A hard pull on your credit report occurs when a lender reviews your credit for a loan or credit card application, potentially impacting your credit score by lowering it slightly. A soft pull, in contrast, happens when you check your own credit or a company pre-approves you for an offer, which does not affect your credit score. Understanding the difference between hard and soft pulls helps protect your credit while managing debt responsibly.

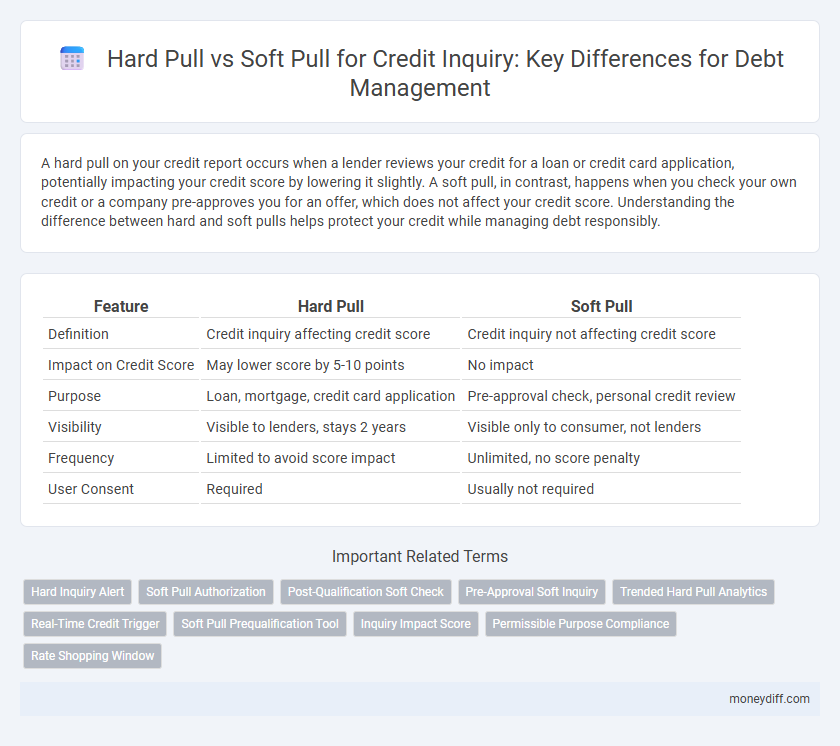

Table of Comparison

| Feature | Hard Pull | Soft Pull |

|---|---|---|

| Definition | Credit inquiry affecting credit score | Credit inquiry not affecting credit score |

| Impact on Credit Score | May lower score by 5-10 points | No impact |

| Purpose | Loan, mortgage, credit card application | Pre-approval check, personal credit review |

| Visibility | Visible to lenders, stays 2 years | Visible only to consumer, not lenders |

| Frequency | Limited to avoid score impact | Unlimited, no score penalty |

| User Consent | Required | Usually not required |

Understanding Credit Inquiries: Hard Pull vs Soft Pull

Hard pulls occur when a lender reviews your credit report for a loan or credit card application, impacting your credit score by a few points and remaining on your report for up to two years. Soft pulls, used for background checks or pre-approved offers, do not affect your credit score and are only visible to you. Recognizing the distinction between hard and soft inquiries helps manage credit risk and maintain a healthy credit profile.

What Is a Hard Pull on Your Credit Report?

A hard pull on your credit report occurs when a lender or creditor reviews your credit history as part of a loan or credit application, impacting your credit score. This inquiry signals to credit bureaus that you are actively seeking credit, which can lower your score temporarily. Hard pulls remain on your credit report for up to two years, influencing your creditworthiness for future borrowing.

The Impact of Soft Pulls on Your Credit Score

Soft pulls, also known as soft inquiries, have minimal to no impact on your credit score since they do not involve a lender actively reviewing your credit for lending purposes. These inquiries typically occur during pre-approval checks or when you review your own credit report, and they remain visible only to you without affecting your eligibility for new credit. Using soft pulls for credit checks can be a strategic way to explore loan options or monitor your credit health without risking a temporary score dip associated with hard pulls.

Key Differences Between Hard and Soft Credit Inquiries

Hard credit inquiries occur when a lender or creditor reviews your credit report as part of a loan or credit application, impacting your credit score by potentially lowering it. Soft credit inquiries, such as those for pre-approved offers or background checks, do not affect your credit score and are visible only to you. The key difference lies in the purpose and impact: hard pulls indicate active credit-seeking behavior, whereas soft pulls are for informational purposes without influencing creditworthiness.

When Do Lenders Perform a Hard Pull?

Lenders perform a hard pull during key credit-related decisions, such as applying for a mortgage, auto loan, or credit card, to assess an applicant's creditworthiness thoroughly. This inquiry impacts the credit score and remains on the credit report for up to two years, signaling serious credit evaluation. Hard pulls provide lenders with detailed financial information, helping them determine risk and set appropriate loan terms.

Common Situations for Soft Pull Credit Checks

Soft pull credit checks commonly occur during pre-approval processes for credit cards, rental applications, and utility accounts, allowing creditors to assess creditworthiness without impacting credit scores. Employers may also use soft pulls for background checks during hiring, and consumers can perform soft inquiries to monitor their own credit. Unlike hard pulls, soft inquiries do not appear on credit reports viewed by lenders, thus preserving the applicant's credit score.

How Hard Pulls Affect Your Ability to Get New Credit

Hard pulls on your credit report occur when lenders check your credit for the purpose of approving new credit accounts, leading to a temporary dip in your credit score by a few points. Multiple hard inquiries within a short period can signal higher risk to creditors, potentially reducing your chances of approval for new loans or credit cards. Managing the frequency of hard pulls is essential to maintain a strong credit profile and optimize your ability to secure favorable credit terms.

Mitigating Negative Effects of Hard Credit Inquiries

Hard credit inquiries can lower your credit score by a few points and remain on your report for up to two years, making it essential to limit their frequency when managing debt. Employing soft pulls for pre-approval offers, balance checks, or personal credit monitoring helps avoid unnecessary negative impacts on credit scores. Opting for lenders who use soft inquiries during initial credit assessments mitigates potential damage while still allowing you to explore financing options.

How to Monitor Your Credit Inquiry Activity

Monitoring your credit inquiry activity requires understanding the difference between hard pulls and soft pulls, as hard inquiries can impact your credit score while soft inquiries do not. Regularly check your credit reports from major agencies like Experian, Equifax, and TransUnion to identify unauthorized or unexpected hard inquiries. Use credit monitoring tools and alerts to stay informed about new inquiries, enabling you to dispute any suspicious activity promptly.

Best Practices for Managing Credit Inquiries During Debt Management

Limiting hard pull credit inquiries is essential for maintaining a strong credit score during debt management, as these inquiries can temporarily lower your credit rating. Soft pulls, which do not impact your score, are preferable when monitoring your credit health or applying for pre-approval offers. Prioritizing financial institutions that use soft inquiries and spacing out necessary hard pull requests can optimize credit management and improve debt repayment outcomes.

Related Important Terms

Hard Inquiry Alert

A hard inquiry alert occurs when a lender or creditor performs a credit check that impacts your credit score, typically during loan or credit card applications. Unlike soft inquiries, hard pulls indicate active credit-seeking behavior and can slightly lower your credit rating for up to 12 months, signaling risk to potential creditors.

Soft Pull Authorization

Soft pull authorization allows lenders to check a consumer's credit report without impacting their credit score, making it ideal for pre-approval offers and account reviews. Unlike hard pulls, soft inquiries do not require explicit permission and are only visible to the individual, preserving credit integrity during routine checks.

Post-Qualification Soft Check

Post-qualification soft checks allow lenders to review an applicant's credit report without impacting their credit score, enabling multiple credit inquiries during the final loan approval process. This type of credit inquiry provides essential risk assessment data while preserving the borrower's credit profile from the negative effects associated with hard pulls.

Pre-Approval Soft Inquiry

Pre-approval soft inquiries, unlike hard pulls, do not impact credit scores and allow lenders to assess a borrower's creditworthiness without a formal application, providing a risk-free evaluation of potential debt. These soft pulls enable consumers to receive credit offers and monitor their credit without the negative effects associated with hard inquiries.

Trended Hard Pull Analytics

Trended Hard Pull Analytics provide a detailed view of credit behavior by analyzing hard credit inquiries over time, allowing lenders to assess borrower risk more accurately than a simple count of hard pulls. This method enhances traditional credit scoring models by incorporating the timing, frequency, and impact of hard pulls, improving predictive accuracy for debt repayment likelihood.

Real-Time Credit Trigger

A hard pull, or hard credit inquiry, occurs when a lender reviews your credit report for loan approval, causing a slight dip in your credit score and appearing on your credit report for up to two years. In contrast, a soft pull triggers no impact on your credit score or report visibility, as it is used for pre-approvals or background checks, making real-time credit triggers shown by hard pulls crucial for assessing current creditworthiness.

Soft Pull Prequalification Tool

Soft pull prequalification tools allow consumers to check their creditworthiness without impacting credit scores, providing a risk-free way to explore loan or credit card options. This method uses non-intrusive credit inquiries, enabling lenders to offer pre-approved offers based on limited credit data without a hard inquiry.

Inquiry Impact Score

Hard pull credit inquiries can lower your credit score by several points because they indicate a potential new debt and involve lender reviews, while soft pull inquiries do not affect your credit score as they are used for background checks or pre-approved offers. Understanding the difference helps manage your Inquiry Impact Score and maintain optimal credit health during debt-related decisions.

Permissible Purpose Compliance

Hard pulls for credit inquiries require explicit consumer consent and must adhere to permissible purpose compliance under the Fair Credit Reporting Act (FCRA), allowing creditors to evaluate creditworthiness for lending decisions. Soft pulls occur without impacting credit scores, used for background checks or pre-approved offers, and must also comply with FCRA guidelines to ensure consumer protection and proper usage.

Rate Shopping Window

A hard pull credit inquiry temporarily lowers your credit score and remains on your report for up to two years, but multiple inquiries for the same type of loan within a 14-45 day rate shopping window are typically counted as a single inquiry to minimize impact. Soft pulls do not affect your credit score and are often used for pre-approvals or personal credit checks without influencing loan approval decisions.

Hard pull vs soft pull for credit inquiry. Infographic

moneydiff.com

moneydiff.com