Secured debt requires collateral, giving lenders a claim on specific assets if the borrower defaults, which often results in lower interest rates and higher borrowing limits. Unsecured debt, lacking collateral, poses a greater risk to lenders and typically carries higher interest rates and stricter qualification criteria. Understanding the distinction between secured and unsecured debt is crucial for managing liabilities effectively and optimizing financial strategy.

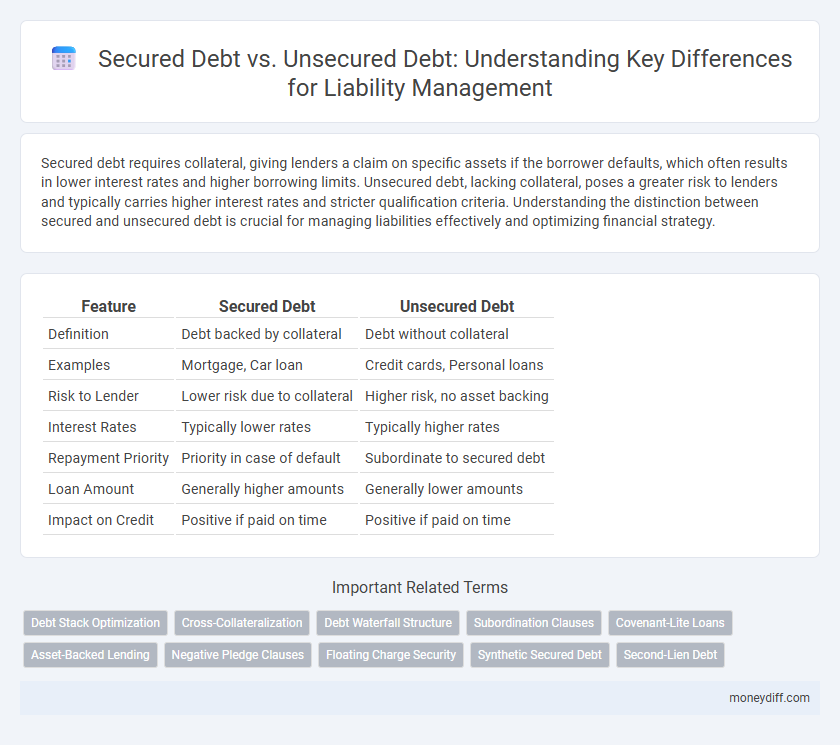

Table of Comparison

| Feature | Secured Debt | Unsecured Debt |

|---|---|---|

| Definition | Debt backed by collateral | Debt without collateral |

| Examples | Mortgage, Car loan | Credit cards, Personal loans |

| Risk to Lender | Lower risk due to collateral | Higher risk, no asset backing |

| Interest Rates | Typically lower rates | Typically higher rates |

| Repayment Priority | Priority in case of default | Subordinate to secured debt |

| Loan Amount | Generally higher amounts | Generally lower amounts |

| Impact on Credit | Positive if paid on time | Positive if paid on time |

Understanding Secured Debt: Definition and Examples

Secured debt is a type of liability backed by collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates for borrowers. Common examples of secured debt include mortgages, auto loans, and secured personal loans, where failure to repay can lead to repossession of the underlying asset. Understanding the distinction between secured and unsecured debt is crucial for assessing financial risk and liability management.

What Is Unsecured Debt? Key Features Explained

Unsecured debt refers to liabilities not backed by collateral, making lenders rely solely on the borrower's creditworthiness and promise to repay. Key features include higher interest rates compared to secured debt, greater risk for lenders, and potential legal action or credit score impact if payments are missed. Common examples of unsecured debt are credit card balances, personal loans, and medical bills.

Secured vs Unsecured Debt: Core Differences

Secured debt is backed by collateral, such as property or assets, reducing lender risk and often resulting in lower interest rates compared to unsecured debt, which has no collateral and relies solely on the borrower's creditworthiness. Unsecured debt typically includes credit cards, medical bills, and personal loans, carrying higher interest rates due to increased lender risk. The core difference lies in the repayment security: secured debt offers lenders asset claims upon default, while unsecured debt does not, making recovery more challenging.

Types of Secured Debts in Personal Finance

Types of secured debts in personal finance primarily include mortgages, auto loans, and secured personal loans, each backed by collateral such as real estate, vehicles, or other valuable assets. These debts typically offer lower interest rates compared to unsecured debts due to the reduced risk for lenders, who can repossess or foreclose on the collateral in case of default. Understanding the nature of secured debt is crucial for effective liability management and protecting personal credit health.

Common Examples of Unsecured Debts

Common examples of unsecured debts include credit card balances, medical bills, personal loans, and utility bills. Unlike secured debt, these liabilities do not require collateral, making them riskier for lenders and often accompanied by higher interest rates. Unsecured debts rely solely on the borrower's creditworthiness, increasing the likelihood of variable repayment terms and impact on credit scores.

Risk Factors: Borrowers’ and Lenders’ Perspectives

Secured debt involves collateral that borrowers pledge to reduce lender risk, making default consequences more severe due to asset forfeiture, but often results in lower interest rates. Unsecured debt poses higher risk to lenders since no collateral backs the loan, leading to higher interest rates and stricter credit requirements, while borrowers face potential damage to credit scores and legal action if payments are missed. Both borrowers and lenders must weigh the risk of asset loss against potential financial strain when choosing between secured and unsecured debt liabilities.

Impact of Secured and Unsecured Debts on Credit Scores

Secured debts, backed by collateral such as a home or vehicle, typically have a more positive impact on credit scores when paid on time due to lower risk for lenders. Unsecured debts like credit cards or personal loans pose higher risk and missed payments can significantly damage credit scores. Maintaining low balances and timely payments on both secured and unsecured debts is crucial for a healthy credit profile and optimal credit score improvement.

Collateral Requirements: What You Need to Know

Secured debt requires collateral, such as property or assets, which lenders can claim if the borrower defaults, providing lower interest rates and higher borrowing limits. Unsecured debt does not involve collateral, relying solely on the borrower's creditworthiness, often resulting in higher interest rates and increased risk for lenders. Understanding collateral requirements helps borrowers evaluate risk, loan terms, and potential financial impact when choosing between secured and unsecured liabilities.

Default Consequences: Secured vs Unsecured Liabilities

Defaulting on secured debt typically triggers asset repossession, as lenders have a legal claim on collateral such as property or equipment, minimizing their financial loss. Unsecured debt default often leads to credit score damage, collection efforts, and potential legal action, without an immediate seizure of personal assets. The recovery process for secured liabilities usually results in lower loss severity for creditors compared to unsecured liabilities, where lenders face higher risk and potential write-offs.

Choosing the Right Debt Type for Your Financial Goals

Choosing the right debt type for your financial goals depends on your ability to manage risk and repayment terms effectively. Secured debt, backed by collateral such as a home or vehicle, offers lower interest rates but carries the risk of asset loss upon default. Unsecured debt, including credit cards or personal loans, lacks collateral but usually demands higher interest rates and stricter credit requirements, making it suitable for short-term or smaller financial needs.

Related Important Terms

Debt Stack Optimization

Secured debt offers lower interest rates by leveraging collateral assets, enhancing a company's debt stack optimization through reduced risk and prioritized creditor claims. Unsecured debt, despite higher costs and subordinated position in liabilities, provides flexibility and faster access to capital, crucial for balancing overall financing strategy and maintaining optimal leverage ratios.

Cross-Collateralization

Cross-collateralization in secured debt involves using multiple assets as collateral to support a single loan or multiple obligations, enhancing the lender's security and potentially lowering interest rates. Unsecured debt lacks collateral, increasing lender risk and typically resulting in higher interest rates and less favorable terms for borrowers.

Debt Waterfall Structure

Secured debt holds priority in the debt waterfall structure, backed by specific collateral that reduces lender risk and ensures repayment before unsecured creditors; unsecured debt lacks asset backing and ranks lower in repayment hierarchy, increasing its risk and potential recovery uncertainty. This structured prioritization impacts creditor claims during bankruptcy, asset liquidation, and influences borrowing costs and creditor negotiations.

Subordination Clauses

Subordination clauses in secured debt contracts prioritize repayment by ranking these liabilities above unsecured debts, enhancing creditor security through collateral claims. Unsecured debts lack such clauses, placing creditors lower in repayment hierarchy and increasing risk during creditor insolvency proceedings.

Covenant-Lite Loans

Covenant-lite loans, a subset of secured debt, feature fewer restrictions and protections for lenders compared to traditional secured debt, often lacking financial maintenance covenants that safeguard creditor interests. Unsecured debt, by contrast, carries higher risk due to absence of collateral and typically imposes more rigorous covenants to mitigate default risk, making covenant-lite structures unique in offering borrowers increased flexibility.

Asset-Backed Lending

Secured debt involves borrowing backed by collateral, such as property or equipment, reducing lender risk and often resulting in lower interest rates compared to unsecured debt, which lacks asset backing and relies solely on borrower creditworthiness. Asset-backed lending specifically leverages tangible assets to secure loans, enabling businesses to access capital by pledging receivables, inventory, or fixed assets, thereby enhancing liquidity while mitigating creditor exposure.

Negative Pledge Clauses

Negative pledge clauses prevent borrowers from granting security interests on assets, ensuring that secured creditors have priority in claims over secured debt compared to unsecured debt. These clauses help maintain the ranking order in liabilities by restricting the creation of secured debt that could diminish the claims of unsecured creditors.

Floating Charge Security

Floating charge security is a type of secured debt that allows a lender to claim a company's assets under a floating charge, which hovers over changing assets like inventory or receivables until it crystallizes upon default. Unlike unsecured debt, which has no claim on specific assets and ranks lower in priority during insolvency, secured debt with a floating charge provides creditors with more protection and priority in recovering liabilities.

Synthetic Secured Debt

Synthetic secured debt leverages financial derivatives or contracts to replicate the risk and collateralization of traditional secured debt without transferring actual collateral, offering enhanced flexibility in managing liabilities. This approach effectively reduces unsecured debt exposure by creating synthetic liens, improving creditor claims' priority while maintaining capital efficiency.

Second-Lien Debt

Second-lien debt is a type of secured debt that holds a subordinate claim on collateral compared to first-lien debt, meaning it is repaid after the primary lender in case of borrower default. Unlike unsecured debt, which lacks collateral and carries higher risk for lenders, second-lien debt typically offers lower interest rates due to its secured status despite its secondary priority position.

Secured debt vs Unsecured debt for liabilities. Infographic

moneydiff.com

moneydiff.com