Payday loan debt typically involves high interest rates and fees, leading to a cycle of debt that can be difficult to escape. Salary advance platform debt offers a more transparent and often lower-cost option, providing employees with short-term liquidity directly linked to their earned wages. Choosing salary advances over payday loans can reduce financial stress and improve overall debt management.

Table of Comparison

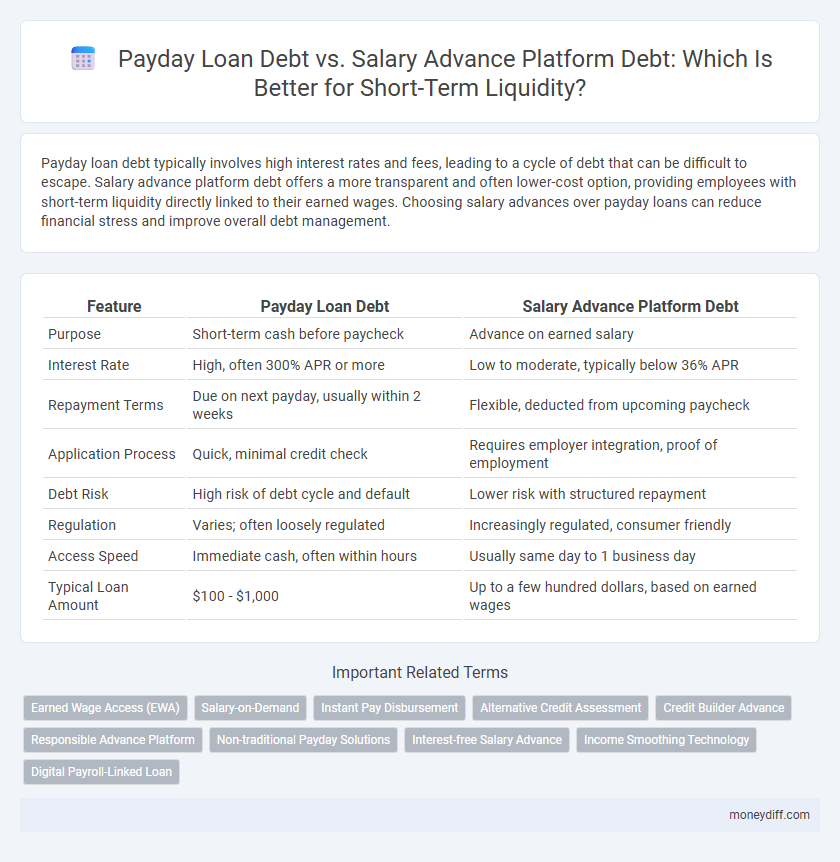

| Feature | Payday Loan Debt | Salary Advance Platform Debt |

|---|---|---|

| Purpose | Short-term cash before paycheck | Advance on earned salary |

| Interest Rate | High, often 300% APR or more | Low to moderate, typically below 36% APR |

| Repayment Terms | Due on next payday, usually within 2 weeks | Flexible, deducted from upcoming paycheck |

| Application Process | Quick, minimal credit check | Requires employer integration, proof of employment |

| Debt Risk | High risk of debt cycle and default | Lower risk with structured repayment |

| Regulation | Varies; often loosely regulated | Increasingly regulated, consumer friendly |

| Access Speed | Immediate cash, often within hours | Usually same day to 1 business day |

| Typical Loan Amount | $100 - $1,000 | Up to a few hundred dollars, based on earned wages |

Understanding Payday Loan Debt: Key Features and Risks

Payday loan debt involves high-interest, short-term borrowing typically due on the borrower's next payday, often leading to a cycle of debt due to exorbitant fees and penalties. Salary advance platform debt offers a more regulated alternative, allowing employees to access a portion of their earned wages before payday, usually with lower fees and clearer repayment terms. Understanding these key differences is crucial for managing short-term liquidity without falling into unsustainable financial obligations.

What Is a Salary Advance Platform and How Does It Work?

A salary advance platform allows employees to access a portion of their earned wages before the regular payday without incurring high interest rates common in payday loans. These platforms connect employers and employees digitally, facilitating instant wage access that helps manage short-term liquidity needs more affordably. Unlike payday loan debt, salary advance platform debt typically involves transparent fees and repayment deductions directly from the next paycheck, reducing the risk of debt cycles.

Interest Rates: Payday Loans vs. Salary Advance Platforms

Payday loan debt typically carries significantly higher interest rates, often exceeding 300% APR, creating a substantial financial burden for borrowers seeking short-term liquidity. In contrast, salary advance platforms usually offer lower and more transparent fees, with interest rates or service charges generally below 36% APR, reducing the risk of debt spirals. Choosing salary advance platforms over payday loans can result in cost-effective borrowing and improved financial stability.

Eligibility Criteria and Application Processes

Payday loan debt typically requires minimal eligibility criteria such as proof of income, an active bank account, and identification, with an expedited application process that often approves funds within hours. Salary advance platform debt usually mandates employment verification, consistent pay stubs, and may impose salary cap limits, featuring a digital application process integrated with payroll systems for faster disbursement. Both options cater to short-term liquidity needs but differ significantly in qualification rigidity and application speed, impacting borrower accessibility and repayment flexibility.

Speed of Access to Funds: Comparative Analysis

Payday loan debt typically provides faster access to funds, often within minutes or hours, due to minimal eligibility requirements and streamlined application processes. Salary advance platforms, while slightly slower, offer access usually within one to two business days by leveraging employer verification and payroll data. This comparison highlights payday loans as the quickest short-term liquidity solution, though salary advances may offer more structured repayment terms.

Impact on Credit Score: Both Options Explained

Payday loan debt typically has a more significant negative impact on credit scores due to high interest rates and frequent defaults reported to credit bureaus, while salary advance platform debt usually offers lower fees and is often repaid directly through payroll deductions, reducing credit risk. Payday loans may appear as high-risk debt on credit reports, leading to credit score drops, whereas salary advances often do not get reported to credit bureaus, minimizing their influence on credit history. Understanding these differences can help consumers choose short-term liquidity options that protect their credit scores while managing urgent financial needs.

Repayment Terms: Flexibility and Consequences

Payday loan debt typically involves high-interest rates with rigid repayment terms, often requiring full repayment by the next paycheck, leading to increased financial strain and potential debt cycles. In contrast, salary advance platform debt offers more flexible repayment schedules aligned with the borrower's pay periods, reducing the risk of default and late fees. The adaptability of salary advances decreases the likelihood of severe credit consequences and promotes better short-term liquidity management.

Common Fees and Hidden Costs

Payday loan debt typically involves high interest rates reaching annual percentage rates (APRs) of 300% or more, along with mandatory origination fees and penalty charges that compound quickly. In contrast, salary advance platforms often charge lower flat fees or fixed percentages based on the advanced amount, with fewer hidden costs and transparent repayment terms tied directly to payroll cycles. Both options risk creating debt cycles, but payday loans carry greater financial burden due to aggressive fees and concealed penalties that escalate overall borrowing costs.

Regulation and Consumer Protection Differences

Payday loan debt is heavily regulated with strict caps on interest rates and mandatory disclosures to protect consumers from predatory lending practices, whereas salary advance platforms often operate under less stringent regulatory frameworks, leading to varied consumer protections. Salary advance platforms typically offer lower costs and more transparent terms, benefiting employees by reducing the risk of excessive debt accumulation compared to payday loans. Differences in regulatory oversight significantly impact borrower outcomes, with payday loans posing higher risks of debt spirals due to aggressive interest rates and fees.

Deciding the Best Short-Term Liquidity Solution

Payday loan debt often involves high interest rates and fees that can quickly escalate, making it a costly short-term liquidity option compared to salary advance platform debt, which typically offers more affordable repayment terms linked directly to upcoming wages. Salary advance platforms provide a structured repayment schedule and lower financial risk, improving cash flow management without the burden of predatory lending practices common with payday loans. Choosing between the two depends on urgency, cost sensitivity, and the borrower's ability to repay within the designated timeframe to avoid long-term financial distress.

Related Important Terms

Earned Wage Access (EWA)

Payday loan debt typically incurs high interest rates and fees, leading to a cycle of borrowing, whereas Salary advance platform debt, especially through Earned Wage Access (EWA), offers employees immediate access to earned wages without excessive costs or long-term obligations. EWA improves financial wellness by providing transparent, affordable short-term liquidity directly tied to actual earned income, reducing reliance on predatory lending options.

Salary-on-Demand

Salary-on-Demand platforms offer a more transparent and cost-effective solution compared to payday loan debt, providing employees with immediate access to earned wages without exorbitant interest rates or fees. By integrating seamlessly with payroll systems, Salary-on-Demand reduces financial stress and the risk of debt cycles often associated with high-interest payday loans.

Instant Pay Disbursement

Payday loan debt typically incurs higher interest rates and fees compared to salary advance platform debt, which offers instant pay disbursement directly from employers, reducing financial strain. Salary advance platforms provide a cost-effective short-term liquidity solution by enabling employees to access earned wages immediately without traditional loan interest.

Alternative Credit Assessment

Payday loan debt often incurs higher interest rates and aggressive fees due to traditional credit scoring limitations, whereas salary advance platform debt leverages alternative credit assessment methods such as income verification and spending patterns to offer more personalized and potentially affordable short-term liquidity solutions. These alternative credit assessments improve access to credit for individuals with thin credit files and reduce default risk by evaluating real-time financial behavior beyond conventional credit reports.

Credit Builder Advance

Payday loan debt typically carries higher interest rates and fees compared to Salary Advance platform debt, which offers more affordable short-term liquidity solutions designed to improve financial health. Credit Builder Advance specifically leverages Salary Advance mechanisms to provide users with lower-cost credit options that help build credit scores while avoiding the debt traps common in payday lending.

Responsible Advance Platform

Payday loan debt often comes with high interest rates and hidden fees that can trap borrowers in a cycle of debt, whereas salary advance platform debt typically offers more transparent terms with lower costs and flexible repayment options. Responsible advance platforms prioritize borrower financial health by offering ethical lending practices, clear disclosures, and support tools to ensure sustainable short-term liquidity without exacerbating financial stress.

Non-traditional Payday Solutions

Non-traditional payday solutions, such as salary advance platforms, offer borrowers short-term liquidity without the high fees and interest rates commonly associated with payday loan debt. Salary advance platforms often integrate with employer payroll systems, enabling faster, more affordable access to funds and reducing reliance on predatory payday loans.

Interest-free Salary Advance

Salary advance platforms offer interest-free advances on earned wages, providing a cost-effective short-term liquidity solution compared to payday loan debt, which typically carries high interest rates and fees leading to a cycle of debt. Utilizing salary advances reduces financial stress and reliance on expensive borrowing options, promoting healthier cash flow management.

Income Smoothing Technology

Payday loan debt often carries high interest rates and fees that exacerbate financial strain, while salary advance platform debt leverages Income Smoothing Technology to provide employees with early access to earned wages, reducing reliance on costly credit options. This technology enables short-term liquidity by stabilizing cash flow, improving financial wellness, and decreasing the need for high-interest payday loans.

Digital Payroll-Linked Loan

Payday loan debt typically features higher interest rates and fees, creating significant repayment challenges compared to salary advance platform debt, which leverages digital payroll-linked loans to offer lower-cost, more flexible short-term liquidity solutions. Digital payroll-linked loans integrate directly with employer payroll systems, enhancing credit assessment accuracy and enabling seamless, affordable access to funds with automated repayment from future salaries.

Payday loan debt vs Salary advance platform debt for short-term liquidity Infographic

moneydiff.com

moneydiff.com