A home equity loan provides a fixed amount of money secured against the borrower's property, requiring regular repayments with interest, which can increase financial burden but retains full property ownership. Shared equity agreements involve selling a portion of the home's future appreciation to an investor in exchange for upfront cash with no monthly payments, reducing immediate debt but sharing potential profits. Choosing between these options depends on the borrower's financial stability, long-term goals, and willingness to share property value growth.

Table of Comparison

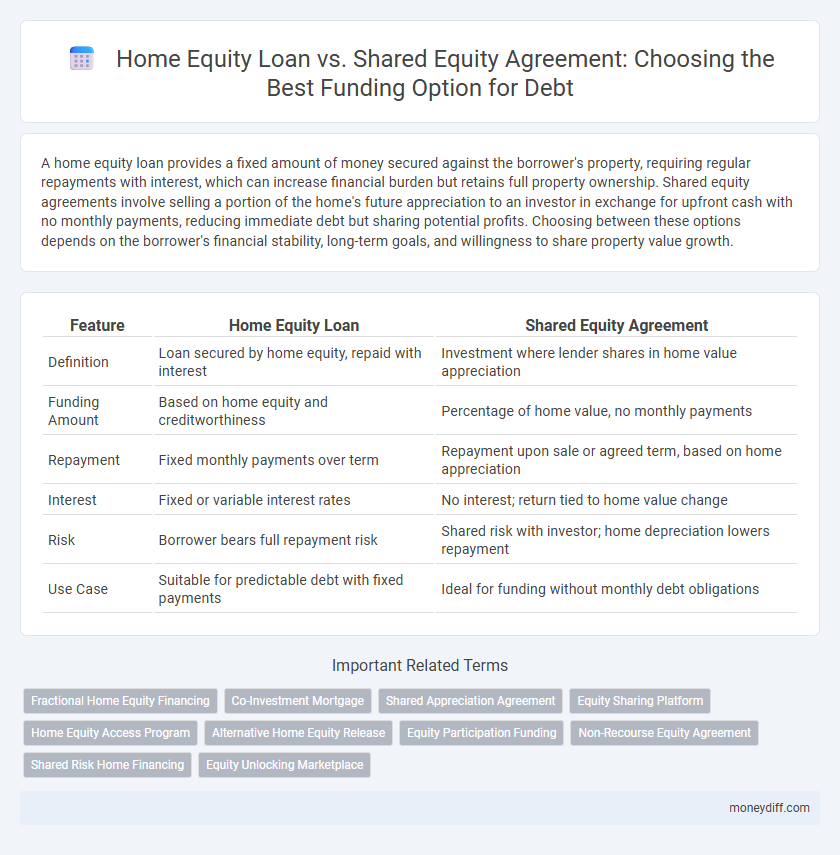

| Feature | Home Equity Loan | Shared Equity Agreement |

|---|---|---|

| Definition | Loan secured by home equity, repaid with interest | Investment where lender shares in home value appreciation |

| Funding Amount | Based on home equity and creditworthiness | Percentage of home value, no monthly payments |

| Repayment | Fixed monthly payments over term | Repayment upon sale or agreed term, based on home appreciation |

| Interest | Fixed or variable interest rates | No interest; return tied to home value change |

| Risk | Borrower bears full repayment risk | Shared risk with investor; home depreciation lowers repayment |

| Use Case | Suitable for predictable debt with fixed payments | Ideal for funding without monthly debt obligations |

Understanding Home Equity Loans: Features and Benefits

Home equity loans offer a fixed interest rate and predictable monthly payments, making them ideal for borrowers seeking stability in funding. These loans allow homeowners to leverage the accumulated value in their property without giving up ownership or future appreciation. With tax-deductible interest and a clear repayment schedule, home equity loans provide a structured and potentially cost-effective borrowing option compared to shared equity agreements.

What Is a Shared Equity Agreement? Key Concepts Explained

A shared equity agreement is a financing arrangement where an investor provides funds for home purchase or renovation in exchange for a percentage of the property's future appreciation. Unlike a home equity loan, it does not require monthly repayments or interest but instead shares the financial gains or losses upon sale or refinancing. This option benefits homeowners needing upfront capital while aligning investor returns with property value changes.

Eligibility Criteria: Qualifying for Home Equity Loans vs. Shared Equity Agreements

Home equity loans typically require borrowers to have substantial homeownership equity, a strong credit score, and stable income to qualify, reflecting traditional lending standards. Shared equity agreements focus more on property value and future appreciation, often allowing homeowners with lower credit scores or irregular income to participate. Eligibility for shared equity programs can be more flexible but may involve relinquishing a portion of home equity gains.

Cost Analysis: Interest Rates, Fees, and Repayment Terms

Home equity loans typically charge fixed interest rates ranging from 4% to 8%, involve origination fees between 1% and 3%, and require monthly repayments over 5 to 30 years. Shared equity agreements often have no monthly payments or interest but demand sharing 20% to 40% of the home's appreciated value upon sale or maturity, potentially resulting in higher long-term costs. Evaluating total repayment amounts, including fees and equity share, is critical to determining the most cost-effective funding option based on individual financial goals and market conditions.

Impact on Homeownership: Rights and Responsibilities Compared

A home equity loan provides homeowners full ownership rights and predictable monthly payments but increases personal debt liability and risk of foreclosure if payments are missed. Shared equity agreements involve selling a percentage of home equity to an investor, reducing upfront costs and monthly debt obligations while sharing future appreciation or depreciation, which affects long-term financial gains and responsibilities. Homeowners retain occupancy rights in both options, but shared equity shifts some control and profit potential to the investor.

Tax Implications: Deductions and Potential Liabilities

Home equity loan interest is generally tax-deductible when used for home improvements, offering potential tax savings for homeowners; however, Shared equity agreements typically do not provide interest deductions since they involve shared property appreciation rather than a traditional loan. Tax liabilities from Shared equity agreements may arise upon property sale, with homeowners responsible for taxes on any capital gains attributable to the investor's share. Understanding the IRS rules on deductibility and capital gains tax implications is crucial when choosing between these funding options for home financing.

Flexibility and Risks: Which Option Offers Greater Control?

Home equity loans provide fixed interest rates and predictable monthly payments, offering homeowners greater control over repayment schedules but increasing the risk of foreclosure if payments are missed. Shared equity agreements involve selling a portion of home equity, reducing financial risk by eliminating monthly payments but limiting future profits and control due to shared ownership. Evaluating flexibility versus potential loss of equity is crucial when choosing between these funding options.

Suitability Scenarios: Matching Funding Choices to Financial Goals

Home equity loans suit homeowners seeking fixed-rate, lump-sum funding for immediate expenses with predictable repayment plans and full ownership retention. Shared equity agreements fit individuals aiming to access home value without monthly payments, ideal for those prioritizing cash flow flexibility and willing to share future property appreciation. Matching funding choices to financial goals depends on factors like repayment capacity, long-term ownership plans, and tolerance for equity sharing risk.

Long-Term Consequences: Equity Retention and Future Home Sales

A home equity loan allows homeowners to retain full ownership and control over their property, with the obligation to repay the borrowed amount plus interest, which can impact future financial flexibility but preserves full equity gains upon sale. Shared equity agreements involve selling a portion of the home's future appreciation in exchange for upfront funds, reducing ownership but eliminating monthly repayments and sharing future profits, which may decrease the homeowner's earnings at sale. Understanding these long-term consequences is crucial for choosing between maintaining complete equity through debt or sharing future value to ease immediate financial burdens.

Choosing Wisely: Factors to Consider When Deciding Between Home Equity Loans and Shared Equity Agreements

Home equity loans provide lump-sum funding with fixed interest rates and predictable monthly payments, making them suitable for homeowners with stable income and strong credit profiles seeking full ownership retention. Shared equity agreements involve exchanging a portion of future home appreciation for upfront capital without monthly payments, appealing to those who prefer flexibility and risk-sharing but are comfortable sharing potential profits. Key considerations include current financial stability, willingness to share home appreciation, repayment capacity, and long-term homeownership goals to determine the optimal funding strategy.

Related Important Terms

Fractional Home Equity Financing

Fractional Home Equity Financing through shared equity agreements allows homeowners to raise capital by selling a percentage of their property's future appreciation, avoiding the fixed monthly payments and interest rates associated with traditional home equity loans. This approach aligns investor returns with property value growth, providing flexible funding without increasing debt obligations or risking foreclosure.

Co-Investment Mortgage

A Co-Investment Mortgage combines a traditional home equity loan with a Shared Equity Agreement, allowing homeowners to access funds by sharing future property appreciation with investors. This hybrid financing option reduces monthly payments compared to conventional loans and aligns investor returns with market-driven home value increases.

Shared Appreciation Agreement

Shared appreciation agreements provide homeowners with funding by offering a percentage of future home value appreciation instead of fixed loan repayments, reducing monthly debt obligations compared to traditional home equity loans. These agreements align lender returns with property market performance, making them a strategic alternative for homeowners seeking flexible, risk-shared financing options without increasing immediate debt burden.

Equity Sharing Platform

A Home Equity Loan provides borrowers with a fixed amount of cash based on their home's current appraised value minus outstanding mortgage balances, offering predictable monthly payments but increasing personal debt. Shared equity agreements through Equity Sharing Platforms allow homeowners to access funds by selling a percentage of future home appreciation, avoiding monthly repayments and interest but sharing potential profit upon sale.

Home Equity Access Program

Home Equity Access Program provides affordable funding by leveraging home equity without immediate repayment requirements, unlike shared equity agreements that require sharing future property appreciation. Home equity loans offer fixed interest rates and predictable payments, making them a stable option for homeowners seeking controlled debt management.

Alternative Home Equity Release

Home equity loans provide a fixed lump sum with regular repayments, leveraging existing home value while maintaining full ownership, whereas shared equity agreements offer funding by selling a percentage of future home appreciation without monthly payments, easing cash flow but sharing potential gains. Alternative home equity release methods like shared equity agreements reduce debt burden and foreclosure risk, making them attractive for homeowners who prefer not to increase traditional secured debt.

Equity Participation Funding

Home equity loans provide borrowers with a fixed amount of cash using existing property equity, requiring monthly repayments and interest, while shared equity agreements involve investors funding homeowners in exchange for a percentage of future property appreciation without monthly payments. Equity participation funding through shared equity agreements reduces immediate financial burden but shares potential gains or losses tied to real estate market fluctuations.

Non-Recourse Equity Agreement

A Non-Recourse Equity Agreement offers homeowners funding by sharing future property appreciation without personal liability, unlike a Home Equity Loan that requires monthly repayments and puts the borrower's credit at risk. This alternative debt solution benefits borrowers seeking capital without increasing their monthly debt obligations or risking foreclosure beyond the property's value.

Shared Risk Home Financing

Shared equity agreements provide homeowners with non-recourse funding by exchanging a percentage of future home appreciation for upfront cash, reducing monthly payment burdens compared to traditional home equity loans. This shared risk home financing model aligns lender and homeowner interests, as repayment depends on property value changes rather than fixed interest, mitigating default risk.

Equity Unlocking Marketplace

Home equity loans provide lump-sum funding secured against the homeowner's property value, requiring fixed repayments with interest, while shared equity agreements offer flexible, interest-free financing by selling a percentage of future home appreciation through the Equity Unlocking Marketplace. The Equity Unlocking Marketplace facilitates access to shared equity investors, enabling homeowners to unlock property value without monthly payments, aligning repayment with property value changes upon sale or refinancing.

Home equity loan vs Shared equity agreement for funding. Infographic

moneydiff.com

moneydiff.com