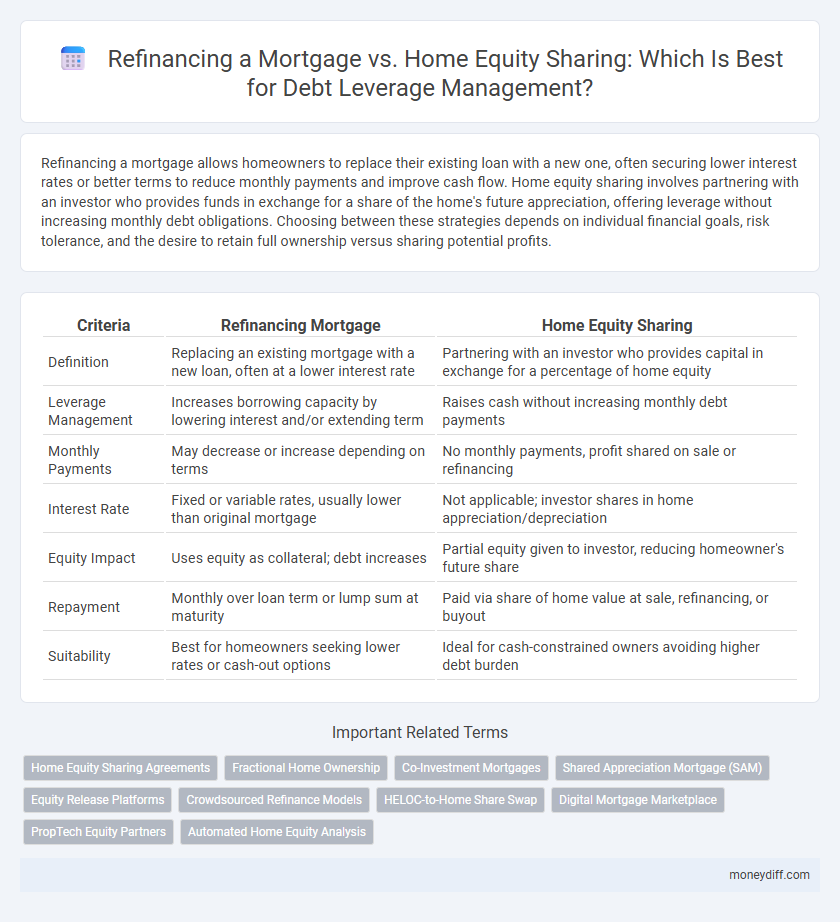

| Criteria | Refinancing Mortgage | Home Equity Sharing |

|---|---|---|

| Definition | Replacing an existing mortgage with a new loan, often at a lower interest rate | Partnering with an investor who provides capital in exchange for a percentage of home equity |

| Leverage Management | Increases borrowing capacity by lowering interest and/or extending term | Raises cash without increasing monthly debt payments |

| Monthly Payments | May decrease or increase depending on terms | No monthly payments, profit shared on sale or refinancing |

| Interest Rate | Fixed or variable rates, usually lower than original mortgage | Not applicable; investor shares in home appreciation/depreciation |

| Equity Impact | Uses equity as collateral; debt increases | Partial equity given to investor, reducing homeowner's future share |

| Repayment | Monthly over loan term or lump sum at maturity | Paid via share of home value at sale, refinancing, or buyout |

| Suitability | Best for homeowners seeking lower rates or cash-out options | Ideal for cash-constrained owners avoiding higher debt burden |

Understanding Mortgage Refinancing and Home Equity Sharing

Mortgage refinancing allows homeowners to replace an existing loan with a new mortgage at a potentially lower interest rate, improving cash flow and managing leverage more effectively. Home equity sharing involves partnering with an investor who provides capital in exchange for a share of the property's future appreciation, reducing monthly payments without increasing debt. Both strategies offer distinct advantages for leveraging home value while balancing financial risk and liquidity needs.

Key Differences Between Refinancing and Home Equity Sharing

Refinancing a mortgage involves replacing an existing loan with a new one, often at a lower interest rate, to reduce monthly payments and leverage more favorable terms. Home equity sharing allows homeowners to access cash by selling a percentage of their property's future appreciation without increasing monthly debt obligations. Key differences include the impact on monthly cash flow, the risk-sharing aspect of home equity sharing versus the interest cost of refinancing, and the long-term financial implications tied to property value fluctuations.

Eligibility Requirements for Refinancing vs Equity Sharing

Refinancing a mortgage typically requires a strong credit score, sufficient home equity, and a stable income to qualify for better interest rates and terms. In contrast, home equity sharing agreements often have more flexible eligibility criteria, allowing homeowners with lower credit scores or irregular income to access cash by sharing a portion of future home appreciation. Understanding these distinct requirements helps homeowners choose the optimal leverage management strategy based on financial stability and creditworthiness.

Potential Financial Benefits of Refinancing

Refinancing a mortgage can lower interest rates and monthly payments, freeing up cash flow for other investments or debt management strategies. It also allows homeowners to extend loan terms and consolidate high-interest debts under a single, more affordable payment. Compared to home equity sharing, refinancing maintains full ownership while potentially increasing property value through improved financial leverage.

How Home Equity Sharing Can Unlock Capital

Home equity sharing enables homeowners to unlock capital by selling a portion of their property's equity in exchange for immediate funds, without increasing monthly debt obligations. This approach provides financial leverage while preserving cash flow, contrasting with refinancing mortgages that typically require higher payments and creditworthiness. Home equity sharing can be especially advantageous for individuals seeking access to capital without taking on additional debt or altering their loan terms.

Risks and Drawbacks in Each Leveraging Strategy

Refinancing a mortgage poses risks such as higher interest rates over time, extended loan terms, and potential fees that can increase the overall debt burden. Home equity sharing introduces risks including loss of property control, profit sharing upon sale, and possible complications if property value declines, which may reduce the owner's financial gains. Both strategies require careful evaluation of long-term financial impacts and market conditions to avoid unfavorable leverage outcomes.

Cost Comparison: Fees, Interest, and Long-Term Impact

Refinancing a mortgage typically involves closing costs ranging from 2% to 5% of the loan amount and can offer lower interest rates, reducing monthly payments and long-term interest expenses. Home equity sharing agreements often have minimal upfront fees but require sharing a percentage of the home's appreciation, which could significantly impact net returns over time. Evaluating the total cost of refinancing fees, interest savings, and potential payout to equity sharers is essential for effective leverage management and maximizing financial benefits.

Tax Implications of Refinancing and Home Equity Sharing

Refinancing a mortgage often allows homeowners to deduct mortgage interest on loans up to $750,000, impacting tax liabilities favorably under current IRS regulations. Home equity sharing agreements may complicate tax situations, as shared equity arrangements could trigger capital gains events or affect basis calculations when selling the property. Understanding the differential tax treatment of interest deductions and potential capital gains is crucial for effective leverage management in real estate financing.

Choosing the Right Option for Your Financial Goals

Refinancing a mortgage involves replacing your existing loan with a new one, often securing lower interest rates or altering loan terms to improve monthly cash flow and reduce debt burden. Home equity sharing allows you to leverage your property's value by partnering with investors who provide capital in exchange for a share of future home appreciation, which can reduce monthly payments without increasing debt. Selecting between refinancing and home equity sharing depends on factors such as interest rates, loan terms, your risk tolerance, and long-term financial objectives, ensuring alignment with your goal to optimize leverage and maintain manageable debt levels.

Expert Tips for Managing Home Leverage Responsibly

Refinancing a mortgage often provides lower interest rates and fixed payment terms, making it a strategic option for managing home leverage with predictable costs. Home equity sharing enables homeowners to tap into property value without monthly repayment obligations, but requires careful consideration of shared ownership implications and future equity dilution. Expert tips emphasize thorough cost-benefit analysis, clarity on terms, and alignment with long-term financial goals to ensure responsible leverage management.

Related Important Terms

Home Equity Sharing Agreements

Home equity sharing agreements allow homeowners to access funds by selling a percentage of their property's future value without incurring additional debt, providing flexible leverage management compared to traditional mortgage refinancing. This approach avoids increased monthly payments and interest obligations, making it a strategic option for homeowners seeking to optimize financial stability while utilizing home equity.

Fractional Home Ownership

Refinancing a mortgage restructures existing debt to secure lower interest rates or improved terms, while home equity sharing through fractional home ownership allows leveraging property value by selling a percentage of the home to investors without incurring traditional loan debt. Fractional home ownership optimizes leverage management by providing liquidity and risk-sharing, offering homeowners an alternative to refinancing that preserves cash flow and avoids increased monthly payments.

Co-Investment Mortgages

Co-investment mortgages combine elements of refinancing and home equity sharing by allowing homeowners to leverage external investors' capital to reduce monthly payments while sharing future home appreciation. This strategy optimizes leverage management by preserving cash flow and mitigating debt risk without increasing traditional mortgage obligations.

Shared Appreciation Mortgage (SAM)

Refinancing a mortgage typically involves replacing an existing loan with a new one to secure better interest rates or terms, whereas Home Equity Sharing, particularly through a Shared Appreciation Mortgage (SAM), allows homeowners to leverage their equity by sharing future property value appreciation with an investor. SAM structures enable borrowers to reduce monthly payments and obtain liquidity without increasing debt burden, as repayment depends on the home's increased value rather than fixed interest, optimizing leverage management in volatile markets.

Equity Release Platforms

Equity release platforms provide homeowners with innovative alternatives for leveraging property value, such as refinancing mortgages or entering home equity sharing agreements, enabling access to cash without traditional loan repayments. Refinancing mortgages typically requires credit evaluation and incurs fixed interest costs, whereas home equity sharing through these platforms allows owners to unlock equity by sharing future property appreciation, balancing immediate liquidity with potential long-term value shifts.

Crowdsourced Refinance Models

Crowdsourced refinance models leverage multiple investors to provide homeowners with competitive mortgage rates through shared equity agreements, reducing reliance on traditional lenders. This approach enables more flexible leverage management by spreading risk and optimizing repayment terms aligned with home value appreciation.

HELOC-to-Home Share Swap

Refinancing a mortgage typically restructures debt to secure lower interest rates or extend terms, while a HELOC-to-home share swap leverages home equity by exchanging a portion of property ownership for cash without monthly repayments. This home equity sharing approach offers flexible leverage management by converting revolving credit into shared investment, aligning risk and return more dynamically than traditional refinancing.

Digital Mortgage Marketplace

Refinancing a mortgage through a digital mortgage marketplace offers streamlined access to lower interest rates and better loan terms, enhancing debt leverage management by reducing monthly payments and freeing up cash flow. In contrast, home equity sharing provides non-traditional leverage by converting home equity into cash without monthly repayments, appealing to homeowners seeking flexibility but requiring careful consideration of future home value appreciation and sharing terms.

PropTech Equity Partners

PropTech Equity Partners offers innovative solutions for leveraging homeownership through refinancing mortgages or home equity sharing, enabling borrowers to optimize debt management while preserving cash flow. Refinancing mortgage provides predictable payments and interest rates, whereas home equity sharing allows access to capital without increasing monthly debt obligations, aligning with diverse financial strategies.

Automated Home Equity Analysis

Automated home equity analysis leverages AI algorithms to accurately assess available equity, enabling homeowners to strategically choose between refinancing mortgage options or home equity sharing models for optimal leverage management. This technology enhances decision-making by providing real-time data on interest rates, loan terms, and potential cash flow impacts, ensuring personalized financial solutions.

Refinancing Mortgage vs Home Equity Sharing for leverage management. Infographic

moneydiff.com

moneydiff.com