Personal loans offer fixed interest rates and structured repayment schedules, making them ideal for borrowers seeking predictable monthly payments and long-term financial planning. Buy now, pay later (BNPL) models provide short-term, interest-free installments, appealing for smaller purchases but risk higher costs if payments are missed or delayed. Choosing between the two depends on the borrower's credit discipline, purchase size, and need for repayment flexibility.

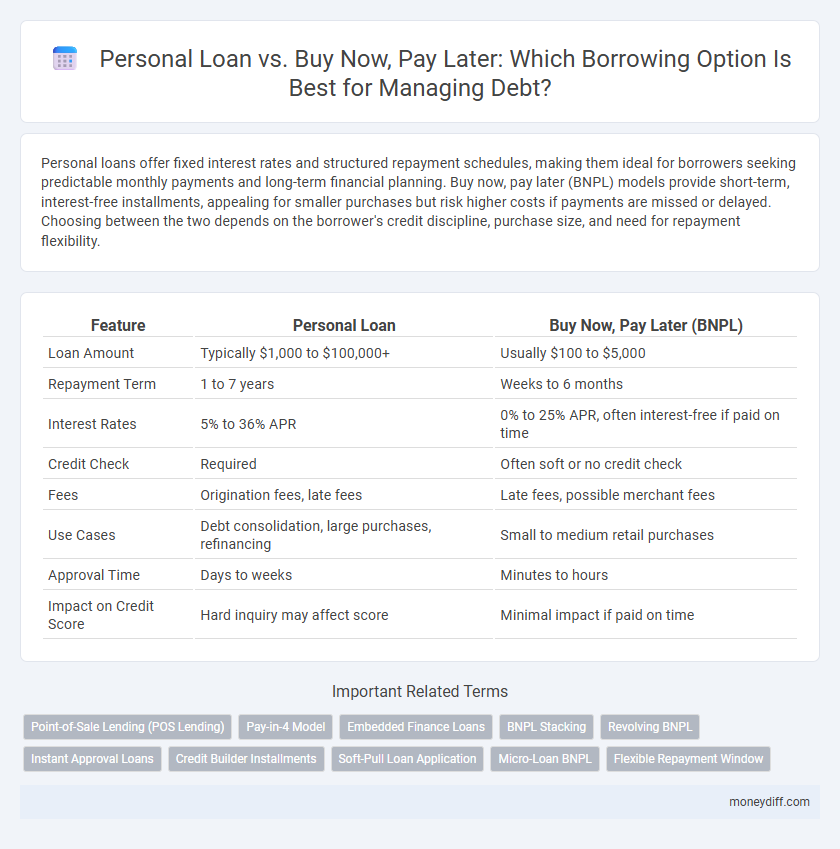

Table of Comparison

| Feature | Personal Loan | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Loan Amount | Typically $1,000 to $100,000+ | Usually $100 to $5,000 |

| Repayment Term | 1 to 7 years | Weeks to 6 months |

| Interest Rates | 5% to 36% APR | 0% to 25% APR, often interest-free if paid on time |

| Credit Check | Required | Often soft or no credit check |

| Fees | Origination fees, late fees | Late fees, possible merchant fees |

| Use Cases | Debt consolidation, large purchases, refinancing | Small to medium retail purchases |

| Approval Time | Days to weeks | Minutes to hours |

| Impact on Credit Score | Hard inquiry may affect score | Minimal impact if paid on time |

Introduction: Comparing Personal Loans and Buy Now, Pay Later

Personal loans offer fixed interest rates and repayment terms, making them suitable for larger expenses or consolidating existing debt. Buy Now, Pay Later (BNPL) services provide interest-free short-term repayment options, appealing for smaller purchases and flexible payment schedules. Understanding the cost structure and impact on credit scores helps borrowers choose the most advantageous financing method.

How Personal Loans Work: An Overview

Personal loans provide a lump sum of money with fixed interest rates and repayment terms, offering predictable monthly payments over a set period, usually ranging from one to seven years. Borrowers must meet credit requirements and undergo a formal application process, resulting in funds disbursed directly to their bank account. Unlike Buy Now, Pay Later (BNPL) options, personal loans often feature lower interest rates for borrowers with good credit, making them suitable for consolidating debt or financing larger expenses.

Understanding the Buy Now, Pay Later Model

The Buy Now, Pay Later (BNPL) model allows consumers to split purchases into interest-free installments, offering flexible short-term credit. Unlike traditional personal loans, BNPL typically requires no credit check and has quicker approval, but it may carry higher fees or penalties for missed payments. Understanding BNPL's structured repayment and potential impact on credit score is crucial when comparing it to personal loans for responsible borrowing.

Key Differences Between Personal Loans and BNPL

Personal loans offer fixed loan amounts with set interest rates and repayment terms, typically ranging from a few months to several years, providing predictable monthly payments. Buy Now, Pay Later (BNPL) models split purchases into interest-free or low-interest installments over shorter periods, often without extensive credit checks or formal loan agreements. While personal loans impact credit scores through hard inquiries and long-term repayment history, BNPL usage may have minimal initial credit impact but can lead to late fees and potential credit damage if payments are missed.

Interest Rates and Fees: Which Option Costs More?

Personal loans typically feature fixed interest rates ranging from 6% to 36%, with fees including origination charges and late payment penalties, making the total cost relatively predictable. Buy Now, Pay Later (BNPL) services often advertise zero interest but charge high late fees or short-term penalties that can significantly increase costs if payments are missed. When comparing, personal loans generally cost less over time due to structured payments and lower fees, whereas BNPL may appear cheaper upfront but can become expensive with hidden fees and shorter repayment terms.

Impact on Credit Score: What Borrowers Need to Know

Personal loans typically have a more significant impact on credit scores because they involve a hard inquiry and require consistent monthly repayments, which can build credit history if managed well. Buy now, pay later (BNPL) services often perform soft credit checks and may not report to credit bureaus unless payments are missed, leading to less immediate impact but potential risks if defaults occur. Borrowers should understand that responsible use of personal loans can enhance credit profiles, whereas BNPL's effect on credit scores is less predictable but can cause harm if payments are not maintained.

Flexibility and Repayment Terms Compared

Personal loans offer fixed repayment schedules with set monthly installments, providing predictable budgeting and often longer terms ranging from one to seven years. Buy Now, Pay Later (BNPL) plans typically allow interest-free periods with smaller, short-term payments, but may incur high fees or interest if delayed beyond the promotional window. Flexibility favors BNPL for immediate purchases without long-term commitments, while personal loans suit borrowers seeking structured, extended repayment options.

Accessibility and Eligibility Requirements

Personal loans typically require a strong credit history, stable income, and lengthy approval processes, limiting accessibility for many borrowers. Buy now, pay later (BNPL) models offer easier eligibility with minimal credit checks and quick approvals, increasing accessibility for consumers with less established credit. BNPL services often target younger or credit-invisible users, while personal loans serve those with more robust financial profiles.

Risks and Benefits of Each Borrowing Option

Personal loans offer fixed interest rates and structured repayment plans, providing predictable monthly payments and building credit history, but they may involve higher interest costs and longer commitment periods. Buy Now, Pay Later (BNPL) options provide convenience and interest-free periods for short-term borrowing, increasing accessibility but risking overspending and late fees that can damage credit scores. Each option requires careful assessment of repayment ability and financial goals to minimize debt-related risks and maximize borrowing benefits.

Choosing the Right Solution for Your Financial Needs

Personal loans offer fixed interest rates and predictable monthly payments, making them ideal for borrowers seeking long-term financial stability. Buy Now, Pay Later (BNPL) services provide short-term, interest-free installment options, which can be beneficial for small purchases but may lead to higher costs if payments are missed. Evaluating factors such as repayment terms, interest rates, credit impact, and purchase size helps determine which borrowing method aligns best with your financial goals.

Related Important Terms

Point-of-Sale Lending (POS Lending)

Point-of-Sale (POS) lending, a subset of buy now, pay later (BNPL) models, offers consumers instant credit approvals and flexible repayment options directly at checkout, often with lower interest rates compared to traditional personal loans. Unlike personal loans that require credit checks and longer approval processes, POS lending enhances purchasing power by enabling smaller, interest-free installments with minimal credit impact, optimizing consumer debt management at the point of sale.

Pay-in-4 Model

The Pay-in-4 model allows borrowers to split purchases into four interest-free installments, offering greater flexibility and reduced financial burden compared to traditional personal loans, which often involve higher interest rates and longer repayment terms. This model appeals to consumers seeking short-term, manageable debt solutions without impacting their credit scores, making it a popular alternative for financing everyday expenses.

Embedded Finance Loans

Embedded finance loans integrate personal loan options directly within shopping platforms, offering consumers seamless access to credit without leaving the purchase environment. This model contrasts with traditional personal loans by providing instant approval and flexible repayment tied to specific transactions, enhancing convenience while often featuring competitive interest rates and minimal application processes.

BNPL Stacking

Buy Now, Pay Later (BNPL) stacking refers to consumers using multiple BNPL services simultaneously, increasing overall debt risk compared to a single personal loan with fixed repayment terms. Personal loans offer structured repayment schedules and credit reporting, while BNPL stacking can obscure total debt levels, leading to potential payment delinquencies and credit score damage.

Revolving BNPL

Revolving Buy Now, Pay Later (BNPL) models offer flexible borrowing by allowing consumers to make purchases and repay over time with ongoing credit access, often featuring lower interest rates than traditional personal loans. Unlike fixed-term personal loans, revolving BNPL provides convenience and continuous spending capacity but may lead to higher overall debt if not managed carefully.

Instant Approval Loans

Personal loans offer structured repayment plans with fixed interest rates, providing borrowers with predictable monthly payments and often faster credit approval for larger sums. Buy Now, Pay Later models provide instant approval with minimal credit checks, ideal for smaller purchases but typically involve higher interest or fees if payments are delayed.

Credit Builder Installments

Credit Builder Installments combine the benefits of personal loans and buy now, pay later models by enabling borrowers to build credit through fixed monthly payments reported to credit bureaus. This structured repayment plan improves credit scores more effectively than typical buy now, pay later options that often lack comprehensive credit reporting.

Soft-Pull Loan Application

Soft-pull loan applications for personal loans minimally impact credit scores, allowing borrowers to explore options without damaging their credit; buy now, pay later (BNPL) models often bypass traditional credit checks, offering flexible short-term payment plans but may lead to higher debt accumulation if not managed carefully. Comparing the two, personal loans provide structured repayment schedules and potentially lower interest rates, while BNPL services emphasize convenience and instant approval, often without soft-pull inquiries but variable terms.

Micro-Loan BNPL

Micro-loan BNPL (Buy Now, Pay Later) models offer short-term, interest-free financing options with fixed repayment schedules, making them ideal for small purchases compared to traditional personal loans that often involve higher interest rates and longer repayment periods. While personal loans provide larger sums for broader financial needs, Micro-loan BNPL solutions emphasize convenience and immediate purchasing power without the burden of long-term debt accumulation.

Flexible Repayment Window

Personal loans offer a flexible repayment window, typically ranging from 12 to 60 months, allowing borrowers to choose installment plans that fit their financial situation. Buy now, pay later models often require repayment within shorter periods, such as 30 to 90 days, which may limit flexibility and increase the risk of missed payments.

Personal loan vs buy now, pay later model for borrowing. Infographic

moneydiff.com

moneydiff.com