Traditional bankruptcy offers a legal process to eliminate most debts but can severely damage credit scores and remain on credit reports for up to 10 years. Debt settlement programs negotiate with creditors to reduce the overall debt amount, providing a potentially less damaging alternative but often require consistent payments and may still harm credit ratings. Both options serve as last-resort solutions, making it crucial to evaluate long-term financial impacts before choosing the best path to debt relief.

Table of Comparison

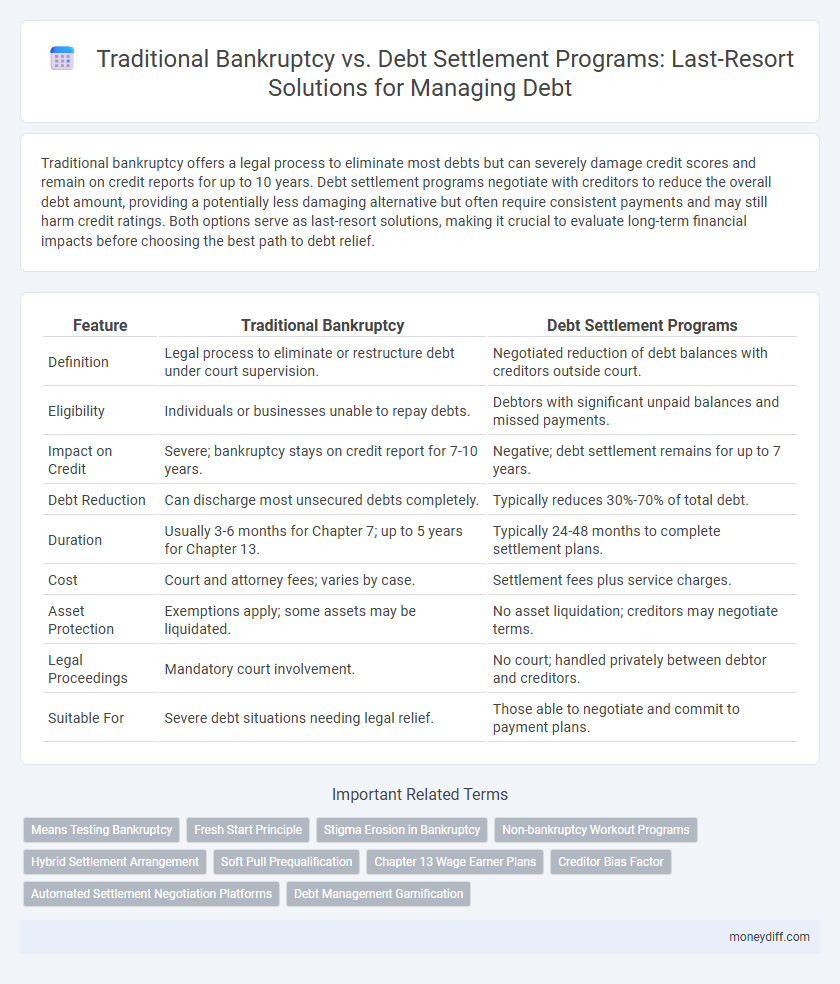

| Feature | Traditional Bankruptcy | Debt Settlement Programs |

|---|---|---|

| Definition | Legal process to eliminate or restructure debt under court supervision. | Negotiated reduction of debt balances with creditors outside court. |

| Eligibility | Individuals or businesses unable to repay debts. | Debtors with significant unpaid balances and missed payments. |

| Impact on Credit | Severe; bankruptcy stays on credit report for 7-10 years. | Negative; debt settlement remains for up to 7 years. |

| Debt Reduction | Can discharge most unsecured debts completely. | Typically reduces 30%-70% of total debt. |

| Duration | Usually 3-6 months for Chapter 7; up to 5 years for Chapter 13. | Typically 24-48 months to complete settlement plans. |

| Cost | Court and attorney fees; varies by case. | Settlement fees plus service charges. |

| Asset Protection | Exemptions apply; some assets may be liquidated. | No asset liquidation; creditors may negotiate terms. |

| Legal Proceedings | Mandatory court involvement. | No court; handled privately between debtor and creditors. |

| Suitable For | Severe debt situations needing legal relief. | Those able to negotiate and commit to payment plans. |

Understanding Traditional Bankruptcy: An Overview

Traditional bankruptcy offers a legal process for debt relief by discharging or reorganizing debts under court supervision, typically through Chapter 7 or Chapter 13 filings. It provides a structured timeline and protection from creditors, but significantly impacts credit scores and may result in asset liquidation. Understanding the eligibility criteria, dischargeable debts, and long-term financial consequences is crucial before choosing this route over debt settlement programs.

What Is a Debt Settlement Program?

A debt settlement program involves negotiating with creditors to reduce the total amount of debt owed, typically settling for a lump sum payment that is less than the full balance. This option can help avoid bankruptcy by providing a structured plan to resolve unsecured debts like credit cards and personal loans. Debt settlement programs may impact credit scores but often result in less severe consequences compared to traditional bankruptcy options such as Chapter 7 or Chapter 13 filings.

Key Differences Between Bankruptcy and Debt Settlement

Bankruptcy legally erases or restructures debt through court processes, providing immediate protection from creditors but significantly impacting credit scores for 7-10 years. Debt settlement programs negotiate reduced balances with creditors without court involvement, often damaging credit temporarily while avoiding bankruptcy's more severe consequences. Choosing between bankruptcy and debt settlement depends on factors like total debt amount, ability to repay, and long-term financial goals.

Eligibility Requirements for Bankruptcy vs Debt Settlement

Eligibility for traditional bankruptcy typically requires demonstrating an inability to pay debts, passing the means test to qualify for Chapter 7, or meeting the income threshold for Chapter 13 repayment plans. Debt settlement programs often require a minimum amount of unsecured debt, steady income to negotiate with creditors, and the willingness to halt payments during negotiation periods. Bankruptcy has strict legal criteria and court oversight, while debt settlement programs offer more flexible entry conditions but may negatively impact credit scores.

The Process: Filing for Bankruptcy vs Enrolling in a Debt Settlement Program

Filing for bankruptcy involves a legal process where an individual or business submits a petition to the court to discharge or restructure debts under Chapter 7 or Chapter 13. In contrast, enrolling in a debt settlement program requires negotiating directly with creditors to reduce the total debt amount, often through a third-party agency, without court involvement. Bankruptcy provides a legal shield and structured plan but impacts credit scores severely, while debt settlement may avoid court but can lead to tax implications and variable creditor acceptance.

Impact on Credit Score: Comparing Long-Term Effects

Traditional bankruptcy typically results in a significant and prolonged negative impact on credit scores, remaining on credit reports for up to 10 years and severely limiting borrowing opportunities. Debt settlement programs generally cause a less drastic immediate credit score drop but can still damage credit by indicating missed payments or accounts settled for less than owed. Over time, debts resolved through settlement may allow for faster credit recovery compared to bankruptcy, though both options substantially affect long-term creditworthiness.

Legal Protections and Consequences

Traditional bankruptcy provides robust legal protections by halting creditor actions through automatic stays and discharging many unsecured debts, which can significantly impact credit scores and lead to long-term financial consequences. Debt settlement programs negotiate reduced balances with creditors without court involvement, offering less legal protection and potential tax liabilities on forgiven amounts. Understanding differences in legal safeguards and implications is crucial when choosing between bankruptcy chapters or debt settlement as last-resort debt relief options.

Costs and Fees: Bankruptcy vs Debt Settlement

Bankruptcy typically involves court filing fees ranging from $300 to $1,500, alongside attorney fees averaging $1,000 to $3,500, which are often mandatory and non-negotiable. Debt settlement programs charge fees based on a percentage of the forgiven debt, usually between 15% and 25%, which can accumulate as the program progresses over months or years. While bankruptcy fees are upfront and fixed, debt settlement fees are variable and contingent upon successful negotiation with creditors, influencing the total out-of-pocket cost for consumers seeking last-resort debt relief.

Pros and Cons of Bankruptcy as a Last-Resort Solution

Bankruptcy offers a structured legal process to eliminate or reorganize debt, providing immediate relief from creditor harassment and stopping wage garnishment, but it significantly impacts credit scores and remains on credit reports for up to 10 years. It allows for the discharge of many unsecured debts, yet certain obligations like student loans, taxes, and child support typically cannot be discharged, limiting its effectiveness for some debtors. While bankruptcy can lead to a fresh financial start, the long-term credit damage and potential asset loss underscore the importance of considering alternative debt settlement options before filing.

Is Debt Settlement a Better Alternative for You?

Debt settlement programs offer a viable alternative to traditional bankruptcy by negotiating reduced payoffs with creditors, often preserving more of your credit score and assets. While bankruptcy provides a legal discharge of debts, it severely impacts credit ratings for up to ten years and may involve asset liquidation under Chapter 7. Choosing debt settlement depends on your ability to make lump-sum payments and willingness to accept potential tax liabilities from forgiven debt, making it crucial to assess your financial situation thoroughly.

Related Important Terms

Means Testing Bankruptcy

Means testing bankruptcy requires debtors to pass a financial assessment determining eligibility for Chapter 7, ensuring only those with insufficient income qualify for liquidation under traditional bankruptcy. Debt settlement programs bypass court approval by negotiating reduced payments with creditors but can negatively impact credit scores and lack the automatic discharge protections offered by bankruptcy.

Fresh Start Principle

Traditional bankruptcy provides a legal fresh start by discharging most unsecured debts under Chapter 7 or reorganizing payments under Chapter 13, offering protection from creditors and stopping wage garnishment or lawsuits. Debt settlement programs negotiate reduced balances with creditors without court involvement but do not guarantee a fresh start, often impacting credit scores negatively and leaving potential tax liabilities on forgiven debt.

Stigma Erosion in Bankruptcy

Traditional bankruptcy, once heavily stigmatized, is experiencing a stigma erosion due to increasing public awareness and acceptance, making it a viable last-resort solution for overwhelming debt. Debt settlement programs offer an alternative by negotiating reduced payments with creditors but often carry negative credit impacts and potential legal risks, influencing the decision between these debt relief options.

Non-bankruptcy Workout Programs

Non-bankruptcy workout programs provide debtors with structured repayment plans to avoid the severe credit impact of traditional bankruptcy filings. These programs often involve negotiated settlements directly with creditors, enabling partial debt forgiveness and preserving more favorable credit terms compared to Chapter 7 or Chapter 13 bankruptcy.

Hybrid Settlement Arrangement

Hybrid settlement arrangements combine elements of traditional bankruptcy and debt settlement programs, offering debtors a flexible approach to reducing outstanding balances while avoiding the full consequences of bankruptcy filings. This method strategically negotiates with creditors to lower debt amounts and sets up structured repayment plans, balancing creditor recovery with debtor relief in last-resort financial solutions.

Soft Pull Prequalification

Traditional bankruptcy requires a hard credit inquiry that can significantly lower credit scores, while debt settlement programs often utilize soft pull prequalification to evaluate eligibility without impacting credit reports. Soft pull prequalification allows consumers to explore debt relief options discreetly, preserving credit standing during the decision-making process for last-resort financial solutions.

Chapter 13 Wage Earner Plans

Chapter 13 Wage Earner Plans allow individuals with regular income to reorganize and repay debts over 3 to 5 years, providing a structured alternative to liquidation under Chapter 7 bankruptcy. This plan enables debtors to keep their property while making manageable monthly payments to creditors, often resulting in less long-term credit damage compared to traditional bankruptcy filings.

Creditor Bias Factor

Traditional bankruptcy often triggers a creditor bias factor as lenders may recover only a fraction of owed amounts, prompting stricter future lending terms. Debt settlement programs can mitigate creditor bias by negotiating reduced balances, improving the likelihood of partial repayment and preserving borrower-creditor relationships.

Automated Settlement Negotiation Platforms

Automated settlement negotiation platforms streamline traditional bankruptcy and debt settlement programs by leveraging AI to generate optimized repayment offers, reducing the need for court intervention and minimizing credit score impact. These platforms analyze creditor data and debtor profiles to propose customized solutions, expediting debt resolution with increased transparency and efficiency compared to conventional manual negotiations.

Debt Management Gamification

Traditional bankruptcy offers court-supervised debt relief by discharging or restructuring debts, often leading to long-term credit damage and asset loss, while debt settlement programs negotiate reduced payoffs with creditors to avoid bankruptcy but can incur fees and impact credit scores. Debt management gamification leverages interactive tools and rewards to enhance user engagement and financial literacy, increasing the effectiveness of debt settlement programs as last-resort solutions by promoting disciplined payment behaviors and strategic decision-making.

Traditional Bankruptcy vs Debt Settlement Programs for last-resort solutions. Infographic

moneydiff.com

moneydiff.com