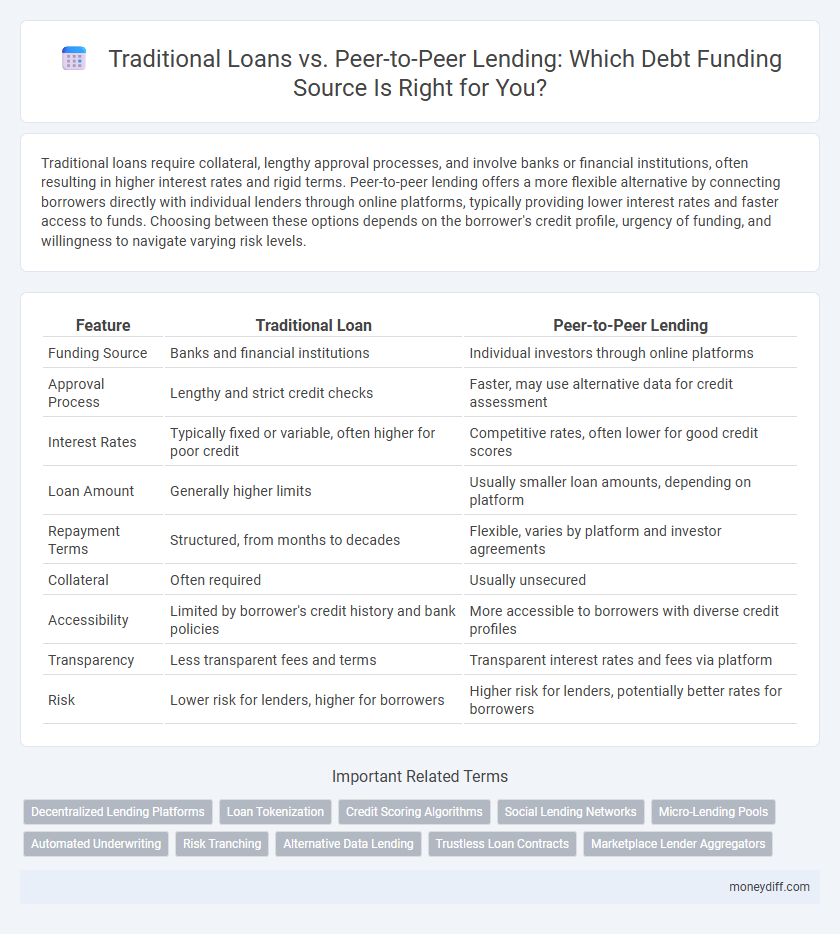

Traditional loans require collateral, lengthy approval processes, and involve banks or financial institutions, often resulting in higher interest rates and rigid terms. Peer-to-peer lending offers a more flexible alternative by connecting borrowers directly with individual lenders through online platforms, typically providing lower interest rates and faster access to funds. Choosing between these options depends on the borrower's credit profile, urgency of funding, and willingness to navigate varying risk levels.

Table of Comparison

| Feature | Traditional Loan | Peer-to-Peer Lending |

|---|---|---|

| Funding Source | Banks and financial institutions | Individual investors through online platforms |

| Approval Process | Lengthy and strict credit checks | Faster, may use alternative data for credit assessment |

| Interest Rates | Typically fixed or variable, often higher for poor credit | Competitive rates, often lower for good credit scores |

| Loan Amount | Generally higher limits | Usually smaller loan amounts, depending on platform |

| Repayment Terms | Structured, from months to decades | Flexible, varies by platform and investor agreements |

| Collateral | Often required | Usually unsecured |

| Accessibility | Limited by borrower's credit history and bank policies | More accessible to borrowers with diverse credit profiles |

| Transparency | Less transparent fees and terms | Transparent interest rates and fees via platform |

| Risk | Lower risk for lenders, higher for borrowers | Higher risk for lenders, potentially better rates for borrowers |

Understanding Traditional Loans: Foundations and Features

Traditional loans, typically offered by banks and credit unions, provide borrowers with fixed or variable interest rates based on creditworthiness and financial history. These loans often require collateral, lengthy application processes, and strict eligibility criteria to mitigate lender risk. Understanding these foundational features enables borrowers to assess repayment terms, interest rates, and potential penalties associated with conventional financing methods.

Peer-to-Peer Lending: An Innovative Funding Alternative

Peer-to-peer lending leverages online platforms to connect borrowers directly with individual investors, bypassing traditional financial institutions and often offering lower interest rates. This innovative funding alternative provides faster access to capital with more flexible terms, appealing especially to small businesses and borrowers with unconventional credit profiles. By utilizing advanced algorithms for credit assessment, peer-to-peer lending minimizes risk while expanding credit availability beyond traditional loan constraints.

Key Differences Between Traditional Loans and P2P Lending

Traditional loans typically involve borrowing from banks or financial institutions with fixed interest rates, stringent credit checks, and longer approval times. Peer-to-peer (P2P) lending connects borrowers directly with individual investors, offering more flexible terms and potentially lower interest rates based on creditworthiness assessed through online platforms. P2P lending often provides faster funding but may carry higher risks for investors due to less regulatory oversight compared to traditional loans.

Eligibility Criteria: Who Qualifies for Each Funding Source?

Traditional loans typically require borrowers to have strong credit scores, stable income, and collateral, making them accessible primarily to established individuals or businesses. Peer-to-peer lending platforms often have more flexible eligibility criteria, allowing borrowers with moderate credit histories or limited collateral to qualify. The streamlined approval process and less stringent requirements of peer-to-peer lending enable broader access to funding for startups and underserved borrowers.

Interest Rates Comparison: Banks Versus P2P Platforms

Traditional bank loans often feature fixed interest rates that range from 4% to 12%, depending on creditworthiness and loan terms, providing predictable repayment schedules. Peer-to-peer (P2P) lending platforms typically offer interest rates between 6% and 15%, influenced by borrower profiles and risk assessments, potentially allowing for more competitive rates for less risky applicants. The variance in interest rates highlights the importance of evaluating individual credit scores and market conditions when choosing between bank loans and P2P lending for debt financing.

Application Process: Traditional Lenders vs. Peer-to-Peer Platforms

Traditional loans require extensive documentation, credit checks, and lengthy approval times due to rigorous underwriting processes by banks and financial institutions. Peer-to-peer lending platforms streamline the application process through online interfaces, offering faster approval and funding by matching borrowers directly with individual investors. This digital approach reduces procedural barriers, making peer-to-peer lending a more accessible and efficient option for many borrowers.

Repayment Flexibility and Terms Analysis

Traditional loans typically offer fixed repayment schedules with predetermined interest rates and rigid terms set by financial institutions. Peer-to-peer lending platforms provide greater repayment flexibility, often allowing borrowers to negotiate terms directly with individual lenders and adjust payment plans based on cash flow fluctuations. The variability in peer-to-peer loan terms can accommodate diverse financial situations, while traditional loans prioritize structured, predictable repayments with less room for modification.

Risks and Security: Evaluating Borrower Protections

Traditional loans often provide stronger borrower protections through regulated financial institutions with established risk assessment protocols and clear legal recourse. Peer-to-peer lending platforms may present higher risks due to less stringent oversight, variable credit evaluation standards, and potential platform insolvency. Borrowers should assess the security measures and regulatory compliance of both options to mitigate default risks and ensure transparent dispute resolution.

Costs and Hidden Fees: What Borrowers Need to Know

Traditional loans often come with fixed interest rates, origination fees, and potential prepayment penalties that can increase the overall borrowing cost. Peer-to-peer lending platforms may offer lower interest rates but frequently charge service fees or platform commissions, which can be less transparent than traditional lender fees. Borrowers should carefully compare the effective annual percentage rate (APR) and scrutinize all terms to avoid unexpected financial charges in both funding options.

Which Option Fits Your Financial Goals? Decision-Making Guide

Traditional loans offer structured repayment schedules and typically require good credit scores, making them suitable for borrowers seeking predictable terms and lower interest rates. Peer-to-peer lending provides more accessible funding options with faster approval, ideal for those with varied credit profiles or urgent cash needs. Assess your creditworthiness, repayment capacity, and funding urgency to determine which source aligns better with your financial goals.

Related Important Terms

Decentralized Lending Platforms

Decentralized lending platforms, a key feature of peer-to-peer lending, eliminate intermediaries by directly connecting borrowers and lenders through blockchain technology, providing faster approval and lower interest rates compared to traditional loans from banks. These platforms enhance transparency and reduce credit risk by utilizing smart contracts, making them an increasingly popular alternative funding source in the debt market.

Loan Tokenization

Loan tokenization transforms traditional loans and peer-to-peer lending into digital assets on blockchain platforms, enhancing liquidity and transparency for investors and borrowers. This innovation bridges the gap between conventional bank loans and decentralized lending, enabling fractional ownership and faster transaction settlements.

Credit Scoring Algorithms

Traditional loans rely heavily on established credit scoring algorithms such as FICO, which assess borrower risk based on historical credit behavior, payment history, and debt levels to determine loan eligibility and interest rates. Peer-to-peer lending platforms often use alternative credit scoring models incorporating social data, transaction history, and machine learning techniques to evaluate creditworthiness, enabling access to funding for borrowers with limited credit histories.

Social Lending Networks

Social lending networks facilitate peer-to-peer lending by connecting borrowers directly with individual lenders, often resulting in lower interest rates and more flexible terms compared to traditional bank loans. These platforms leverage technology and community-driven assessments to provide accessible funding alternatives beyond conventional financial institutions.

Micro-Lending Pools

Traditional loans typically involve financial institutions lending to individuals or businesses with fixed interest rates and established credit requirements, while peer-to-peer lending platforms facilitate micro-lending pools by connecting multiple small investors directly to borrowers, often enabling more flexible terms and faster access to funds. Micro-lending pools in P2P lending democratize funding sources, reduce dependency on banks, and provide diversified risk exposure for investors, making them an innovative alternative in the debt financing landscape.

Automated Underwriting

Automated underwriting in traditional loans leverages extensive credit data and established algorithms to assess borrower risk efficiently, ensuring faster approval but often stringent criteria. Peer-to-peer lending platforms utilize automated underwriting models that incorporate alternative data and social lending behaviors, enabling more flexible risk evaluation and potentially broader access to funding.

Risk Tranching

Traditional loans typically involve a single lender bearing the entire credit risk, which may result in higher interest rates to compensate for potential default, whereas peer-to-peer lending platforms use risk tranching by splitting loans into multiple segments with varying risk levels that are distributed among diversified investors. This risk segmentation allows peer-to-peer lending to offer more tailored investment opportunities and potentially lower borrowing costs compared to conventional lending models.

Alternative Data Lending

Traditional loans rely heavily on credit scores and financial history, making them less accessible for borrowers with limited credit data, whereas peer-to-peer lending incorporates alternative data like social behavior, utility payments, and online activity to assess creditworthiness, expanding funding opportunities for underserved individuals. Leveraging alternative data in peer-to-peer lending enhances risk prediction accuracy and offers a more inclusive financing solution compared to conventional lending models.

Trustless Loan Contracts

Traditional loans rely on centralized financial institutions that require credit checks and collateral, often leading to lengthy approval processes. Peer-to-peer lending utilizes blockchain-based trustless loan contracts, enabling direct, transparent, and automated transactions without intermediaries, reducing risk and increasing efficiency.

Marketplace Lender Aggregators

Marketplace lender aggregators streamline access to diverse peer-to-peer lending options, offering borrowers competitive interest rates compared to traditional bank loans, which often involve stricter credit requirements and longer approval times. These aggregators leverage big data analytics and borrower profiles to match funding needs with multiple investors efficiently, enhancing transparency and flexibility in debt financing.

Traditional loan vs Peer-to-peer lending for funding sources. Infographic

moneydiff.com

moneydiff.com