Consolidation loans combine multiple debts into a single loan with a fixed interest rate, providing predictable monthly payments and potentially lowering interest costs. Balance transfers move high-interest credit card debt to a new card offering a low or 0% introductory APR, which can save money if the balance is paid off before the promotional period ends. Choosing between consolidation loans and balance transfers depends on your credit score, debt amount, and ability to pay off balances quickly.

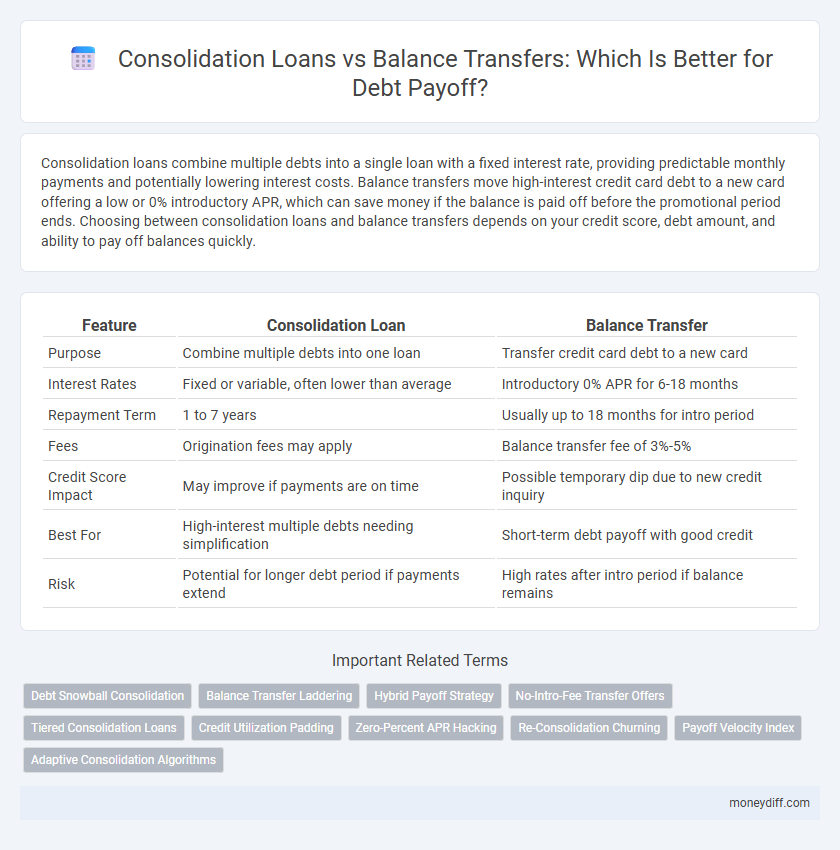

Table of Comparison

| Feature | Consolidation Loan | Balance Transfer |

|---|---|---|

| Purpose | Combine multiple debts into one loan | Transfer credit card debt to a new card |

| Interest Rates | Fixed or variable, often lower than average | Introductory 0% APR for 6-18 months |

| Repayment Term | 1 to 7 years | Usually up to 18 months for intro period |

| Fees | Origination fees may apply | Balance transfer fee of 3%-5% |

| Credit Score Impact | May improve if payments are on time | Possible temporary dip due to new credit inquiry |

| Best For | High-interest multiple debts needing simplification | Short-term debt payoff with good credit |

| Risk | Potential for longer debt period if payments extend | High rates after intro period if balance remains |

Understanding Consolidation Loans and Balance Transfers

Consolidation loans combine multiple debts into a single loan with a fixed interest rate and monthly payment, simplifying debt management and often lowering overall interest costs. Balance transfers involve moving high-interest credit card debt to a new card with a lower or 0% introductory interest rate, which can reduce interest expenses during the promotional period but may require paying a transfer fee. Both strategies aim to streamline debt repayment but differ in structure, eligibility, and impact on credit scores.

Key Differences Between Consolidation Loans and Balance Transfers

Consolidation loans combine multiple debts into a single loan with a fixed interest rate and repayment term, providing predictable monthly payments and often improving credit score by reducing utilization ratios. Balance transfers move existing credit card debt to a new card with a typically low or 0% introductory interest rate, which can save on interest but may have balance transfer fees and variable rates post-introductory period. Key differences include loan type, interest rate structure, repayment timeline, and fee considerations, making consolidation loans preferable for long-term payoff and balance transfers suited for short-term interest savings.

Pros and Cons of Debt Consolidation Loans

Debt consolidation loans simplify multiple debts into a single monthly payment, often with a lower interest rate compared to credit cards, improving financial management and credit score if paid on time. However, these loans may require good credit for approval, and extending the repayment period can increase total interest paid. Borrowers risk accumulating more debt if spending habits remain unchanged, potentially worsening financial strain despite the initial relief.

Pros and Cons of Balance Transfer Credit Cards

Balance transfer credit cards offer the advantage of low or 0% introductory interest rates, enabling borrowers to pay down debt faster without accruing extra interest if paid within the promotional period. However, these cards often come with balance transfer fees ranging from 3% to 5%, and if the balance is not cleared before the introductory period ends, high-interest rates can apply, increasing the total debt cost. Limited credit limits and potential credit score impact from application inquiries also pose challenges for borrowers using balance transfer credit cards for debt payoff.

Eligibility Criteria for Consolidation Loans vs Balance Transfers

Consolidation loans typically require a stable income, a good credit score usually above 620, and a low debt-to-income ratio to qualify, ensuring the borrower can reliably manage a single monthly payment. Balance transfer eligibility primarily depends on credit card approval, often requiring excellent credit scores above 700 and the ability to pay off transferred balances within introductory 0% APR periods. Lenders and issuers evaluate financial history differently, making creditworthiness a critical factor in determining access to consolidation loans versus balance transfers.

Interest Rates: Which Option Saves More?

Consolidation loans often offer fixed interest rates that can be lower than the average credit card APR, providing predictable monthly payments and potential savings over time. Balance transfer cards typically feature introductory 0% APR periods, allowing for interest-free debt payoff if the balance is cleared before the promotional term ends. Evaluating the total cost with fees and the likelihood of paying off debt within the balance transfer window determines which option yields greater interest savings.

Impact on Your Credit Score

Consolidation loans can improve your credit score by reducing overall credit utilization and simplifying payments, as they often convert multiple debts into a single installment loan with a fixed term. Balance transfers may lower credit card balances immediately, but frequent transfers or high utilization on new cards can temporarily lower your credit score. Both options impact credit differently, so understanding their effects on credit mix, utilization, and payment history is crucial for optimizing your credit health.

Fees and Hidden Costs to Consider

Consolidation loans typically involve origination fees, application charges, and sometimes prepayment penalties, which can increase overall costs. Balance transfers often come with balance transfer fees ranging from 3% to 5% of the transferred amount, along with higher interest rates if promotional periods expire without full repayment. Borrowers should carefully analyze these fees and hidden costs to determine the most cost-effective debt payoff strategy.

Choosing the Right Strategy for Your Debt Situation

Consolidation loans typically offer fixed interest rates and a single monthly payment, making them ideal for individuals with multiple high-interest debts seeking simplified management and predictable costs. Balance transfer cards provide a low or 0% introductory APR for a limited period, which can accelerate debt payoff if the balance is cleared before the promotional rate expires. Evaluating factors such as credit score, debt amount, interest rates, and repayment timeline is crucial for selecting the most effective strategy between consolidation loans and balance transfers.

Steps to Successfully Pay Off Debt Using Consolidation or Balance Transfer

Start by assessing your total debt amount, interest rates, and credit score to determine whether a consolidation loan or balance transfer card offers better savings. Apply for the chosen option, ensuring to understand all fees, repayment terms, and promotional periods before committing. Create a strict repayment plan that prioritizes paying off the consolidated loan or transferred balance within the promotional timeframe to avoid increased interest costs.

Related Important Terms

Debt Snowball Consolidation

Debt snowball consolidation loans combine multiple high-interest debts into a single loan with a fixed repayment schedule, accelerating payoff by focusing on smaller balances first to build momentum and improve credit score. Balance transfers typically offer low introductory rates but risk higher long-term costs and require disciplined payments to avoid accumulating new debt.

Balance Transfer Laddering

Balance transfer laddering involves strategically using multiple credit cards with promotional zero or low-interest balance transfer offers to gradually pay down debt while minimizing interest costs. This method can be more flexible and cost-effective than consolidation loans, especially for borrowers with good credit who can manage multiple payments and avoid fees.

Hybrid Payoff Strategy

A hybrid payoff strategy combines consolidation loans and balance transfers to optimize debt repayment by leveraging low-interest rates from balance transfers and the structured payment plan of consolidation loans, reducing overall interest and improving credit score management. This approach enables borrowers to efficiently manage multiple debts by first clearing high-interest balances through transfers and then consolidating remaining debts for long-term payoff stability.

No-Intro-Fee Transfer Offers

Consolidation loans typically provide a fixed repayment schedule and potentially lower interest rates, making them a reliable option for long-term debt payoff without introductory fees. Balance transfer offers with no intro fees allow consumers to move high-interest credit card debt onto a new card, helping to reduce interest charges immediately while simplifying payments.

Tiered Consolidation Loans

Tiered consolidation loans offer structured repayment plans with varying interest rates based on loan segments, enabling more manageable debt payoff compared to standard balance transfers that typically provide a low introductory interest rate on credit card debt. These loans help borrowers with diverse debt types by segmenting balances into tiers, each with tailored rates, reducing overall interest costs and improving credit score impact during consolidation.

Credit Utilization Padding

Consolidation loans typically lower credit utilization ratios by replacing multiple high-interest balances with a single installment loan, which can improve credit scores more effectively than balance transfers that may simply shift debt without reducing total credit limits. Balance transfers often maintain or increase credit utilization padding limitations due to potential lower credit limits on the new card, making consolidation loans a more strategic option for managing and reducing overall debt exposure.

Zero-Percent APR Hacking

Consolidation loans often offer structured repayment plans with fixed interest rates, but balance transfer credit cards provide a strategic advantage through zero-percent APR hacking, allowing debtors to transfer high-interest balances and pay down principal without accruing interest during the promotional period. Effective use of zero-percent APR balance transfers can significantly accelerate debt payoff by minimizing finance charges, compared to consolidation loans that may carry higher rates or fees.

Re-Consolidation Churning

Re-consolidation churning occurs when borrowers repeatedly consolidate existing loans or balance transfers, leading to extended debt payoff periods and increased fees without reducing the principal amount owed. This practice can undermine the benefits of debt consolidation loans or balance transfers by trapping debtors in a cycle of refinancing instead of accelerating their path to financial freedom.

Payoff Velocity Index

Consolidation loans often offer lower interest rates and fixed terms, accelerating debt payoff velocity by reducing overall interest accumulation compared to balance transfers with promotional rates that can expire and increase costs. The Payoff Velocity Index favors consolidation loans when long-term rate stability and predictable payments enhance faster principal reduction and debt resolution.

Adaptive Consolidation Algorithms

Adaptive consolidation algorithms optimize debt payoff strategies by dynamically selecting between consolidation loans and balance transfers based on interest rates, credit scores, and payment history. These algorithms enhance financial outcomes by minimizing interest accumulation and improving repayment timelines through personalized debt structuring.

Consolidation loans vs Balance transfer for debt payoff Infographic

moneydiff.com

moneydiff.com