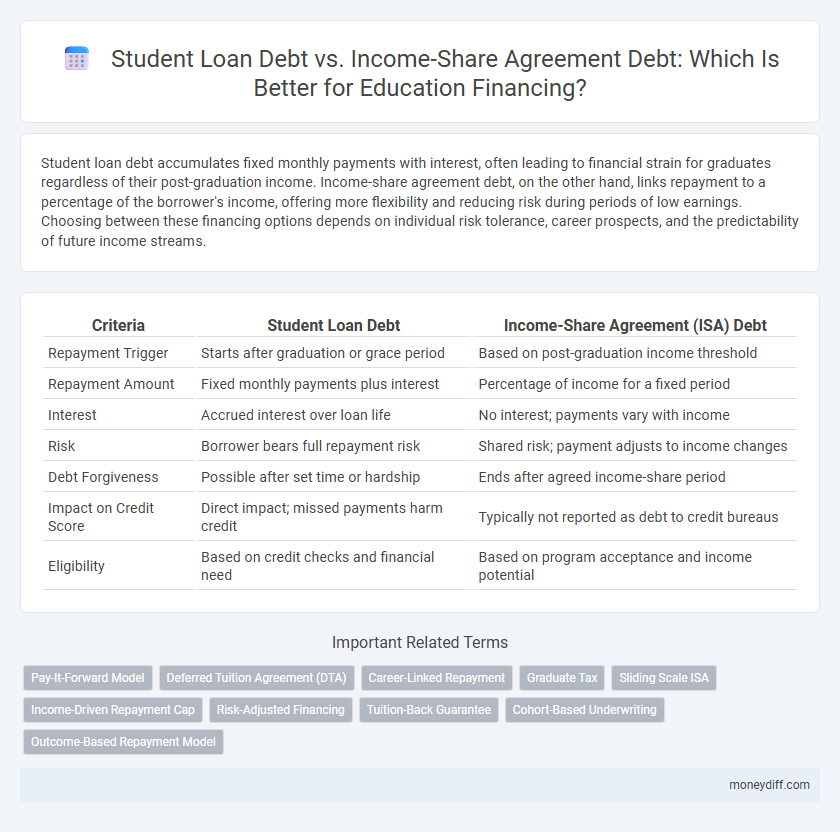

Student loan debt accumulates fixed monthly payments with interest, often leading to financial strain for graduates regardless of their post-graduation income. Income-share agreement debt, on the other hand, links repayment to a percentage of the borrower's income, offering more flexibility and reducing risk during periods of low earnings. Choosing between these financing options depends on individual risk tolerance, career prospects, and the predictability of future income streams.

Table of Comparison

| Criteria | Student Loan Debt | Income-Share Agreement (ISA) Debt |

|---|---|---|

| Repayment Trigger | Starts after graduation or grace period | Based on post-graduation income threshold |

| Repayment Amount | Fixed monthly payments plus interest | Percentage of income for a fixed period |

| Interest | Accrued interest over loan life | No interest; payments vary with income |

| Risk | Borrower bears full repayment risk | Shared risk; payment adjusts to income changes |

| Debt Forgiveness | Possible after set time or hardship | Ends after agreed income-share period |

| Impact on Credit Score | Direct impact; missed payments harm credit | Typically not reported as debt to credit bureaus |

| Eligibility | Based on credit checks and financial need | Based on program acceptance and income potential |

Understanding Student Loan Debt in Education Financing

Student loan debt typically involves borrowing a fixed amount to be repaid with interest over time, often resulting in long-term financial burden for graduates. Income-share agreements (ISAs) offer an alternative where repayment amounts vary based on a percentage of the borrower's income post-graduation, reducing upfront financial risk but potentially leading to higher total payments if salaries rise. Understanding these differences is crucial for students evaluating education financing options to balance debt impact and future financial stability.

What Are Income-Share Agreements (ISAs)?

Income-Share Agreements (ISAs) are an alternative education financing model where students agree to pay a fixed percentage of their future income for a set period instead of taking on traditional student loan debt. Unlike student loans that accrue interest and require fixed monthly payments, ISAs align repayment with the borrower's earnings, reducing financial risk during unemployment or low-income periods. This model promotes income-driven repayment, providing flexibility and potentially lowering the overall cost of financing education.

Key Differences: Student Loans vs Income-Share Agreements

Student loan debt requires fixed monthly repayments with interest accrual regardless of post-graduation income, often leading to financial strain for borrowers. Income-share agreements (ISAs) involve paying a percentage of future income for a defined period, aligning repayment amounts with the borrower's financial capacity. Unlike traditional student loans, ISAs transfer risk from the borrower to the institution, potentially offering more flexible and income-sensitive education financing.

Eligibility Criteria for Student Loans and ISAs

Student loan eligibility typically requires proof of enrollment in an accredited institution, credit history assessment, and demonstration of financial need or income level. Income-share agreements (ISAs) often have more flexible criteria, focusing on the student's potential future income rather than credit scores or debt history. ISAs generally do not require collateral or co-signers, making them accessible to students who may not qualify for traditional loans.

Repayment Structures: Student Loans vs ISAs

Student loan debt requires fixed monthly payments with set interest rates, leading to predictable but potentially burdensome repayment schedules regardless of income fluctuations. Income-share agreements (ISAs) tie repayments to a percentage of the borrower's income, offering flexible payments that adjust to earnings and reduce the risk of default during low-income periods. While student loans accumulate interest over time, ISAs provide a repayment cap, ensuring borrowers never pay more than a predetermined amount based on their income.

Interest Rates and Payment Caps: A Comparative Analysis

Student loan debt typically involves fixed or variable interest rates averaging around 4-7%, leading to compounded repayments that can extend decades beyond graduation. Income-share agreement (ISA) debt features payment caps linked directly to a percentage of the borrower's post-graduation income, often eliminating traditional interest rates and capping total repayment amounts. This structure mitigates the risk of ballooning debt from low income, offering a more flexible and risk-aligned alternative to conventional student loans.

Financial Risks and Protections for Borrowers

Student loan debt often involves fixed repayment schedules and accruing interest, creating long-term financial burdens and risks of default or wage garnishment for borrowers. Income-share agreement (ISA) debt ties repayments to a percentage of future income, providing flexibility and reducing the risk of overwhelming debt, but may result in higher total payments if income increases significantly. Borrowers with ISAs benefit from protections against low earnings periods, whereas traditional student loans generally lack such income-based adjustments, increasing the potential for financial distress.

Impact on Credit Scores and Future Borrowing

Student loan debt typically appears as a traditional installment loan on credit reports, directly impacting credit scores through regular repayment history and outstanding balances, which can either build or damage creditworthiness over time. Income-share agreement (ISA) debt, often not reported as a loan, may have a less pronounced effect on credit scores since repayments are contingent on income and not a fixed debt obligation. This distinction influences future borrowing potential, as lenders prioritize conventional credit history and debt-to-income ratios, potentially making traditional student loans more recognizable for credit evaluation than ISAs.

Long-Term Cost: Which Option Is Cheaper?

Student loan debt typically involves fixed interest rates and rigid repayment schedules, often resulting in high long-term costs due to accumulating interest over years. Income-share agreements (ISAs) adjust payments based on a percentage of future income, potentially reducing the total repayment burden if earnings remain moderate but can become costly for high-income graduates. Evaluating the long-term cost effectiveness depends on projected career earnings, with ISAs offering more flexibility and possibly lower overall costs for lower-to-moderate earners compared to traditional student loans.

Choosing the Right Financing: Factors to Consider

Evaluating student loan debt versus income-share agreement (ISA) debt requires analyzing repayment flexibility, total repayment cost, and income variability post-graduation. Student loans often have fixed interest rates and repayment schedules, while ISAs adjust repayments based on a percentage of future income, potentially lowering financial strain during low-earning periods. Key factors include projected career income, risk tolerance, and the impact on long-term financial goals to determine the optimal education financing strategy.

Related Important Terms

Pay-It-Forward Model

Student loan debt often burdens graduates with fixed monthly payments and accruing interest, while Income-Share Agreement (ISA) debt under the Pay-It-Forward Model ties repayment directly to a percentage of future income, aligning financial obligations with earning capacity. This model reduces default risk and provides more flexible, income-driven repayment compared to traditional student loans.

Deferred Tuition Agreement (DTA)

Student loan debt typically involves fixed repayments with interest accruing over time, whereas Deferred Tuition Agreements (DTAs) under Income-Share Agreement (ISA) models require repayment as a percentage of future income, aligning education costs with graduates' earning potential. DTAs reduce immediate financial burden and risk of default by deferring payments until employment, making them an innovative alternative to traditional student loans in education financing.

Career-Linked Repayment

Student loan debt typically requires fixed monthly payments regardless of income, often leading to financial strain during early career stages, whereas income-share agreement (ISA) debt aligns repayment with career earnings by deducting a fixed percentage of future income for a set period, promoting flexible, income-contingent repayment. Career-linked repayment through ISAs incentivizes education providers to support student career success and reduces default risk compared to traditional student loans.

Graduate Tax

Graduate Tax, a form of Income-share Agreement (ISA) debt, ties repayment to a fixed percentage of a graduate's income for a set period, contrasting with traditional student loan debt that requires fixed monthly payments regardless of earnings. This model reduces the risk of financial distress by adjusting payments based on actual income, offering a more flexible and income-contingent approach to education financing.

Sliding Scale ISA

Sliding Scale Income-Share Agreements (ISAs) adjust repayment amounts based on a percentage of the borrower's income, offering a flexible alternative to fixed student loan debt that often imposes rigid monthly payments regardless of earnings. This model reduces financial strain by aligning education financing costs with actual post-graduation income, contrasting with traditional student loans that accumulate interest and can lead to long-term debt burdens.

Income-Driven Repayment Cap

Student loan debt often involves fixed monthly payments that can become unmanageable, whereas Income-Share Agreement (ISA) debt features payments capped by a percentage of income, offering a flexible Income-Driven Repayment Cap that adjusts with earnings. This repayment cap reduces the risk of default and financial strain by aligning debt obligations with actual income levels during and after education financing.

Risk-Adjusted Financing

Student loan debt carries fixed repayment obligations regardless of future income, increasing risk with unstable earnings, while income-share agreement (ISA) debt adjusts repayments based on actual income, mitigating default risk by aligning payments with financial capacity. Risk-adjusted financing in ISAs offers a flexible, income-sensitive alternative to the traditional fixed-debt model, potentially improving repayment outcomes and reducing financial strain on borrowers.

Tuition-Back Guarantee

Student loan debt often leads to fixed monthly payments irrespective of post-graduation income, whereas Income-share agreements (ISAs) link payments to a percentage of future earnings, reducing financial risk. Tuition-Back Guarantees in ISAs provide additional security by refunding tuition if graduates do not meet income thresholds, enhancing affordability and aligning education financing with employment outcomes.

Cohort-Based Underwriting

Student loan debt typically imposes fixed repayment schedules regardless of post-graduation income, whereas Income-Share Agreement (ISA) debt utilizes cohort-based underwriting by assessing groups of borrowers with similar educational backgrounds and career outcomes to determine repayment terms. This model aligns repayments with actual earnings, potentially reducing default risk and enabling more flexible, income-sensitive education financing.

Outcome-Based Repayment Model

Student loan debt often leads to fixed monthly payments regardless of borrower income, whereas income-share agreement debt utilizes an outcome-based repayment model, tying repayment amounts directly to graduates' earnings and employment status. This approach reduces financial strain for low-income earners by aligning repayment obligations with actual income, promoting more manageable and equitable education financing.

Student loan debt vs Income-share agreement debt for education financing Infographic

moneydiff.com

moneydiff.com