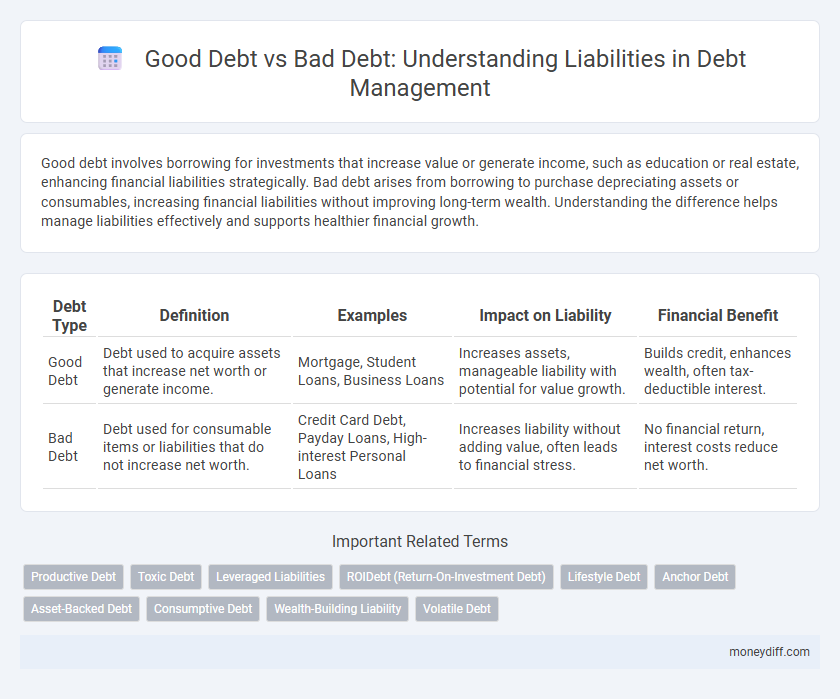

Good debt involves borrowing for investments that increase value or generate income, such as education or real estate, enhancing financial liabilities strategically. Bad debt arises from borrowing to purchase depreciating assets or consumables, increasing financial liabilities without improving long-term wealth. Understanding the difference helps manage liabilities effectively and supports healthier financial growth.

Table of Comparison

| Debt Type | Definition | Examples | Impact on Liability | Financial Benefit |

|---|---|---|---|---|

| Good Debt | Debt used to acquire assets that increase net worth or generate income. | Mortgage, Student Loans, Business Loans | Increases assets, manageable liability with potential for value growth. | Builds credit, enhances wealth, often tax-deductible interest. |

| Bad Debt | Debt used for consumable items or liabilities that do not increase net worth. | Credit Card Debt, Payday Loans, High-interest Personal Loans | Increases liability without adding value, often leads to financial stress. | No financial return, interest costs reduce net worth. |

Understanding the Basics: What is Debt Liability?

Debt liability represents the financial obligations a person or organization owes to external parties, classified as either good debt or bad debt based on its impact on financial health. Good debt typically includes loans that fund assets likely to appreciate or generate income, such as mortgages or business investments, while bad debt involves borrowing for depreciating items or consumption with no long-term value. Understanding the distinction helps in managing liabilities effectively by prioritizing debt that supports wealth building over liabilities that drain resources without financial returns.

Good Debt vs Bad Debt: Defining the Difference

Good debt refers to liabilities that generate long-term value or income, such as mortgages, student loans, and business investments, which can enhance financial stability. Bad debt typically involves high-interest consumer loans or credit card debt used for depreciating assets or discretionary spending, leading to financial strain. Understanding the distinction helps individuals prioritize borrowing that contributes to wealth building rather than unnecessary financial burden.

The Role of Good Debt in Wealth Building

Good debt, such as mortgages or student loans, functions as an investment that can enhance net worth and generate long-term wealth by enabling asset acquisition or skill development. Leveraging good debt responsibly increases financial leverage, allowing individuals to build equity and improve credit profiles, which can lead to lower borrowing costs. In contrast to bad debt, which typically involves high-interest consumer credit, good debt contributes positively to liability management by supporting value-creating financial strategies.

How Bad Debt Impacts Your Financial Health

Bad debt, such as high-interest credit card balances and payday loans, burdens your financial health by escalating interest expenses and reducing disposable income. It increases your liability, lowers your credit score, and hampers your ability to secure favorable loan terms in the future. Unlike good debt, which can build assets or generate income, bad debt drains resources and creates long-term financial instability.

Common Examples of Good and Bad Debt

Common examples of good debt include mortgages, student loans, and business loans, which typically appreciate in value or generate long-term income. Bad debt often consists of high-interest credit card balances and payday loans that do not build wealth and can lead to financial strain. Understanding the differences helps individuals leverage liabilities for growth while avoiding financial pitfalls.

Evaluating Liabilities: Is This Debt Worth It?

Evaluating liabilities involves distinguishing between good debt and bad debt based on the potential for asset appreciation or income generation. Good debt, such as a mortgage or student loan, typically contributes to long-term financial growth by increasing net worth or career prospects, whereas bad debt often funds depreciating assets like credit card balances or high-interest consumer loans. Prioritizing liabilities that enhance financial stability ensures debt remains a strategic tool rather than a harmful burden.

Credit Scores: How Good and Bad Debt Affect Them

Good debt, such as mortgages and student loans, can positively impact credit scores by demonstrating responsible debt management and increasing credit mix. Bad debt, including high-interest credit card balances and payday loans, typically harms credit scores due to high utilization rates and missed or late payments. Maintaining low credit utilization and timely payments on good debt boosts creditworthiness, while bad debt leads to higher debt-to-income ratios and damages credit profiles.

Strategies for Leveraging Good Debt Effectively

Leveraging good debt effectively involves using borrowed funds to invest in assets that generate positive cash flow or appreciate over time, such as real estate or education. Prioritizing low-interest loans and maintaining a strong credit score ensures favorable borrowing conditions and reduces overall liability risk. Regularly reviewing debt-to-income ratios and creating a structured repayment plan helps maximize financial growth while minimizing potential liabilities.

Warning Signs: When Good Debt Turns Bad

Good debt turns bad when liabilities exceed your ability to generate returns or disrupt cash flow, signaling financial strain. Warning signs include escalating interest rates, missed payments, and borrowing to cover existing debts rather than investments. Monitoring debt-to-income ratio and maintaining discipline in borrowing ensures liabilities remain manageable and aligned with long-term financial goals.

Smart Money Tips: Minimizing Bad Debt Liabilities

Good debt, such as mortgages or student loans, typically leads to asset building and financial growth, whereas bad debt involves high-interest liabilities like credit card balances that drain resources. Prioritizing repayment of high-interest bad debt minimizes liabilities and protects credit scores, enabling better financial stability. Utilizing strategies like budgeting, timely payments, and debt consolidation can significantly reduce bad debt liabilities and optimize money management.

Related Important Terms

Productive Debt

Productive debt enhances financial growth by financing assets that generate income or appreciate in value, such as real estate or business investments, distinguishing it from bad debt used for non-essential consumption. Proper management of productive debt improves creditworthiness and builds long-term wealth, making it a strategic liability rather than a financial burden.

Toxic Debt

Toxic debt refers to high-interest, unmanageable liabilities that deteriorate financial health and limit borrowing capacity, contrasting with good debt which typically funds appreciating assets or investments generating income. Recognizing toxic debt is crucial for liability management as it often leads to default risks and long-term fiscal instability.

Leveraged Liabilities

Leveraged liabilities classified as good debt typically fund investments that generate income or appreciate in value, enhancing overall financial growth; bad debt involves borrowing for depreciating assets or non-essential expenses that increase financial burden without returns. Understanding the impact of leveraged liabilities on cash flow and net worth is crucial for differentiating between productive and detrimental debt.

ROIDebt (Return-On-Investment Debt)

Good debt, or Return-On-Investment Debt (ROIDebt), strategically leverages borrowed capital to finance assets and projects that generate returns exceeding the cost of debt, enhancing overall profitability and net worth. In contrast, bad debt incurs liabilities on non-productive expenditures that offer no income or appreciation, ultimately reducing financial stability and increasing risk.

Lifestyle Debt

Lifestyle debt typically refers to borrowing that finances non-essential expenses such as vacations, luxury goods, or dining out, often leading to higher interest liabilities and financial strain. Good debt, by contrast, usually involves loans for assets that appreciate or generate income, like mortgages or education, which can improve long-term financial stability.

Anchor Debt

Anchor debt represents a strategic form of good debt that businesses use to secure long-term financing with favorable terms, improving cash flow and supporting growth initiatives. In contrast, bad debt often stems from high-interest liabilities or unsecured borrowing that can strain financial stability and increase risk exposure.

Asset-Backed Debt

Asset-backed debt leverages tangible assets such as real estate or equipment to secure loans, often classified as good debt due to its potential to generate income or appreciate in value. In contrast, bad debt typically involves unsecured liabilities with high interest rates that do not contribute to wealth creation or asset growth.

Consumptive Debt

Consumptive debt, often classified as bad debt, primarily includes liabilities incurred for non-essential purchases like vacations, electronics, or luxury items, which typically do not generate income or appreciate in value. Unlike good debt that is used for investments such as education or real estate, consumptive debt increases financial liabilities without contributing to long-term wealth or financial stability.

Wealth-Building Liability

Good debt, such as mortgages or student loans, acts as a wealth-building liability by enabling asset acquisition and investment that generate long-term financial growth, while bad debt typically involves high-interest consumer borrowing that diminishes net worth and limits cash flow. Focusing on leveraging good debt strategically can improve credit scores and increase equity, distinguishing it from liabilities that create financial burdens without wealth accumulation.

Volatile Debt

Volatile debt refers to liabilities that can fluctuate significantly in amount or interest rate, often increasing financial risk compared to stable good debt used for productive investments such as education or property. Bad debt typically includes high-interest volatile liabilities like credit card balances or payday loans, which undermine financial health by accruing costs without generating value.

Good debt vs bad debt for liability. Infographic

moneydiff.com

moneydiff.com